Pennsylvania Assignment of Partnership Interest

Description

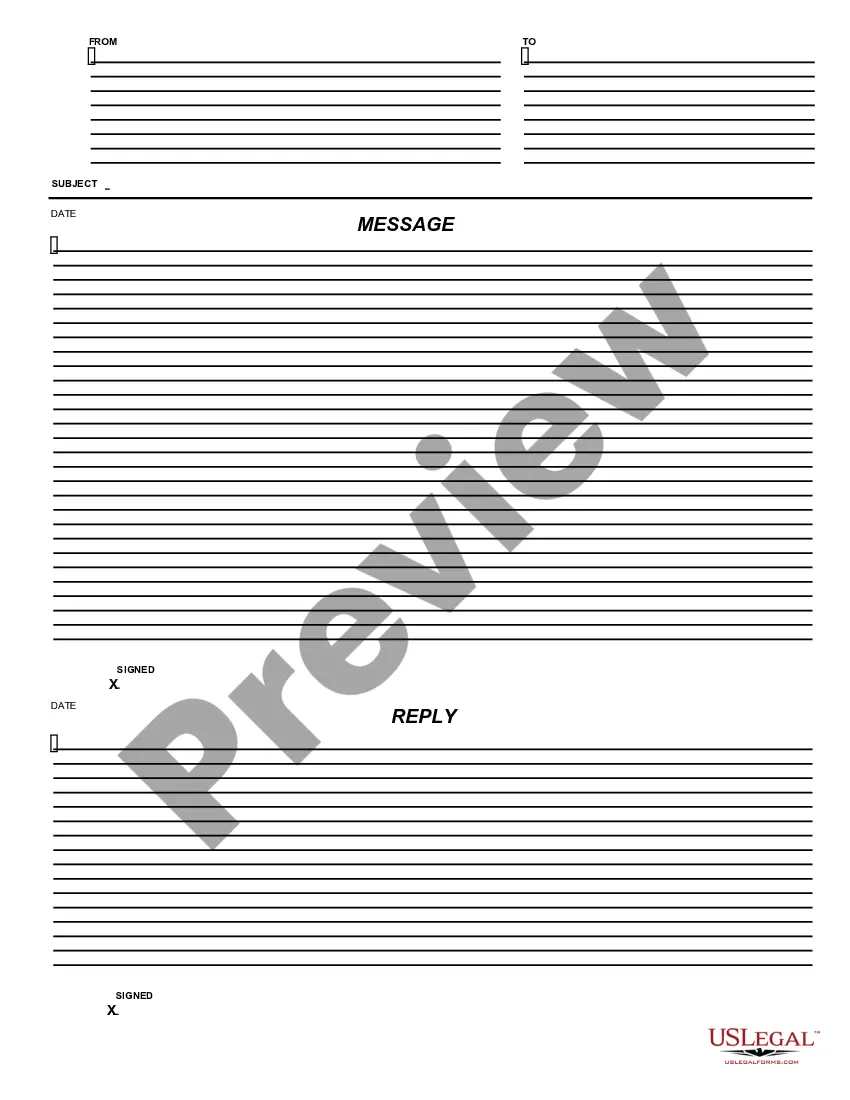

How to fill out Assignment Of Partnership Interest?

You can spend numerous hours online searching for the legal document format that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can easily download or print the Pennsylvania Assignment of Partnership Interest from the service.

If you wish to find another variant of the document, use the Search field to locate the format that fulfills your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you can fill out, edit, print, or sign the Pennsylvania Assignment of Partnership Interest.

- Each legal document you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click on the corresponding option.

- Should this be your first time using the US Legal Forms website, follow the simple instructions outlined below.

- First, ensure you have selected the correct format for your state/region.

- Review the form description to confirm you have chosen the appropriate document.

Form popularity

FAQ

An assignment of an interest in a general partnership refers to the process of transferring a partner's share of ownership and rights to another individual or entity. This transfer may involve both financial interest and the right to partake in partnership decisions. It’s important to follow the partnership’s agreements and Pennsylvania laws to ensure a smooth transition.

Yes, you can assign a partnership interest, but you must adhere to the terms outlined in your partnership agreement. This process usually requires approval from the other partners before a transfer is finalized. It’s essential to document the assignment properly to ensure that all parties are aware of their rights and responsibilities under the Pennsylvania Assignment of Partnership Interest.

To report a transfer of partnership interest, the partnership must update its records to reflect the new ownership. Typically, the transferring partner should provide notice to the partnership and the other partners. Additionally, amend any tax filings as necessary, and consider seeking legal assistance to ensure compliance with the Pennsylvania Assignment of Partnership Interest regulations.

To form a partnership, you need at least two individuals or entities willing to collaborate. A partnership agreement is highly recommended to clearly define rights and responsibilities. Additional requirements may include obtaining licenses and registering your business name, depending on your local regulations.

Yes, Pennsylvania does tax partnerships, but not in the same way as corporations. Instead, partnerships are pass-through entities, meaning the income is reported on the individual partners' tax returns. Each partner is responsible for paying taxes on their share of the partnership's income, so it's vital to keep track of financial records diligently.

Forming a partnership in Pennsylvania involves selecting a business name, drafting a partnership agreement, and deciding on a structure for your partnership. Once you've established these key elements, you may need to register your business name with the state if it differs from your own. Additionally, consider consulting with a legal professional to ensure compliance with Pennsylvania's laws regarding partnership formation.

The primary disadvantage of a partnership is the exposure to personal liability. In a partnership, each partner is personally liable for the debts and obligations of the business. This means that if the partnership faces lawsuits or incurs debt, your personal assets may be at risk.

To form a partnership in Pennsylvania, you need to choose a business name and register it with the Pennsylvania Department of State if you're using a name other than your own. Next, you should draft a partnership agreement that outlines the roles and responsibilities of each partner. It's also essential to obtain any necessary licenses or permits depending on your business activities.

Yes, you can gift an interest in a partnership, but it is advisable to document the process properly, especially under a Pennsylvania Assignment of Partnership Interest. This type of gift may involve tax implications, so understanding the consequences is vital for both the giver and receiver. Engage with a legal or tax professional to ensure compliance and avoid potential pitfalls.

Changing partners in a partnership is possible and often occurs through the Pennsylvania Assignment of Partnership Interest. This change may require consent from existing partners, and it’s important to follow the procedures outlined in your partnership agreement. Documenting the change helps ensure clarity and continuation of business operations.