Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Declaration of Gift Over Several Year Period

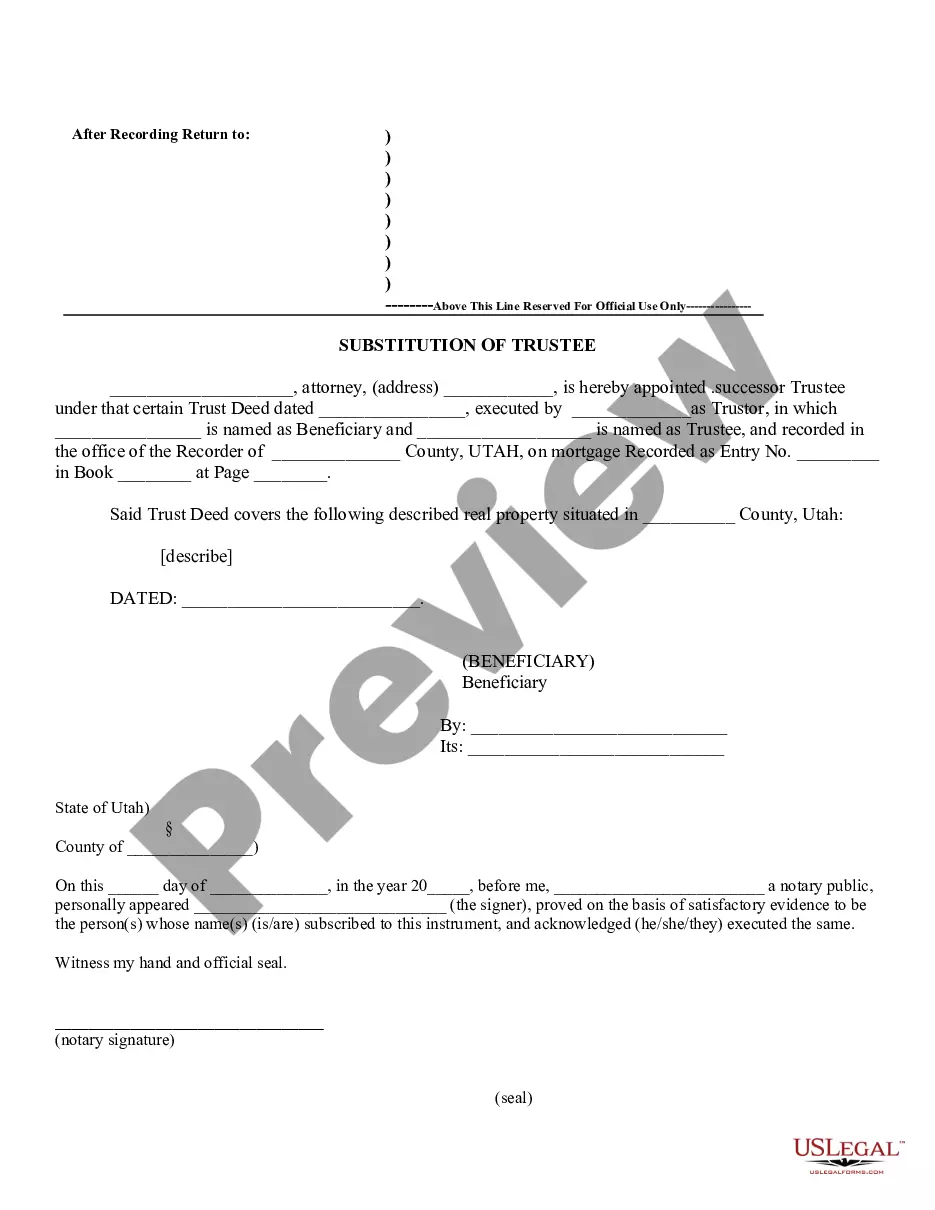

Description

How to fill out Declaration Of Gift Over Several Year Period?

