Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

If you require to completely, download, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online. Take advantage of the site's user-friendly and efficient search function to find the documents you need. Various templates for business and individual purposes are organized by categories and states, or keywords.

Use US Legal Forms to acquire the Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Download button to locate the Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor. You can also access forms you have previously downloaded in the My documents section of your account.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded within your account. Browse the My documents section and select a form to print or download again.

Complete and download, and print the Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Step 1. Make sure you have selected the form for the correct city/state.

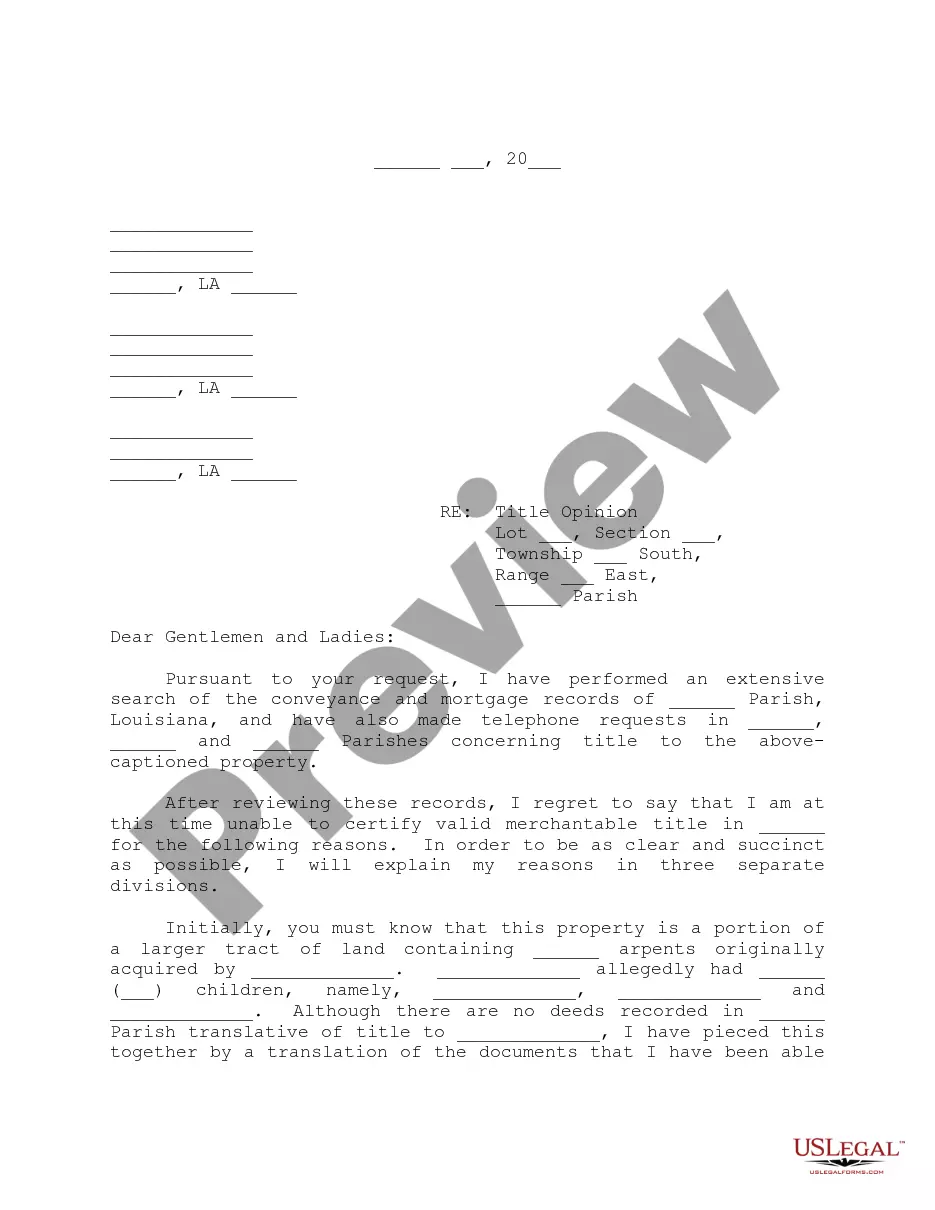

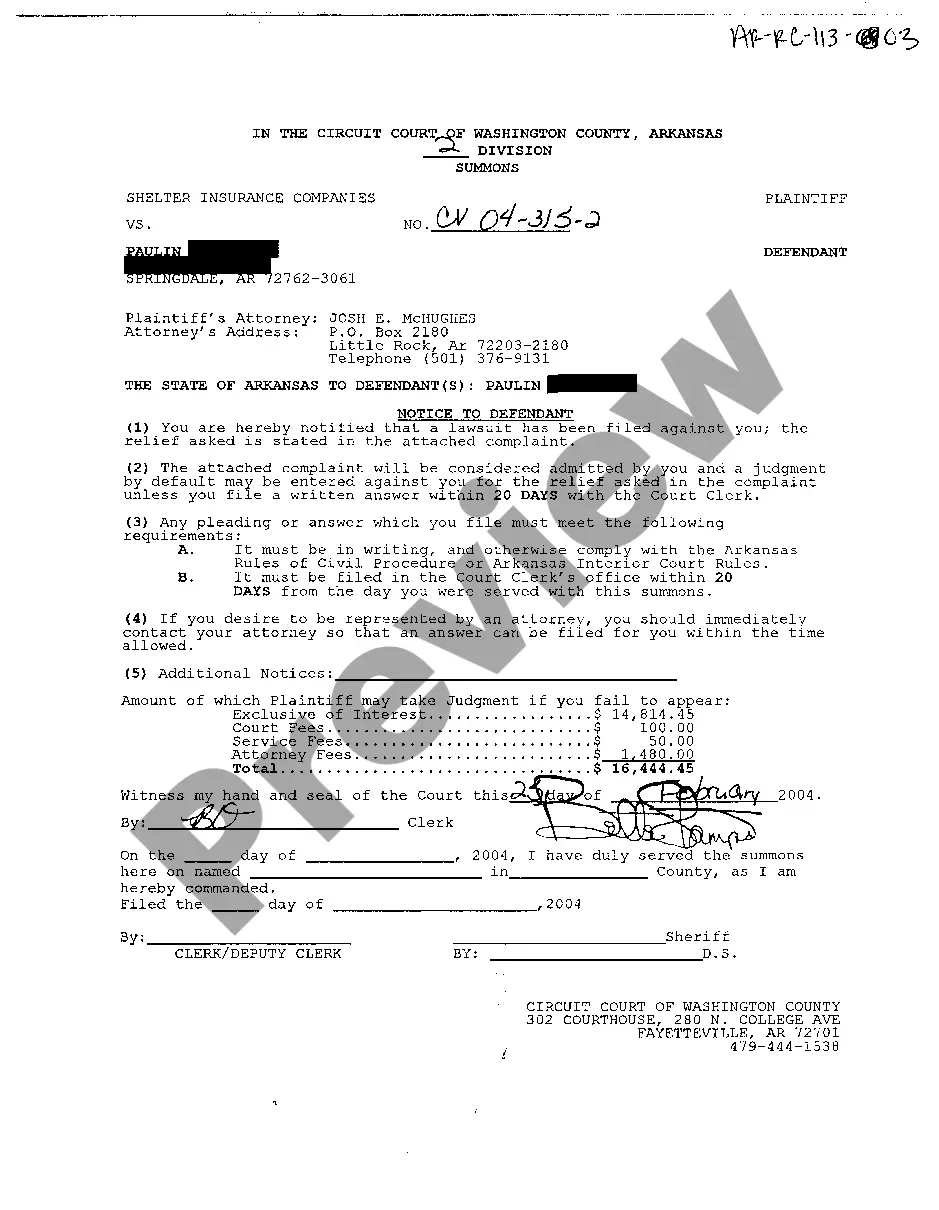

- Step 2. Utilize the Preview option to review the form's content. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Writing an independent contractor agreement involves outlining the terms of the contract clearly. Start with the parties' details, followed by the duties and payment arrangements. It is essential to classify it as a Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor to reflect the nature of the work. To create a comprehensive contract effortlessly, consider uslegalforms, which provides customizable templates tailored to your needs.

1099 employees, or independent contractors, are often not classified as temporary employees. They operate under their schedules and are typically engaged for specific projects or tasks. However, within a Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor, one can outline the project's duration, emphasizing the temporary nature of the contract. Understanding this distinction can help clarify roles and responsibilities.

To fill out an independent contractor agreement, start by clearly identifying both parties involved. Include essential details such as the scope of work, payment terms, and deadlines. Additionally, ensure you specify the status as a Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor. Using a platform like uslegalforms can simplify this process with ready-made templates and guidance.

In Pennsylvania, 1099 employees, often classified as independent contractors, do not typically require workers' compensation insurance. However, the need may vary based on specific job duties and agreements, like a Pennsylvania Temporary Worker Agreement for Self-Employed Independent Contractors. It's beneficial for these workers to assess their risk factors and consult legal professionals for tailored advice. Ultimately, ensuring proper coverage can safeguard your business from unforeseen liabilities.

