This form is used when the Assignor transfers, assigns, and conveys to Assignee, as a production payment, a percentage of 8/8 of all oil, gas, and other minerals produced and saved from the Lands under the terms of the Lease and any renewals or extensions of the Lease which are obtained by Assignor or Assignor's successors and/or assigns.

Puerto Rico Assignment of Production Payment by Lessee to Third Party

Description

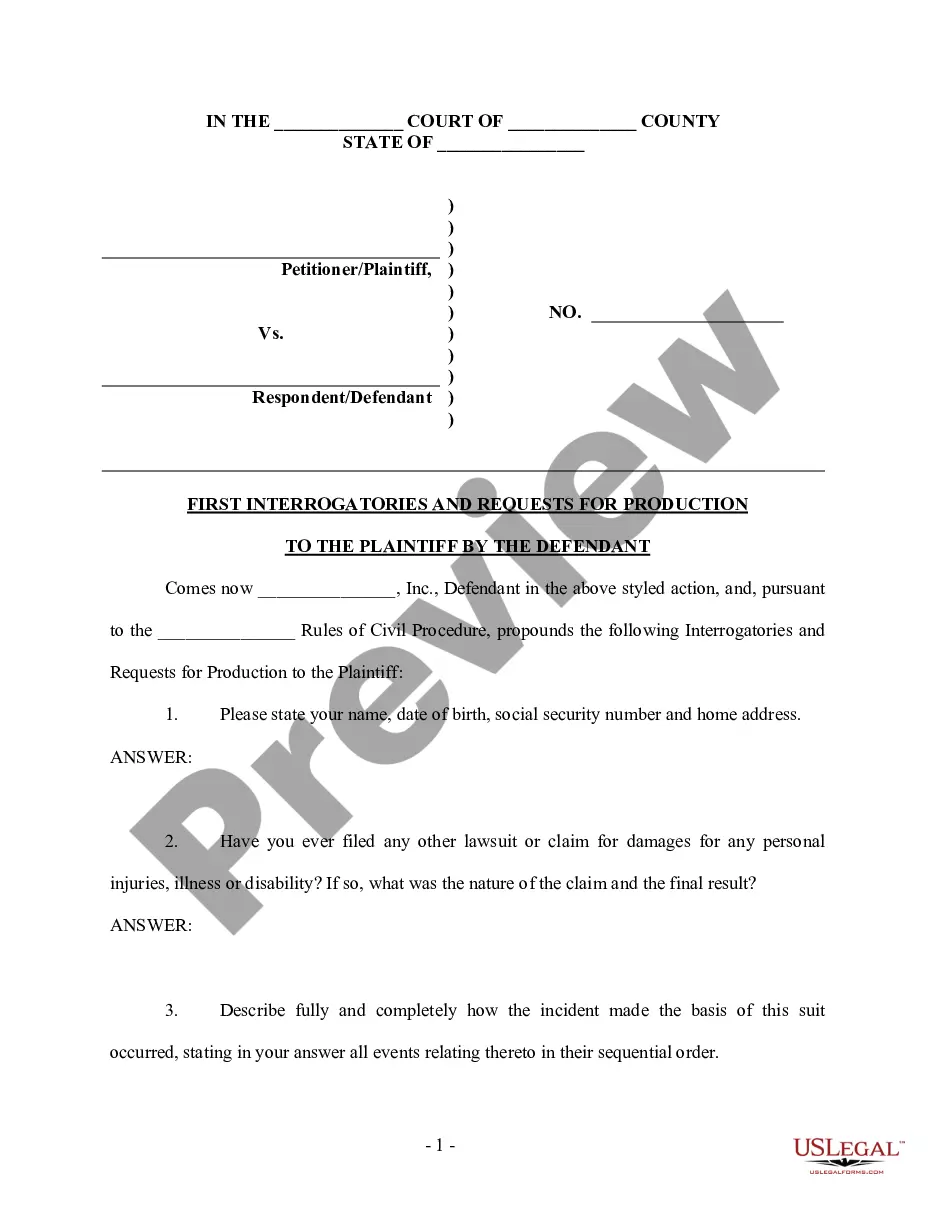

How to fill out Assignment Of Production Payment By Lessee To Third Party?

Have you been inside a place the place you require files for either company or individual functions just about every working day? There are a lot of lawful file web templates available on the Internet, but getting versions you can depend on isn`t straightforward. US Legal Forms offers 1000s of kind web templates, much like the Puerto Rico Assignment of Production Payment by Lessee to Third Party, that are published to meet state and federal specifications.

