Vermont Owner Financing Contract for Sale of Land

Description

How to fill out Owner Financing Contract For Sale Of Land?

Are you in the position the place you will need paperwork for either company or specific functions virtually every working day? There are a variety of authorized record templates available on the Internet, but getting kinds you can rely isn`t straightforward. US Legal Forms provides 1000s of kind templates, much like the Vermont Owner Financing Contract for Sale of Land, which can be composed in order to meet federal and state needs.

When you are previously informed about US Legal Forms internet site and get your account, just log in. Afterward, you may down load the Vermont Owner Financing Contract for Sale of Land format.

Unless you come with an profile and wish to begin to use US Legal Forms, abide by these steps:

- Find the kind you will need and ensure it is for your proper metropolis/area.

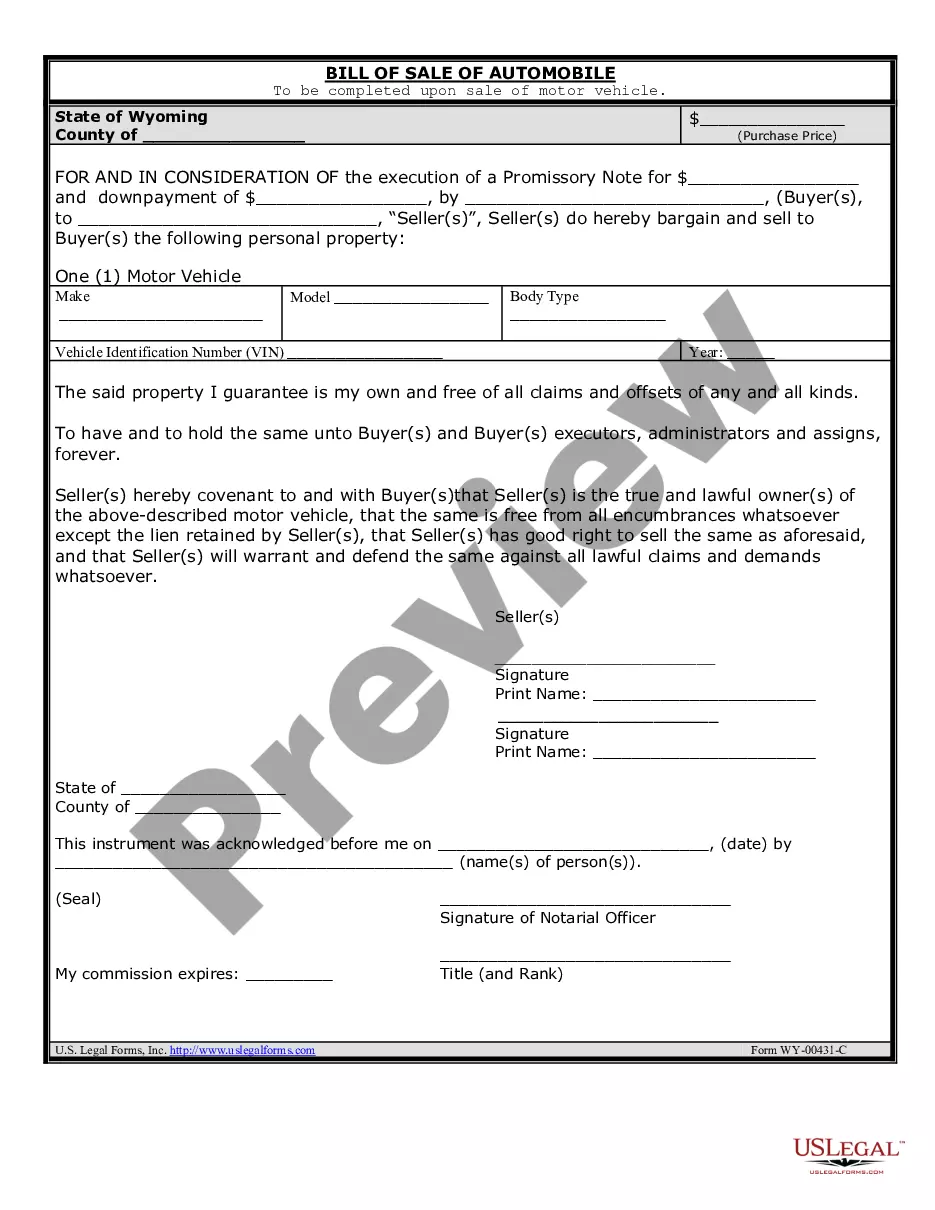

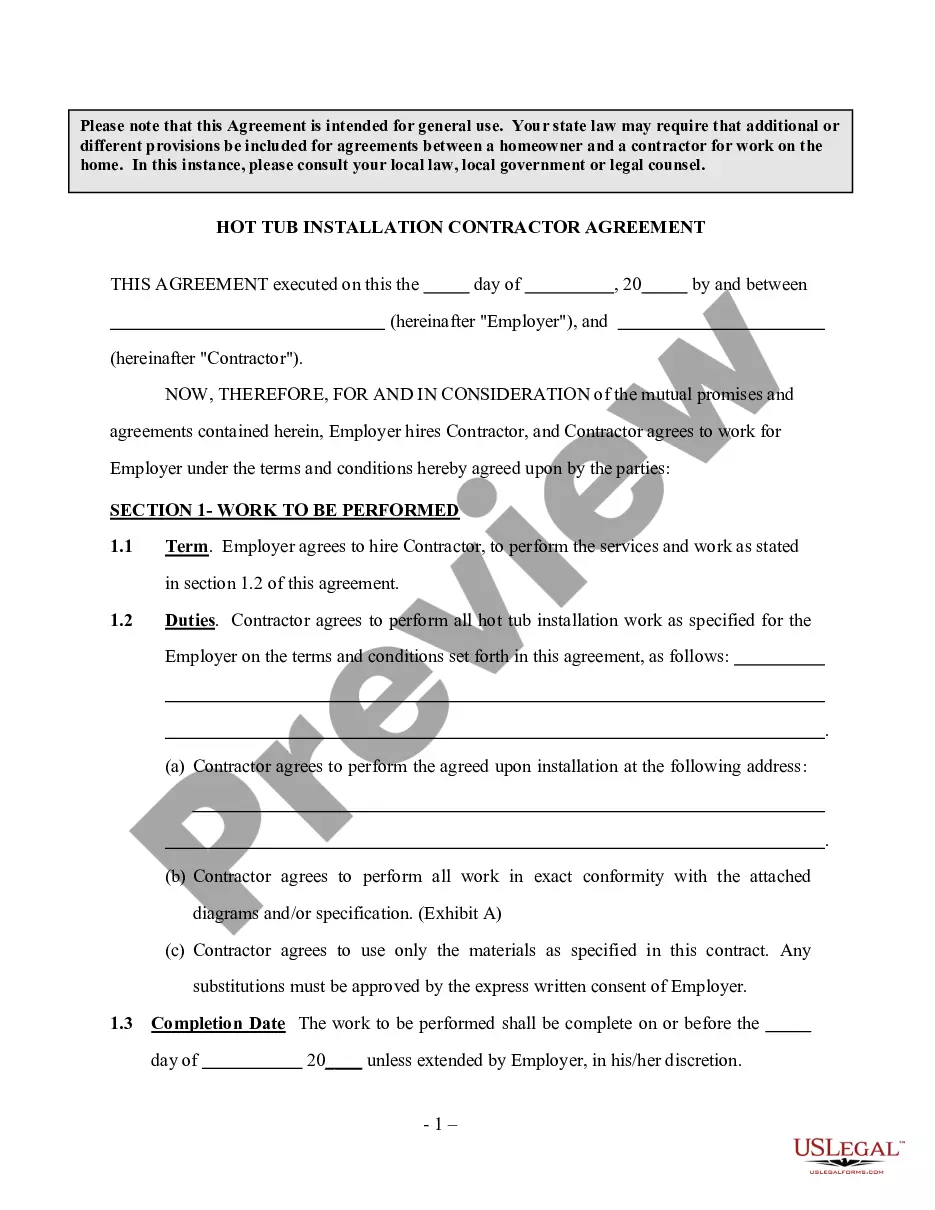

- Make use of the Review key to analyze the form.

- Look at the outline to ensure that you have chosen the correct kind.

- When the kind isn`t what you are trying to find, utilize the Lookup area to find the kind that meets your requirements and needs.

- Once you get the proper kind, simply click Purchase now.

- Opt for the pricing strategy you would like, submit the necessary info to produce your account, and buy an order utilizing your PayPal or bank card.

- Decide on a handy data file formatting and down load your copy.

Find each of the record templates you have bought in the My Forms food list. You can obtain a more copy of Vermont Owner Financing Contract for Sale of Land any time, if possible. Just click on the needed kind to down load or printing the record format.

Use US Legal Forms, one of the most considerable selection of authorized types, in order to save time as well as prevent faults. The service provides appropriately made authorized record templates that you can use for a range of functions. Produce your account on US Legal Forms and commence producing your daily life a little easier.

