Rhode Island Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

Finding the appropriate legal document template can be a challenge. Naturally, there are numerous formats accessible online, but how do you locate the legal form you require? Utilize the US Legal Forms website. The service provides thousands of formats, including the Rhode Island Chef Services Contract - Self-Employed, which you can use for business and personal purposes. All of the documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to find the Rhode Island Chef Services Contract - Self-Employed. Use your account to browse through the legal documents you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

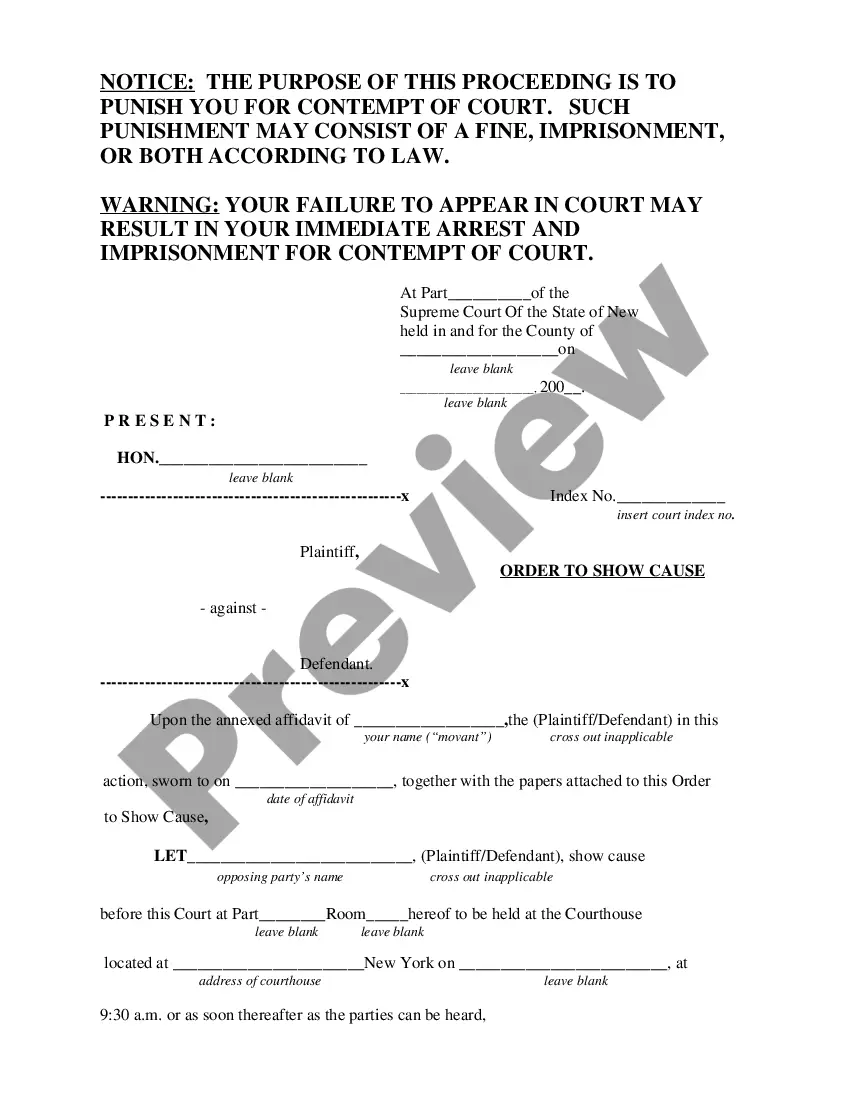

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure that you have selected the correct form for your city/county. You can preview the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are certain that the form is appropriate, click the Buy Now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the acquired Rhode Island Chef Services Contract - Self-Employed.

- US Legal Forms is the largest repository of legal documents where you can find various document formats.

- Utilize the service to obtain professionally crafted files that adhere to state standards.

- The templates offered are diverse and cater to both personal and business needs.

- Documents are vetted by professionals ensuring compliance with legal requirements.

- The platform provides an easy interface for searching and downloading forms.

Form popularity

FAQ

Yes, you can certainly be a self-employed chef if you have the necessary skills and a solid business plan. This status lets you directly manage client relationships and customize your services. Implementing a Rhode Island Chef Services Contract - Self-Employed is crucial to ensure clarity and professionalism in your engagements.

Absolutely, a chef can be self-employed and many choose this path for the freedom it offers. Being self-employed allows chefs to create their own schedules and select the types of services they want to provide. A Rhode Island Chef Services Contract - Self-Employed aids in outlining the relationship with clients and securing agreements.

Yes, you can cook meals to sell from home, but be sure to check local health regulations and permits required in Rhode Island. Establishing a Rhode Island Chef Services Contract - Self-Employed can also help you define your business model and protect your interests. This ensures you operate within the law while providing delicious meals to your clients.

In many cases, you can call yourself a chef if you have the skills and experience necessary to prepare meals professionally. However, to operate legally and protect your business, it is wise to establish a Rhode Island Chef Services Contract - Self-Employed. This contract helps to authenticate your role and sets parameters around your services.

Indeed, most private chefs are self-employed. They typically work directly with clients to prepare meals in their homes or for events. By utilizing a Rhode Island Chef Services Contract - Self-Employed, private chefs can outline their services, fees, and expectations, creating a clear understanding with their clients.

Yes, a chef can be an independent contractor if they run their own business and provide services to clients without relying on a single employer. When you establish a Rhode Island Chef Services Contract - Self-Employed, you define the terms of your services, ensuring you have control over your work. This arrangement can provide flexibility and the potential for higher earnings.

The self-employment tax in Rhode Island includes both Social Security and Medicare taxes, similar to federal rates. As a self-employed individual, you are responsible for the entire tax amount, making it essential to keep accurate records. Consulting with a tax professional can help you navigate your obligations. Additionally, a Rhode Island Chef Services Contract - Self-Employed can help you account for potential tax deductions related to your business.

To qualify as an independent contractor, you must meet specific IRS guidelines. Typically, you need to demonstrate that you operate your business independently, control your work schedule, and provide your tools or resources. It is often helpful to have a Rhode Island Chef Services Contract - Self-Employed to define your contracting terms and ensure compliance with these requirements.

To become an independent contractor in Rhode Island, begin by determining your service offerings and establishing a business structure. Then, register your business and set up your finances properly. A Rhode Island Chef Services Contract - Self-Employed can clarify your relationship with clients and protect your interests as you build your independent contracting business.

You can sell food from your home in Rhode Island, but you must follow specific guidelines. Make sure to adhere to local health regulations and consider getting a home-based food business permit. Additionally, utilizing a Rhode Island Chef Services Contract - Self-Employed may help you define the terms of your sales and maintain compliance.