Pennsylvania Waiver of the Right to be Spouse's Beneficiary

Description

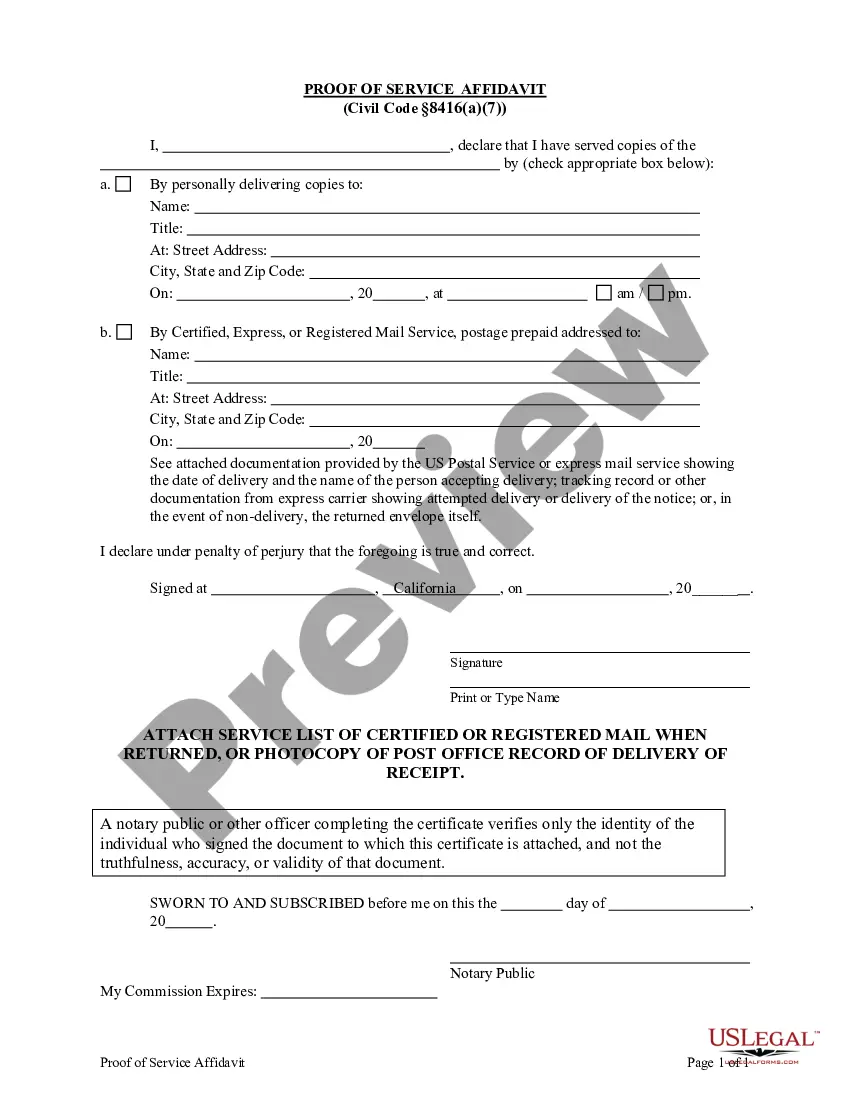

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

It is feasible to allocate time on the Internet searching for the legally sanctioned document template that meets the state and federal criteria you need.

US Legal Forms provides a vast array of legal forms that are verified by professionals.

You can download or print the Pennsylvania Waiver of the Right to be Spouse's Beneficiary from the service.

Review the form description to confirm you have chosen the correct form. If available, use the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can fill out, modify, print, or sign the Pennsylvania Waiver of the Right to be Spouse's Beneficiary.

- Every legal document template you purchase is yours permanently.

- To access another copy of any purchased form, visit the My documents tab and click the respective button.

- If you are visiting the US Legal Forms site for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for your area/city of choice.

Form popularity

FAQ

Pennsylvania wants to assure that these individuals are provided for in the event of the untimely demise of a loved one. In addition to the surviving spouse and children, the law may also provide an inheritance for the decedent's parents, siblings, aunts, uncles, and their children and grandchildren.

Generally, inheritances are not subject to equitable distribution because by law in Pennsylvania, inheritances are not considered marital property. Instead, inheritances are treated as separate property belonging to the recipient, and therefore may not be divided by the parties in a divorce.

Pennsylvania law states that you cannot completely disinherit your spouse. Whether you have been married for 1 day or 40 years, if you create a Will with little or no provision for your spouse, a spouse who survives you is permitted to elect against your estate and to claim a sizable portion of your property.

In Pennsylvania, marriage does not revoke the will. However, Pennsylvania law provides that unless the will is made in contemplation of marriage, the surviving spouse, even if he or she is not mentioned in the will, gets what would be his or her intestate share of the deceased spouse's estate.

Spouses in Pennsylvania Inheritance Laws While spouses will typically inherit most or all of their spouse's intestate estate, children and parents can complicate that scenario. But if none of those relatives survive the decedent, the spouse is given the entire estate.

The Spouse's Share in Pennsylvania. In Pennsylvania, if you are married and you die without a will, what your spouse gets depends on whether or not you have living parents or descendants -- children, grandchildren, or great-grandchildren. If you don't, then your spouse inherits all of your intestate property.

The rates for Pennsylvania inheritance tax are as follows: 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; 4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

In Pennsylvania, marriage does not revoke the will. However, Pennsylvania law provides that unless the will is made in contemplation of marriage, the surviving spouse, even if he or she is not mentioned in the will, gets what would be his or her intestate share of the deceased spouse's estate.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Pennsylvania law provides that if a person is still married at the time of their death with no divorce pending, the surviving spouse can elect to receive 1/3 of that person's estate.