Pennsylvania Pot Testamentary Trust

Description

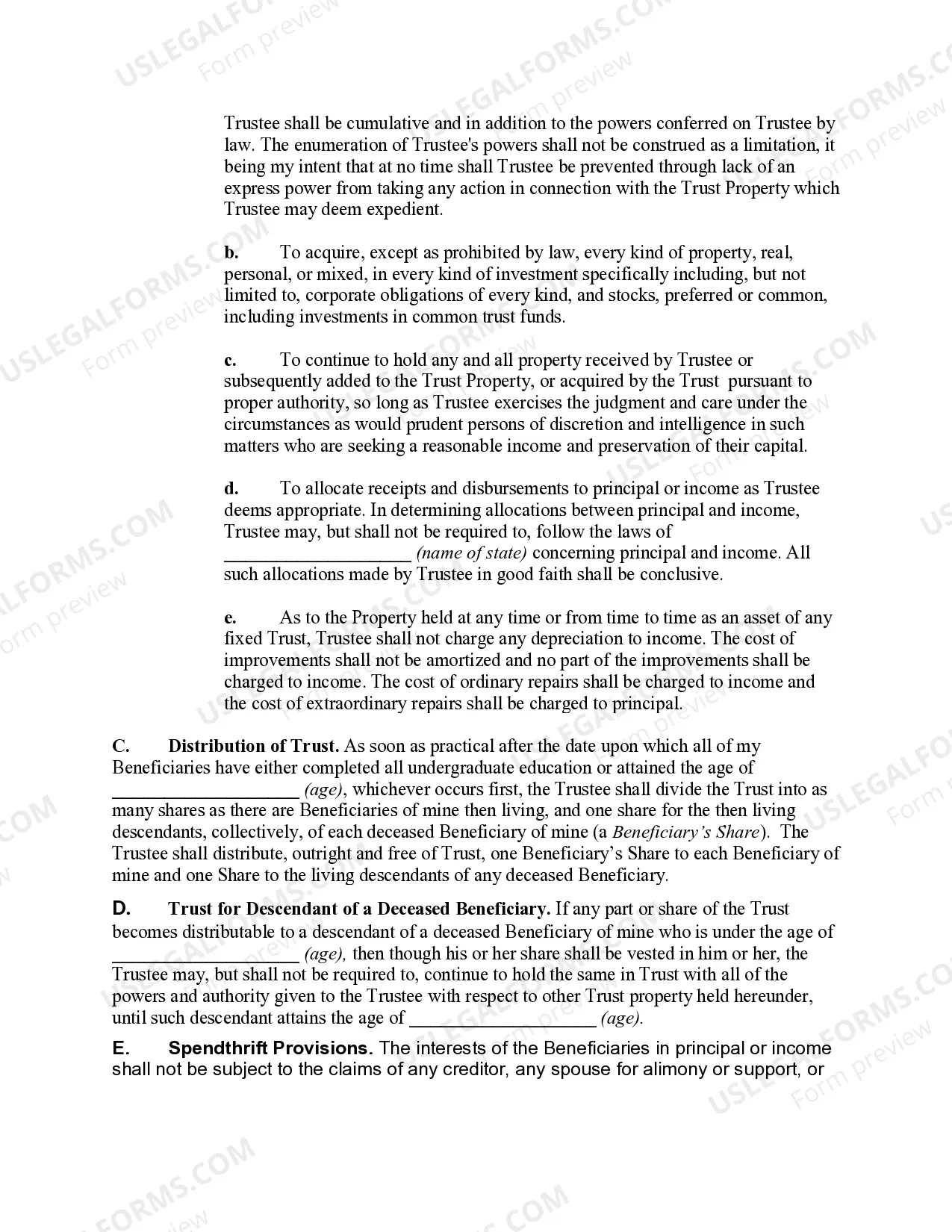

How to fill out Pot Testamentary Trust?

You can invest time online searching for the legal document template that meets the state and federal requirements you have.

US Legal Forms provides thousands of legal templates examined by experts.

You can conveniently download or create the Pennsylvania Pot Testamentary Trust from the service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Afterward, you can complete, edit, create, or sign the Pennsylvania Pot Testamentary Trust.

- Every legal document template you buy is yours for a long time.

- To acquire another copy of any purchased form, visit the My documents tab and click the associated button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure you have selected the correct document template for the area/city of your choice.

- Read the form description to confirm you have chosen the correct template.

Form popularity

FAQ

Yes, nonresidents may need to file a Pennsylvania tax return if they have taxable income sourced from Pennsylvania. This includes income allocated to a Pennsylvania Pot Testamentary Trust. Nonresidents must report their proportionate share of income generated within the state. Always check the latest tax regulations to ensure compliance, as rules may change.

In Pennsylvania, a living trust is a legal agreement in which the testator's assets, including bank accounts, home, securities, etc., can be transferred and handled by an individual, including the testator, or corporation, such as a trust or bank. The person or company managing the trust is called a trustee.

Between the two main types of trusts, revocable trusts are the most common. This is primarily due to the level of flexibility they provide. In a revocable trust, the trustor (or the person who created the trust) has the option to modify or cancel the trust at any time during their lifetime.

Here are the most common types of trusts:Living Trusts.Testamentary Trusts.Irrevocable Life Insurance Trust.Charitable Remainder Trust.Qualified Domestic Trust.Special Needs Trust.What Types of Trusts Can Be Set Up for Minor Beneficiaries?What Type of Investments Are Allowed in Trusts?More items...

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

They are useful in a variety of very specific circumstances, but as discussed below, in Pennsylvania, Revocable Living Trusts are unnecessary in most cases. A Revocable Living Trust is a Trust that a person, called the Grantor, creates, funds, and retains control over during his lifetime.

The four main types are living, testamentary, revocable and irrevocable trusts. However, there are further subcategories with a range of terms and potential benefits.

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

Additionally, wills and trusts generally allow the person more flexibility than POD accounts, such as naming alternate beneficiaries. Alternatively, there may be more complex requirements in order for a will or trust to be considered valid. In this way, POD's are generally much more simple to create.

Pennsylvania is one of the states that has adopted the Uniform Trust Code.