This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Pennsylvania Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

It is possible to devote time on-line searching for the legal file design that suits the state and federal specifications you require. US Legal Forms provides a large number of legal varieties that happen to be analyzed by experts. You can easily down load or print out the Pennsylvania Application for Certificate of Discharge of IRS Lien from your assistance.

If you already have a US Legal Forms accounts, you can log in and then click the Down load button. Afterward, you can complete, change, print out, or indication the Pennsylvania Application for Certificate of Discharge of IRS Lien. Each legal file design you buy is yours eternally. To obtain one more duplicate of the bought develop, proceed to the My Forms tab and then click the related button.

Should you use the US Legal Forms internet site for the first time, adhere to the basic directions under:

- Very first, ensure that you have selected the right file design to the state/metropolis of your choice. Browse the develop description to ensure you have picked out the correct develop. If accessible, utilize the Review button to appear from the file design also.

- If you want to get one more version of the develop, utilize the Research field to discover the design that fits your needs and specifications.

- Once you have identified the design you desire, click Purchase now to continue.

- Pick the prices plan you desire, enter your credentials, and sign up for your account on US Legal Forms.

- Full the transaction. You may use your bank card or PayPal accounts to purchase the legal develop.

- Pick the format of the file and down load it in your device.

- Make modifications in your file if necessary. It is possible to complete, change and indication and print out Pennsylvania Application for Certificate of Discharge of IRS Lien.

Down load and print out a large number of file templates while using US Legal Forms website, that provides the biggest variety of legal varieties. Use specialist and state-specific templates to handle your small business or specific requires.

Form popularity

FAQ

In order to obtain a corporate lien certificate, please select the ?Corporate Lien Certificate Request? option under the ?Tax Compliance? tile at .mypath.pa.gov. Note: Please keep in mind the Corporate Lien Certificate Application will only work with certain web browsers.

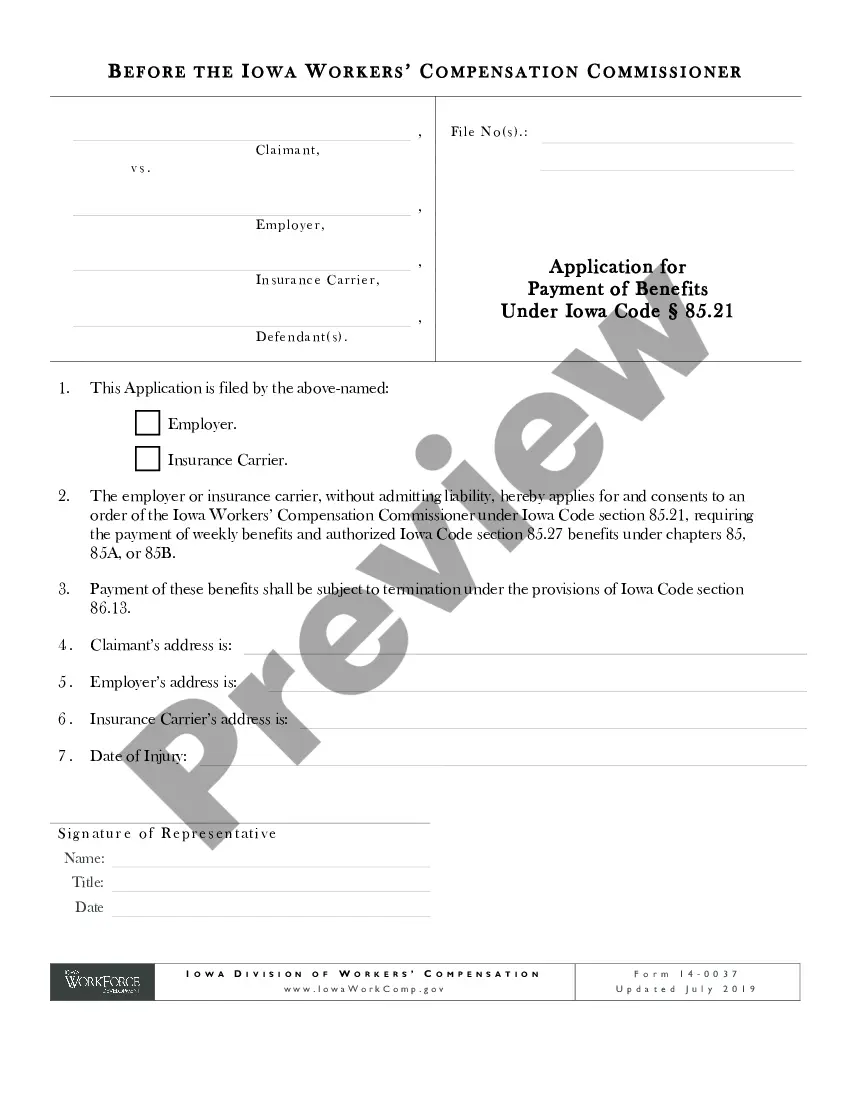

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

If you need a copy of a certificate of release and it's been more than 30-days since the taxes were full paid: Contact the IRS Centralized Lien Office by calling 800-913-6050 or e-fax 855-390-3530.

If the lien is released by the lienholder on Form MV-38O, or with a notarized lien release statement on lienholder's letterhead, PennDOT's counter service area will accept a properly completed application and issue a duplicate title to the vehicle owner (with proper owner ID) with no lien.

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

If the Internal Revenue Service (IRS) has placed a tax lien on your property, once you've satisfied the debt, the IRS should notify you that the lien has been removed. To do so, the IRS should send you a ?Certificate of Release of Federal Tax Lien,? also known as Form 668(Z).

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.

Station Overview. The Notice of Federal Tax Lien (NFTL) can affect the sale of different types of property, like a house, boat, car, or equipment. Applying for a Certificate of Discharge, if granted, will remove the effect of the NFTL from the property named in the discharge document.