Vermont Owner Financing Contract for Moblie Home

Description

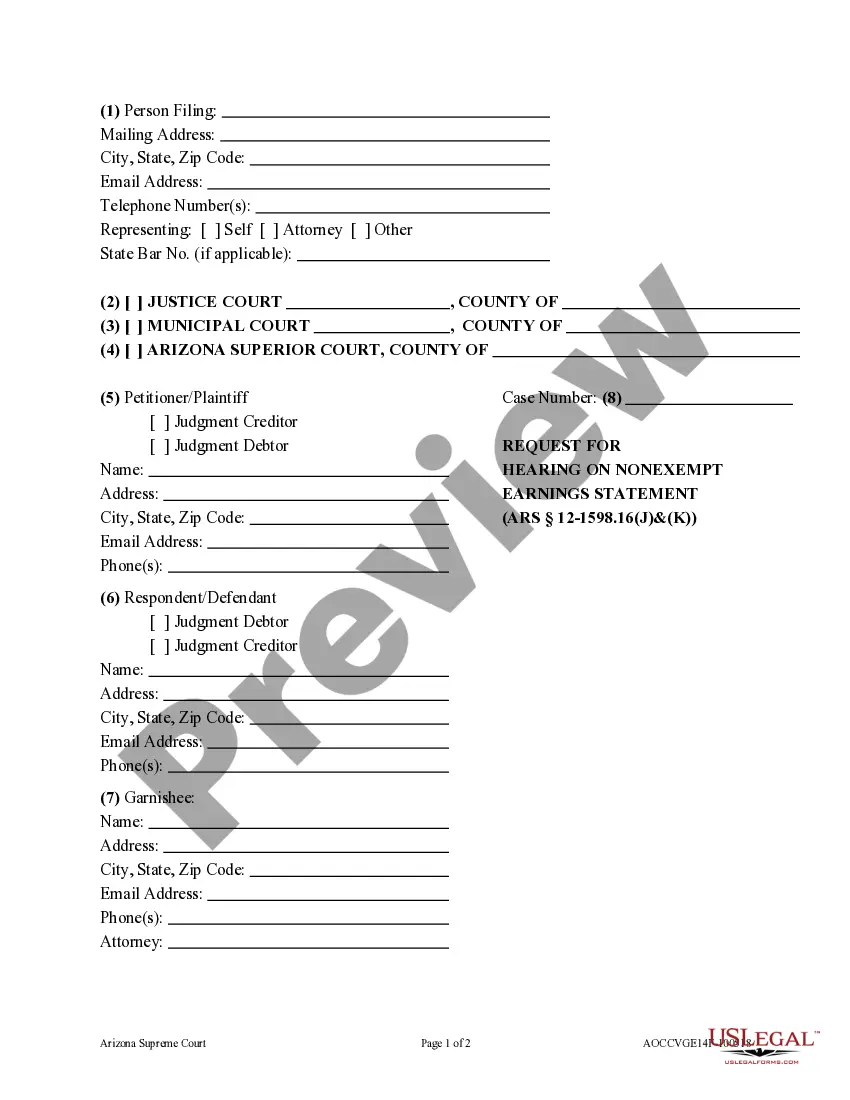

How to fill out Owner Financing Contract For Moblie Home?

If you are looking to finalize, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Make use of the website's user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Employ US Legal Forms to acquire the Vermont Owner Financing Agreement for Mobile Home in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Vermont Owner Financing Agreement for Mobile Home.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure that you have chosen the form for the appropriate area/state.

- Step 2. Use the Preview option to review the form's contents. Be sure to read the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other variations of the legal document template.

Form popularity

FAQ

In certain situations, a mobile home park may have the right to take your mobile home, often due to violations of park rules or unpaid fees. It's crucial to understand the lease agreements and relevant laws to protect your property. Utilizing a Vermont Owner Financing Contract for Mobile Home can safeguard your interests and clarify ownership responsibilities, ensuring you stay informed.

The Missouri Mobile Home Act governs the relationship between mobile home owners and park operators in Missouri. While it does not apply directly to Vermont, its principles highlight the importance of understanding state-specific legal frameworks. If you are considering a Vermont Owner Financing Contract for Mobile Home, familiarize yourself with local regulations that will affect your ownership.

Buying a mobile home in a mobile home park can be a strategic choice for many individuals. Parks usually offer amenities and a sense of community that enhance living experiences. However, always ensure you thoroughly review the terms of a Vermont Owner Financing Contract for Mobile Home, as this can influence your long-term satisfaction and financial investment.

In Vermont, a mobile home can be classified as real estate if it is permanently affixed to land. This distinction impacts taxes, ownership rights, and financing options. If you’re looking to secure a Vermont Owner Financing Contract for Mobile Home, understanding this classification can guide your decision regarding property rights and investment potential.

Yes, a mobile home park can impose rules that may restrict your ability to move your mobile home. Each park has specific regulations regarding the relocation of homes, which might include needing approval from the management. To navigate these rules effectively, consider consulting a Vermont Owner Financing Contract for Mobile Home. This contract can provide clarity on your rights and responsibilities.

While financing a mobile home can carry challenges, it's not insurmountable. Many lenders have specific criteria that need to be met, which can complicate the process. However, exploring options like the Vermont Owner Financing Contract for Mobile Home can provide you with more accessible ways to finance your dream home.

Most lenders prefer to finance mobile homes that are no older than 20 years, though this can vary by lender. If you're considering an older home, options like the Vermont Owner Financing Contract for Mobile Home might help you find the right deal. Always check with your lender for specific requirements regarding financing for older models.

The credit score required to finance a mobile home generally falls between 580 and 620 for most lenders. However, certain financing options, like a Vermont Owner Financing Contract for Mobile Home, may allow you to qualify with a lower score. It's always beneficial to assess your options and see what best suits your financial profile.

Yes, you can finance a repo mobile home, but the options may vary. Repo homes may be appealing due to lower prices, yet securing financing can sometimes be challenging. Using a Vermont Owner Financing Contract for Mobile Home can provide you with options that make this process smoother and more accessible.

Financing a manufactured home can be somewhat different than financing traditional homes. Lenders often have stricter guidelines for manufactured homes, especially if they are older. However, with a Vermont Owner Financing Contract for Mobile Home, you may find more flexible terms that suit your financial situation.