Puerto Rico Fireplace Contractor Agreement - Self-Employed

Description

How to fill out Fireplace Contractor Agreement - Self-Employed?

Are you presently in a position where you require documents for potential company or personal tasks nearly every workday.

There are numerous legal document templates accessible online, but finding reliable forms is not straightforward.

US Legal Forms offers thousands of form templates, including the Puerto Rico Fireplace Contractor Agreement - Self-Employed, designed to comply with federal and state regulations.

Once you find the right form, click Buy now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Puerto Rico Fireplace Contractor Agreement - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

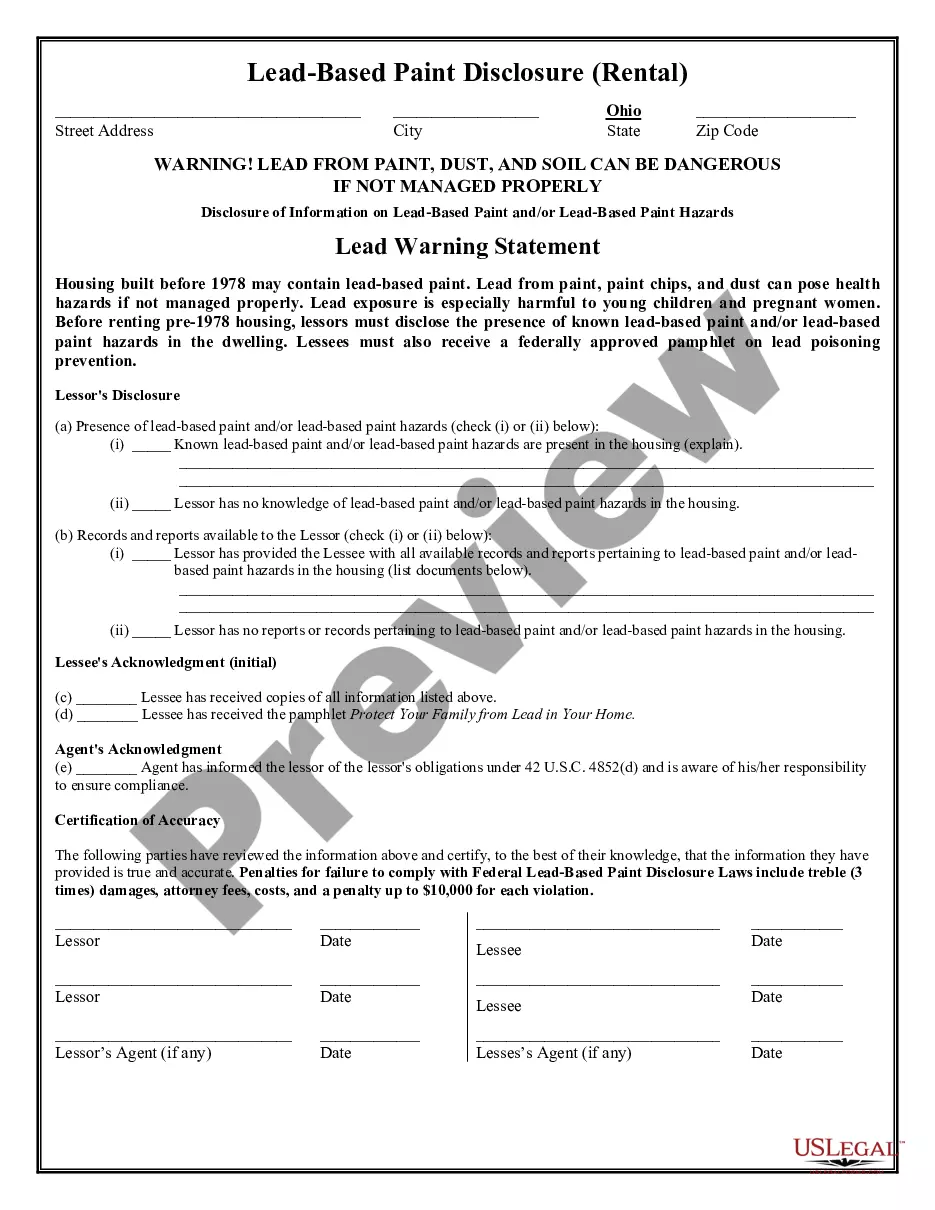

- Utilize the Preview button to review the document.

- Check the details to make sure you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the document that suits your needs.

Form popularity

FAQ

To establish yourself as a self-employed contractor, begin by choosing your business niche and registering your business accordingly. You should draft an agreement like the Puerto Rico Fireplace Contractor Agreement - Self-Employed to define your services and expectations clearly. Finally, stay updated with local laws and tax requirements to ensure your business operates smoothly.

Law 75, also known as the Law of the Sale of Goods, governs contractual agreements related to the sale and distribution of goods. If you’re operating as a self-employed contractor in Puerto Rico, knowing this law helps you create comprehensive contracts, such as the Puerto Rico Fireplace Contractor Agreement - Self-Employed, that comply with local regulations.

Law 80, known as the Law for the Protection of Job Stability, protects employees engaged in work relationships. While it primarily focuses on employees, as a self-employed individual, understanding this law can help you navigate contractual agreements more effectively, including your Puerto Rico Fireplace Contractor Agreement - Self-Employed to avoid potential disputes.

To set yourself up as a contractor, start by defining the services you will offer and creating a business plan. Next, use the Puerto Rico Fireplace Contractor Agreement - Self-Employed to draft a clear and professional agreement with your clients. This ensures both parties understand the terms of your service, protecting your business interests.

The self-employment tax rate in Puerto Rico is generally around 15.3%, which comprises Social Security and Medicare taxes. You must also consider local income taxes when calculating your total tax liability. Keeping accurate records and using tools available on the uslegalforms platform can help you manage your taxes effectively.

Setting yourself up as an independent contractor involves several steps. First, you must choose a business structure, such as a sole proprietorship or an LLC. Next, draft a solid agreement, such as the Puerto Rico Fireplace Contractor Agreement - Self-Employed, to clarify your work terms and obligations. Finally, register with local tax authorities to secure your necessary identification numbers.

To be an independent contractor in Puerto Rico, you must register your business with the Department of State and obtain the necessary licenses. Additionally, you need to have a clear contract, like the Puerto Rico Fireplace Contractor Agreement - Self-Employed, which outlines your services, payment terms, and responsibilities. Ensuring compliance with local regulations is important to operate legally.

Receiving a 1099 form usually signifies that you are self-employed, as it indicates you earned income outside of a traditional employment structure. This classification comes with both responsibilities and benefits, so understanding it is essential. When engaging with clients under a Puerto Rico Fireplace Contractor Agreement - Self-Employed, being aware of your 1099 status will help maintain clarity in your financial dealings.

To be considered self-employed, an individual must operate their own business and earn income without an employer-employee relationship. They typically handle their own taxes and retain control over their work processes. Utilizing a Puerto Rico Fireplace Contractor Agreement - Self-Employed is a great step to formalizing this status and outlining the necessary terms.

Absolutely, an independent contractor qualifies as self-employed. This classification highlights their autonomy in business operations and relationships with clients. When you create a Puerto Rico Fireplace Contractor Agreement - Self-Employed, acknowledging this status can help ensure proper alignment with local regulations.