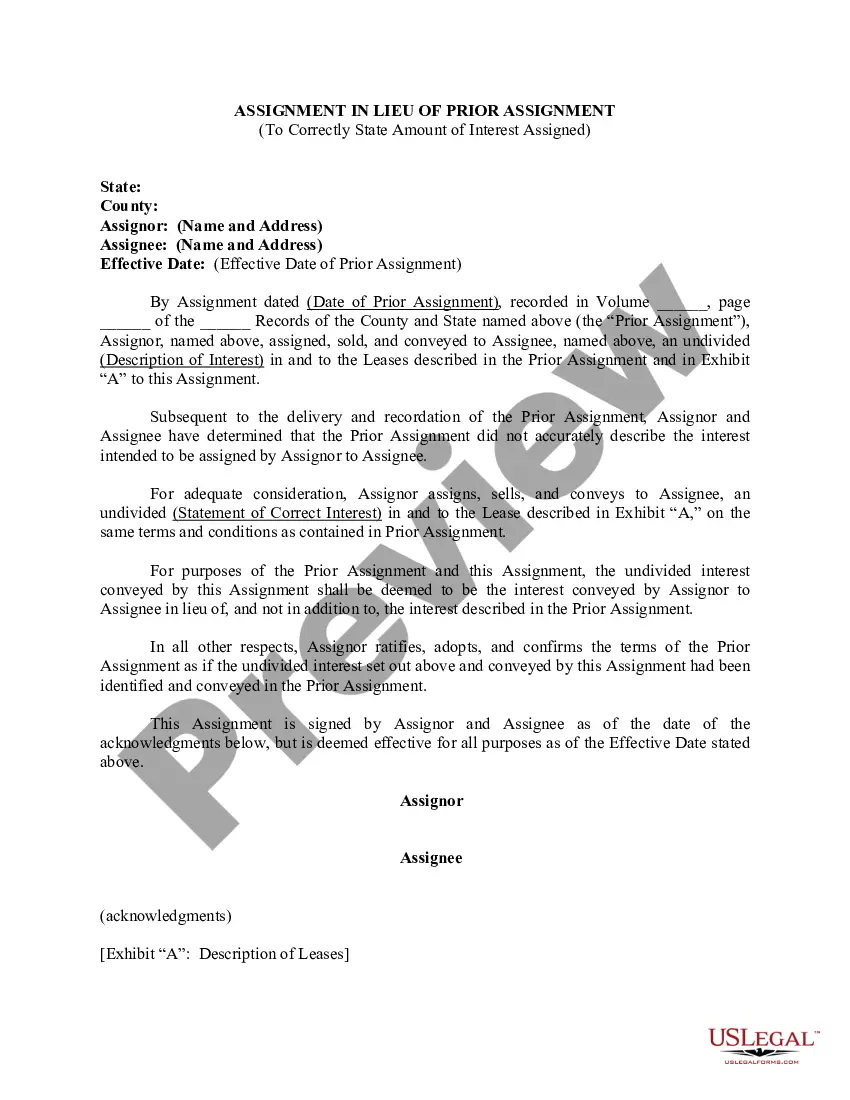

Puerto Rico Correction Assignment to Correct Amount of Interest

Description

How to fill out Correction Assignment To Correct Amount Of Interest?

You can spend time on the Internet searching for the authorized document template that suits the state and federal requirements you want. US Legal Forms provides a huge number of authorized varieties that are evaluated by specialists. You can actually obtain or print the Puerto Rico Correction Assignment to Correct Amount of Interest from my services.

If you have a US Legal Forms accounts, it is possible to log in and click on the Acquire key. Next, it is possible to comprehensive, revise, print, or sign the Puerto Rico Correction Assignment to Correct Amount of Interest. Every single authorized document template you get is the one you have eternally. To get one more backup of the bought type, check out the My Forms tab and click on the related key.

If you use the US Legal Forms website the first time, stick to the simple guidelines listed below:

- Initially, make sure that you have chosen the best document template for that area/city that you pick. Look at the type description to ensure you have picked the correct type. If readily available, use the Preview key to appear throughout the document template as well.

- In order to get one more variation of the type, use the Research area to get the template that meets your needs and requirements.

- After you have identified the template you want, simply click Buy now to carry on.

- Choose the rates program you want, type your references, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal accounts to pay for the authorized type.

- Choose the structure of the document and obtain it to your device.

- Make modifications to your document if required. You can comprehensive, revise and sign and print Puerto Rico Correction Assignment to Correct Amount of Interest.

Acquire and print a huge number of document web templates utilizing the US Legal Forms web site, which provides the greatest collection of authorized varieties. Use professional and express-certain web templates to handle your small business or specific requirements.

Form popularity

FAQ

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

Puerto Rico offers great tax incentives to LLCs and individuals who move to Puerto Rico, including a 4% income tax and exemptions from paying taxes on capital gains, interest, or dividends (for individuals and businesses that meet the requirements).

As has been widely reported, Puerto Rico's Act #20 and Act #22 provides incentives for high net worth U.S. citizens to move to Puerto Rico and potentially reduce their 39.6% federal income tax (plus any applicable state tax) to a 0% ? 4% Puerto Rico income tax rate.

One of the greatest of many Puerto Rico tax benefits is the Act 60 Investor Resident Individual Tax Incentive (formerly Act 22), which allows you to pay 0% federal or Puerto Rico capital gains tax on all capital gains incurred during the time that you qualify as a bona fide Puerto Rico resident living in Puerto Rico.

Act 80 (the Unjust Dismissal Act) regulates employment termination of employees hired for an indefinite term. Puerto Rico is not an 'employment at will' jurisdiction.

Puerto Rico Overtime Employees covered by the FLSA are entitled to overtime pay at a rate of 150 percent of their regular wage (commonly known as ?time and a half?).

Once you live in Puerto Rico, your passive income is now ?Puerto Rico source income,? and Section 933 of the Internal Revenue Code says you don't have to pay federal taxes on Puerto Rico source income. Act 60 says you don't have to pay Puerto Rico taxes on passive income.

Interest income is generally taxable, except interest from obligations of the federal government or any state, or territory, or political subdivisions; the District of Columbia; and the Commonwealth of Puerto Rico or any of its instrumentalities or political subdivisions.