Pennsylvania Housecleaning Services Contract - Self-Employed

Description

How to fill out Housecleaning Services Contract - Self-Employed?

If you require to complete, acquire, or create authentic document templates, utilize US Legal Forms, the most significant selection of valid forms, which can be accessed online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require. Numerous templates for business and personal purposes are categorized by categories and states, or keywords.

Use US Legal Forms to obtain the Pennsylvania Housecleaning Services Contract - Self-Employed with just a few clicks.

Each legal document template you purchase is yours forever. You can access every form you acquired from your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Pennsylvania Housecleaning Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Pennsylvania Housecleaning Services Contract - Self-Employed.

- You can also access forms you previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

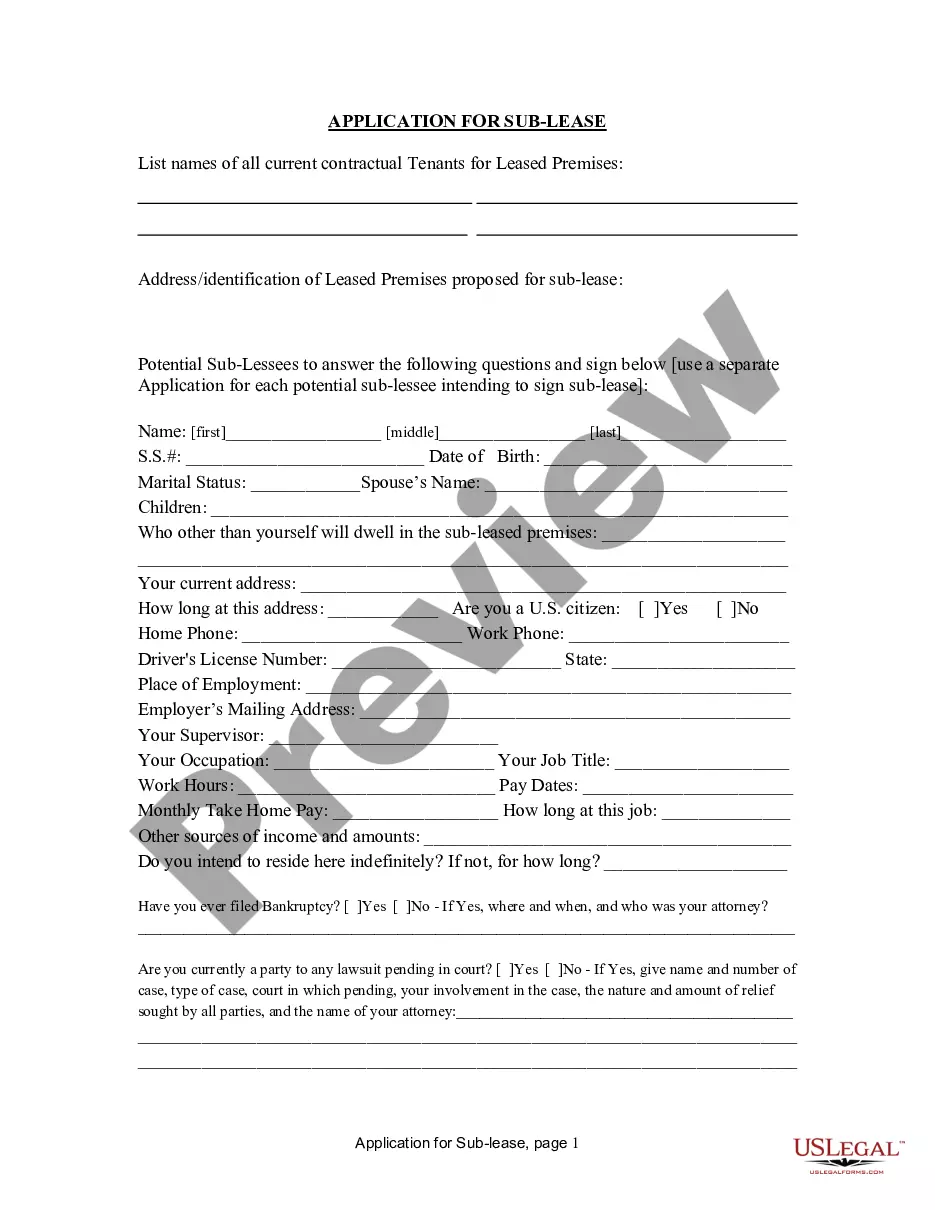

- Step 2. Utilize the Review option to examine the form's content. Do not forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have located the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Housecleaning Services Contract - Self-Employed.

