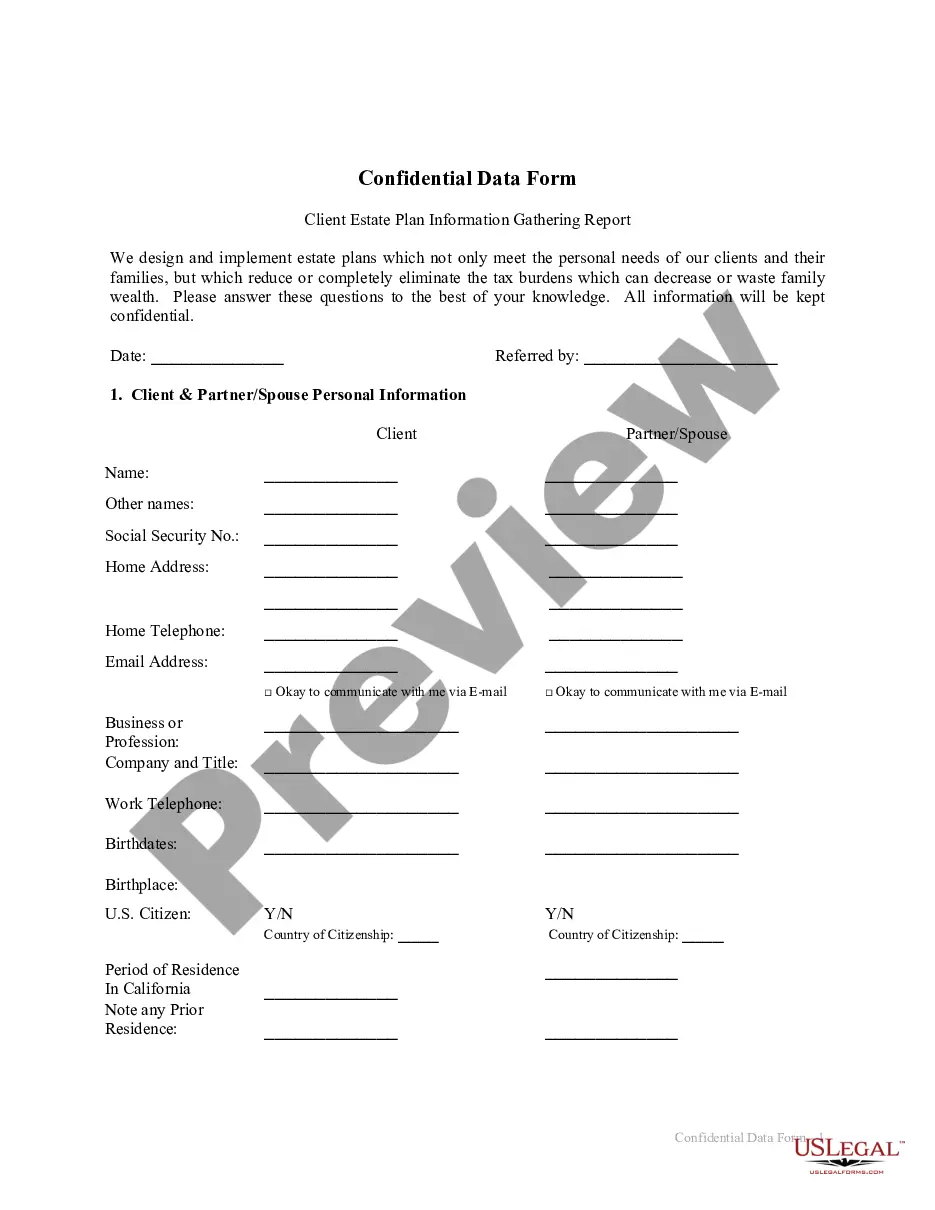

Pennsylvania REV-1737-4 -- Schedule E is a form issued by the Pennsylvania Department of Revenue. It is used to report a business's total net income or loss from certain transactions. There are three types of this form: self-employment income, rental income, and royalties. Self-employment income includes any income earned through a business that is not subject to taxation by the state, such as income from services or the sale of goods. Rental income includes income earned from renting out real estate or other property, and royalty income includes income from the exploitation of intellectual property rights. All three types of Pennsylvania REV-1737-4 -- Schedule E must be filed in order to accurately report a business's net income or loss.

