Pennsylvania Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

If you wish to finalize, acquire, or create sanctioned document formats, utilize US Legal Forms, the most extensive array of sanctioned forms available online.

Employ the site’s simple and user-friendly search function to locate the documents you require.

An assortment of formats for business and personal purposes are categorized by types and recommendations, or search terms. Use US Legal Forms to find the Pennsylvania Drafting Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document template you obtain belongs to you permanently. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Finalize and obtain, and print the Pennsylvania Drafting Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Pennsylvania Drafting Agreement - Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps listed below.

- Step 1. Ensure you have selected the form for the correct city/state.

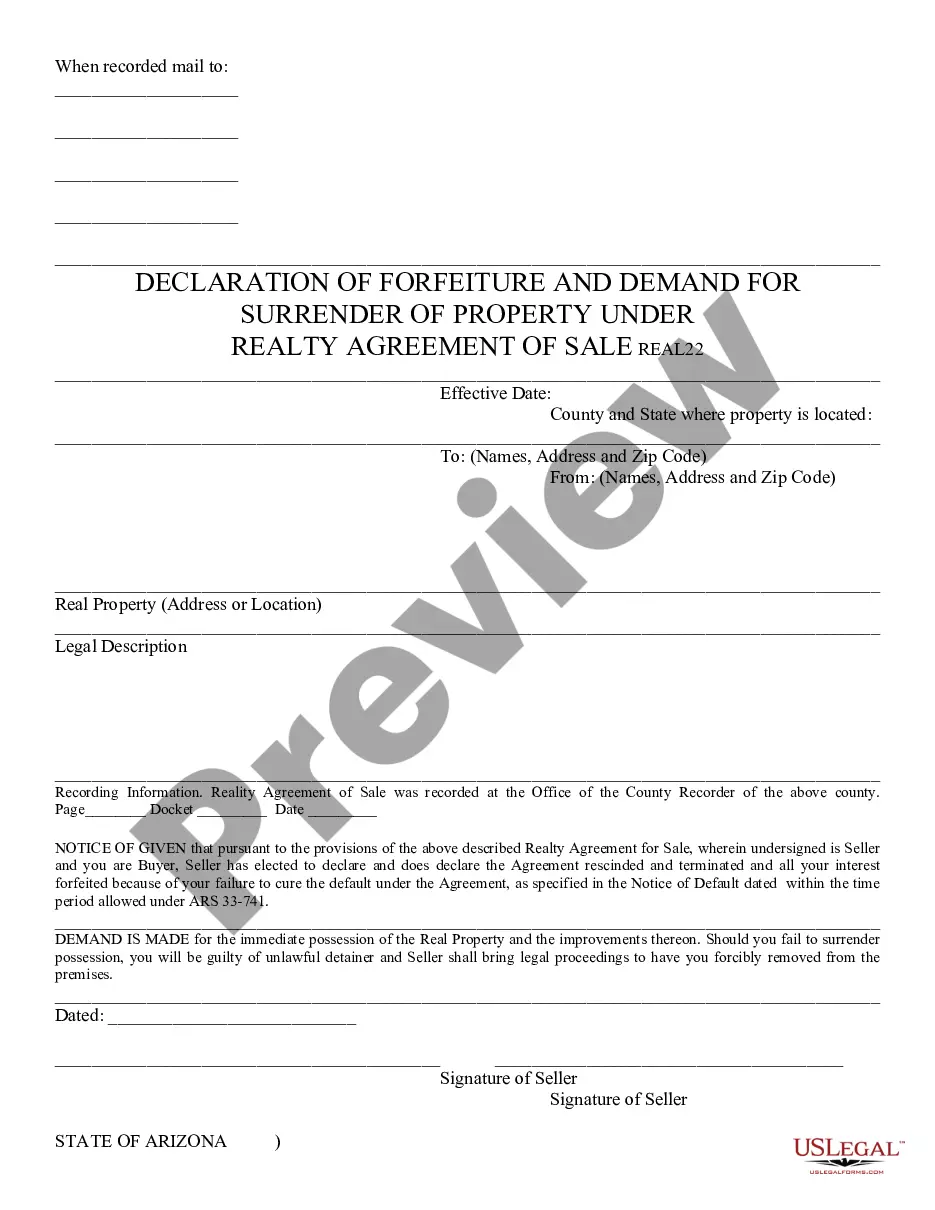

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Pennsylvania Drafting Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

An independent contractor typically needs to complete a few essential documents, including a contract, tax forms, and possibly business licenses. The independent contractor agreement in Pennsylvania is particularly important as it lays out terms clearly. Ensure you also track any invoices for payment. Utilizing platforms like uslegalforms can help you manage and complete these documents efficiently.

Writing an independent contractor agreement involves several key components. Begin with the names and roles of both parties, followed by a detailed description of the work and payment structure. Be sure to also define the timeline and any confidentiality terms. For a more streamlined approach, explore templates like the Pennsylvania Drafting Agreement - Self-Employed Independent Contractor offered by uslegalforms.

Filling out an independent contractor agreement involves entering specific details about the project and the parties involved. Start with names, addresses, and contact information. Then, include the scope of work, payment terms, and deadlines. Using a Pennsylvania Drafting Agreement - Self-Employed Independent Contractor template can streamline this process.

The independent contractor agreement in Pennsylvania outlines the relationship between a client and a self-employed independent contractor. This document specifies the terms of work, payment, and project expectations. It protects both parties by clarifying their responsibilities and reducing misunderstandings. Understanding this agreement is crucial for successful freelance work in Pennsylvania.

Yes, you can write your own legally binding contract, provided it meets the legal requirements set forth by Pennsylvania law. Ensure it includes clear terms related to services, payment, and any necessary provisions like confidentiality. For a reliable Pennsylvania Drafting Agreement - Self-Employed Independent Contractor, using tools from UsLegalForms can be beneficial in crafting a contract that stands up in court.

A contractor contract in Pennsylvania must include essential elements such as the names of both parties, a detailed description of the work, and payment terms. Additionally, it should outline any applicable laws or regulations that both parties must adhere to. For a well-structured Pennsylvania Drafting Agreement - Self-Employed Independent Contractor, it's helpful to consult templates that provide a solid framework.

An independent contractor in Pennsylvania refers to individuals or businesses that provide services to clients but are not considered employees. They maintain control over how work is performed, ultimately determining the methods to complete tasks. Understanding this distinction is crucial, especially when drafting a Pennsylvania Drafting Agreement - Self-Employed Independent Contractor.

To create an independent contractor agreement, start by defining the services to be provided and the payment structure. Next, include relevant clauses regarding confidentiality and dispute resolution. You can utilize resources from platforms like UsLegalForms to obtain templates tailored for a Pennsylvania Drafting Agreement - Self-Employed Independent Contractor, making the process simpler.

A basic independent contractor agreement outlines the terms and conditions under which a contractor provides services to a client. This agreement specifies payment terms, scope of work, and deadlines. In the context of a Pennsylvania Drafting Agreement - Self-Employed Independent Contractor, clarity on these points helps ensure both parties understand their rights and obligations.