Puerto Rico Employment Information Form

Description

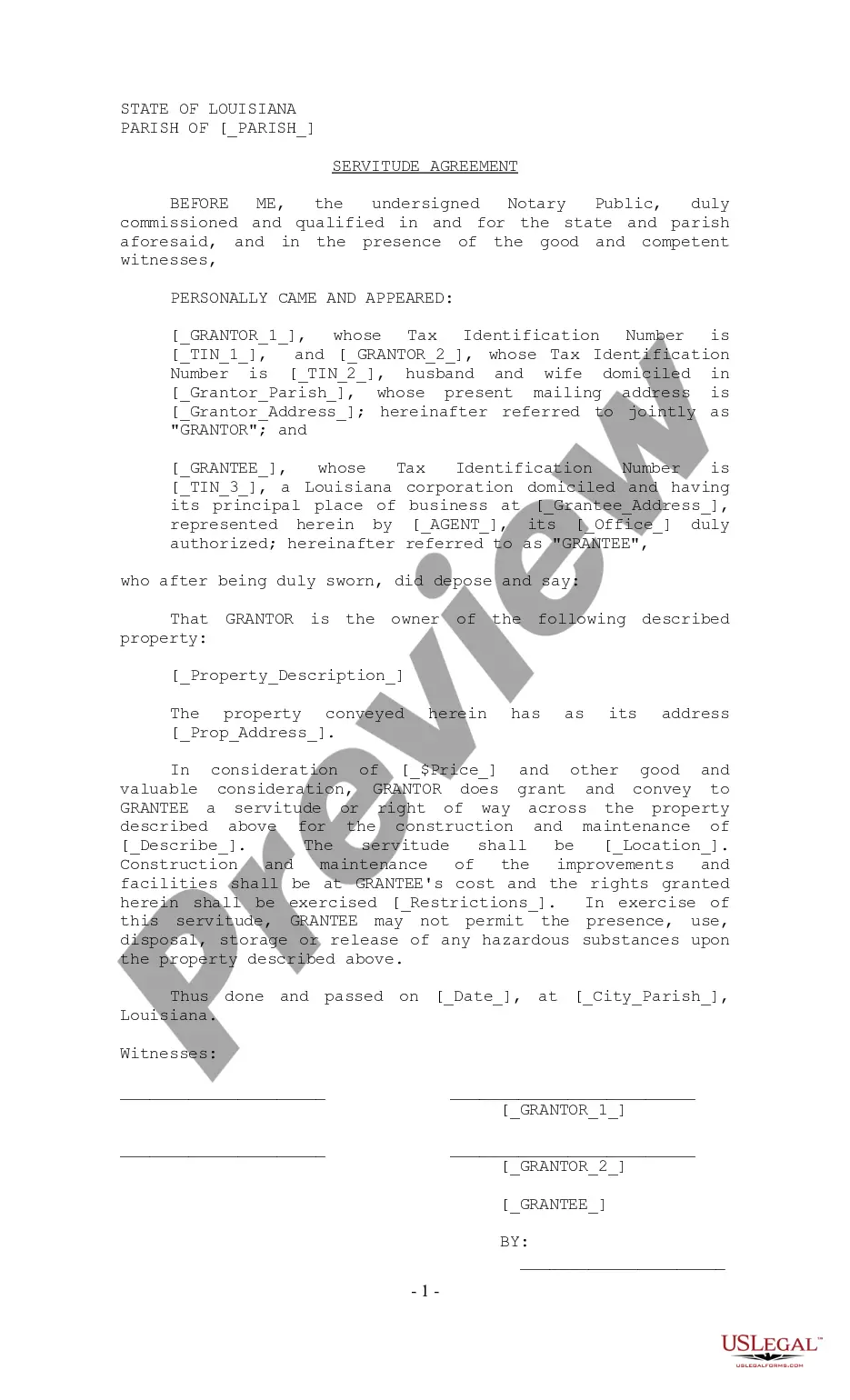

How to fill out Employment Information Form?

If you need to finalize, acquire, or print authorized document templates, utilize US Legal Forms, the largest compilation of authorized forms available online.

Take advantage of the site’s straightforward and efficient search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every authorized document template you download is yours indefinitely. You have access to each form you obtained in your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Puerto Rico Employment Information Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to procure the Puerto Rico Employment Information Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to locate the Puerto Rico Employment Information Form.

- You can also find forms you have previously obtained in the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Remember to read the description.

- Step 3. If you are not happy with the form, use the Search field at the top of the screen to find other versions of the authorized form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to sign up for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the authorized form and download it to your device.

- Step 7. Complete, edit, and print or sign the Puerto Rico Employment Information Form.

Form popularity

FAQ

You can get the I-9 form from your employer or directly from the U.S. Citizenship and Immigration Services website. Once you have the form, complete it as instructed, ensuring you provide accurate information about your identity and authorization to work. If you're unsure about any part of the process, the Puerto Rico Employment Information Form can offer guidance and help you meet all requirements.

The 2021 Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, was released Dec. 3 by the Internal Revenue Service. The 2021 Form 940 was not substantially changed from the 2020 version. The form's 2021 Schedule A, Multi-State Employer and Credit Reduction Information, also was released.

When do I file Form 940? Unlike your FUTA payments, which are due every calendar quarter, you must submit Form 940 annually. The due date for filing Form 940 for 2021 is January 31, 2022.

About Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

Since these forms are virtually identical in function, the main reason to use Form 1040-SR is if you're filling out your tax return by hand rather than online. Form 1040-SR has larger type and larger boxes to write numbers in, making it slightly easier for seniors to read and fill out.

You must file Form 1040-SS if you meet all three requirements below. 1. You, or your spouse if filing a joint return, had net earnings from self-employment (from other than church employee income) of $400 or more (or you had church employee income of $108.28 or moresee Church Employees, later).

Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only employers pay FUTA tax.

Taxpayers complete Form 8862 and attach it to their tax return if: Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

You should file Form 1040 if: Your taxable income is greater than $100,000. You itemize deductions. You receive income from the sale of property.

When Must You File Form 940? The due date for filing Form 940 for 2021 is January 31, 2022. However, if you deposited all your FUTA tax when it was due, you may file Form 940 by February 10, 2022.