Mississippi Order authorizing the closing of the estate and the discharge of the executor

Description

Key Concepts & Definitions

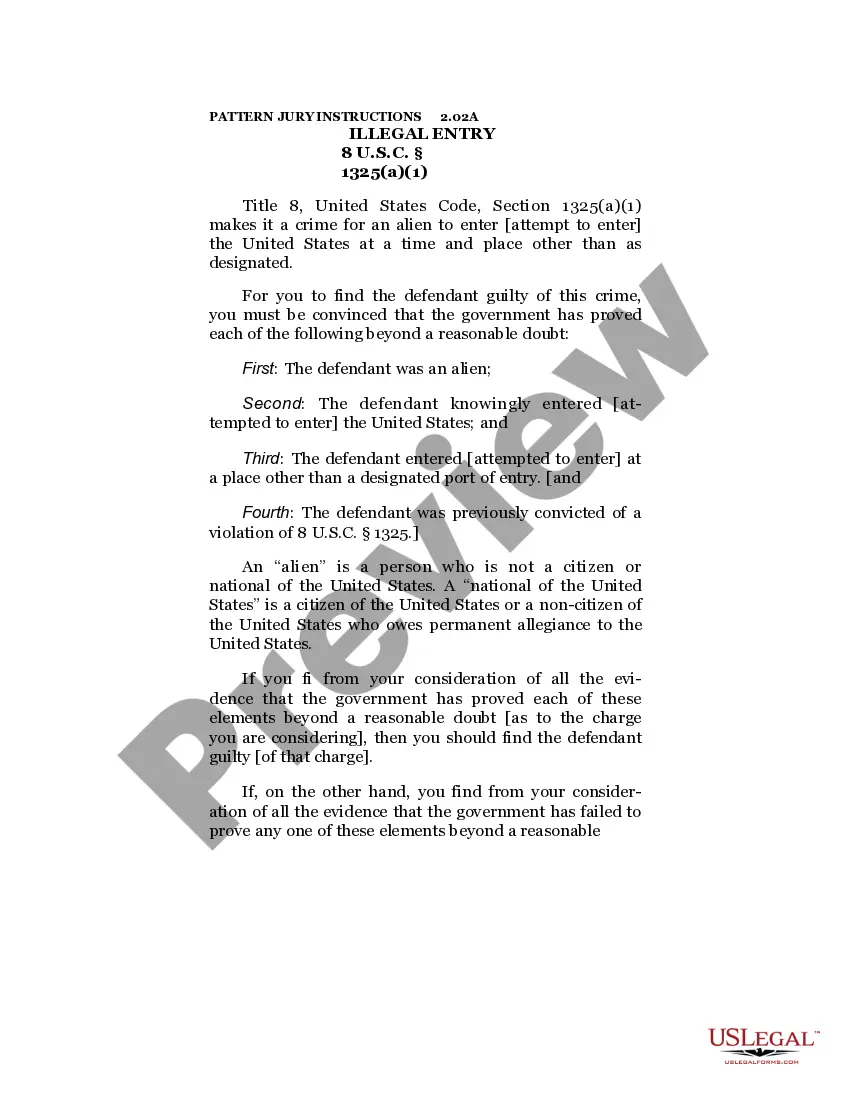

Order Authorizing the Closing of the Estate: This legal document signifies a court's approval to formally conclude the administrative activities of an estate. Closing Estate: The process encompassing all activities to finalize an estate's dealings, including the distribution of assets. Discharge Executor: The release of an executor from their duties once the estate has been appropriately managed and closed. Personal Representative: Another term for an executor, often used interchangeably, particularly tasked with managing and closing the deceased's estate according to the will and state laws.

