Pennsylvania Industrial Contractor Agreement - Self-Employed

Description

How to fill out Industrial Contractor Agreement - Self-Employed?

Have you ever been in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating forms you can trust isn't simple.

US Legal Forms provides thousands of template options, including the Pennsylvania Industrial Contractor Agreement - Self-Employed, which can be tailored to meet federal and state regulations.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and prevent errors.

The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Pennsylvania Industrial Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for your correct city/state.

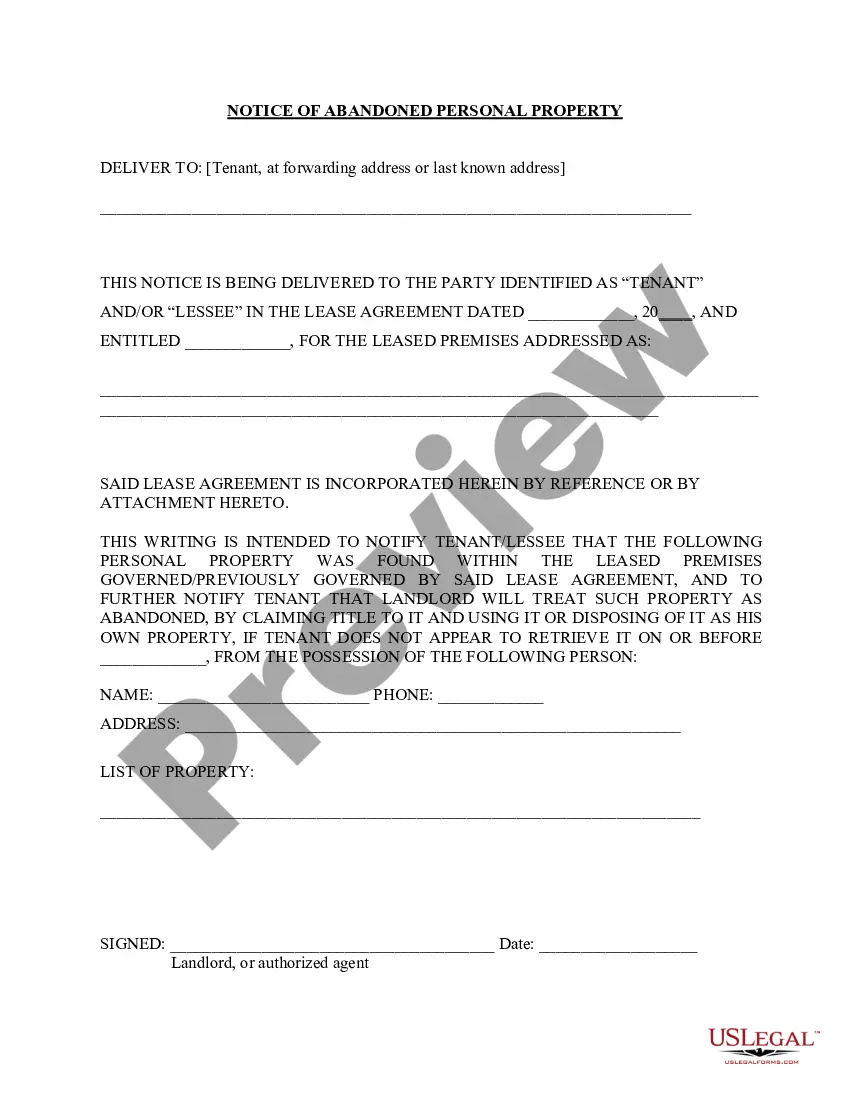

- Use the Preview button to review the document.

- Read the description to ensure you have selected the correct form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs and specifications.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, fill in the required information to create your account, and complete the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents list. You can download another copy of the Pennsylvania Industrial Contractor Agreement - Self-Employed anytime, if necessary. Just select the desired form to download or print the document template.

Form popularity

FAQ

Filling out an independent contractor agreement requires careful attention to detail. Start by identifying the parties, then describe the work, payment terms, and durations. Make sure to include any clauses that relate to confidentiality and dispute resolution, as this ensures clarity and security for both parties involved, especially under a Pennsylvania Industrial Contractor Agreement - Self-Employed.

Yes, independent contractors file as self-employed when it comes to taxes. They report their income using Schedule C, which allows them to list their earnings and deduct any business expenses. Understanding the filing process is essential, especially for those operating under a Pennsylvania Industrial Contractor Agreement - Self-Employed, as it influences tax obligations and potential deductions.

Filling out an independent contractor form involves providing your personal information, including your name, address, and Social Security number or EIN. You’ll also need to detail the nature of the services you will provide and specify the payment structure. When using a Pennsylvania Industrial Contractor Agreement - Self-Employed, ensuring the accuracy of your information can help maintain compliance and protect your interests.

An independent contractor typically fills out several key documents, such as a W-9 form to provide their taxpayer identification number. Additionally, they may need to complete a contract that outlines the terms of their work and payment. Depending on the project and state regulations, they might also need to fill out forms related to permits or insurance, especially when following Pennsylvania Industrial Contractor Agreement - Self-Employed guidelines.

To write an independent contractor agreement, begin by clearly stating the parties involved, including the contractor's name and business address. Next, outline the scope of work, detailing specific responsibilities, deadlines, and payment terms. Consider incorporating information about confidentiality and liability, ensuring that the agreement complies with Pennsylvania Industrial Contractor Agreement - Self-Employed standards.

To set up as a self-employed contractor, start by registering your business with the state of Pennsylvania and acquiring any necessary licenses or permits. It’s important to establish a separate business bank account and keep thorough records for tax purposes. Using a Pennsylvania Industrial Contractor Agreement - Self-Employed from uslegalforms is a great way to formalize your services and protect your business interests.

A standard independent contractor clause typically states that the contractor is not an employee and is responsible for their own taxes and benefits. It may also outline the contractor's rights to work for multiple clients and specifies that they will provide their tools and materials. Including this clause in a Pennsylvania Industrial Contractor Agreement - Self-Employed ensures clarity regarding the contractor’s status.

The primary purpose of an independent contractor agreement is to clarify the expectations and obligations of both parties. It helps prevent misunderstandings and legal disputes by detailing the terms of the relationship. When structuring a Pennsylvania Industrial Contractor Agreement - Self-Employed, this document becomes a vital tool for promoting clear communication and protecting your interests.

The independent contractor agreement in Pennsylvania is a legal document that outlines the terms of work between a business and a contractor. It details the roles, responsibilities, and payment structure while ensuring compliance with state laws. This agreement is essential for establishing a solid working relationship and protecting both parties in the context of a Pennsylvania Industrial Contractor Agreement - Self-Employed.

To create an independent contractor agreement, begin by clearly defining the scope of work and the compensation structure. Include clauses related to duration, confidentiality, and termination rights. By utilizing a reliable platform like uslegalforms, you can easily generate a Pennsylvania Industrial Contractor Agreement - Self-Employed tailored to your specific needs.