Puerto Rico Self-Employed Lecturer - Speaker - Services Contract

Description

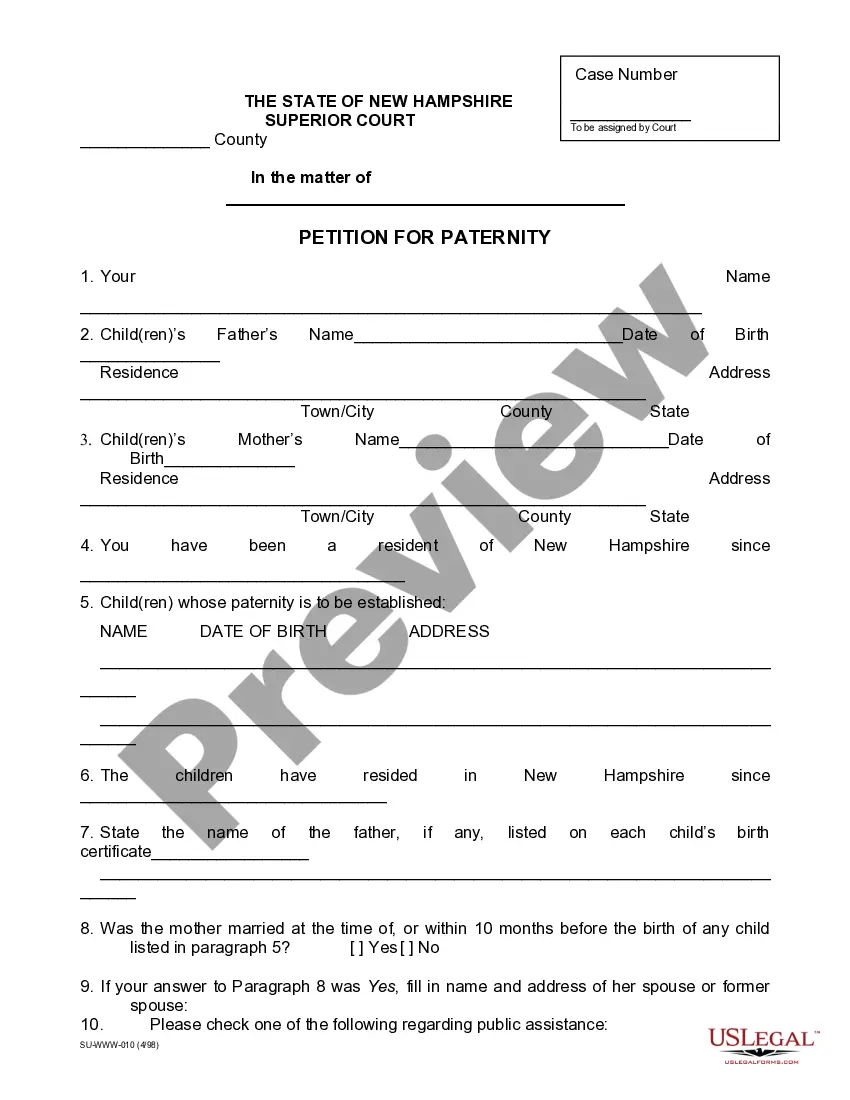

How to fill out Self-Employed Lecturer - Speaker - Services Contract?

If you need to thoroughly download or print authorized document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

Various templates for commercial and individual purposes are categorized by types and states, or keywords. Use US Legal Forms to acquire the Puerto Rico Self-Employed Lecturer - Speaker - Services Contract with just a few clicks.

Every legal document format you acquire is yours indefinitely. You have access to every form you downloaded within your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the Puerto Rico Self-Employed Lecturer - Speaker - Services Contract with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- When you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Puerto Rico Self-Employed Lecturer - Speaker - Services Contract.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form’s details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions in the legal form format.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Fill out, edit, print, or sign the Puerto Rico Self-Employed Lecturer - Speaker - Services Contract.

