Puerto Rico Escrow Instructions in Short Form

Description

How to fill out Escrow Instructions In Short Form?

You can spend hours online looking for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that are evaluated by professionals.

It is easy to download or print the Puerto Rico Escrow Instructions in Short Form from our services.

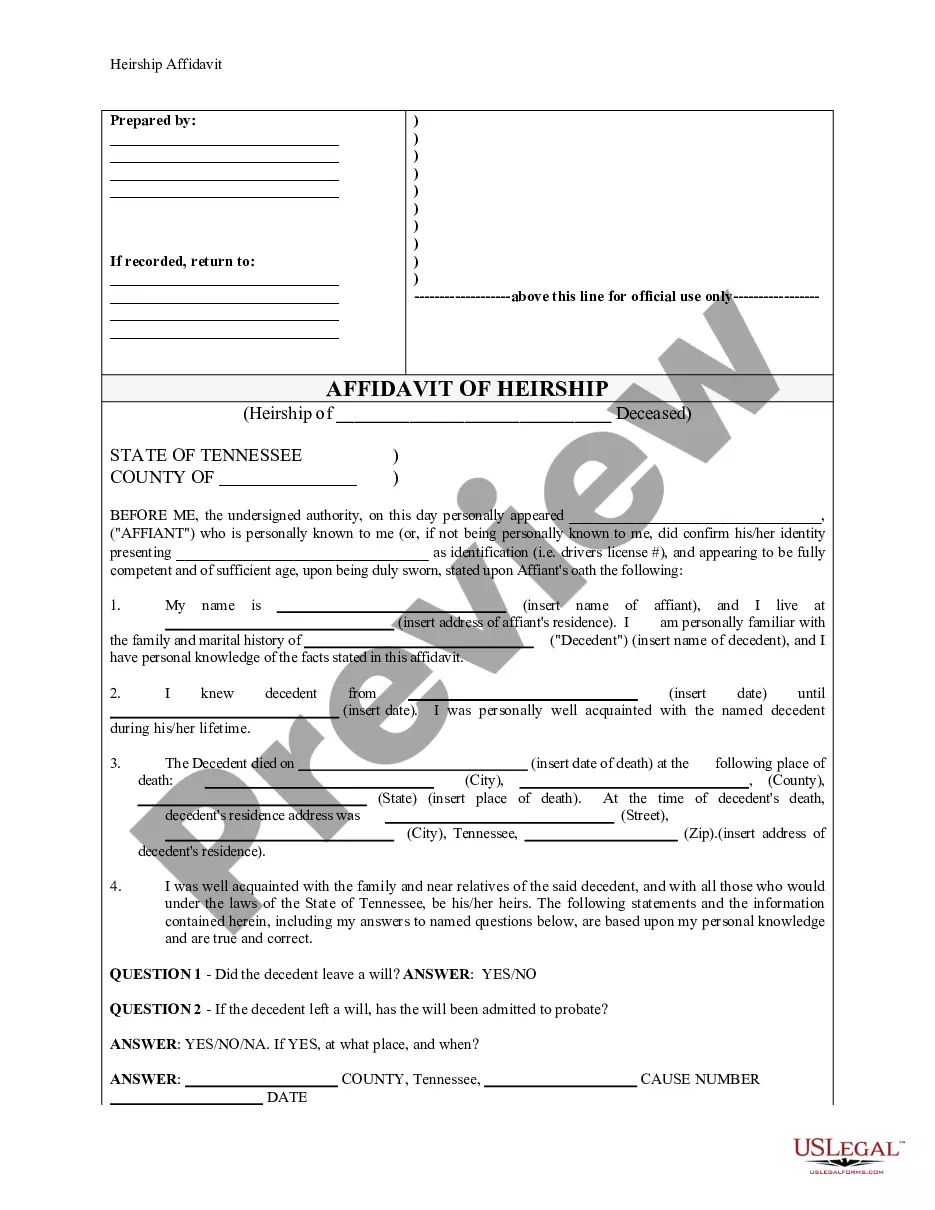

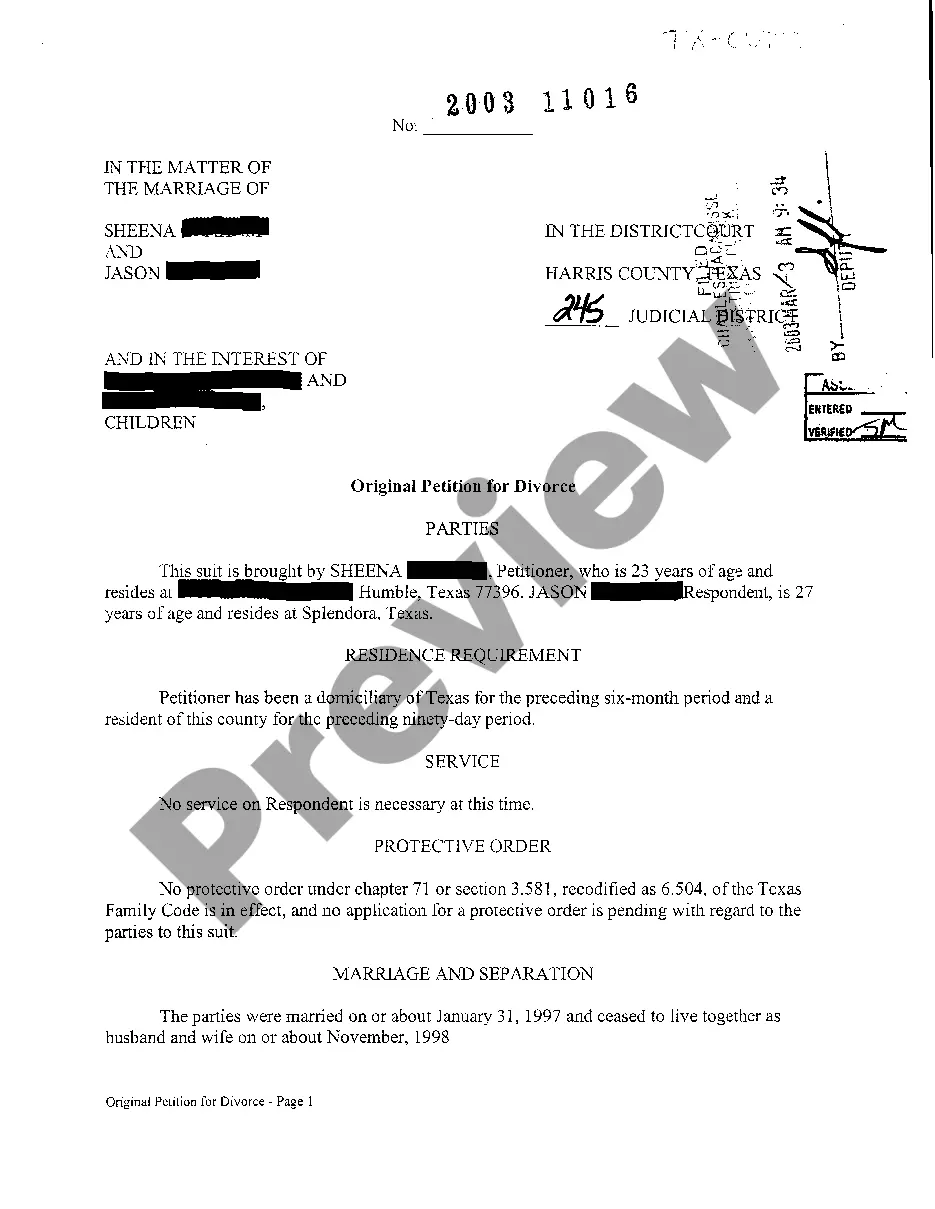

If available, use the Preview button to view the document template as well. If you want to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Purchase button.

- Then, you can complete, modify, print, or sign the Puerto Rico Escrow Instructions in Short Form.

- Every legal document template you obtain is yours permanently.

- To get another copy of the document you've purchased, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for your county/region of choice.

- Review the description of the document to ensure you've chosen the right form.

Form popularity

FAQ

The document that serves as escrow instructions is typically titled 'Escrow Agreement' or 'Escrow Instructions.' It contains all the terms, conditions, and stipulations related to the escrow arrangement. Using concise Puerto Rico Escrow Instructions in Short Form helps streamline these details for better understanding and execution.

The primary purpose of escrow instructions is to protect all parties in a transaction by clearly outlining responsibilities and expectations. They ensure that funds and documents are handled as agreed upon. When you utilize effective Puerto Rico Escrow Instructions in Short Form, you create a reliable framework that builds trust among all involved.

An escrow letter is another term used for escrow instructions. It provides detailed instructions for the escrow agent about how to manage the funds and assets involved in the transaction. By referring to Puerto Rico Escrow Instructions in Short Form, you can ensure that this letter meets all necessary requirements for a successful escrow process.

Both parties involved in the transaction must sign the escrow instructions to confirm their agreement. This signature signifies that each party understands and agrees to the terms laid out in the document. Clear Puerto Rico Escrow Instructions in Short Form can prevent misunderstandings and help facilitate a seamless transaction.

