Puerto Rico Revocable Trust for Estate Planning

Description

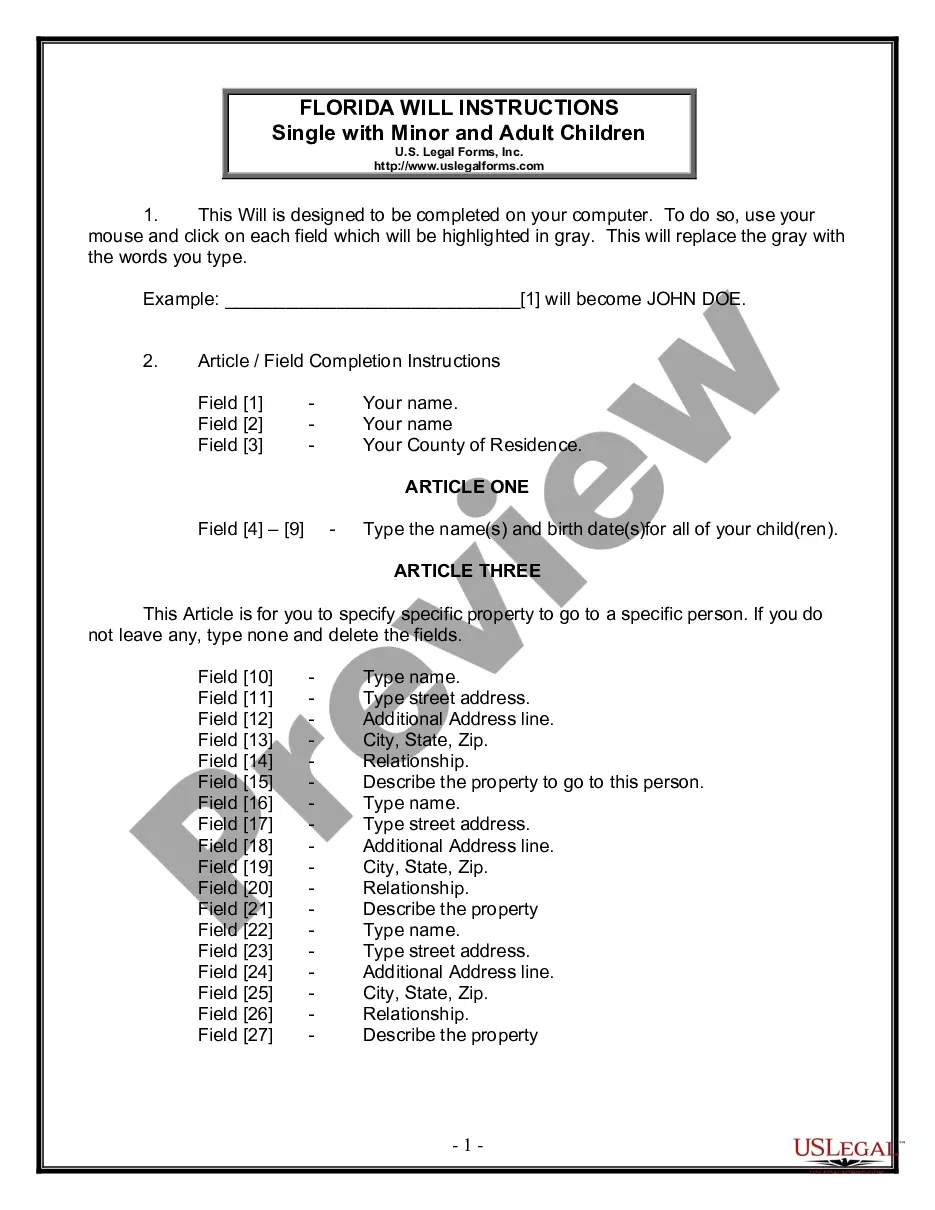

How to fill out Revocable Trust For Estate Planning?

If you require extensive, obtain, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available on the web.

Employ the site’s straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your Visa, Mastercard, or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Puerto Rico Revocable Trust for Estate Planning effortlessly.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Puerto Rico Revocable Trust for Estate Planning.

- You can also access documents you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have selected the correct form for the respective city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other types of legal form templates.

Form popularity

FAQ

To avoid probate in Puerto Rico, you can set up a revocable trust, such as a Puerto Rico Revocable Trust for Estate Planning. By placing your assets into this trust, they can bypass the probate process when you pass away. Additionally, discussing options with an estate planning attorney can further streamline your estate management and ensure that your wishes are followed.

The most common living trust is the revocable living trust. Many individuals and families opt for a Puerto Rico Revocable Trust for Estate Planning due to its simplicity and adaptability. It allows you to manage your assets during your lifetime and provides a plan for distribution upon your death, helping to avoid the lengthy probate process.

While there are benefits to forming a revocable trust in many states, Puerto Rico offers unique advantages for estate planning. A Puerto Rico Revocable Trust for Estate Planning aligns with local laws and regulations, making it a practical choice for residents. This trust structure allows greater flexibility and control over your assets while ensuring compliance with relevant legal frameworks.

When it comes to property, a revocable living trust is often one of the best options. A Puerto Rico Revocable Trust for Estate Planning not only allows you to maintain control over your assets but also provides a straightforward way to manage property ownership. This type of trust can reduce complications for your heirs, making property transfer smoother when you pass away.

To avoid taxes, many individuals consider creating an irrevocable trust rather than a revocable trust. However, a Puerto Rico Revocable Trust for Estate Planning can still provide certain tax advantages, particularly in managing your estate’s assets. It is wise to consult a tax advisor or estate planning attorney to explore the options that best suit your situation.

The best type of living trust often depends on your specific needs and goals. Generally, a revocable living trust is recommended for most individuals looking to manage their estate effectively. A Puerto Rico Revocable Trust for Estate Planning allows for flexibility, meaning you can alter it during your lifetime. It's a valuable tool for those wanting to avoid probate and maintain control over their assets.

Yes, you can put a house in a trust in Puerto Rico. By creating a Puerto Rico Revocable Trust for Estate Planning, you can transfer ownership of your property into the trust. This process helps ensure that your assets are managed according to your wishes. Additionally, it simplifies the transfer of property when you pass away.

One downside of a Puerto Rico Revocable Trust for Estate Planning is that it does not offer asset protection from creditors. Since the trust is revocable, you maintain control over the assets, which means they are still part of your estate for liability purposes. Additionally, while a revocable trust can avoid probate, it does require ongoing management and can incur costs for setup and maintenance. Evaluating these factors is crucial for making informed estate planning decisions.

Filing taxes for a Puerto Rico Revocable Trust for Estate Planning involves reporting income generated by the trust on your personal tax return. Since the trust is revocable, the IRS treats it as a disregarded entity, meaning the income is taxed to the grantor. Proper documentation and adherence to local and federal tax laws are essential, so it's wise to consult with a tax advisor for accurate filing. Utilizing tools from US Legal Forms can simplify this process.

Yes, you can set up a Puerto Rico Revocable Trust for Estate Planning. This type of trust allows you to manage your assets during your lifetime and designate beneficiaries for your estate after you pass away. Establishing a trust in Puerto Rico offers various benefits, including avoiding probate and ensuring privacy for your estate. Consider consulting with a legal professional to guide you through the process.