Step-by-Step Guide to Closing an Estate in Mississippi

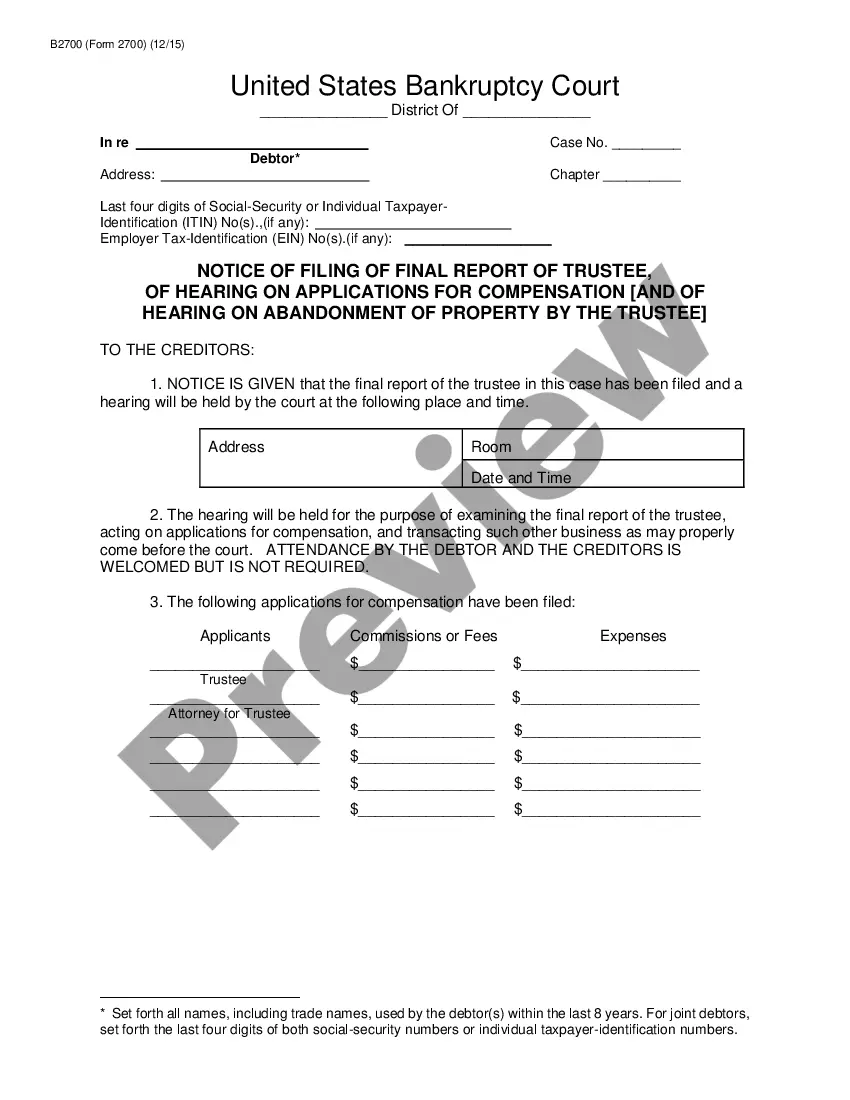

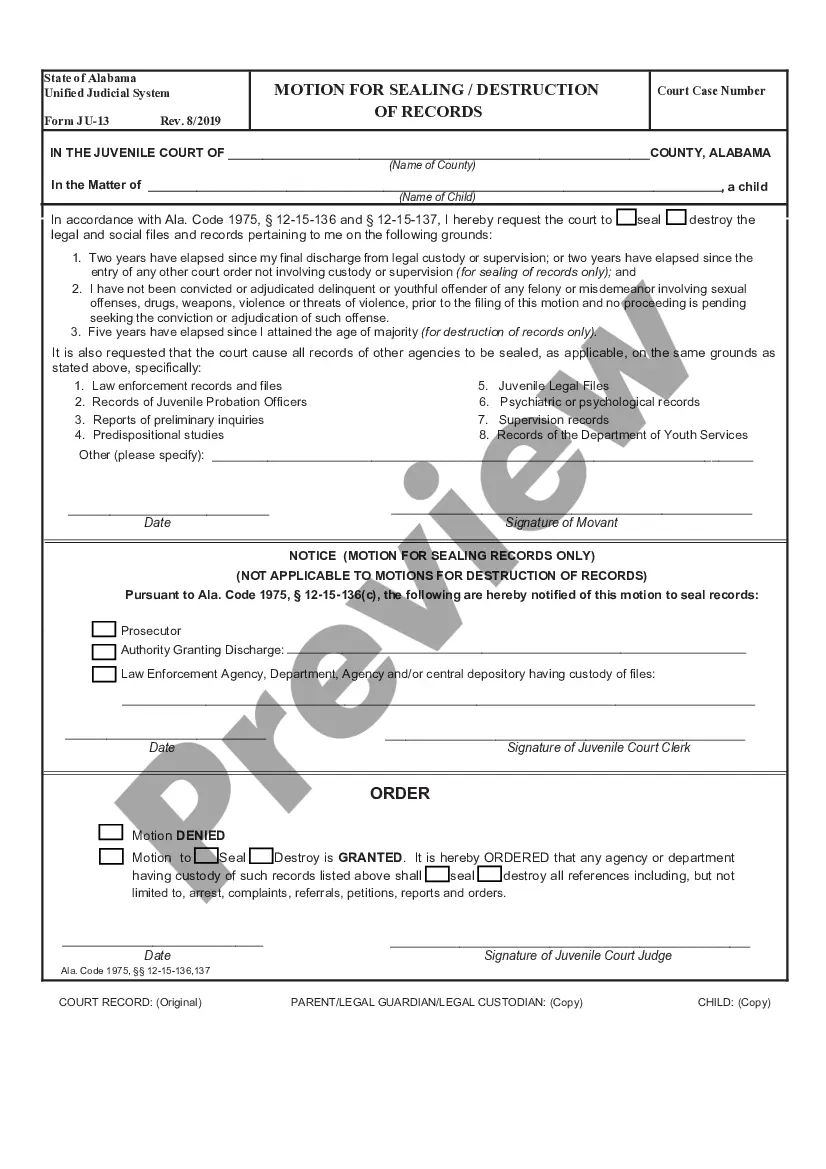

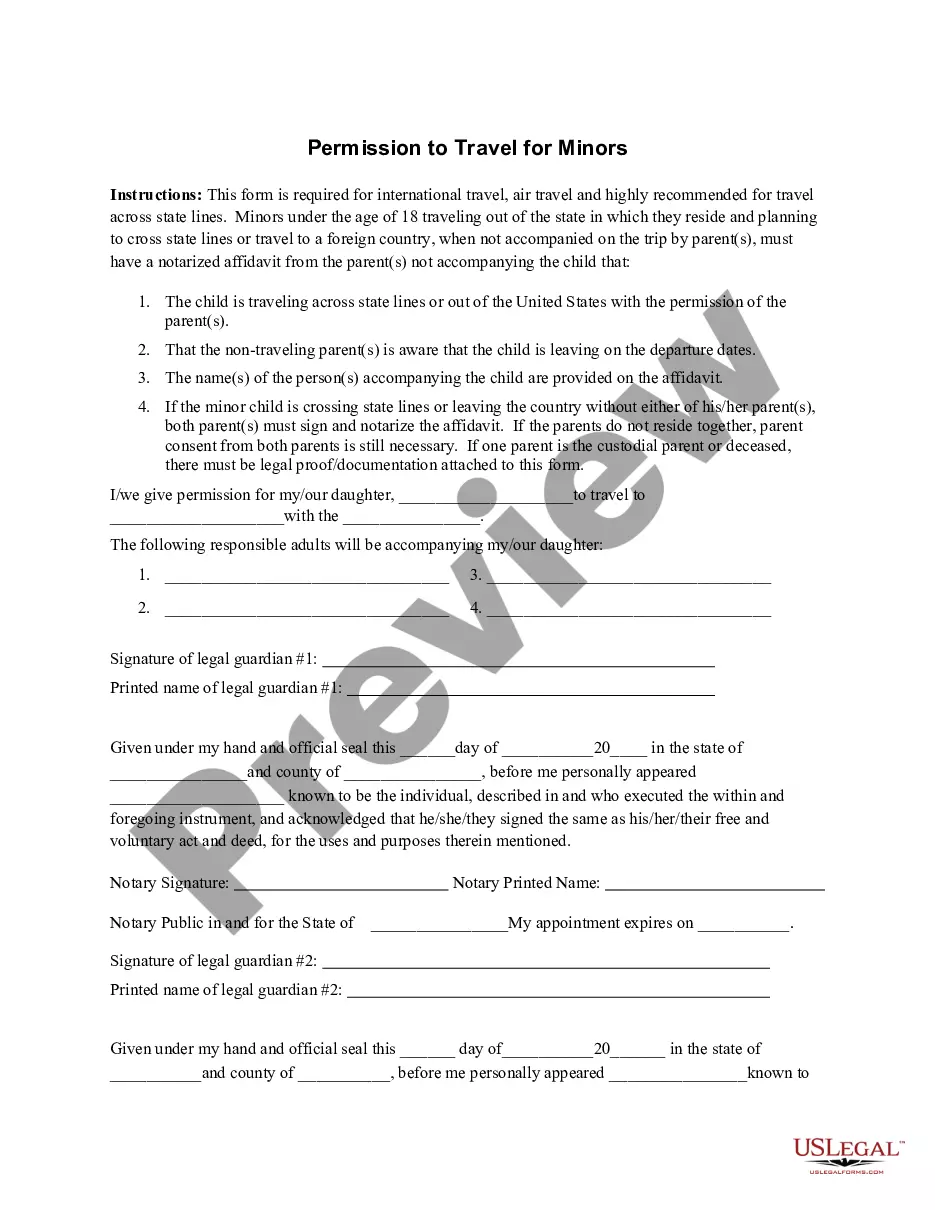

- File the Necessary Forms: Initiate by filing an 'Order Authorizing the Closing of the Estate' alongside any necessary estate forms required in Mississippi.

- Notice to Creditors and Settling Debts: Notify all creditors as required by law and settle the estates debts.

- Distribute Assets: Following the court's authorization and once all debts are cleared, distribute the remaining estate assets among the beneficiaries.

- File Fiduciary Tax Returns: Complete any requisite tax filings for the estate.

- Obtain Discharge of Executor: Apply for discharge form, confirming the full execution of executor responsibilities and closing of the estate.

Risk Analysis for Executors in Estate Administration

- Financial Liability: Executors can be held financially liable for mismanagement of estate funds or failure to address all debts and taxes properly.

- Legal Penalties: Inaccurate filings or inadequate notice to creditors and heirs may result in legal challenges or penalties.

- Delay in Distribution: Delays can occur if the estate is complex, lacking proper documentation or facing legal disputes, potentially leading to beneficiary dissatisfaction.

Common Mistakes & How to Avoid Them

- Failure to Properly Notify Creditors: Ensure adherence to state laws regarding notifications to avoid future claims against the estate.

- Incomplete Documentation: Maintain thorough records and submit all necessary filing responsibilities to prevent legal complications.

- Ignoring Estate Tax Obligations: Understand fiduciary tax responsibilities to prevent penalties and personal liability issues.

