Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust without the necessity of court supervision in the event of the trustor's incapacity or death. Other provisions of the trust document include: trust assets, disposition of income and principal, and administration of the trust assets after the death of the trustor.

Puerto Rico Living Trust - Revocable

Description

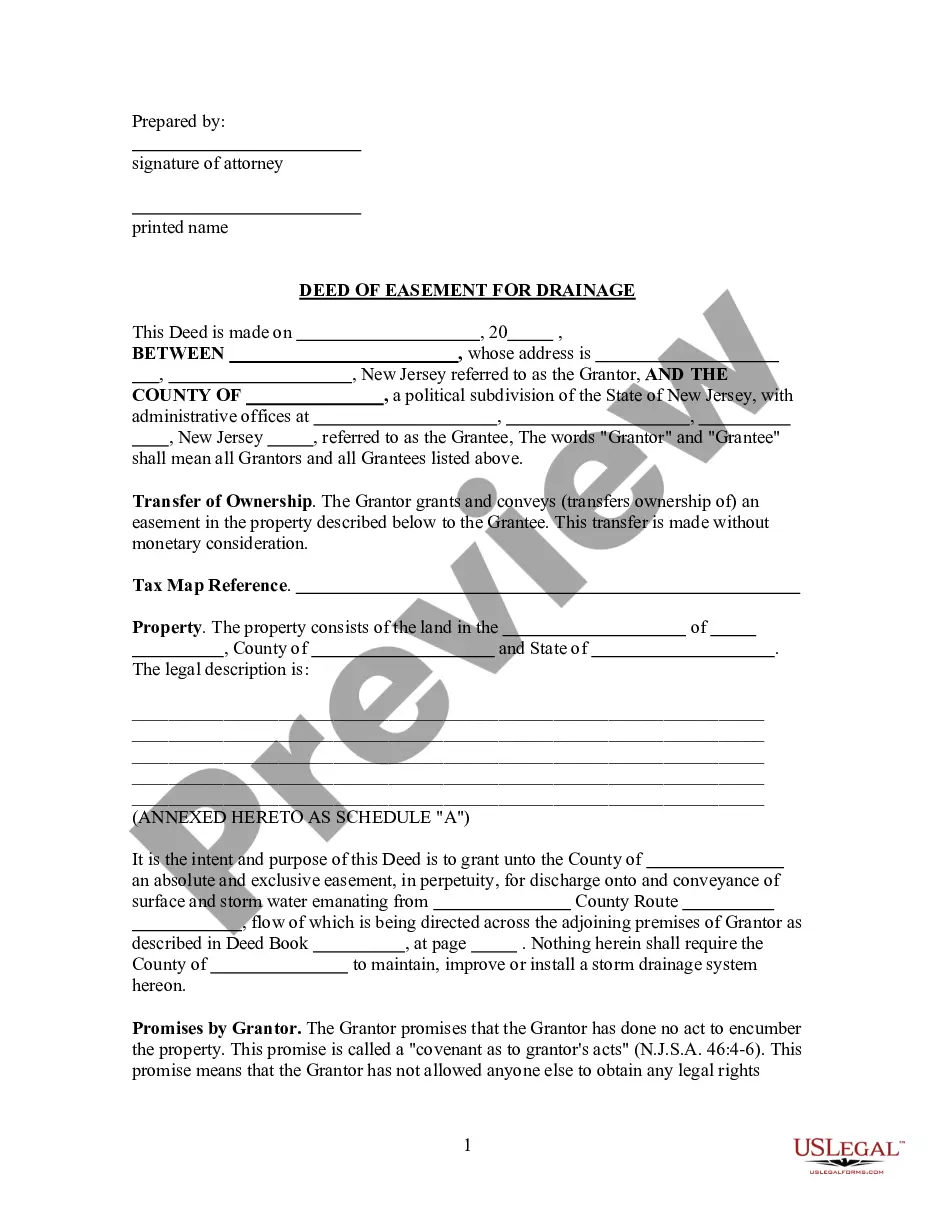

How to fill out Living Trust - Revocable?

Are you currently in the location where you need paperwork for either corporate or personal purposes almost on a daily basis.

There are numerous legal document templates available online, but finding ones you can trust isn't simple.

