Puerto Rico Revocable Trust for Asset Protection

Description

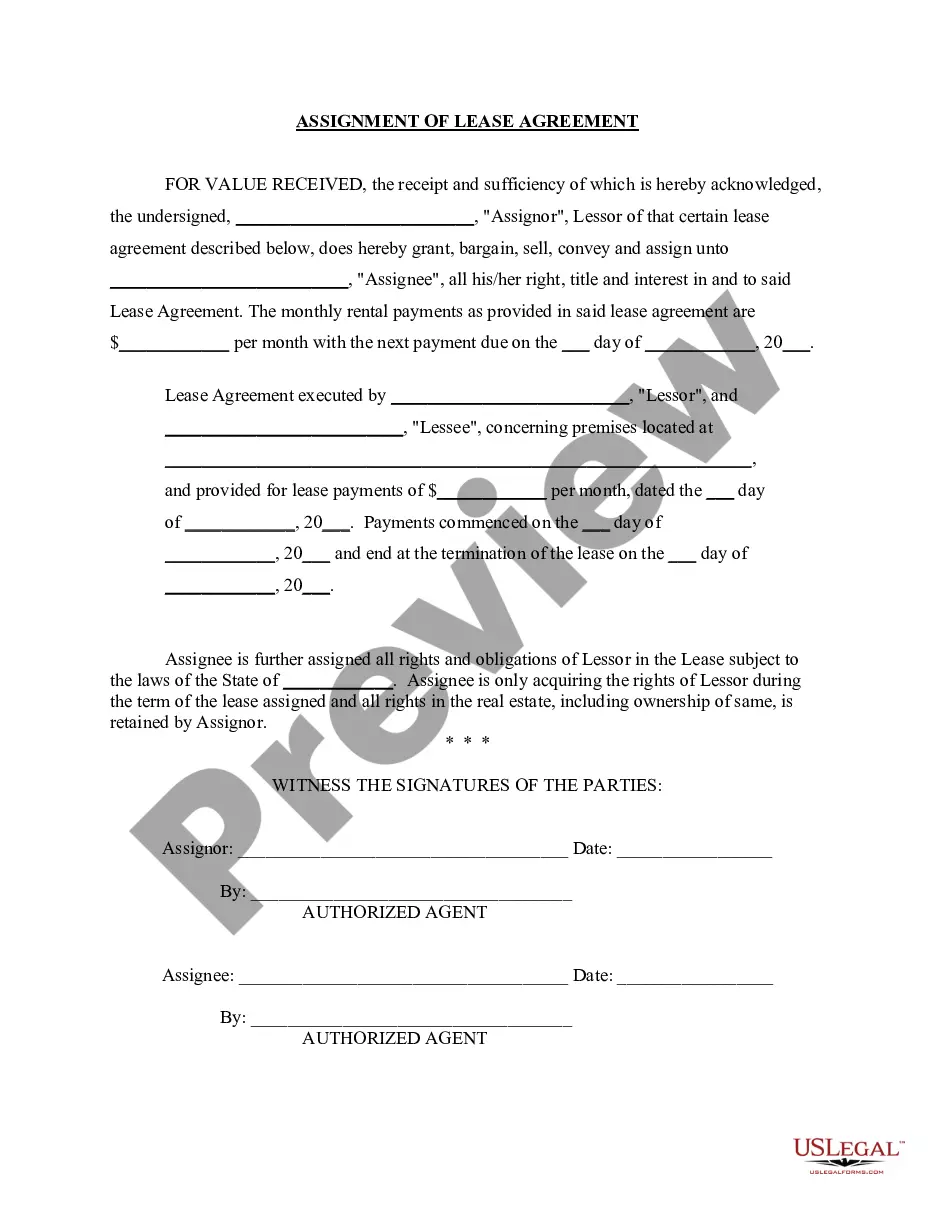

How to fill out Revocable Trust For Asset Protection?