Should you be presently familiar with US Legal Forms site and have a merchant account, just log in. Following that, you are able to obtain the Puerto Rico Assignment of Production Payment by Lessee to Third Party template.

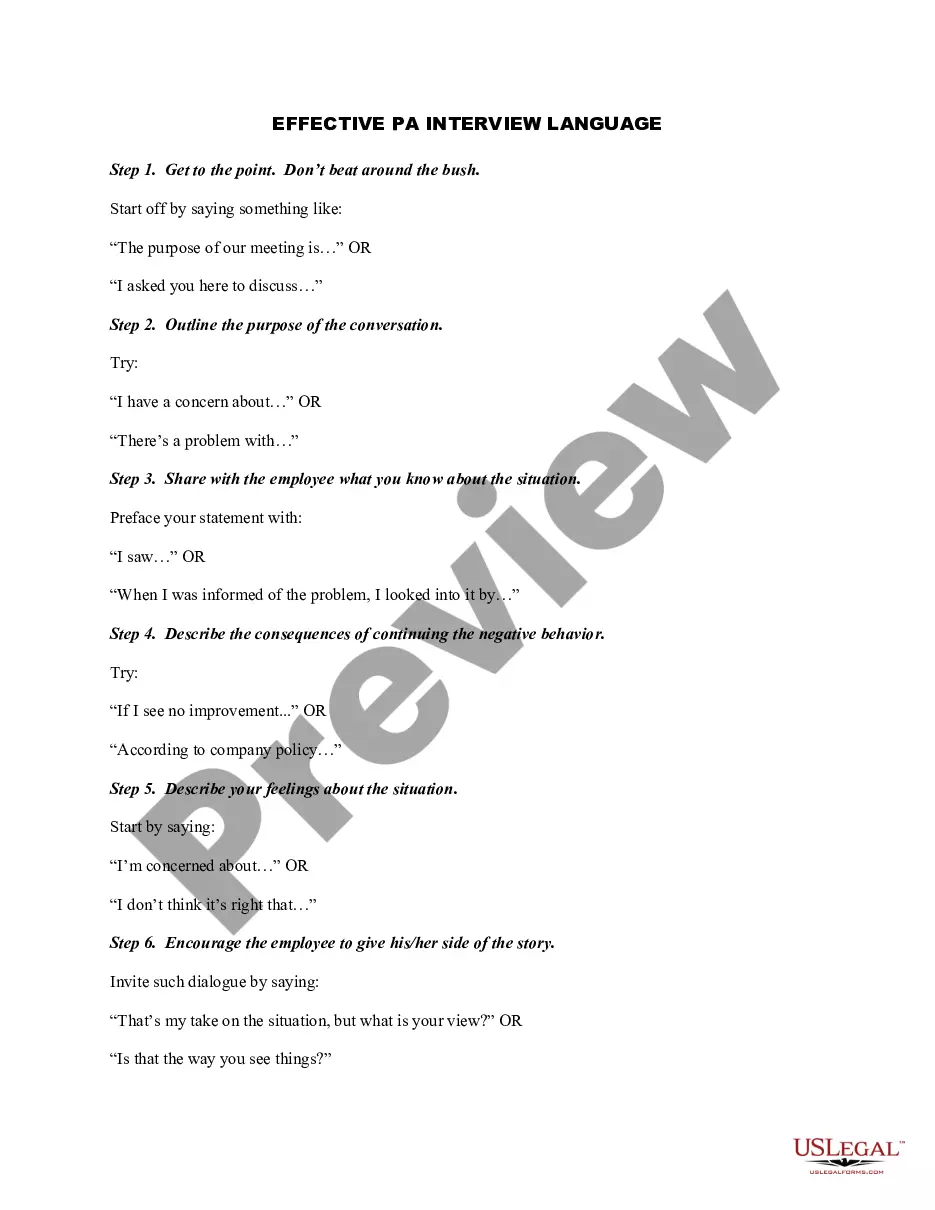

If you do not have an accounts and want to start using US Legal Forms, follow these steps:

