This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Pennsylvania Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Finding the right lawful record design might be a battle. Obviously, there are a variety of templates available on the Internet, but how do you discover the lawful kind you want? Make use of the US Legal Forms website. The support gives a huge number of templates, like the Pennsylvania Application for Release of Right to Redeem Property from IRS After Foreclosure, which can be used for company and private requirements. All the varieties are checked out by specialists and fulfill state and federal specifications.

When you are previously listed, log in to the account and then click the Obtain switch to have the Pennsylvania Application for Release of Right to Redeem Property from IRS After Foreclosure. Make use of your account to check through the lawful varieties you have acquired previously. Proceed to the My Forms tab of your own account and obtain an additional copy of your record you want.

When you are a fresh end user of US Legal Forms, listed here are straightforward directions so that you can adhere to:

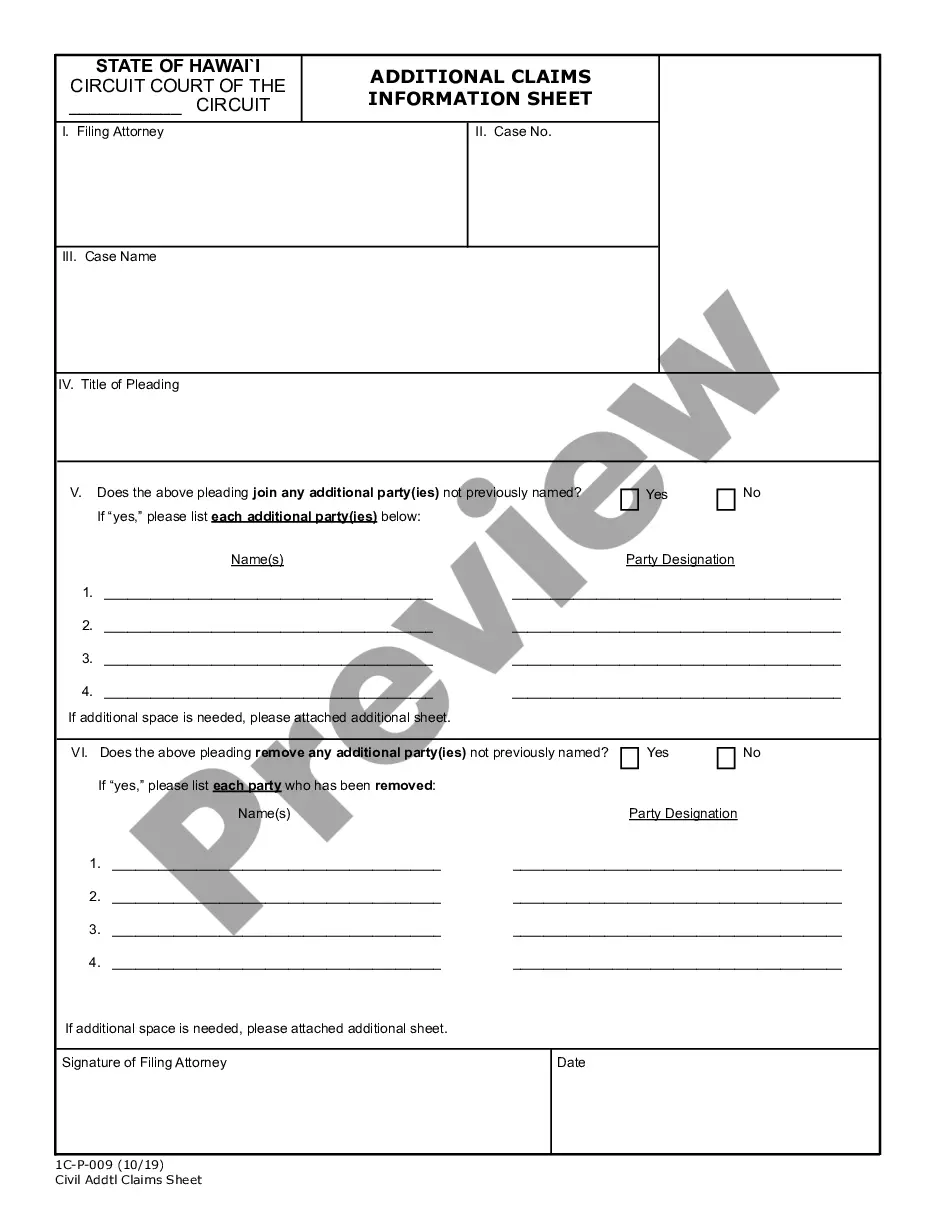

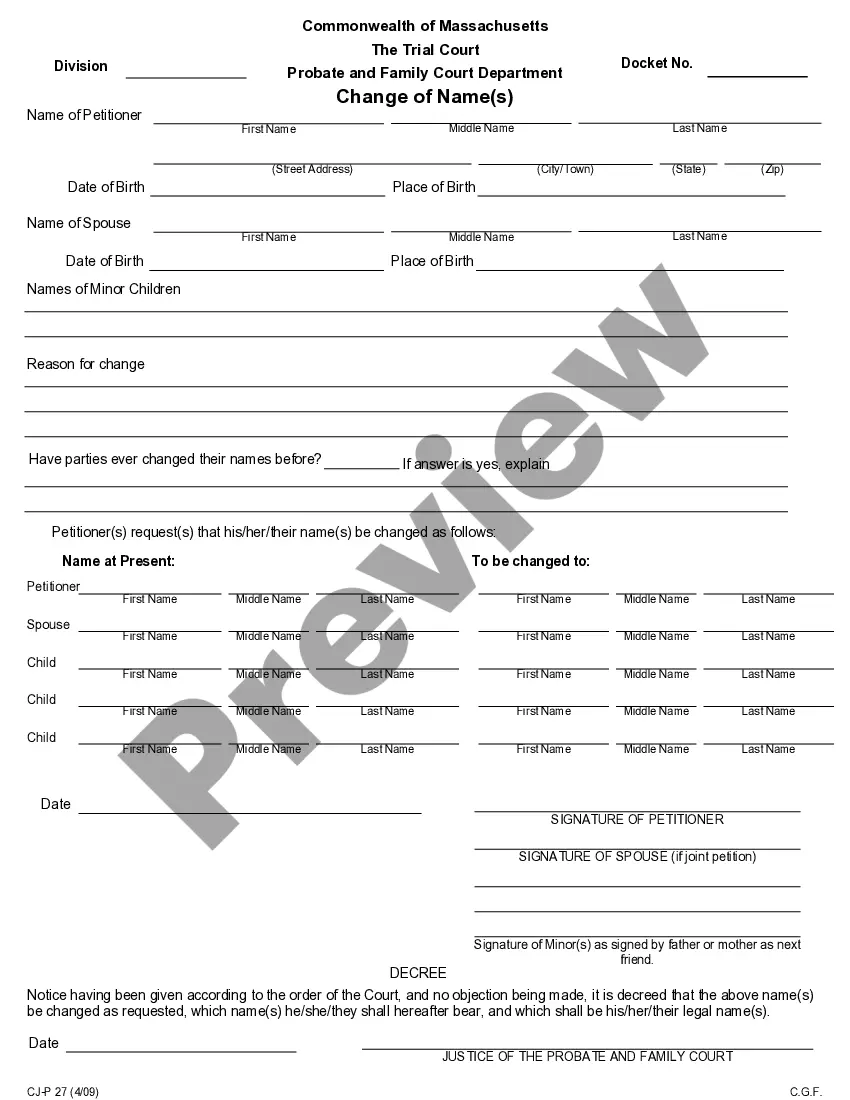

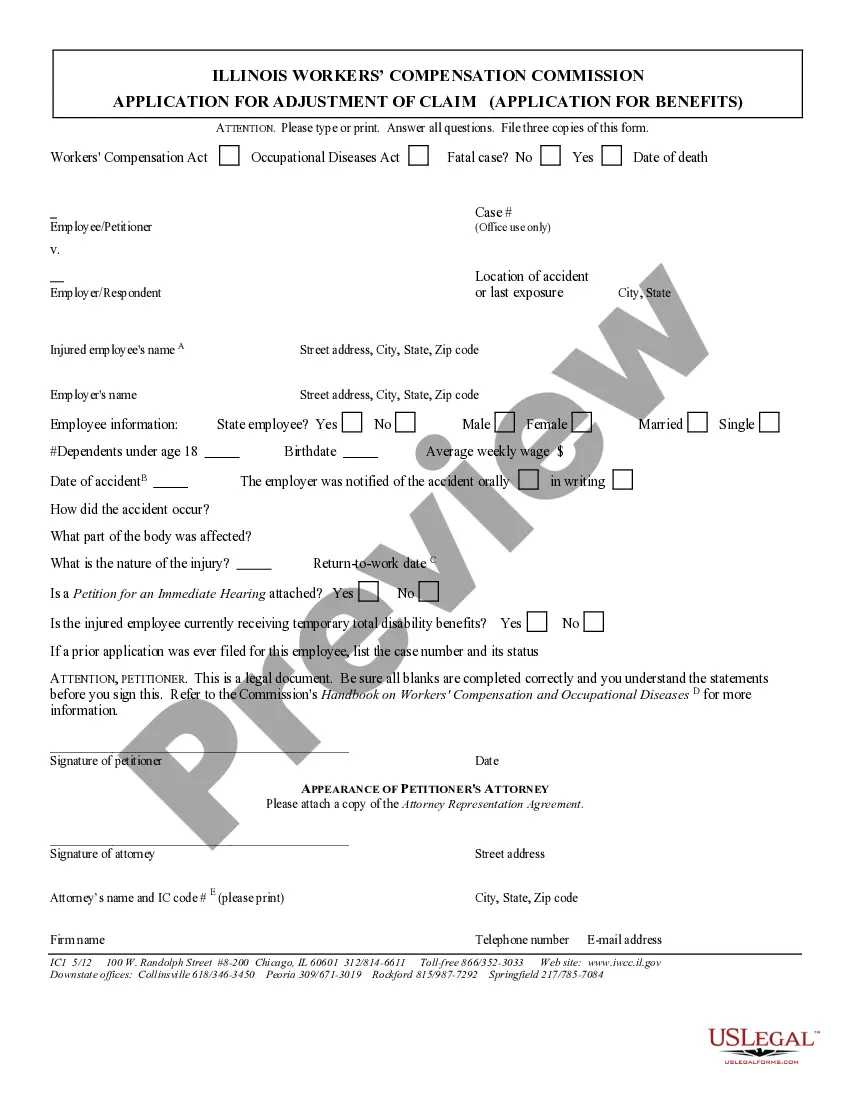

- First, make sure you have chosen the proper kind for your town/area. You may examine the form while using Review switch and browse the form explanation to ensure it will be the right one for you.

- In case the kind will not fulfill your needs, utilize the Seach field to obtain the proper kind.

- When you are certain the form is proper, click the Get now switch to have the kind.

- Pick the costs plan you need and enter the essential information and facts. Make your account and buy the order making use of your PayPal account or credit card.

- Select the document format and down load the lawful record design to the device.

- Total, edit and print and indication the attained Pennsylvania Application for Release of Right to Redeem Property from IRS After Foreclosure.

US Legal Forms will be the largest collection of lawful varieties where you can find a variety of record templates. Make use of the company to down load professionally-produced documents that adhere to condition specifications.

Form popularity

FAQ

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

Releasing a Lien The IRS will release the lien once you pay the debt ? either in a lump sum or over time. However, if the IRS releases a lien, it may remain on your credit report for many years.

The time to redeem your property in Pennsylvania is only 9 months. This deadline begins to count down on the date the sheriff transfers the deed of the property. This is a tight deadline, to say the least.

If your real estate was seized and sold, you have redemption rights. You or anyone with an interest in the property may redeem your real estate within 180 days after the sale. This includes: your heirs, executors, administrators.

53 P.S. Section 7293 governs Right of Redemption in Pennsylvania. Under the statute, a property that is sold at tax lien sheriff sale can be redeemed or essentially repurchased by the prior owner of the property within nine months of the date of the sale.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.