Escrow instructions are usually prepared by the escrow agent or company handling the transaction. They collect details from both parties and compile the necessary guidelines. For those seeking effective Puerto Rico Escrow Instructions in Short Form, the right escrow agent can make all the difference in your transaction's smoothness.

Typically, the buyer, seller, or both parties provide escrow instructions, depending on the nature of the transaction. These instructions are crucial as they outline what each party expects from the escrow process. Having precise Puerto Rico Escrow Instructions in Short Form helps ensure that everyone is on the same page, minimizing conflicts.

An escrow instruction letter outlines the specific guidelines for how funds and property will be handled in an escrow arrangement. It details the terms agreed upon by the parties involved in a transaction. When you need clear Puerto Rico Escrow Instructions in Short Form, this letter serves as a vital tool to ensure clarity and fairness.

Filing a Form 1120 in Puerto Rico involves completing the corporate tax return for entities doing business within the territory. Ensure you gather all the necessary financial records and understand the specific requirements for Puerto Rico corporate taxes. For comprehensive guidance on the filing process, refer to resources like US Legal Forms, which offers Puerto Rico Escrow Instructions in Short Form to support businesses in meeting their tax obligations.

Moving to Puerto Rico may offer some individuals the opportunity for favorable tax treatment; however, this does not mean you can completely avoid income tax. Individuals who establish residency and meet specific criteria can benefit from lower tax rates on certain types of income. Make sure to examine the qualifications carefully, and US Legal Forms can provide valuable Puerto Rico Escrow Instructions in Short Form to aid your transition.

Puerto Rico is a territory of the United States, but the rules regarding residency differ compared to the 50 states. Living in Puerto Rico may grant certain tax advantages, but it does not automatically confer US residency for all tax purposes. It is important to understand your residency status under Puerto Rico law, and resources like US Legal Forms can offer clear Puerto Rico Escrow Instructions in Short Form to help you navigate these rules.