Independent contractors should consider different types of insurance, including general liability insurance, professional liability insurance, and, in many cases, health insurance. If you are operating under a Pennsylvania Temporary Worker Agreement as a Self-Employed Independent Contractor, having the right coverage can protect you against various risks. It’s advisable to evaluate your industry to determine the specific insurance needs based on your services. You can explore options available through platforms like uslegalforms to find suitable policies.

Self-employed contractors in Pennsylvania typically do not qualify for traditional unemployment benefits. However, during specific times, such as economic crises, programs may provide assistance to individuals under a Pennsylvania Temporary Worker Agreement as a Self-Employed Independent Contractor. It's crucial to stay updated on available programs and potential eligibility criteria. Contacting your local unemployment office can provide clarity regarding your unique situation.

In Pennsylvania, several groups are exempt from workers' compensation requirements, including sole proprietors and self-employed individuals under certain conditions. If you operate under a Pennsylvania Temporary Worker Agreement as a Self-Employed Independent Contractor, you may qualify for this exemption. However, it's essential to understand your specific circumstances to make an informed decision. Always consider consulting a legal expert if you have any uncertainties.

A contractor contract in Pennsylvania must include key details such as the names of the parties, a description of services, payment terms, and the duration of the agreement. It should also specify the responsibilities of both parties and include any legal clauses necessary for compliance. Utilizing a Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor ensures that your contract covers these essential elements effectively.

No, a temporary employee and an independent contractor are distinct. Temporary employees work under the supervision of an employer and receive specific instructions on tasks. In contrast, independent contractors have the freedom to control how they complete their work. Knowing this difference helps clarify the use of a Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor.

The basic independent contractor agreement defines the terms of engagement between a contractor and a client. It typically outlines the scope of work, payment terms, deadlines, and responsibilities. This agreement helps protect both parties by clarifying their expectations. It’s essential to use a Pennsylvania Temporary Worker Agreement - Self-Employed Independent Contractor to ensure it meets state requirements.