Puerto Rico Personnel File Sheet

Description

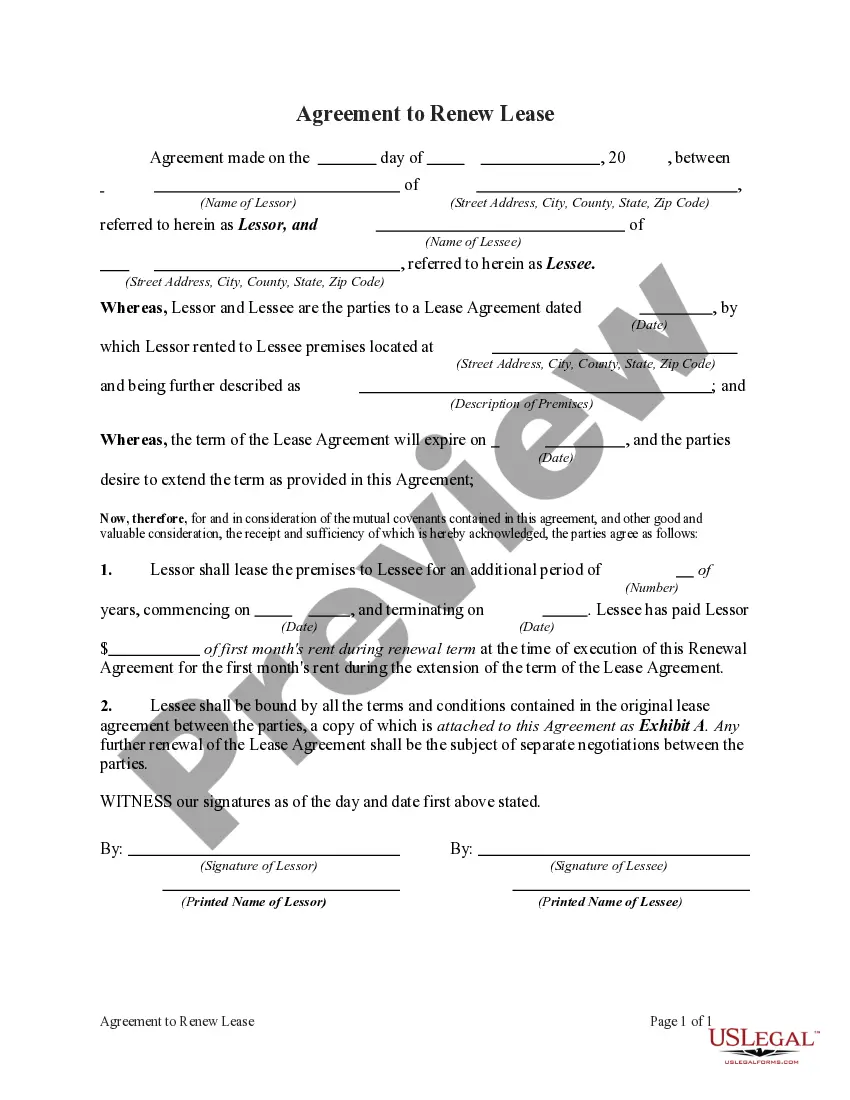

How to fill out Personnel File Sheet?

You might spend numerous hours online searching for the appropriate legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been vetted by experts.

You can easily download or print the Puerto Rico Personnel File Sheet from your service.

If available, utilize the Review button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Puerto Rico Personnel File Sheet.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and select the appropriate button.

- If it’s your first time using the US Legal Forms website, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for your area/city that you choose.

- Review the form description to confirm you have selected the right type.

Form popularity

FAQ

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

Wage and hour coverage in Puerto Rico for non-exempt employees is governed by the US Fair Labor Standards Act (FLSA) as well as local laws.

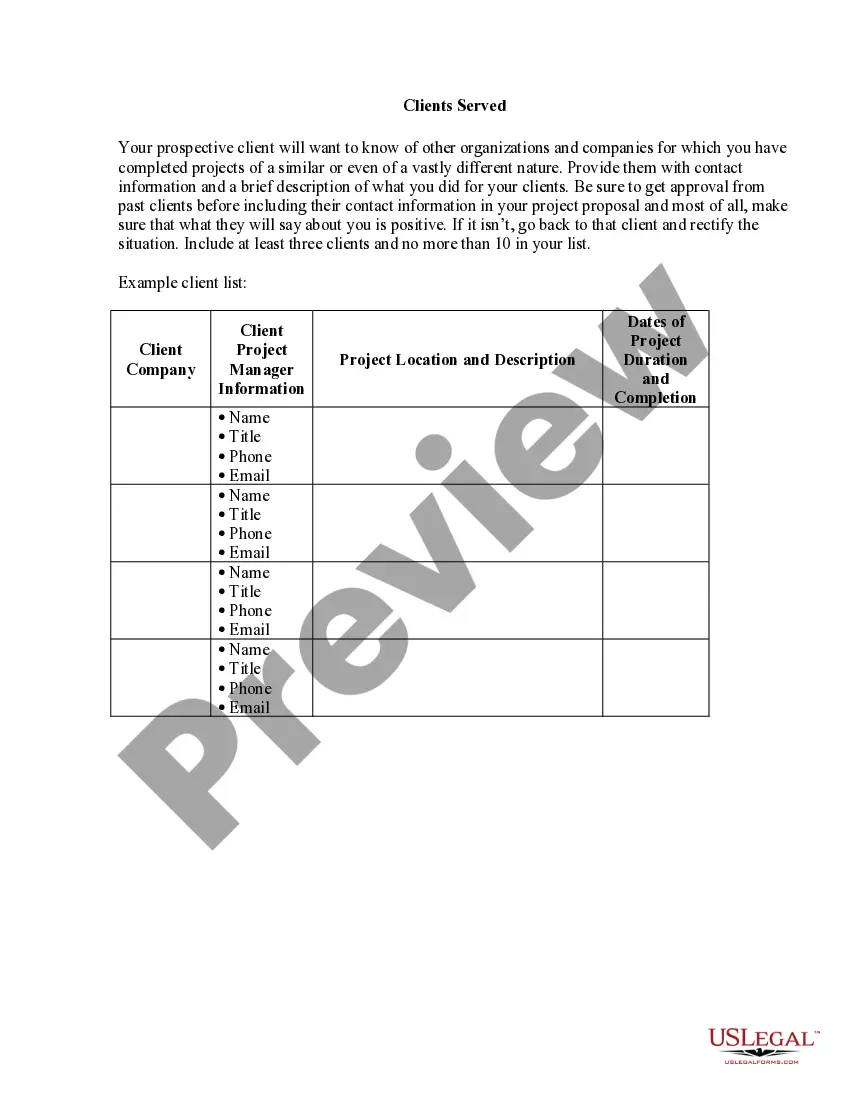

If you're looking to hire employees in Puerto Rico, check out the job bank maintained by the Puerto Rico Department of Labor. It's an entirely free service that allows you to create an employer account and sift through the resumes of potential employees.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.

No. You don't even need a passport. For U.S. citizens, traveling to and working in Puerto Rico is like traveling to or working in another state. U.S. citizens only need a valid driver's license to travel to and work from Puerto Rico.

In Puerto Rico, workers' compensation is compulsory, and no waivers are permitted. There is an exclusive state fund. Employers may not insure through private carriers, self-insurance, or through groups of employers. There is no exemption for employers with small numbers of employees.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

If you are a U.S. citizen who is also a bona fide resident of Puerto Rico during the fiscal year but receive income as a U.S. government employee in Puerto Rico, you must file a federal tax return.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.