An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Pennsylvania Petition to Require Accounting from Testamentary Trustee

Description

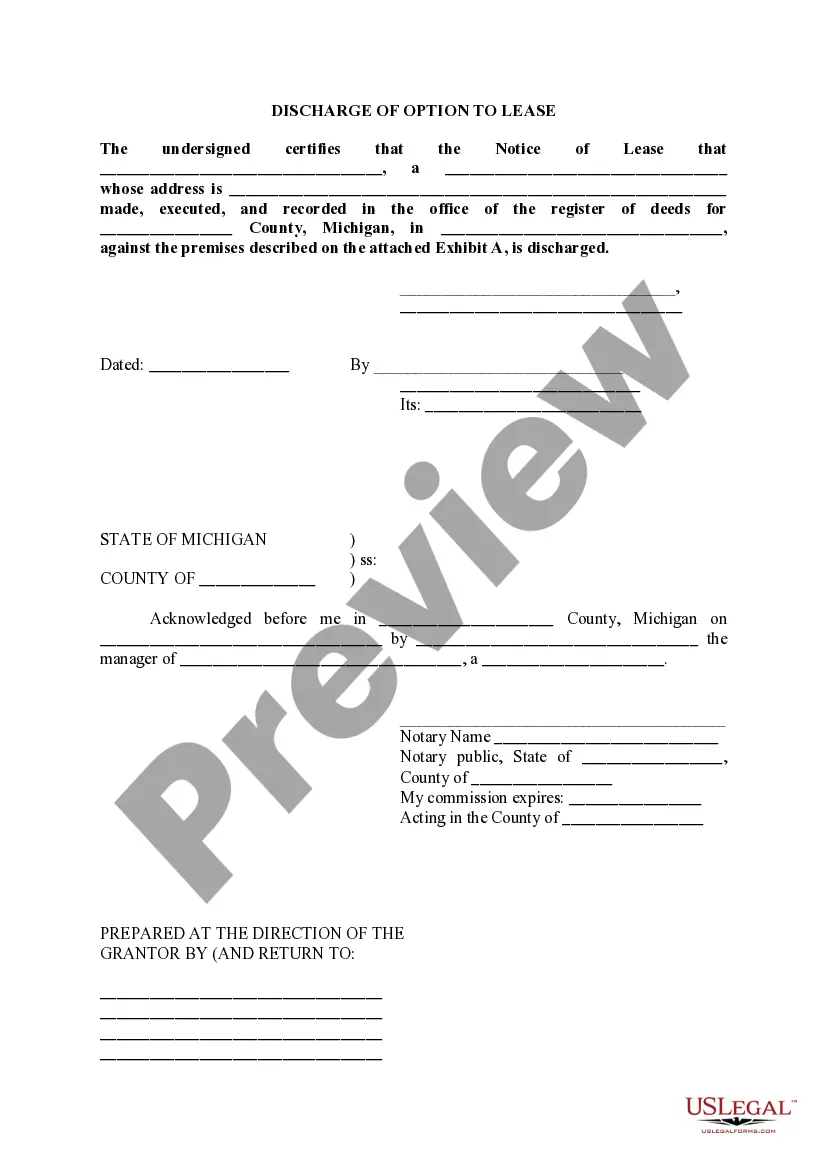

How to fill out Petition To Require Accounting From Testamentary Trustee?

Are you in a situation in which you require papers for both organization or specific uses just about every day time? There are a variety of lawful record layouts available on the net, but getting ones you can rely on isn`t effortless. US Legal Forms provides 1000s of type layouts, like the Pennsylvania Petition to Require Accounting from Testamentary Trustee, which can be composed to meet federal and state needs.

If you are previously informed about US Legal Forms internet site and have an account, simply log in. After that, it is possible to down load the Pennsylvania Petition to Require Accounting from Testamentary Trustee format.

If you do not come with an bank account and would like to start using US Legal Forms, follow these steps:

- Obtain the type you want and ensure it is to the right area/state.

- Take advantage of the Preview key to review the form.

- Browse the outline to actually have selected the correct type.

- In case the type isn`t what you are seeking, make use of the Research field to discover the type that fits your needs and needs.

- If you obtain the right type, click on Buy now.

- Opt for the pricing strategy you need, fill in the required information and facts to make your bank account, and purchase the order using your PayPal or Visa or Mastercard.

- Pick a hassle-free document formatting and down load your duplicate.

Locate every one of the record layouts you have purchased in the My Forms menus. You can obtain a extra duplicate of Pennsylvania Petition to Require Accounting from Testamentary Trustee anytime, if possible. Just select the required type to down load or printing the record format.

Use US Legal Forms, by far the most considerable assortment of lawful kinds, to conserve time and prevent errors. The service provides skillfully manufactured lawful record layouts that you can use for a variety of uses. Produce an account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

Trust funds are legal arrangements that allow individuals to place assets in a special account to benefit another person or entity. Trust funds can be complex and often require the assistance of an attorney to set up, though there are online tools for the do-it-yourselfer.

The duty to account is a legal obligation that requires trustees to provide an accurate and complete report of the trust's activities. This includes any transactions or distributions made from the trust, any income or receipts earned by the trust, as well as any fees or expenses incurred.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

Executors have to keep beneficiaries informed of whether or not they're entitled to anything in the estate and they have to provide proper accounting in a timely manner. That said, as a general rule, it's unreasonable to expect updates and accounting during the first few months of the estate administration.

Next Steps If a Trustee Refuses Accounting Duties Your trust and probate attorney files a petition to compel the trustee to carry out their accounting duties. The court issues a citation to your trustee mandating them to appear in court on a specified hearing date.

A Probate Court Petition to compel a trustee to account goes beyond the everyday informal accountings. It is filed by a beneficiary when a trustee fails to provide the beneficiary with an account.

--Any employer of a person dying domiciled in this Commonwealth at any time after the death of the employee, whether or not a personal representative has been appointed, may pay wages, salary or any employee benefits due the deceased in an amount not exceeding $10,000 to the spouse, any child, the father or mother, or ...

A beneficiary can force the passing of accounts by obtaining a Court order, A passing of accounts is legally required under certain circumstances, or. An estate trustee can voluntarily apply to Court for a passing of accounts.

After your death, the beneficiary has a right to collect any money remaining in your account. They need to go to the bank with proper identification. They must also bring a certified copy of the death certificate.

You can easily have more than one trust if you so choose. Factors and reasons to create more than one trusts depend on your situation. Any person can create an unlimited number of trusts. A large majority of people may be looking into a revocable living trust.