Pennsylvania REV-1513 Instructions -- Instructions for REV-1513 Schedule J are instructions for filing out Schedule J of the REV-1513 tax form. This form is used when filing a Pennsylvania Inheritance Tax Return. The instructions provide information on who must file the return, when the return must be filed, what information must be provided on the return, and how to correctly calculate and compute the Inheritance Tax due. The instructions also provide information on how to claim deductions, calculate the tax rates, and properly complete the form. There are three different types of instructions: General Instructions, Beneficiaries instructions, and Decedent instructions. General Instructions provide information on who must file the return, when the return must be filed, what information must be provided on the return, and how to correctly calculate and compute the Inheritance Tax due. Beneficiaries instructions provide information on how to correctly calculate and compute the Inheritance Tax due for beneficiaries. This includes how to calculate total assets, calculate deductions, calculate the applicable tax rates, and complete the form. Decedent instructions provide information on how to correctly calculate and compute the Inheritance Tax due for the decedent. This includes how to calculate total assets, calculate deductions, calculate the applicable tax rates, and complete the form.

Pennsylvania REV-1513 Instructions -- Instructions for REV-1513 Schedule J - Beneficiaries

Description

How to fill out Pennsylvania REV-1513 Instructions -- Instructions For REV-1513 Schedule J - Beneficiaries?

If you’re looking for a way to properly prepare the Pennsylvania REV-1513 Instructions -- Instructions for REV-1513 Schedule J - Beneficiaries without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of documentation you find on our web service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to get the ready-to-use Pennsylvania REV-1513 Instructions -- Instructions for REV-1513 Schedule J - Beneficiaries:

- Make sure the document you see on the page meets your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Pennsylvania REV-1513 Instructions -- Instructions for REV-1513 Schedule J - Beneficiaries and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Am I required to pay inheritance tax on an IRA I inherited? The IRA will be subject to inheritance tax if the decedent was over 59 1/2 years old at the time of death (for traditional IRAs). Roth IRAs are always taxable regardless of the decedent's...

If the executor moves the IRA directly into inherited IRAs for each of the beneficiary children, the beneficiaries would be responsible for paying the taxes. If the executor withdraws the IRA assets, then the executor would pay the taxes from the estate assets.

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

Property owned jointly between spouses is exempt from inheritance tax.

PA SCHEDULE J (LINE 7) Report the total income that you received or that the estate or trust credited to you. For PA income tax purposes, an estate or trust cannot distribute a loss. Enter the name, identification number, and amount of PA-taxable income from each PA Schedule RK-1 or NRK-1.

If an IRA owner passes away before they reach the age of 59 1/2, the IRA given to a beneficiary will not be subject to Pennsylvania's inheritance tax. Therefore, if the decedent was over the age of 59 ½, the beneficiary must pay the inheritance tax.

The main thing to remember about inheriting a traditional IRA is that distributions are generally taxable at the beneficiary's ordinary tax rate. If you inherit an IRA and take money out of it, you'll pay income taxes on it.

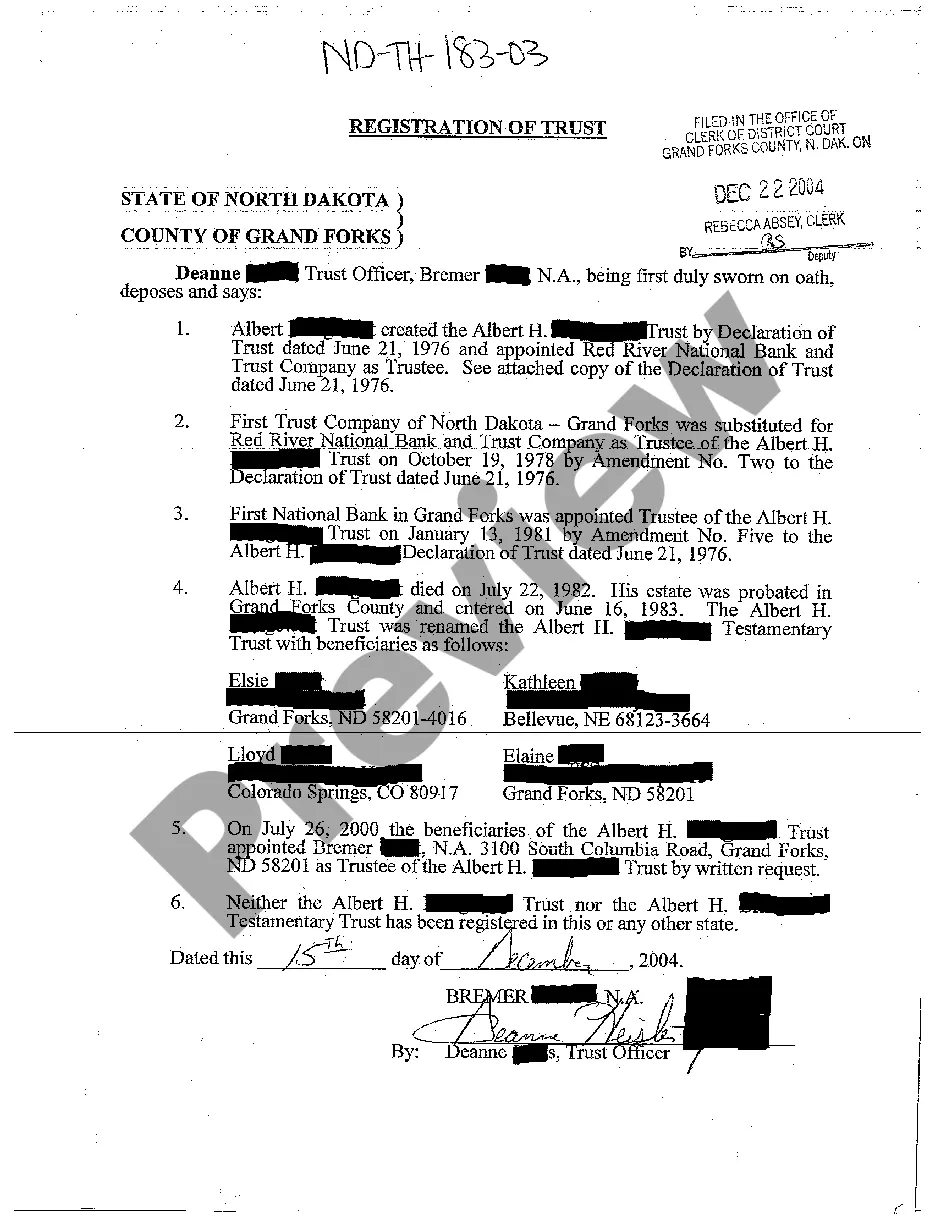

Schedule J, REV-1513 - Beneficiaries Report all beneficiaries and their relationship to the dece- dent. Schedule K, REV-1514 - Life Estate, Annuity and Term Certain Report all presently vested life estate, annuities and terms certain created by the decedent for which valuations must be actuarially determined.