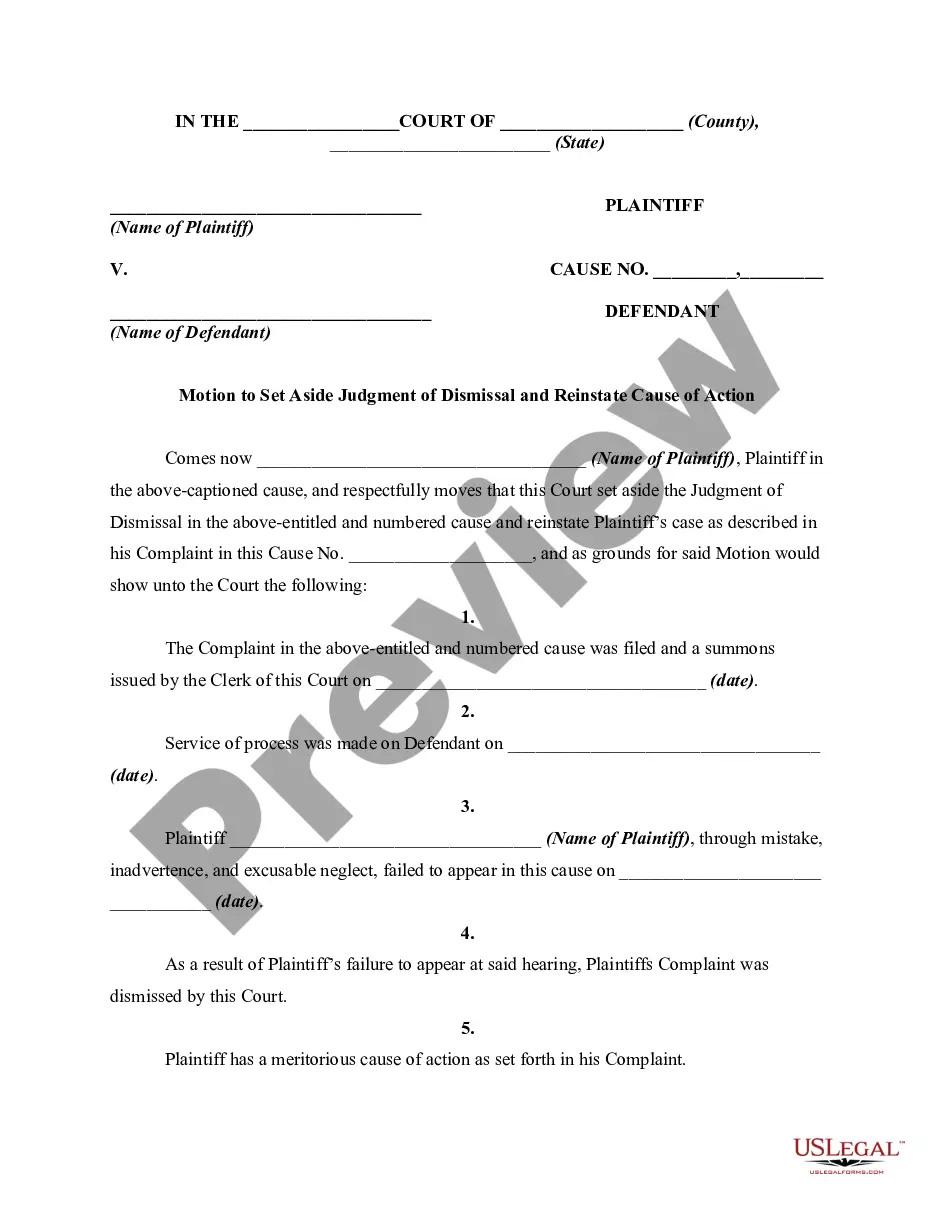

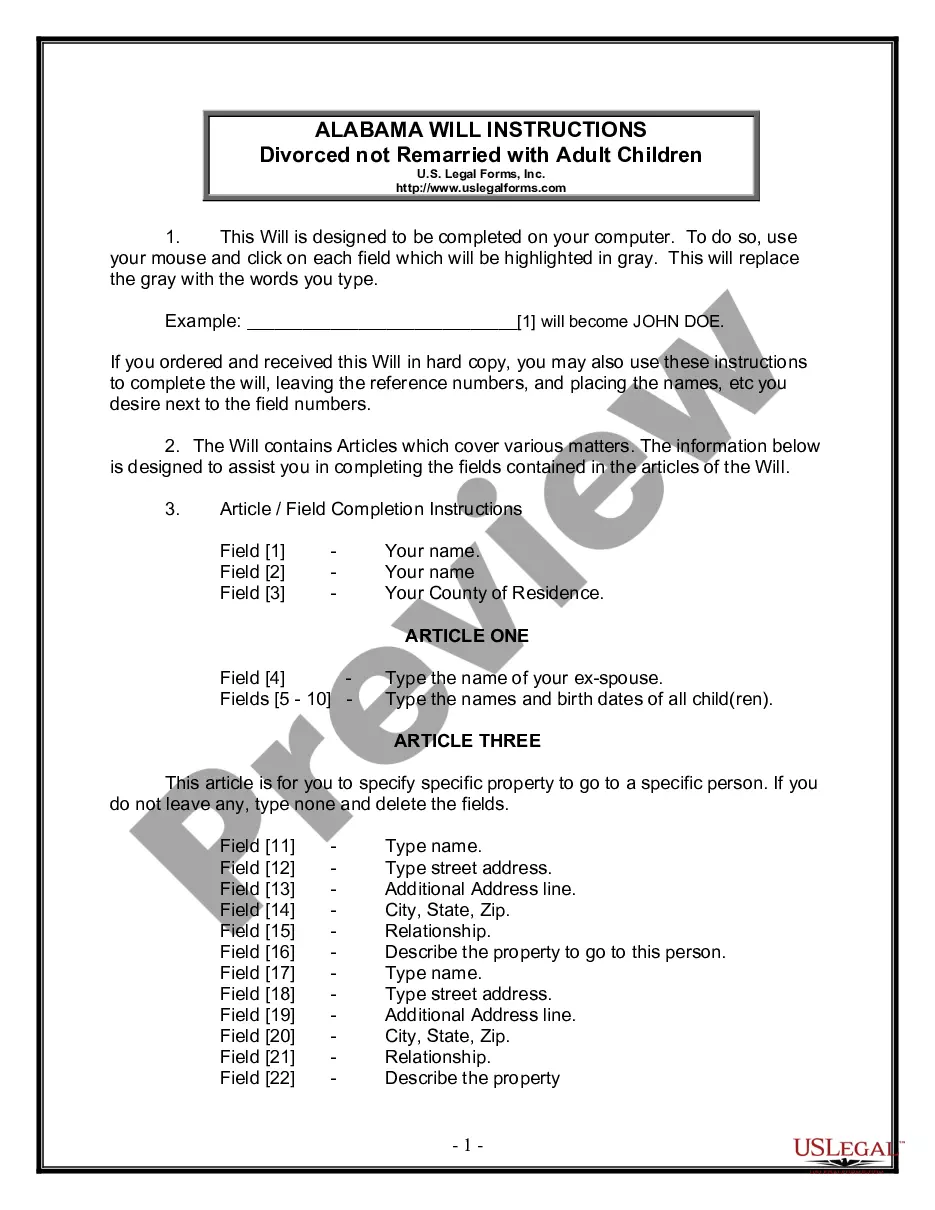

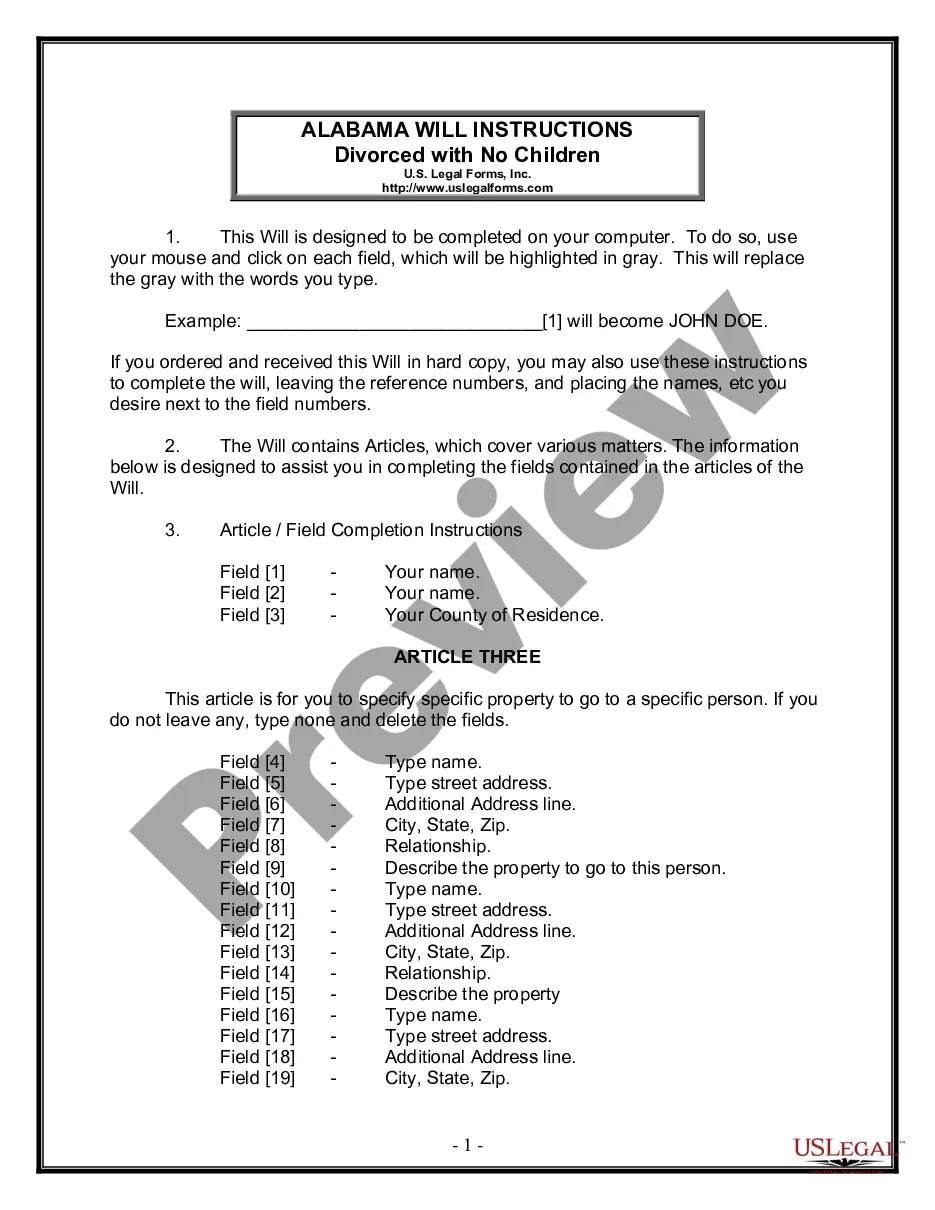

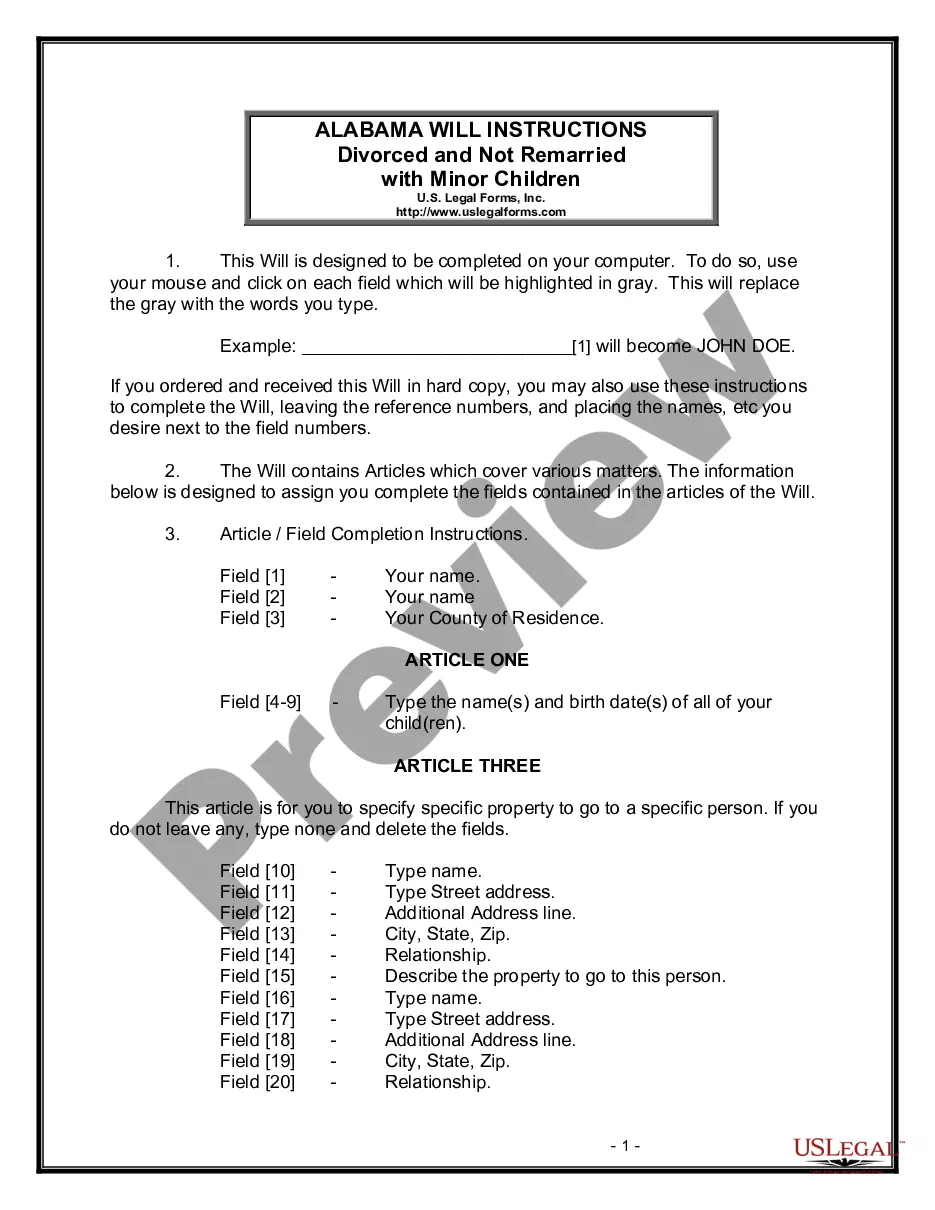

How to fill out Mississippi Order Authorizing The Closing Of The Estate And The Discharge Of The Executor?

Obtain a printable Mississippi Order authorizing the closing of the estate and the discharge of the executor within just several mouse clicks in the most extensive catalogue of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of reasonably priced legal and tax templates for US citizens and residents on-line since 1997.

Customers who already have a subscription, must log in directly into their US Legal Forms account, get the Mississippi Order authorizing the closing of the estate and the discharge of the executor see it stored in the My Forms tab. Customers who don’t have a subscription must follow the tips listed below:

- Make certain your template meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If available, review the form to discover more content.

- When you are sure the template is right for you, click on Buy Now.

- Create a personal account.

- Choose a plan.

- Pay via PayPal or credit card.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Mississippi Order authorizing the closing of the estate and the discharge of the executor, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

The length of time an executor has to distribute assets from a will varies by state, but generally falls between one and three years.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Keep the letter brief and straightforward as it is a legal document. Confirm the situation whereby probate has been granted. Was it written in the will? Clearly outline the obligations of the recipient so they know what is required of them. Sign the letter to make it legally binding.

By Stephanie Kurose, J.D. Closing a person's estate after they die can often be a long, detailed process. This includes paying off debts, filing final tax returns, and, finally, distributing the estate's assets according to the wishes of the deceased.

Under the Administration and Probate Act there is a period of 6 months once Probate (or Letters of Administration, if there was no Will) is granted in which claims can be made on an Estate.

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.