Pennsylvania Employee Time Sheet

Description

How to fill out Employee Time Sheet?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that are vetted by experts.

It is easy to obtain or print the Pennsylvania Employee Time Sheet from our services.

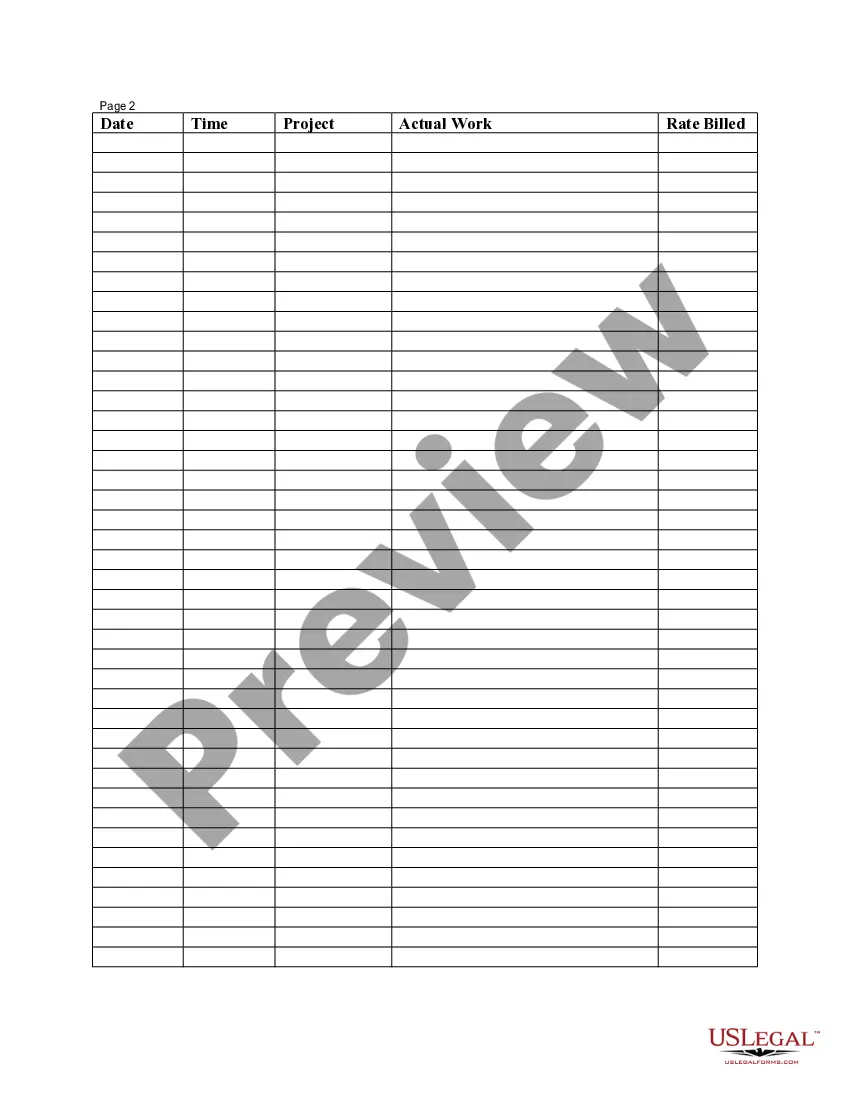

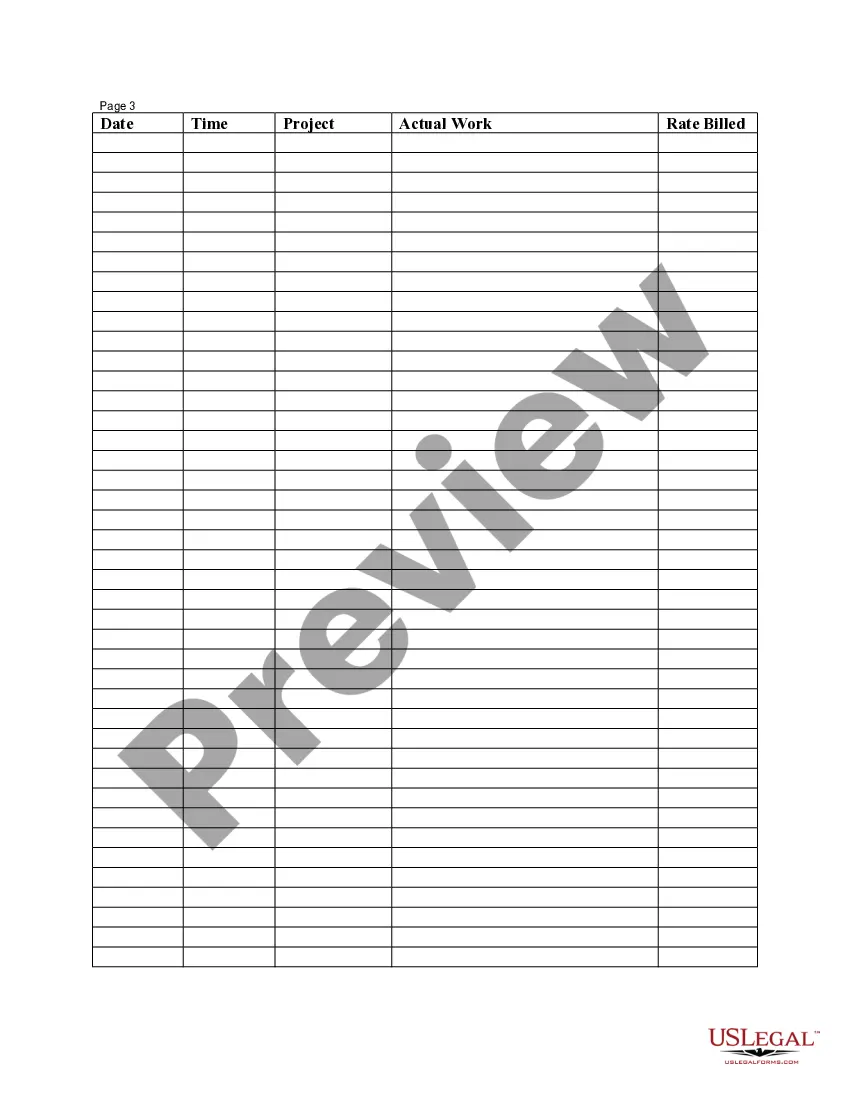

If available, use the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Get button.

- After that, you can complete, modify, print, or sign the Pennsylvania Employee Time Sheet.

- Every legal document template you acquire is yours indefinitely.

- To get an additional copy of any obtained form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

- Review the form details to ensure you have selected the correct template.

Form popularity

FAQ

What is the Law Regarding Breaks and Meal Periods? Pennsylvania employers are required to provide break periods of at least 30 minutes for minors ages 14 through 17 who work five or more consecutive hours. Employers are not required to give breaks for employees 18 and over.

Currently I am offered 15 annual days 4 personal and 11 sick days a year. As long as you have available vacation time, you can vacation. Earned at 3.33 hours per week.

Pennsylvania Labor Laws do not require employers to provide their employees with any meal breaks no matter how long their shift. Unless you're an employee between the ages of 14-17, there is no state law regarding meal breaks. However, each individual employer can choose to allow their employees a meal break.