Form popularity

FAQ

Yes, a US company can conduct business in Puerto Rico, taking advantage of its unique status as a U.S. territory. However, companies must comply with local regulations and tax requirements, including those related to contracts like a Puerto Rico Self-Employed Lecturer - Speaker - Services Contract. Engaging in business here can offer valuable opportunities, but it is wise to seek guidance from legal professionals or use resources like uslegalforms to ensure you meet all necessary legal criteria.

Law 52, also known as the 'Law of Professional Services', establishes guidelines for independent professionals in Puerto Rico, including self-employed lecturers and speakers. This law outlines the rights and responsibilities of these professionals, ensuring they receive fair treatment in their contracts. If you are a Puerto Rico Self-Employed Lecturer - Speaker - Services Contract, understanding Law 52 is essential for your legal protection and operational success. Consider using uslegalforms to access resources that clarify these legal obligations.

In Puerto Rico, professional services, including those provided by a Puerto Rico Self-Employed Lecturer - Speaker - Services Contract, are subject to sales tax. This means that when you engage the services of a lecturer or speaker, you should be prepared to account for this tax in your budget. It is crucial to consult with a tax professional to ensure compliance and understand how this affects your overall costs. Utilizing platforms like uslegalforms can help you navigate these requirements effectively.

Rule 141 in Puerto Rico pertains to the regulations for self-employed individuals, particularly focusing on contracts for services. This rule is crucial for Puerto Rico Self-Employed Lecturers, Speakers, and Service Providers as it outlines the necessary legal requirements for operating under a services contract. Understanding this rule helps you comply with local laws, ensuring your contracts are valid and enforceable. Utilizing platforms like US Legal Forms can simplify the process by providing templates tailored to meet these specific legal standards.

A speaking agreement is a formal contract that outlines the terms and conditions between a speaker and an organization or individual hiring them for a speaking engagement. This contract typically includes details such as the date, location, payment terms, and specific services the Puerto Rico Self-Employed Lecturer - Speaker will provide. By establishing clear expectations, both parties can avoid misunderstandings and ensure a successful event. To create a robust speaking agreement, consider using a platform like US Legal Forms, which offers customizable templates tailored for Puerto Rico Self-Employed Lecturers and Speakers.

A speaker agreement is a more detailed document that specifies the relationship between a speaker and an organization. It covers aspects like the scope of the presentation, duration, and any additional services provided. For individuals offering services as a Puerto Rico Self-Employed Lecturer - Speaker, having a clear speaker agreement can prevent misunderstandings and ensure a successful event. Consider using US Legal Forms to draft a comprehensive agreement tailored to your needs.

A basic speaker contract outlines the essential terms and conditions between a speaker and an event organizer. It typically includes details such as payment, venue, and responsibilities. For anyone looking to formalize their engagements as a Puerto Rico Self-Employed Lecturer - Speaker, this contract serves as a foundation to ensure both parties understand their commitments. Utilizing a platform like US Legal Forms can help you create this contract easily and efficiently.

To write a self-employed contract, begin by outlining the services you will provide, including any relevant deadlines and payment terms. Clearly define the relationship between you and your client, emphasizing the independent nature of your work. Using a Puerto Rico Self-Employed Lecturer - Speaker - Services Contract can streamline this process and offer you a solid foundation to ensure all critical aspects are covered.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. It should include the essential elements such as offer, acceptance, consideration, and mutual consent. For specific guidance, consider using a Puerto Rico Self-Employed Lecturer - Speaker - Services Contract template from uslegalforms, which can simplify the process and ensure compliance with local laws.

To create a self-employment contract, start by detailing the services you will provide and the expectations for both parties. Include payment terms, timelines, and any applicable legal obligations. A well-structured Puerto Rico Self-Employed Lecturer - Speaker - Services Contract will help you and your client understand the scope of work and protect both parties’ interests.