Pennsylvania REV-1649 Instructions -- Instructions for REV-1649 Schedule O — Deferral/Election of Spousal Trusts provide guidance to taxpayers for filing a deferral or election of spousal trusts. These trusts are used to defer income and/or capital gains taxes on assets transferred between spouses. The form is used for filing a Qualified Terminable Interest Property (TIP) trust, a Qualified Revocable Transfer (ART) trust, or a Disclaimer Trust. TIP Trust: A TIP trust enables a married couple to provide for a surviving spouse while maintaining control over the assets in the trust. The surviving spouse is entitled to income from the trust, but the principal remains in the trust and is not available to the surviving spouse. ART Trust: A ART trust allows a married couple to set up a trust that provides income and principal to a surviving spouse with the assets in the trust being passed on to another beneficiary at the surviving spouse’s death. Disclaimer Trust: A disclaimer trust allows a married couple to set up a trust that provides for the income and principal to go to a surviving spouse, but the survivor may disclaim any or all of the trust assets so that they are passed on to another beneficiary at the surviving spouse’s death. To file a deferral or election of a spousal trust, the taxpayer must complete REV-1649 Schedule O. This form requires the taxpayer to provide information regarding the trust, including the trust name, date of the trust, name of the granter, name of the trustee, name of the beneficiary, and the amount of the deferral or election. The taxpayer must also provide the necessary supporting documents, such as a copy of the trust agreement, a copy of the trust’s tax return, and any other documents requested by the Department of Revenue. Once the form is complete, the taxpayer must submit the form and any supporting documents to the Department of Revenue for review and approval. If the form is approved, the taxpayer will receive a letter from the Department of Revenue confirming the deferral or election.

Pennsylvania REV-1649 Instructions -- Instructions for REV-1649 Schedule O - Deferral/Election of Spousal Trusts

Description

How to fill out Pennsylvania REV-1649 Instructions -- Instructions For REV-1649 Schedule O - Deferral/Election Of Spousal Trusts?

If you’re looking for a way to appropriately complete the Pennsylvania REV-1649 Instructions -- Instructions for REV-1649 Schedule O - Deferral/Election of Spousal Trusts without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business situation. Every piece of paperwork you find on our web service is drafted in accordance with federal and state regulations, so you can be sure that your documents are in order.

Adhere to these simple guidelines on how to get the ready-to-use Pennsylvania REV-1649 Instructions -- Instructions for REV-1649 Schedule O - Deferral/Election of Spousal Trusts:

