Puerto Rico Personnel Change Form

Description

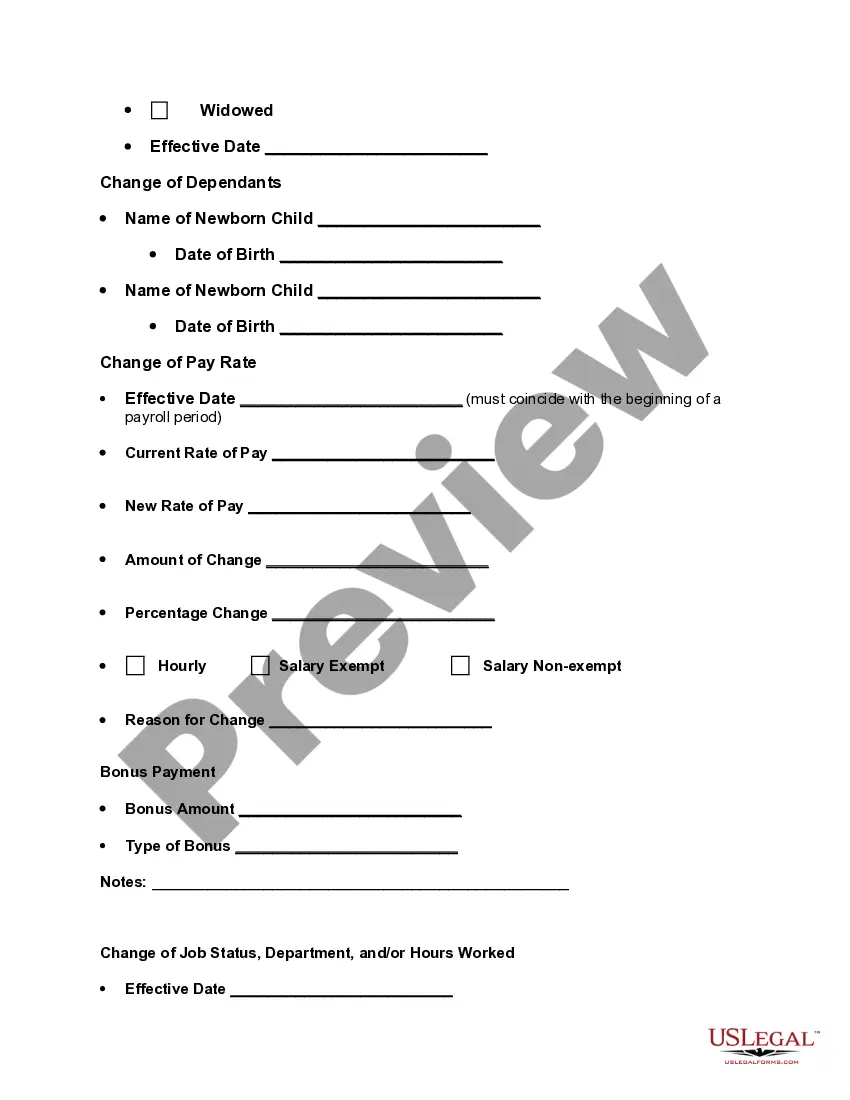

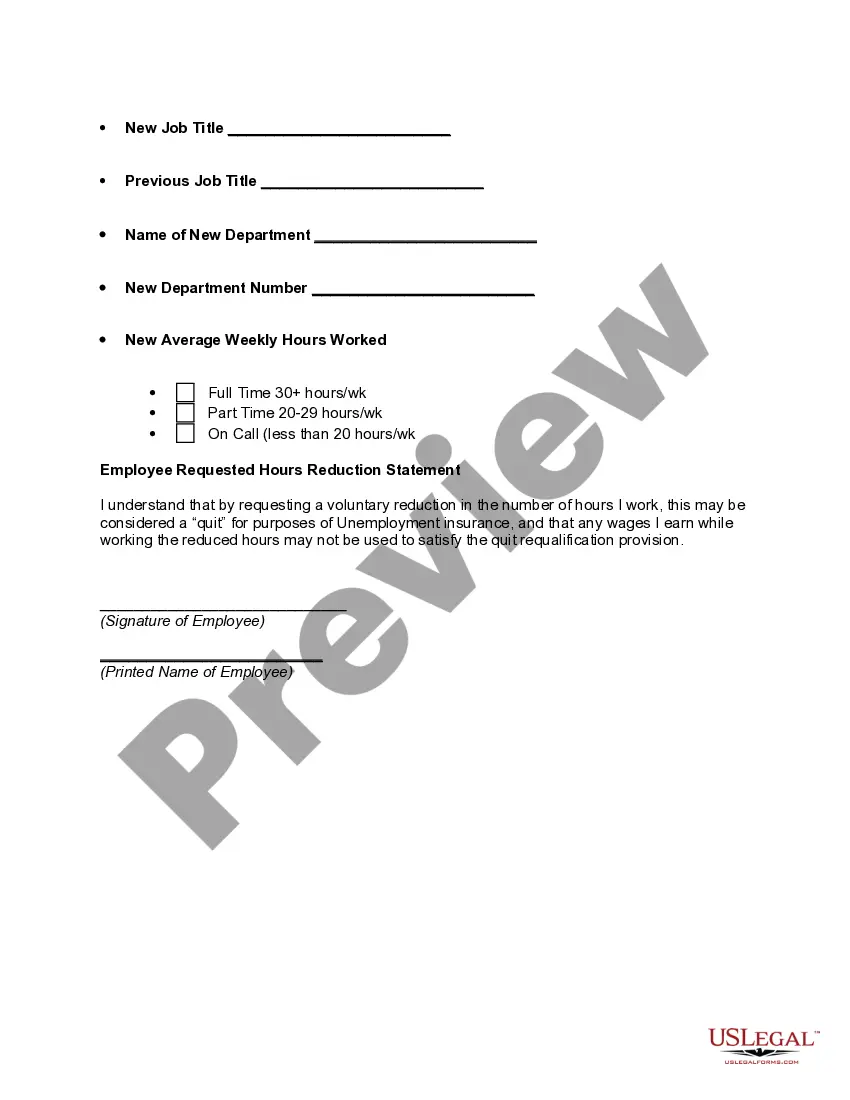

How to fill out Personnel Change Form?