Form popularity

FAQ

Seller Financing vs Land Contracts (What's the Difference ... - YouTube YouTube Start of suggested clip End of suggested clip But you won't get the deed. Until you pay the seller. Off regular seller financing allows you to getMoreBut you won't get the deed. Until you pay the seller. Off regular seller financing allows you to get the deed up front and then you make monthly payments like you would to a regular bank.

Owner financing can be a good option for buyers who don't qualify for a traditional mortgage. For sellers, owner financing provides a faster way to close because buyers can skip the lengthy mortgage process.

Pros of Owner Financing (for Buyers) Owner financing offers several advantages over traditional lenders. Borrowers may find it easier to qualify for and to make it through the entire approval process. Due to more fluid underwriting constraints, borrowers may find they are able to put less money down.

A traditional owner-financed transaction involves conveying paid-for property to a buyer by warranty deed with the seller taking back a real estate lien note secured by a first-lien deed of trust.

For example, if a seller-financed loan is for $100,000 at an interest rate of 8%, you would calculate that $100,000 x 0.08, which means $8,000 in interest for the year. In this scenario, a $100,000 loan at 8% would look like $666.67 in a monthly interest-only payment.

In an owner-financed sale, the seller pays capital gains on the principal and income tax on the interest over time as the seller receives annual installments from the buyer, rather than having all state and federal taxes taken in one big chunk in the year of the closing?as is the case in a traditional sale.

Most sellers of small businesses want a minimum down payment of 50%, and most sellers offer terms ranging from three to seven years; however, the terms must make sense financially for both parties involved.