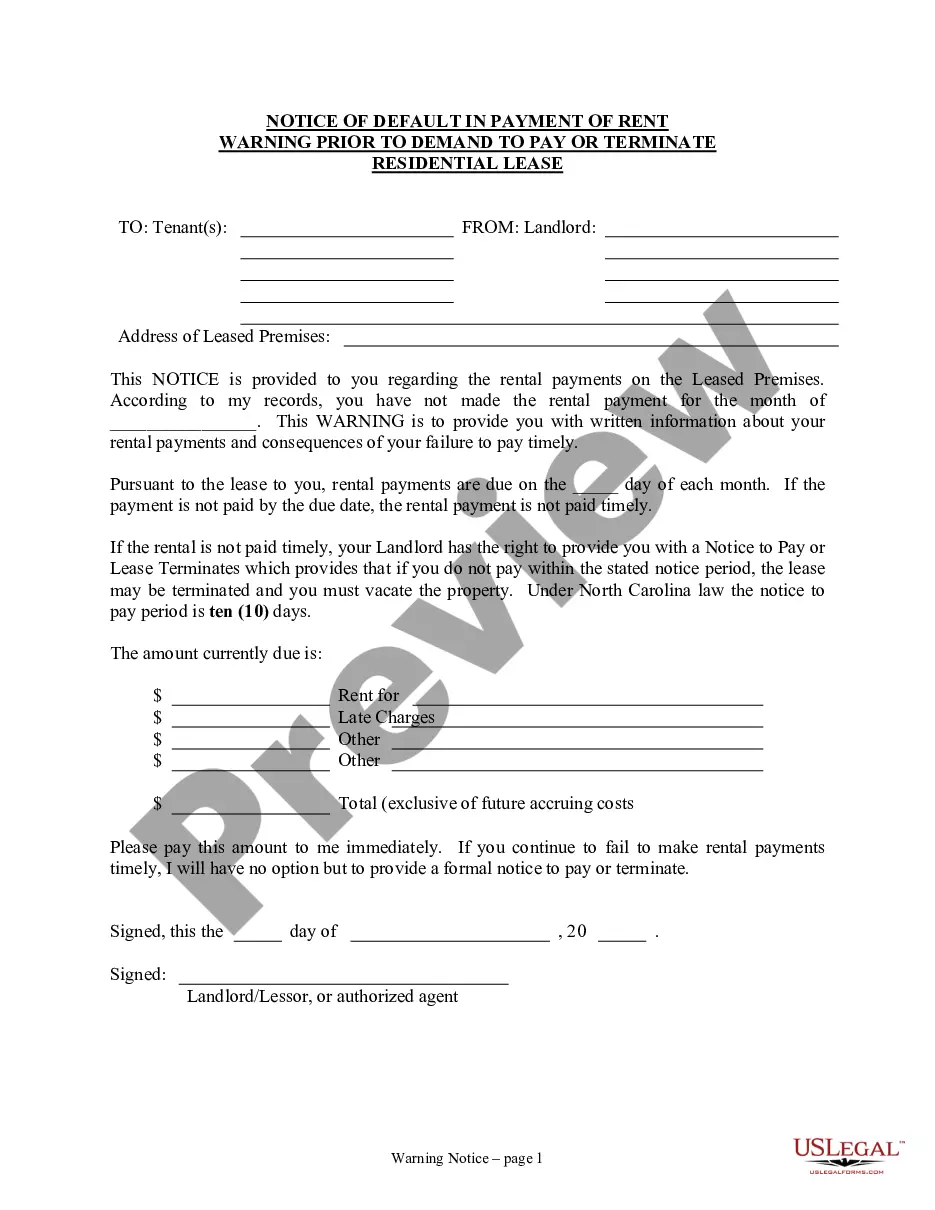

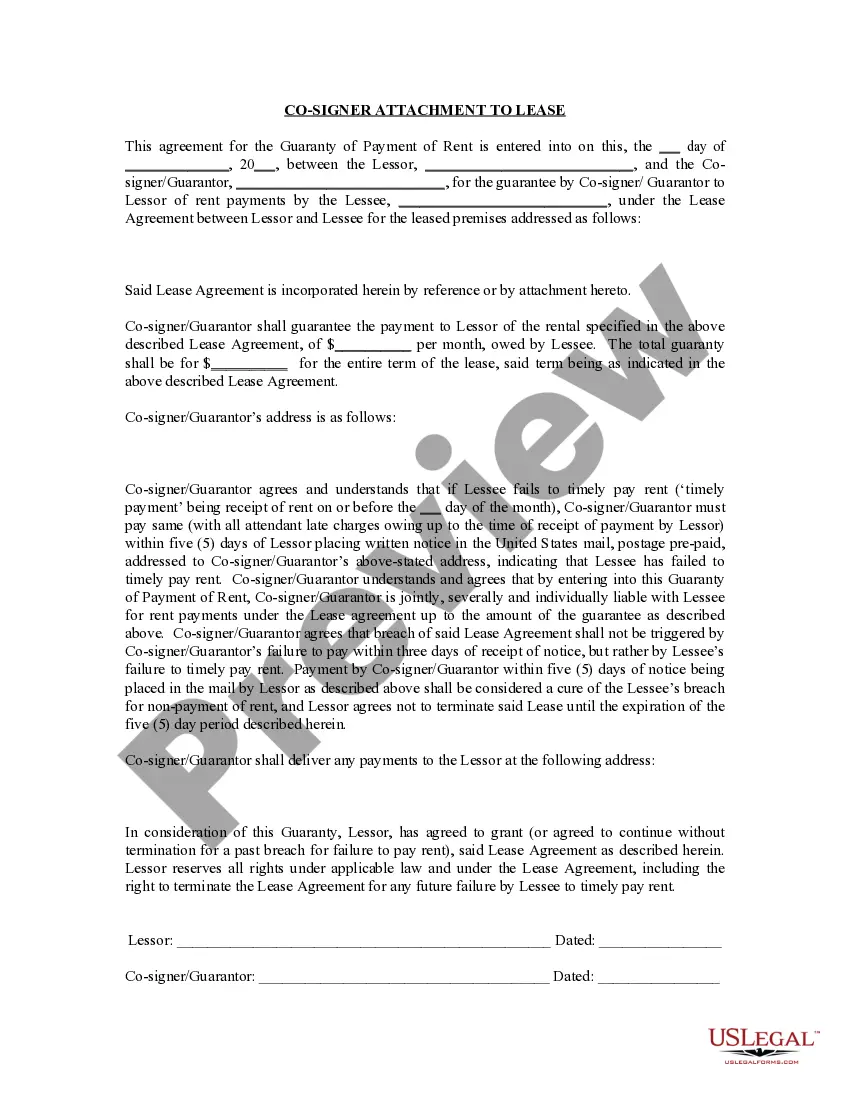

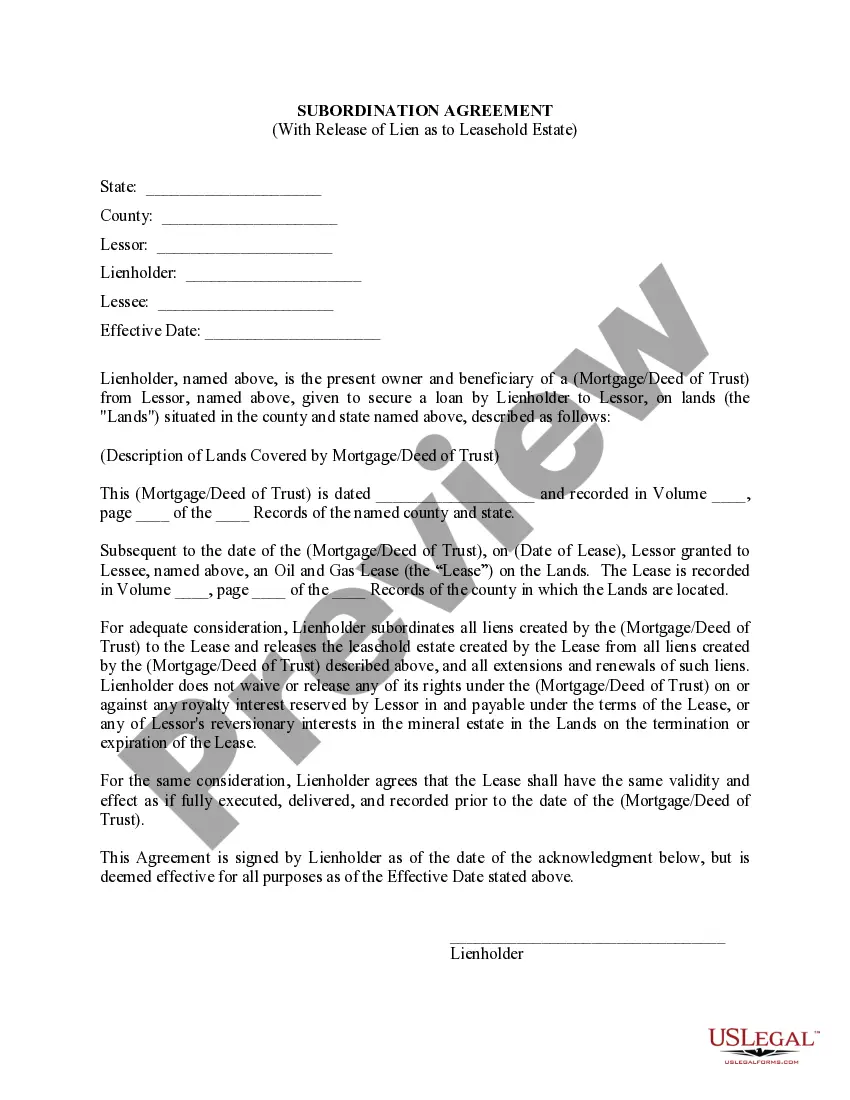

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the list to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Pennsylvania REV-1649 Instructions -- Instructions for REV-1649 Schedule O - Deferral/Election of Spousal Trusts and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Property owned jointly between husband and wife is exempt from Inheritance Tax, while property inherited from a spouse, or from a child twentyone or younger by a parent, is taxed at a rate of 0 percent. Inheritance Tax returns are due nine calendar months after a person's death.

Assets in the trust are protected from long-term care costs. Assets avoid probate in PA. Assets avoid PA inheritance tax and federal estate tax.

4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and. 15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; 4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion (DSUE) amount to a surviving spouse, regardless of the size of the gross estate or amount of adjusted taxable gifts.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death. After nine months, the tax due accrues interest and penalties.