Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Pennsylvania Last Will And Testament With All Property To Trust Called A Pour Over Will?

The work with documents isn't the most simple job, especially for those who rarely work with legal papers. That's why we recommend making use of accurate Pennsylvania Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will templates made by skilled lawyers. It allows you to prevent difficulties when in court or handling official organizations. Find the documents you need on our website for top-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will automatically appear on the template page. Right after downloading the sample, it will be saved in the My Forms menu.

Customers without an active subscription can easily get an account. Look at this brief step-by-step guide to get your Pennsylvania Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will:

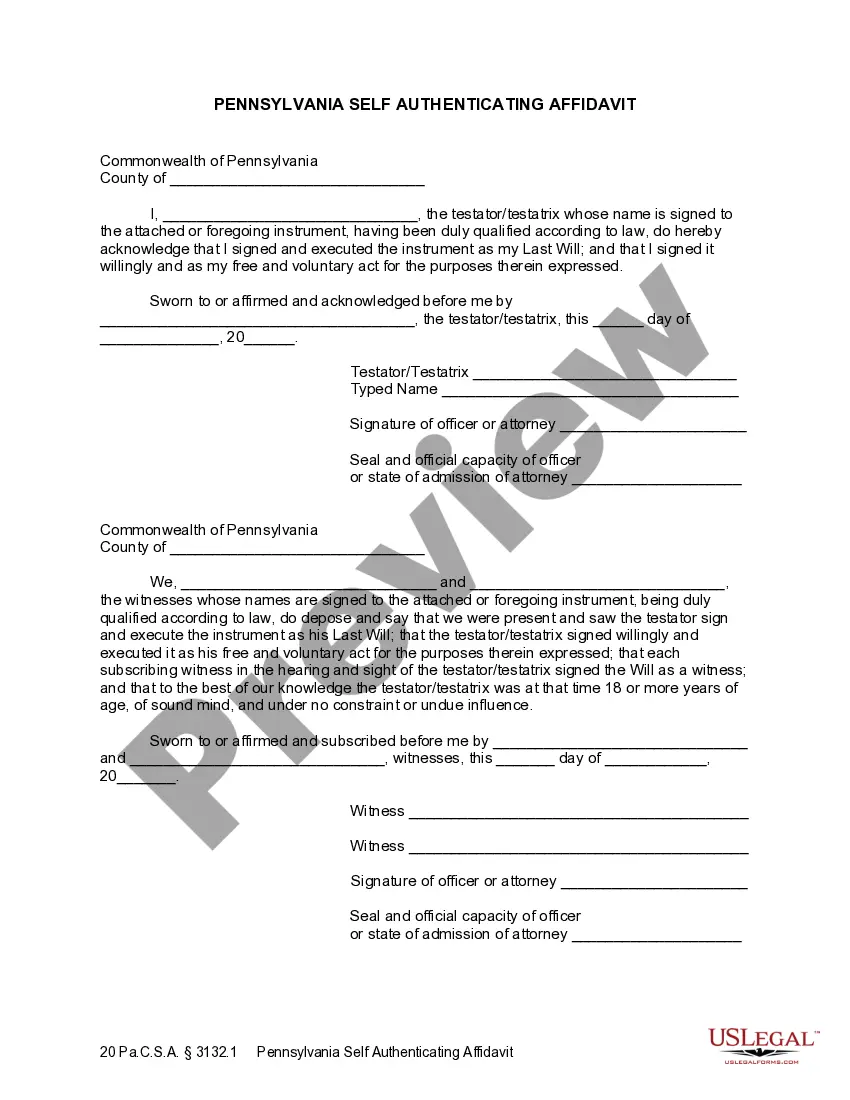

- Make certain that the document you found is eligible for use in the state it is necessary in.

- Verify the file. Make use of the Preview feature or read its description (if readily available).

- Click Buy Now if this sample is what you need or utilize the Search field to get another one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after completing these simple steps, you can complete the sample in an appropriate editor. Recheck completed data and consider asking a legal professional to examine your Pennsylvania Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

Pour-over wills act as a backstop against issues that could frustrate the smooth operation of a living trust. They ensure any assets a grantor neglects to add to a trust, whether by accident or on purpose, will end up in the trust after execution of the will.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.