Maine Aircraft Affidavit

Description

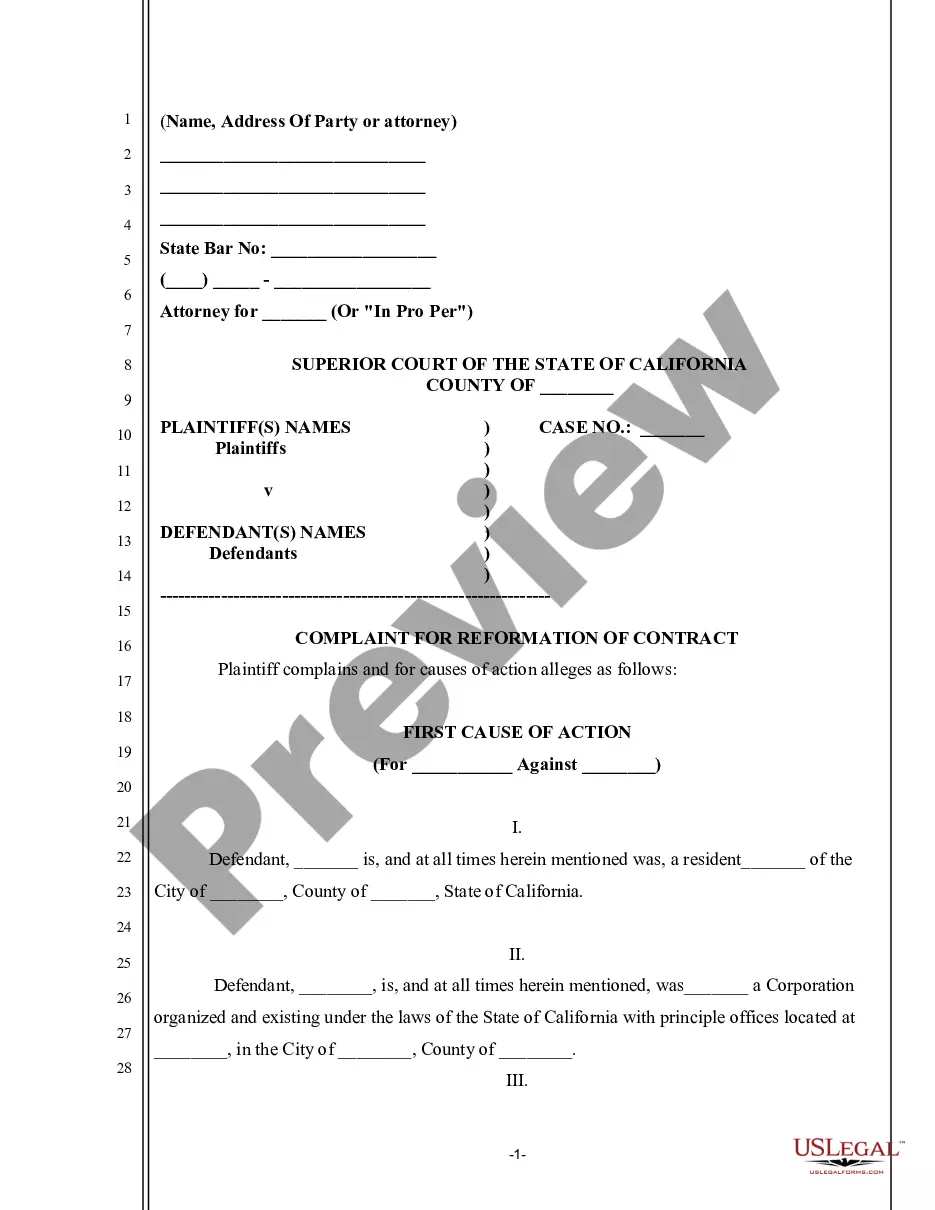

How to fill out Aircraft Affidavit?

Discovering the right lawful document format could be a have a problem. Obviously, there are tons of web templates accessible on the Internet, but how can you discover the lawful form you need? Take advantage of the US Legal Forms site. The assistance delivers thousands of web templates, including the Maine Aircraft Affidavit, that you can use for business and private needs. Every one of the varieties are examined by professionals and fulfill federal and state demands.

Should you be currently signed up, log in to the accounts and click the Obtain switch to find the Maine Aircraft Affidavit. Use your accounts to check from the lawful varieties you might have purchased formerly. Visit the My Forms tab of your respective accounts and get another backup of the document you need.

Should you be a fresh customer of US Legal Forms, allow me to share simple recommendations that you can follow:

- Initial, ensure you have chosen the proper form to your metropolis/region. You are able to look through the shape making use of the Preview switch and browse the shape information to make sure it will be the right one for you.

- When the form does not fulfill your needs, make use of the Seach area to obtain the correct form.

- Once you are sure that the shape is acceptable, click the Buy now switch to find the form.

- Opt for the rates plan you would like and enter the needed info. Make your accounts and pay money for your order utilizing your PayPal accounts or charge card.

- Select the document file format and acquire the lawful document format to the device.

- Complete, change and printing and indication the acquired Maine Aircraft Affidavit.

US Legal Forms is the greatest local library of lawful varieties that you can see various document web templates. Take advantage of the company to acquire expertly-made files that follow condition demands.

Form popularity

FAQ

Personal exemption. The personal exemption amount is $5,000. Standard deduction. The standard deduction amounts are as follows: single-$14,600; married filing jointly-$29,200; head-of-household-$21,900; and married filing separately-$14,600.

It's important to note that Vermont Resale Certificates do not expire. However, the seller must keep the certificate on file for three years from the date of the last sale. How to Use a Vermont Resale Certificate - TaxJar taxjar.com ? blog ? how-to-use-a-vermont-r... taxjar.com ? blog ? how-to-use-a-vermont-r...

Lodging, including hotels, trailer camps, tourist camps, and rooming houses, are taxable at 9 percent. Exemptions to the lodging tax include: Casual rentals for less than 15 days. These include someone who rents out a single room or a single condo unit for less than 15 days in a calendar year.

Purchases of goods for resale should be exempt from the (generally) 5.5% Maine sales tax under the following circumstances: You must obtain a resale certificate from the State Tax Assessor. You must specifically state in the purchase order, whether written or oral, that the property is purchased for resale. Maine Retailer Certificates, Resale Certificates and Sales and ... Rudman Winchell ? Attorney Blog Rudman Winchell ? Attorney Blog

You can apply for a Maine Sales Tax Exemption in the Maine Tax Portal by clicking here, navigate to the Business panel, and selecting the Exemptions link. If you are unable to apply using the Maine Tax Portal, you can click on the application number next to the type of organization to download an application form. Maine Sales Tax Exempt Organizations maine.gov ? sales-use-service-provider-tax maine.gov ? sales-use-service-provider-tax

May I accept resale certificates from a customer with an out-of-state registration number? Except for sales of antiques and used collectibles, sellers may not accept resale certificates from out-of-state customers who do not have a Maryland sales and use tax license. Business Tax Tip #4 - Resale Certificates - Marylandtaxes.gov marylandtaxes.gov ? forms ? bustip4 marylandtaxes.gov ? forms ? bustip4

Resale Certificates expire on December 31st. A Resale Certificate issued before October 1st is valid for the remainder of that calendar year and the following three calendar years. A Resale Certicate issued after October 1st is valid for the remainder of that calendar year and the following four calendar years.

You can apply for a Maine Sales Tax Exemption in the Maine Tax Portal by clicking here, navigate to the Business panel, and selecting the Exemptions link. If you are unable to apply using the Maine Tax Portal, you can click on the application number next to the type of organization to download an application form.