Pennsylvania Schedule of Fees

Description

How to fill out Schedule Of Fees?

Discovering the right legitimate document format can be a have a problem. Obviously, there are tons of layouts available on the Internet, but how can you find the legitimate form you require? Take advantage of the US Legal Forms website. The support gives a huge number of layouts, including the Pennsylvania Schedule of Fees, which can be used for organization and personal requires. Every one of the types are checked out by pros and meet state and federal specifications.

If you are already listed, log in to your bank account and then click the Down load key to find the Pennsylvania Schedule of Fees. Make use of bank account to search through the legitimate types you have bought in the past. Go to the My Forms tab of the bank account and acquire an additional version of your document you require.

If you are a new end user of US Legal Forms, listed below are easy guidelines that you should adhere to:

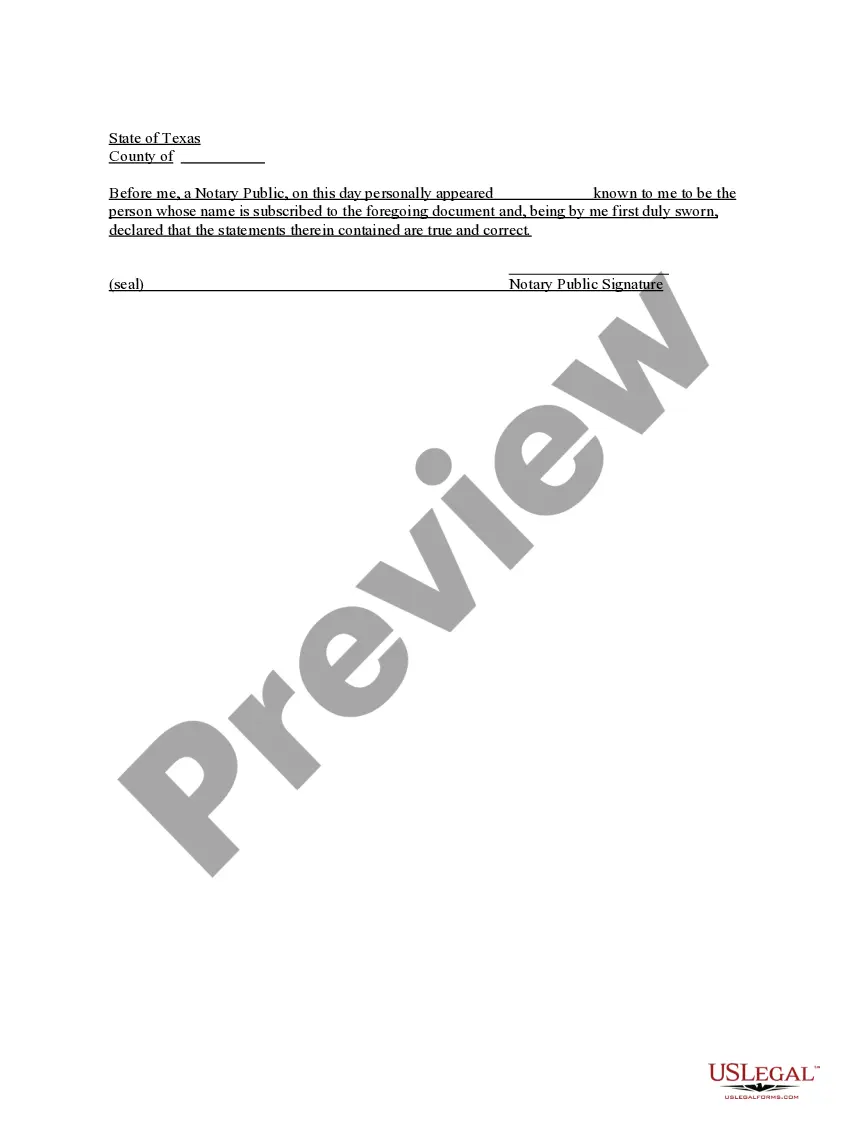

- Very first, ensure you have selected the appropriate form for your personal town/region. It is possible to look through the shape using the Preview key and study the shape description to make certain it will be the best for you.

- In the event the form will not meet your preferences, utilize the Seach discipline to get the appropriate form.

- Once you are positive that the shape is proper, click the Purchase now key to find the form.

- Select the rates strategy you desire and type in the needed details. Make your bank account and pay for the order utilizing your PayPal bank account or credit card.

- Choose the file formatting and obtain the legitimate document format to your gadget.

- Full, change and produce and indication the received Pennsylvania Schedule of Fees.

US Legal Forms may be the most significant catalogue of legitimate types where you will find different document layouts. Take advantage of the service to obtain skillfully-made documents that adhere to condition specifications.

Form popularity

FAQ

What is the Pennsylvania title transfer fee? ing to PennDot, it costs $58 to do a Pennsylvania title transfer. The fee is the same whether getting an original title, duplicate title, or at a registered dealer. If there's a lien on the vehicle, the cost will be $86.

If you're registering a car you bought, you'll need: Proof of ownership in the form of Manufacturer Certificate of Origin (MCO) or Manufacture Statement of Origin (MSO) or Pennsylvania Certificate of Title. Application for Certificate of Title (Form MV-1 ? not available online) Driver's license. Proof of insurance.

PennDOT requires all motor vehicle owners to provide proof that they are financially responsible (have liability insurance) at the time of initial registration.

Section 1912 - The fee for passenger vehicle registrations adjusts from $39 to $45. Section 1913 - The fees for motor home registrations adjust as follows: Class 1 from $73 to $83, Class 2 from $101 to $116, and.

You've formed a limited liability company (LLC) in Pennsylvania, but your work isn't over yet. After you've registered your LLC, you must renew your registration and pay the required business taxes. If you've hired employees, you also probably need to pay employer taxes.

Payments and Fees Motor Vehicle Services FeesAmountPassenger Vehicle Registration:$45.00Replacement of Registration Plate:$13.00School Bus/School Vehicle:$42.00Special Mobile Equipment:$66.0040 more rows

Payments and Fees Motor Vehicle Services FeesAmountPassenger Vehicle Registration:$45.00Replacement of Registration Plate:$13.00School Bus/School Vehicle:$42.00Special Mobile Equipment:$66.0040 more rows

The Commonwealth makes registering an LLC in Pennsylvania an easy and affordable process. The only fee to register an LLC in Pennsylvania is $125 at initial registration. Then, every 10 years your business will be required to submit a decennial report with a registration fee of $70.