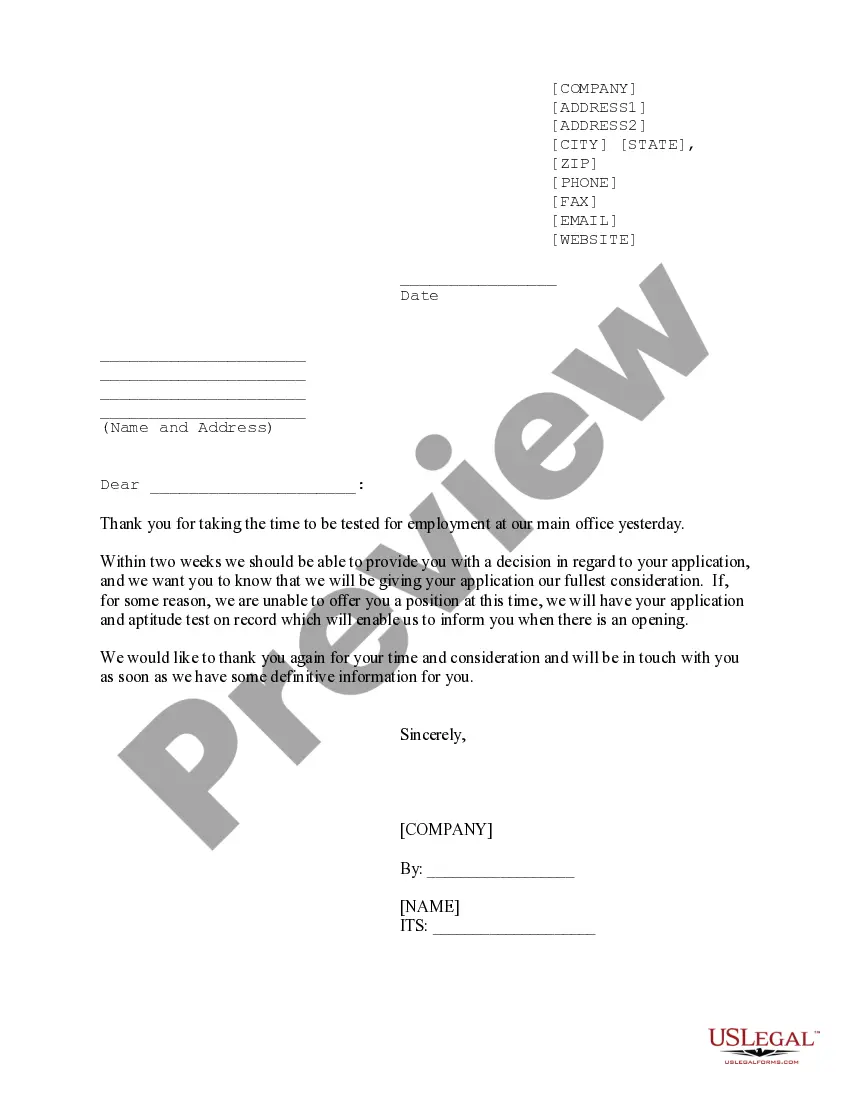

If you require complete, download, or printing valid document templates, utilize US Legal Forms, the top selection of valid forms, which can be accessed online.