Form popularity

FAQ

Yes, residential cleaning services are generally subject to sales tax in Pennsylvania. When you enter into a Pennsylvania Housecleaning Services Contract - Self-Employed, it is important to understand your tax obligations to avoid penalties. However, certain exemptions may apply, depending on the services provided. Utilizing resources from US Legal Forms can help you clarify tax regulations and ensure compliance.

To become a subcontractor for cleaning services, you will need to establish relationships with larger cleaning companies that require additional help. Start by showcasing your capabilities, certifications, and work history to potential partners. Using the Pennsylvania Housecleaning Services Contract - Self-Employed can help you create a clear agreement that outlines the terms of your subcontracting role, ensuring a beneficial working relationship.

To become a self-employed cleaner, first, you should assess your skills and develop a business plan that outlines your services and target market. Next, register your business and acquire the necessary insurance for protection. Finally, leverage tools like the Pennsylvania Housecleaning Services Contract - Self-Employed for clarity in service agreements and to instill confidence in your clients.

Starting a cleaning business in Pennsylvania typically requires forming a business structure, like an LLC or sole proprietorship. Additionally, you will need to obtain appropriate insurance, gather necessary cleaning supplies, and establish a client base. Utilizing resources like the Pennsylvania Housecleaning Services Contract - Self-Employed can streamline the process, providing essential templates and legal forms to help you get started.

In Pennsylvania, you can perform certain tasks without needing a contractor license. Generally, small cleaning jobs that do not exceed specific financial thresholds allow for self-employment under the Pennsylvania Housecleaning Services Contract - Self-Employed. However, it is crucial to understand the local regulations governing such work. Familiarizing yourself with these guidelines will help ensure that you stay compliant while maximizing your business potential.

To write a contract agreement for cleaning services, start with a clear introduction of the parties and their addresses. List the cleaning services offered, payment terms, and the schedule for service completion. Be sure to include clauses for termination, liability, and dispute resolution. A Pennsylvania Housecleaning Services Contract - Self-Employed can guide you through the process, providing a structured and legally sound foundation for your agreement.

In Pennsylvania, cleaning services may be subject to sales tax, depending on the nature of the services provided. For example, residential cleaning services are generally exempt, but commercial services may incur tax liabilities. It is crucial to consult local regulations or a tax professional for clarity on your specific situation. Utilizing a Pennsylvania Housecleaning Services Contract - Self-Employed can help you understand financial implications before entering any agreements.

Writing a cleaning contract agreement involves detailing the services offered, payment structure, and duration of the contract. Clearly define the responsibilities of both the cleaner and the client to avoid misunderstandings. Furthermore, consider incorporating clauses about cancellations and modifications. A Pennsylvania Housecleaning Services Contract - Self-Employed provides a solid framework for creating a comprehensive and effective agreement.

To write a simple contract agreement, start by clearly stating the parties involved and the purpose of the agreement. Next, outline the specific terms, including the services provided, payment details, and deadlines. Ensure both parties agree to the terms, and conclude by having each party sign the document. Using a Pennsylvania Housecleaning Services Contract - Self-Employed template can simplify this process and ensure you cover all essential elements.

In Pennsylvania, specific licensing requirements can depend on your location and business structure. While a general business license may be necessary, a specific cleaning license may not be required. It’s advisable to consult local regulations and consider using resources like the Pennsylvania Housecleaning Services Contract - Self-Employed to clarify your obligations.