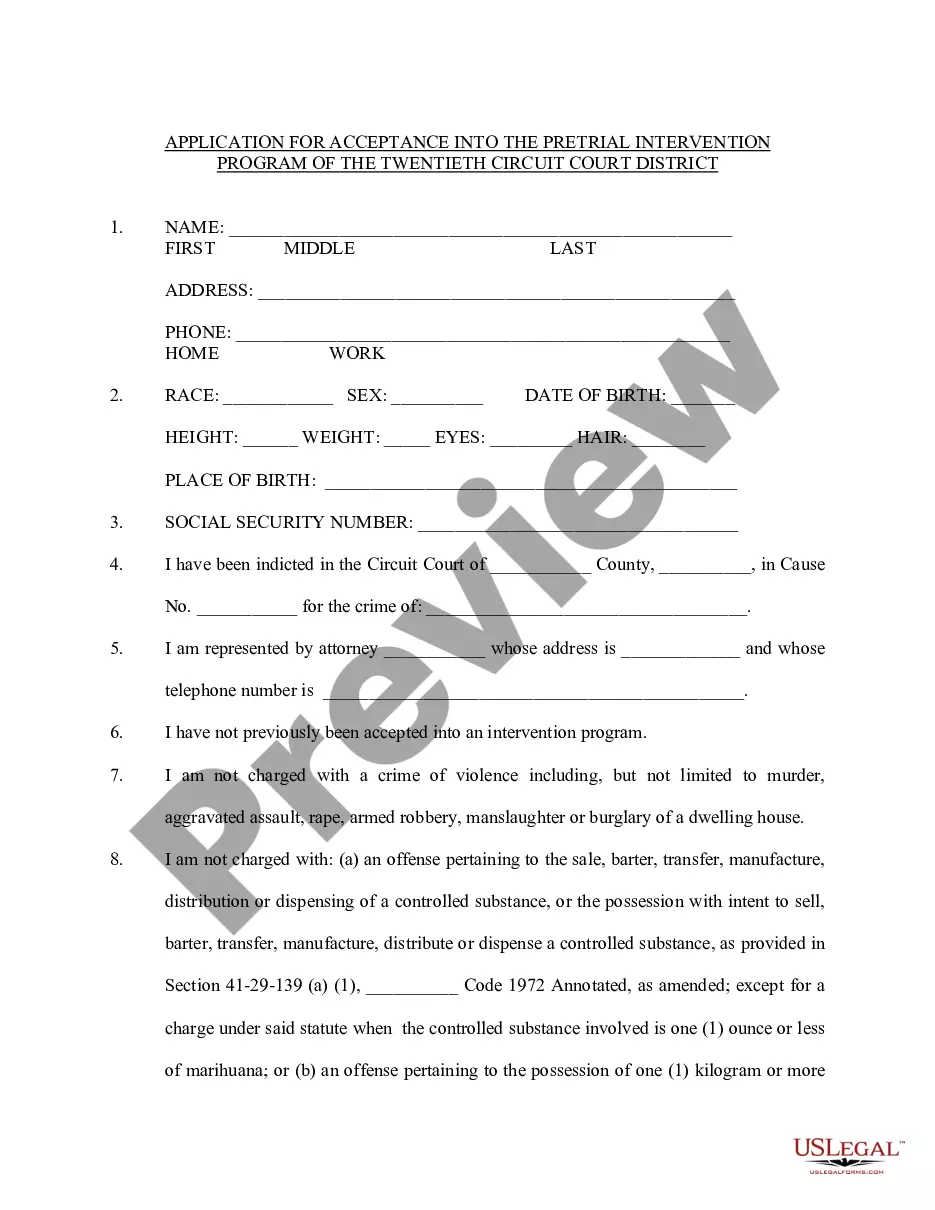

- Obtain the kind you will need and make sure it is for the appropriate metropolis/region.