If you need to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s straightforward and convenient search to find the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords.

Every legal document format you acquire is yours permanently. You will have access to every form you obtained in your account.

Click the My documents section to select a form to print or download again. Complete, acquire, and print the Puerto Rico Declaration of Gift Over Several Year Period with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Puerto Rico Declaration of Gift Over Several Year Period with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain option to get the Puerto Rico Declaration of Gift Over Several Year Period.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s details. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form format.

- Step 4. Once you have located the form you need, click on the Obtain now option. Choose the pricing plan you prefer and enter your credentials to sign up for an account.

- Step 5. Process the order. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, review, and print or sign the Puerto Rico Declaration of Gift Over Several Year Period.

Form popularity

FAQ

Yes, you can file form 3520 on TurboTax, which provides a user-friendly platform to manage your tax filings. However, it's essential to ensure that your version of TurboTax supports filing the Puerto Rico Declaration of Gift Over Several Year Period. Utilizing TurboTax can simplify the process, but always double-check for any specific requirements or exclusions related to your situation.

Certain tax forms, including some specialized estate and gift tax forms, may not be available for electronic filing. It is important to verify with current IRS regulations which forms cannot be submitted electronically. For the Puerto Rico Declaration of Gift Over Several Year Period, make sure to check if form 3520 aligns with e-filing options and stay updated on any changes.

Yes, form 3520 is filed separately and serves a specific purpose related to gifts and inheritances. By filing this form, you provide the IRS with detailed information about your Puerto Rico Declaration of Gift Over Several Year Period. Filing separately helps in avoiding confusion and ensures that you meet all reporting obligations accurately.

You can file form 3520 separately from your other tax forms, which can be beneficial in certain situations. This allows you to specifically address the requirements for the Puerto Rico Declaration of Gift Over Several Year Period without combining it with other tax documents. Filing separately can lead to better organization and clarity in your tax reporting.

The annual gift tax exclusion can vary year by year, but it typically allows individuals to gift a certain amount without incurring gift tax. Keeping track of these exclusions is essential for your Puerto Rico Declaration of Gift Over Several Year Period. Understanding these limits helps you plan your gifts better and avoid unnecessary tax burdens.

Yes, form 3520 can be electronically filed, which simplifies the process for reporting gifts and inheritances. Using platforms like USLegalForms enables you to submit the Puerto Rico Declaration of Gift Over Several Year Period efficiently. Electronic filing streamlines your tax responsibilities and ensures that you meet all deadlines without unnecessary hassles.

Form 3520 cannot be filed electronically, as it must be mailed to the IRS. This form is important for reporting foreign gifts and is related to the Puerto Rico Declaration of Gift Over Several Year Period. Be sure to review the filing instructions carefully to prevent any issues. Utilizing platforms like USLegalForms can simplify the completion of this form and ensure accuracy.

Yes, if you receive a foreign gift over a certain amount, you must report it to the IRS. This includes gifts that may fall under the Puerto Rico Declaration of Gift Over Several Year Period. Reporting helps ensure compliance and may prevent possible penalties later. Make sure to consult the IRS guidelines or a tax professional for specific reporting requirements.

You do not need to file form 3520 every year; however, certain circumstances require it. If you make gifts that may be subject to reporting under the Puerto Rico Declaration of Gift Over Several Year Period, you might need to complete this form. This form is designed to report specific transactions and is crucial for maintaining transparency with tax authorities. For clarity on when to file, it's advisable to consult a tax expert or use reliable resources like UsLegalForms.

The annual exclusion form for gifts allows individuals to report gifts exceeding the annual exclusion limit to the IRS. This form includes details about the recipients and the value of the gifts under the Puerto Rico Declaration of Gift Over Several Year Period. By filing this form, you ensure compliance with tax regulations and maintain clear records. Using platforms like UsLegalForms can simplify the process of completing necessary forms accurately.