Leverage the site's straightforward and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by groups and regions, or keywords.

Use US Legal Forms to find the Puerto Rico Personnel Change Form with just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to every form you saved in your account.

Be proactive and download, and print the Puerto Rico Personnel Change Form with US Legal Forms. There are countless professional and state-specific templates you can utilize for your business or personal needs.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to obtain the Puerto Rico Personnel Change Form.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form's content. Remember to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Puerto Rico Personnel Change Form.

Form popularity

FAQ

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

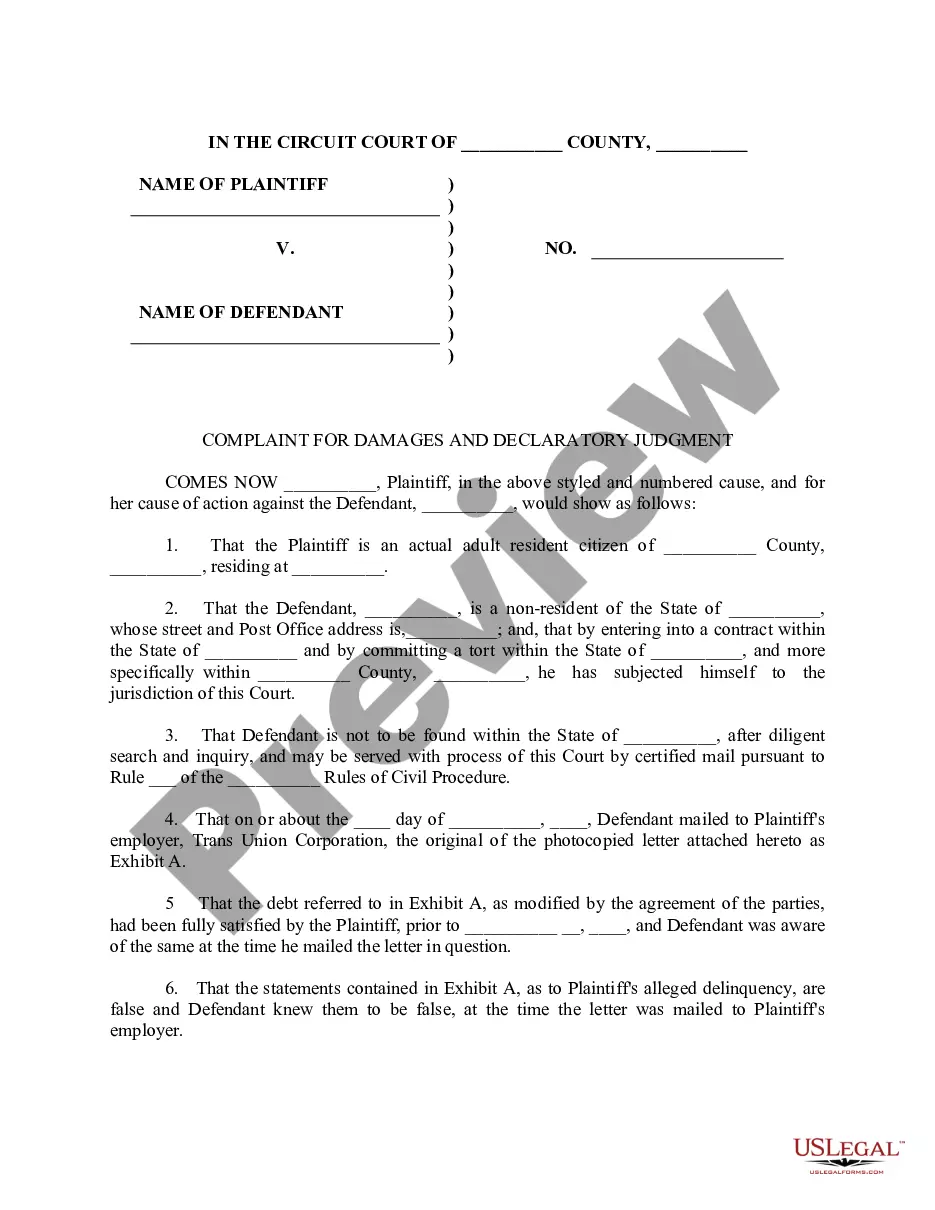

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

If you are a U.S. citizen who is also a bona fide resident of Puerto Rico during the fiscal year but receive income as a U.S. government employee in Puerto Rico, you must file a federal tax return.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.