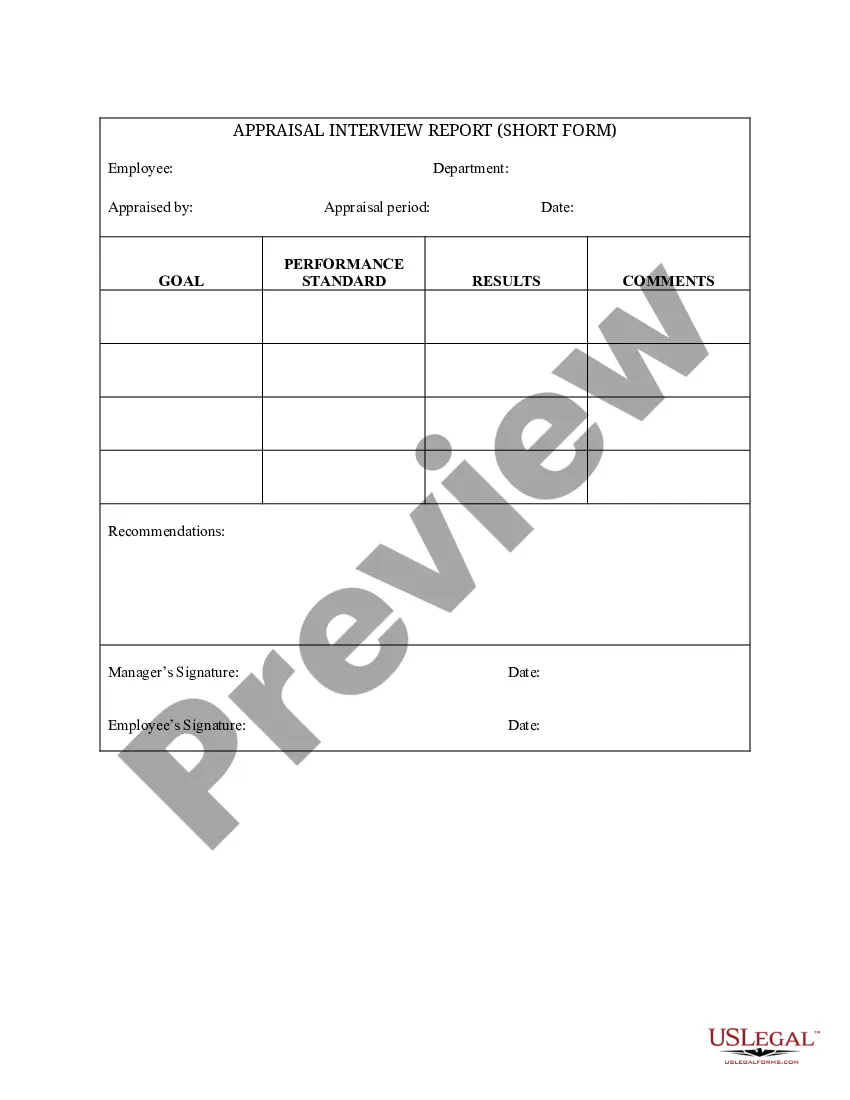

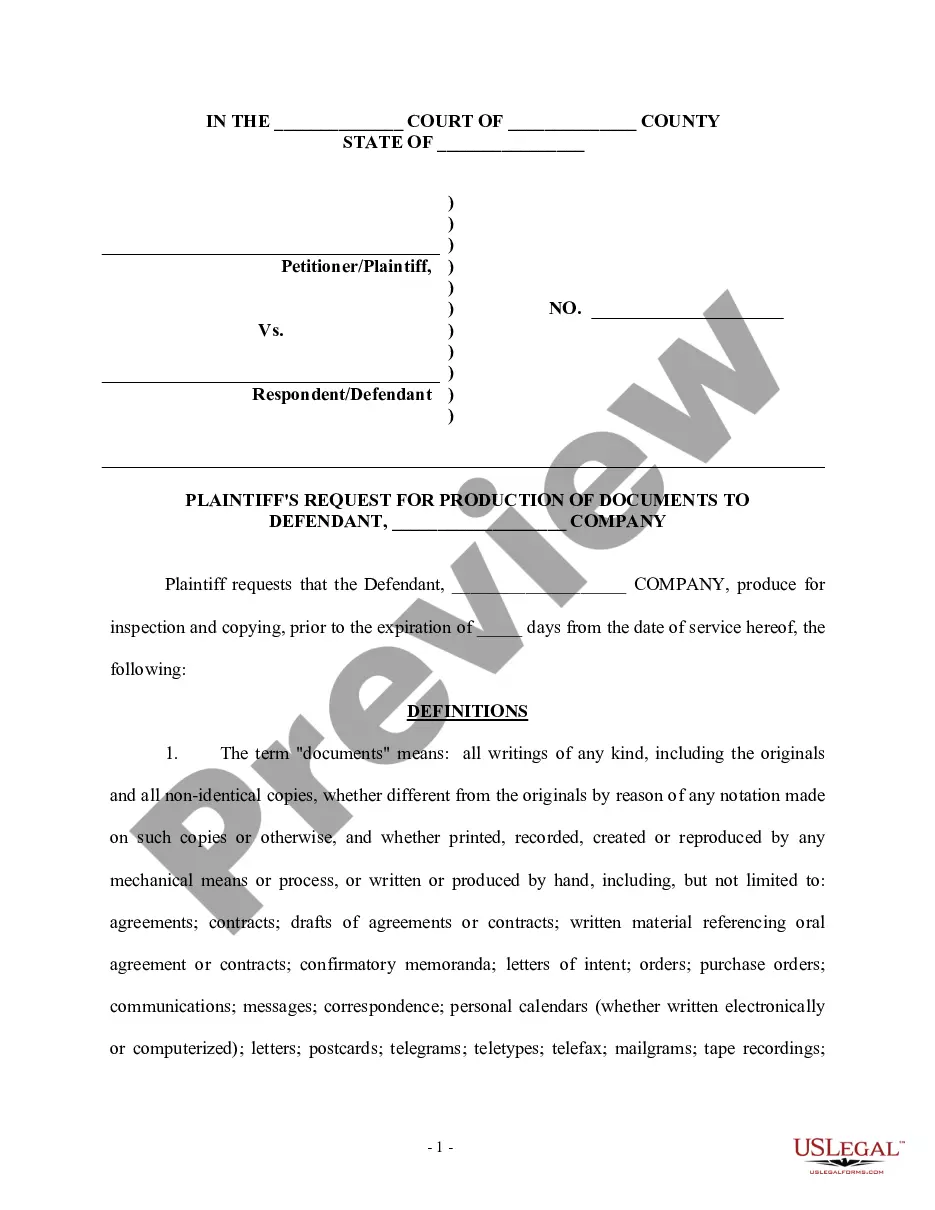

- Utilize the Review button to examine the form.

- See the explanation to actually have selected the proper kind.

- In the event the kind isn`t what you`re searching for, make use of the Research area to find the kind that meets your needs and specifications.

- Whenever you obtain the appropriate kind, click Get now.

- Opt for the prices plan you need, fill in the desired information to make your money, and buy the transaction with your PayPal or bank card.

- Choose a hassle-free data file file format and obtain your version.

Get all of the file web templates you have purchased in the My Forms menus. You can obtain a more version of Puerto Rico Assignment of Production Payment by Lessee to Third Party whenever, if possible. Just go through the necessary kind to obtain or print out the file template.

Use US Legal Forms, the most considerable assortment of lawful varieties, to conserve efforts and steer clear of faults. The assistance offers professionally made lawful file web templates which you can use for an array of functions. Generate a merchant account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

Lessees and lessors must identify the individual lease components and nonlease components of the contract, but do not have to separate the nonlease components from the associated lease component if a practical expedient to not separate is elected (see discussion below).

In a lease agreement, the owner of the assets is 'lessor' and the party that uses the asset is known as 'lessee'. The lessee pays a fixed periodic amount known as the lease rent to the lessor for the use of the assets.

In a finance lease agreement, ownership of the asset is transferred to the lessee at the end of the lease term. In contrast, in an operating lease agreement, the ownership of the asset remains during and after the lease term with the leasing company. Flexible payments are one of the benefits of a finance lease.

