Pennsylvania Declaration of Trust

Description

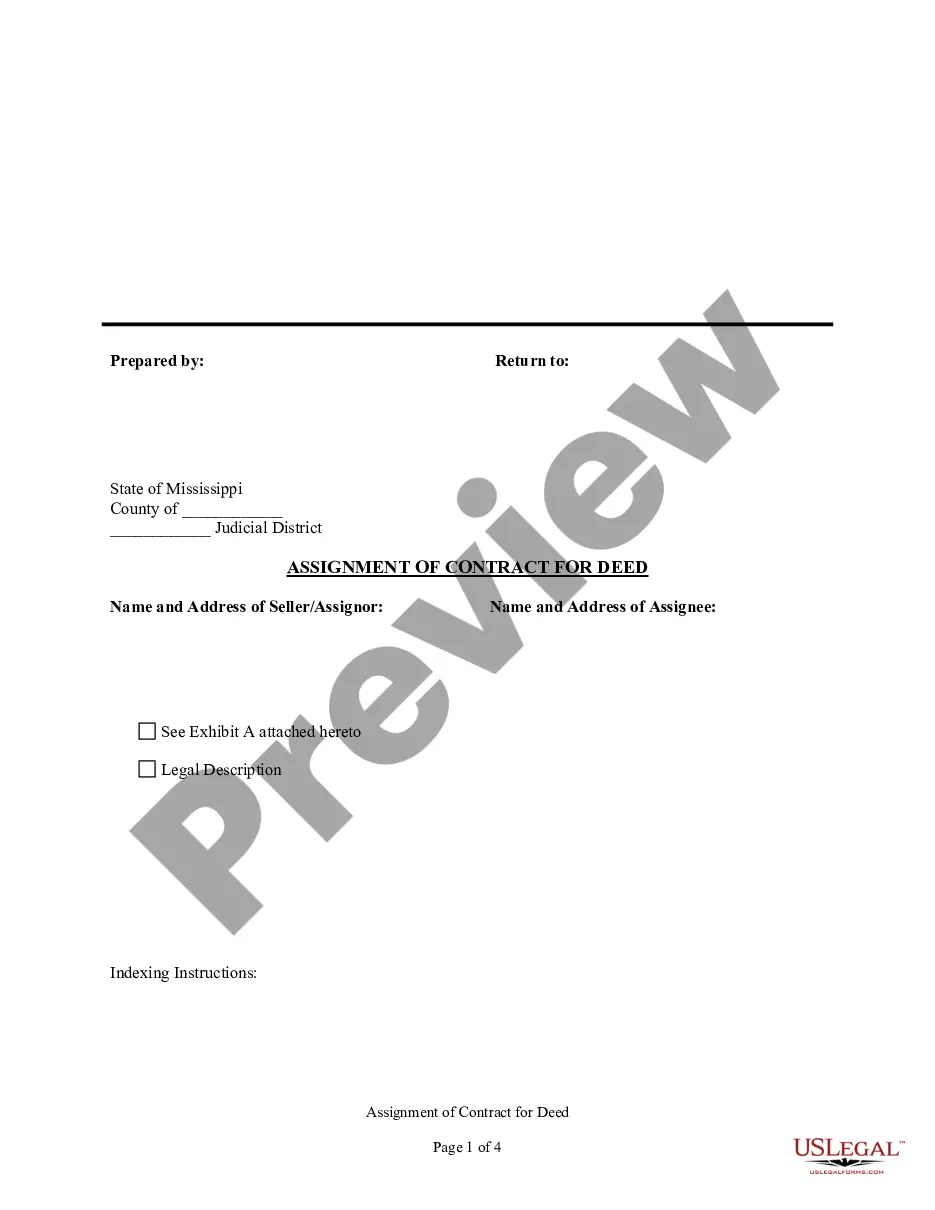

How to fill out Declaration Of Trust?

If you wish to full, download, or print out legal record layouts, use US Legal Forms, the biggest variety of legal types, that can be found on-line. Use the site`s basic and hassle-free look for to discover the paperwork you will need. Various layouts for company and personal uses are sorted by classes and says, or search phrases. Use US Legal Forms to discover the Pennsylvania Declaration of Trust within a number of clicks.

Should you be previously a US Legal Forms client, log in for your profile and click on the Down load option to have the Pennsylvania Declaration of Trust. You can even accessibility types you formerly delivered electronically within the My Forms tab of your respective profile.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that correct city/land.

- Step 2. Take advantage of the Review option to examine the form`s articles. Don`t neglect to see the information.

- Step 3. Should you be not happy with all the type, utilize the Research industry at the top of the monitor to find other versions of your legal type design.

- Step 4. After you have identified the shape you will need, select the Buy now option. Select the pricing plan you choose and include your references to sign up for an profile.

- Step 5. Process the transaction. You should use your bank card or PayPal profile to complete the transaction.

- Step 6. Select the file format of your legal type and download it in your device.

- Step 7. Comprehensive, modify and print out or sign the Pennsylvania Declaration of Trust.

Each legal record design you buy is your own property permanently. You may have acces to each type you delivered electronically inside your acccount. Click on the My Forms section and choose a type to print out or download once again.

Compete and download, and print out the Pennsylvania Declaration of Trust with US Legal Forms. There are millions of skilled and condition-particular types you may use for your company or personal requirements.

Form popularity

FAQ

How much does a Trust cost in Pennsylvania? The cost of setting up a trust in Pennsylvania varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

It's a legal document, also referred to as a deed of trust, which records the financial arrangements between everyone who has a financial interest in the property. This could be necessary if you're buying as a joint owner or getting help from someone else, such as a parent.

Only assets owned solely by the decedent at the time of death are subject to probate. Jointly owned assets, assets with designated beneficiaries like life insurance or retirement accounts, and assets held in a trust typically avoid the probate process.

Except as otherwise provided in the instrument, title to real and personal property may be held in the name of the trust, without in any manner diminishing the rights, powers and duties of the trustees as provided in subsection (a).

A Declaration of Trust is a legal document that declares who owns an asset or property and who will benefit from it. On the other hand, a Trust Agreement is an agreement between two parties where one party agrees to hold assets for another party's benefit.

In Pennsylvania, a living trust is a legal agreement in which the testator's assets, including bank accounts, home, securities, etc., can be transferred and handled by an individual, including the testator, or corporation, such as a trust or bank.

*Notice includes the following: (1) The fact of the trust's existence. (2) The identity of the settlor. (3) The trustee's name, address and telephone number. (4) The recipient's right to receive upon request a copy of the trust instrument.

A will or a living trust are two valuable tools used for estate planning. A will is important to avoid having your estate distributed in ance with Pennsylvania's laws. A living trust can essentially operate as a vault to hold several types of assets that you transfer into it.