US Legal Forms provides a wide array of form templates, including the Puerto Rico Living Trust - Revocable, designed to comply with federal and state regulations.

Once you find the right form, click Acquire now.

Select the pricing plan you desire, fill in the required details to complete your purchase, and process an order using your PayPal or credit card.

- If you are currently acquainted with the US Legal Forms site and hold an account, simply Log In.

- After that, you can download the Puerto Rico Living Trust - Revocable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review button to inspect the form.

- Check the details to confirm that you have chosen the right form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that satisfies your requirements and specifications.

Form popularity

FAQ

While many living trusts are revocable, not all of them are. Some individuals opt for irrevocable living trusts for specific estate planning reasons, such as tax benefits or asset protection. However, the Puerto Rico Living Trust - Revocable is designed with flexibility in mind, allowing you to change, update, or revoke it as your circumstances change. If you seek a more adaptable estate planning solution, choosing a revocable living trust might be the best path for you.

The main difference between a general trust and a revocable living trust lies in their management and flexibility. A traditional trust may be irrevocable, making it difficult to change after it is established. In contrast, a revocable living trust, like the Puerto Rico Living Trust - Revocable, allows you to retain control over the assets and modify the terms whenever you choose. This adaptability is a key feature that many people find appealing when planning their estate.

Most living trusts are revocable, with the Puerto Rico Living Trust - Revocable being a popular choice. This means you can change or dissolve the trust at any time during your lifetime. Irrevocable trusts, on the other hand, cannot be altered without the consent of the beneficiaries. Because of their flexibility, revocable trusts are generally more common among individuals planning their estate.

The primary downside of a revocable trust, such as a Puerto Rico Living Trust - Revocable, is that it does not provide asset protection from creditors. If you owe debts, creditors can reach the assets within a revocable trust. Additionally, during your lifetime, you retain control over the assets, which means they are still considered part of your estate for tax purposes. Therefore, while revocable trusts offer flexibility, they may not shield your assets as effectively as other options.

Yes, Puerto Rico recognizes trusts, including a Puerto Rico Living Trust - Revocable. The legal framework in Puerto Rico allows individuals to establish these vehicles for estate planning, making it easier to manage and distribute assets according to their wishes. This recognition provides a reliable and clear method for asset management, ensuring your estate plan is effective. To set up a trust correctly and ensure compliance, consider using platforms like USLegalForms, which offer comprehensive tools and resources tailored to your needs.

One downside of a Puerto Rico Living Trust - Revocable is that it might not provide asset protection from creditors. Unlike certain other estate planning tools, a revocable trust does not shield your assets, as you can still alter the trust or withdraw assets during your lifetime. Moreover, setting up a trust may involve legal fees and ongoing administration costs. It’s wise to weigh these factors carefully, especially when considering your unique financial situation.

Yes, you can put a house in a Puerto Rico Living Trust - Revocable. This type of trust allows you to transfer your property into the trust, which can help streamline the management of your assets. Additionally, a revocable trust can offer flexibility since you can change or revoke it at any time. By placing your home in this trust, you can also simplify the process for your heirs when transferring ownership.

The Puerto Rico Trust Act outlines the legal framework for creating and managing trusts in the territory. It establishes rules for revocable and irrevocable trusts, providing clear guidelines for trustees and beneficiaries. Understanding the Puerto Rico Living Trust - Revocable within this context can help you leverage the law to your advantage. With a platform like uslegalforms, you can navigate the intricacies of the Trust Act easily and set up your living trust effectively.

In Puerto Rico, inheritance laws dictate that assets must be distributed according to a set order. Typically, heirs such as children and spouses have the first claim to an estate. The Puerto Rico Living Trust - Revocable can greatly simplify this process, allowing for clearer distribution per your wishes. By utilizing a revocable trust, you can avoid probate, making inheritance more efficient.

While an irrevocable trust offers many benefits, there are downsides to consider. Once you establish a Puerto Rico Living Trust - Revocable as irrevocable, you lose control over the assets placed within it. This lack of flexibility can be concerning if your financial situation changes. Hence, it’s vital to evaluate your long-term goals before making such a commitment, and US Legal Forms can provide insight and resources to assist with your decision.