Follow these steps to set up payroll:Get an Employer Identification Number (EIN)Find out whether you need state or local tax IDs.Decide if you want an independent contractor or an employee.Ensure new employees return a completed W-4 form.Schedule pay periods to coordinate tax withholding for IRS.More items...

Currently I am offered 15 annual days 4 personal and 11 sick days a year. As long as you have available vacation time, you can vacation.

Pennsylvania law generally does not require employees be given breaks or meals. However, the law requires minors ages 14 through 17 years of age to be given break periods of at least 30 minutes when they work five or more hours.

How to process payrollStep 1: Establish your employer identification number.Step 2: Collect relevant employee tax information.Step 3: Choose a payroll schedule.Step 4: Calculate gross pay.Step 5: Determine each employee's deductions.Step 6: Calculate net pay, and pay your employees.More items...

Running Payroll in Pennsylvania: Step-by-Step InstructionsStep 1: Set up your business as an employer.Step 2: Register with the Pennsylvania Department of Revenue.Step 3: Register for City Taxes.Step 4: Register for local taxes.Step 5: Set up payroll and collect employee forms.More items...?

Yes, it is entirely possible to set up payroll yourself, although you do need to know your way around a computer. To DIY your payroll you can either buy an off-the-shelf payroll package or use the HM Revenue & Customs (HMRC) online payroll scheme.

15 minute break for 4-6 consecutive hours or a 30 minute break for more than 6 consecutive hours. If an employee works 8 or more consecutive hours, the employer must provide a 30-minute break and an additional 15 minute break for every additional 4 consecutive hours worked.