Pennsylvania REV-1647 -- Schedule M — Future Interest Compromise (or “Schedule M”) is a form used by taxpayers in the state of Pennsylvania to compromise future interest owed on delinquent state taxes. This form is used when the taxpayer is unable to pay the full amount of interest due on the delinquent taxes and wishes to negotiate a lower amount with the Department of Revenue. This form is also used to waive or reduce fines and penalties. There are two types of Schedule M: “Regular” and “Automatic”. The “Regular” version requires the taxpayer to go through the normal application process, while the “Automatic” version can be used by taxpayers who meet certain criteria and do not need to submit an application.

Pennsylvania REV-1647 -- Schedule M - Future Interest Compromise

Description

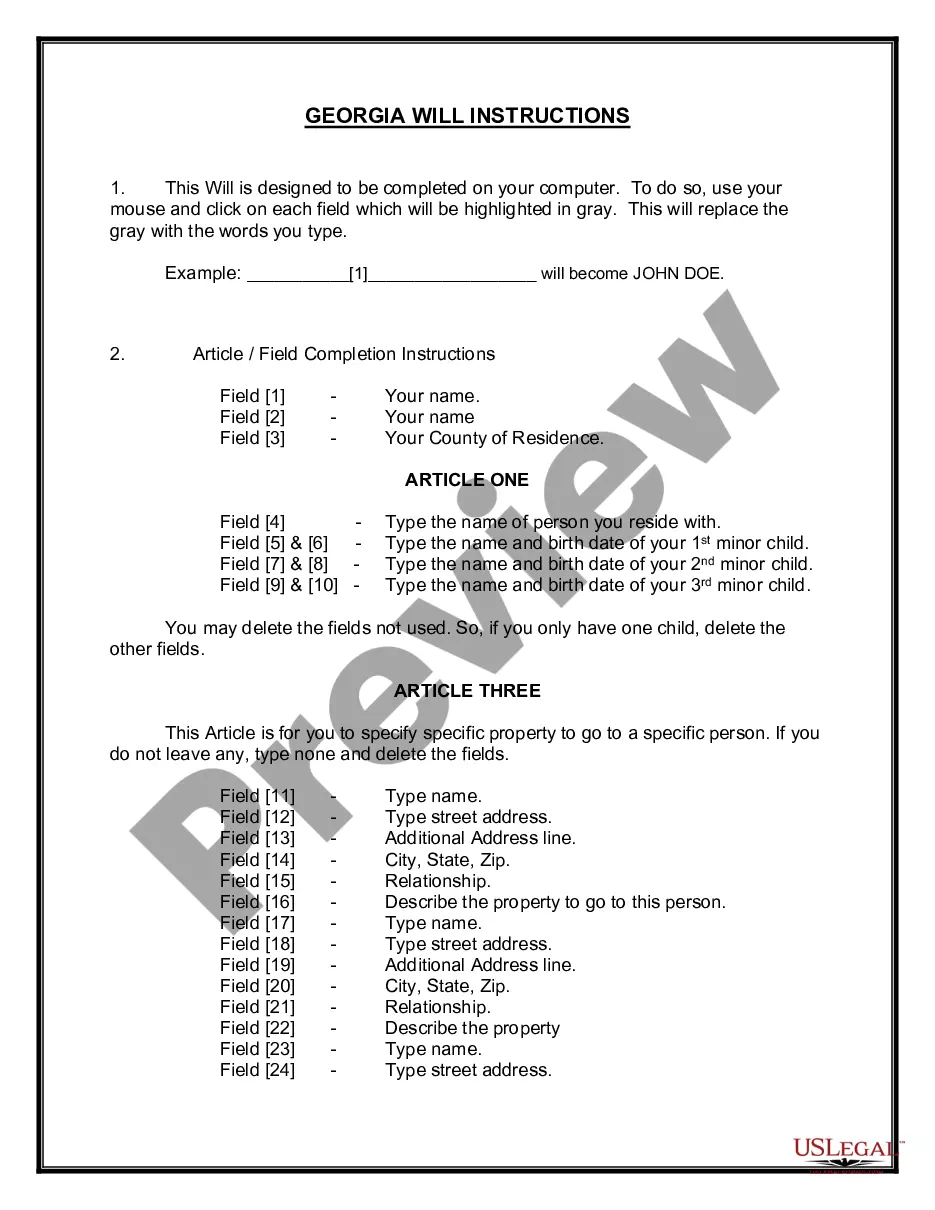

How to fill out Pennsylvania REV-1647 -- Schedule M - Future Interest Compromise?

If you’re searching for a way to appropriately complete the Pennsylvania REV-1647 -- Schedule M - Future Interest Compromise without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of documentation you find on our online service is drafted in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these simple guidelines on how to get the ready-to-use Pennsylvania REV-1647 -- Schedule M - Future Interest Compromise:

- Make sure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Pennsylvania REV-1647 -- Schedule M - Future Interest Compromise and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death. After nine months, the tax due accrues interest and penalties.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; 4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

How To Avoid Inheritance Tax. One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

Pennsylvania Inheritance Tax Rates for IRAs 5% for transfers made to direct descendants like children or grandchildren. 12% for distributions to siblings. 15% for transfers to non-spousal beneficiaries.

An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion (DSUE) amount to a surviving spouse, regardless of the size of the gross estate or amount of adjusted taxable gifts.