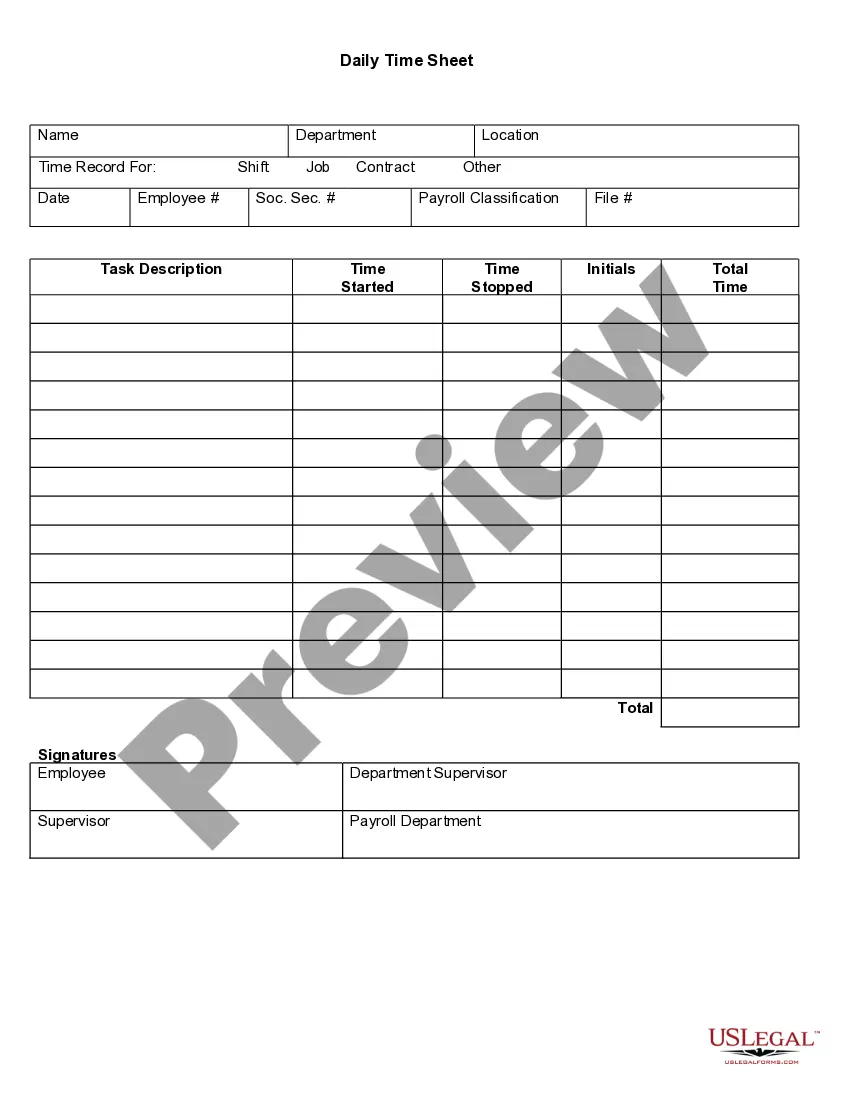

Pennsylvania Time Sheet Instructions

Description

How to fill out Time Sheet Instructions?

Are you currently in a situation where you require documents for both business or personal purposes almost every day? There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a wide array of form templates, including the Pennsylvania Time Sheet Instructions, that are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Pennsylvania Time Sheet Instructions template.

- Identify the form you need and verify that it is for the correct area/county.

- Utilize the Preview option to review the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you need, use the Search box to find the form that meets your needs and requirements.

- Upon finding the appropriate form, click Purchase now.

- Choose the pricing option you prefer, enter the required information to create your account, and process your payment using PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

What is the Law Regarding Breaks and Meal Periods? Pennsylvania employers are required to provide break periods of at least 30 minutes for minors ages 14 through 17 who work five or more consecutive hours. Employers are not required to give breaks for employees 18 and over.

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

How to process payroll yourselfStep 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.

Register for employer withholding tax online through the Online PA-100. Employers can file and pay employer withholding tax returns and submit W-2 information online using e-TIDES, by phone using TeleFile or through third-party software.

Definition of Full-Time Employee For purposes of the employer shared responsibility provisions, a full-time employee is, for a calendar month, an employee employed on average at least 30 hours of service per week, or 130 hours of service per month.

About Employer Withholding Taxes: Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.

Running Payroll in Pennsylvania: Step-by-Step InstructionsStep 1: Set up your business as an employer.Step 2: Register with the Pennsylvania Department of Revenue.Step 3: Register for City Taxes.Step 4: Register for local taxes.Step 5: Set up payroll and collect employee forms.More items...?

How to process payrollStep 1: Establish your employer identification number.Step 2: Collect relevant employee tax information.Step 3: Choose a payroll schedule.Step 4: Calculate gross pay.Step 5: Determine each employee's deductions.Step 6: Calculate net pay, and pay your employees.More items...

Neither Pennsylvania nor federal law establish limits on the number of hours employees can work in a day or workweek. All employees who are over the age of 16 are free to determine for themselves how many hours per day or week they are able to work.