You can invest hours online searching for the legal document template that meets the federal and state requirements you desire.

US Legal Forms offers a wide array of legal forms that can be reviewed by professionals.

You can easily download or print the Puerto Rico Revocable Trust for Asset Protection from their service.

If you wish to find another version of your form, use the Lookup field to locate the template that meets your requirements. Once you have found the template you need, click Buy now to proceed.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Puerto Rico Revocable Trust for Asset Protection.

- Every legal document template you obtain is yours permanently.

- To get another copy of the downloaded form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

The requirements for an asset protection trust typically include creating a formal trust document and designating a trustee. You will need to specify the trust's purpose, identify beneficiaries, and detail how the assets are managed. Each jurisdiction may have unique regulations, so using a Puerto Rico Revocable Trust for Asset Protection can ensure you meet specific local requirements while providing the necessary protections.

Setting up a protective trust requires a few key steps. First, identify the assets you want to protect and choose your beneficiaries wisely. Next, draft the trust document detailing terms of management and distribution. For those looking for an effective solution, a Puerto Rico Revocable Trust for Asset Protection offers an ideal framework to secure your assets while maintaining your ability to modify the trust as your needs change.

The best trust structure for asset protection usually includes a revocable trust tailored to individual needs. This structure allows flexibility in managing assets while still providing a layer of protection against creditors. Many choose a Puerto Rico Revocable Trust for Asset Protection due to its advantages like privacy and control over your assets. Consulting with a legal professional can help you determine the best structure for your situation.

Writing an asset protection trust involves outlining the trust's purpose, beneficiaries, and terms of administration. First, decide what assets to include and the level of protection required. Next, select a trustee responsible for managing the trust. Using a Puerto Rico Revocable Trust for Asset Protection can help secure your assets while ensuring compliance with local laws.

One of the biggest mistakes parents make when setting up a trust fund is overlooking the details of asset distribution. They often fail to clearly define how and when beneficiaries receive their assets. This lack of clarity can lead to confusion or conflict among family members. When setting up a Puerto Rico Revocable Trust for Asset Protection, ensure you outline specific terms and conditions to prevent misunderstandings.

When creating a Puerto Rico Revocable Trust for Asset Protection, it’s wise to leave out certain assets. Assets like retirement accounts and health accounts typically should not be included due to potential tax implications. Additionally, ongoing business interests may require separate arrangements outside of the trust. Evaluating your asset portfolio with an expert can help you identify which should be excluded.

To set up a Puerto Rico Revocable Trust for Asset Protection, you should start by gathering your essential documents and determining which assets you want to protect. Next, drafting the trust agreement is crucial, establishing the terms and the roles of trustees and beneficiaries. You may want to consult platforms like uslegalforms for comprehensive templates and legal guidance to ensure compliance with Puerto Rico laws and regulations.

When creating a Puerto Rico Revocable Trust for Asset Protection, some assets should generally remain outside the trust. For instance, assets with designated beneficiaries, like life insurance and retirement accounts, should not be transferred into the trust. Also, assets subject to specific legal restrictions may not be suitable for trust inclusion. Consulting with a legal expert can provide tailored advice for your situation.

While a Puerto Rico Revocable Trust for Asset Protection offers many benefits, it also has some disadvantages. One potential downside is that it does not protect assets from creditors; creditors can still reach the trust's assets. Additionally, setting up a trust may involve upfront legal fees, which some individuals may find burdensome. Understanding these drawbacks is important when considering whether a revocable trust is right for you.

Certain assets typically don’t belong in a Puerto Rico Revocable Trust for Asset Protection. For example, retirement accounts, health savings accounts, and life insurance policies should remain outside the trust to avoid unnecessary complications. Additionally, valuable personal items or certain real estate may not be suitable for inclusion in the trust structure. Reviewing your assets with a legal professional can clarify what to include and what to exclude.