The key difference between the two models is that variable payments, other than those that depend on an index or rate, are recognized under ASC 842 only as they are earned. In contrast, variable consideration under ASC 606 is estimated (subject to a constraint) and included in the initial allocation of consideration.

There are two parties to a lease: the owner called the lessor and the user called the lessee. The lessor is the person who owns the asset and gives it on lease. The lessee takes the asset on lease and uses it for the period of the lease.

Examples of non-lease components include services contracts for the leased asset and common area maintenance (CAM). You may also have items that are not considered a contract component, which may include insurance and real estate taxes, which are paid for separately from the regular rent payment.

ASC 842 introduces a lessee model that brings most leases onto the balance sheet; aligns certain of the underlying principles of the lessor model with those in ASC 606, the FASB's new revenue recognition standard; and addresses other concerns related to the nearly 40-year-old leasing model from the previous guidance.

A lessor is the owner of an asset that is leased, or rented, to another party, known as the lessee. Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement.

The lessor is the legal owner of the asset or property, and he gives the lessee the right to use or occupy the asset or property for a specific period.

ASC 842 is a lease accounting standard by the Financial Accounting Standards Board (FASB), requiring all leases longer than 12 months to be reflected on a company's balance sheet. This enhances financial transparency by giving a clear picture of an entity's lease obligations.