Pennsylvania REV-1737-4 -- Schedule E

Description

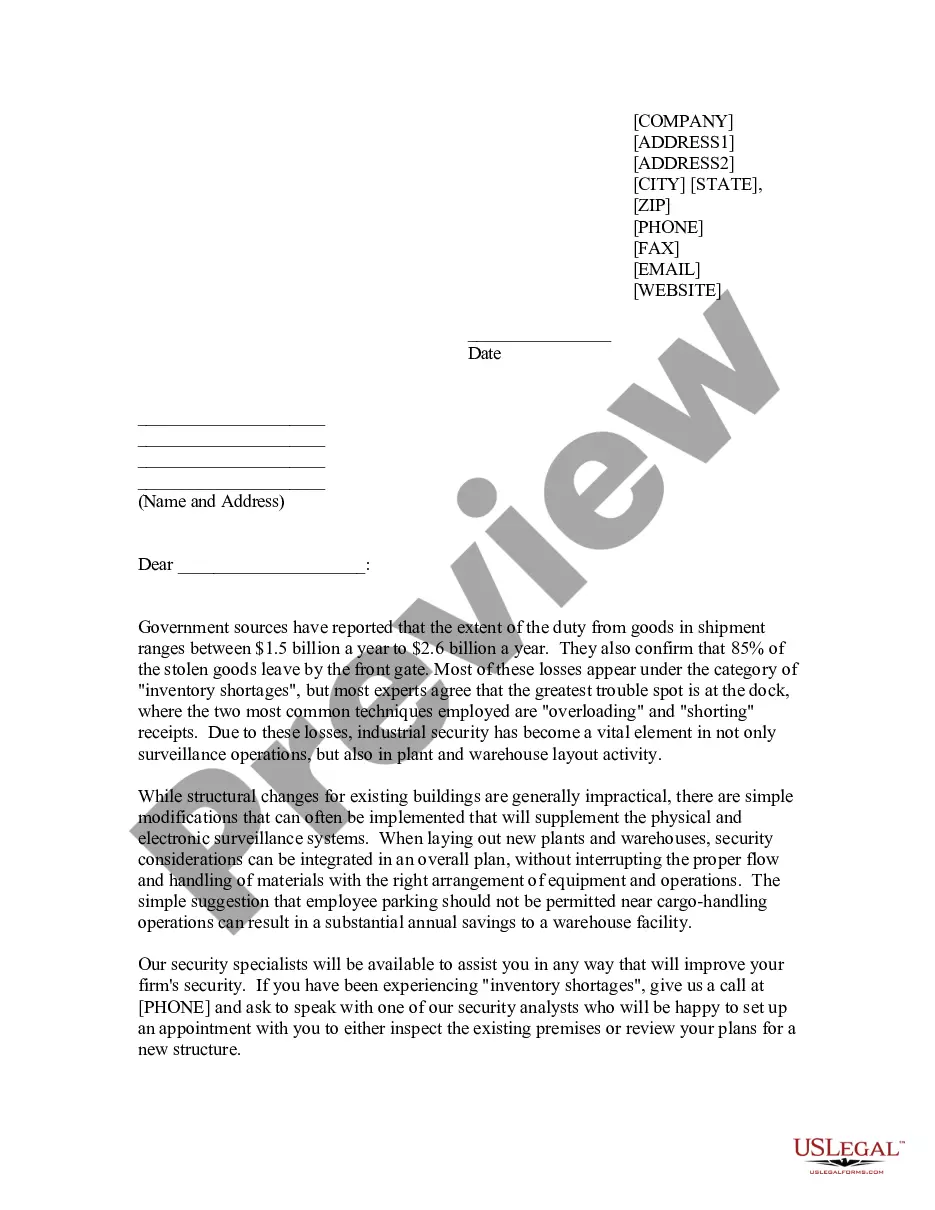

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Pennsylvania REV-1737-4 -- Schedule E?

If you’re looking for a way to properly complete the Pennsylvania REV-1737-4 -- Schedule E without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business scenario. Every piece of documentation you find on our online service is designed in accordance with federal and state regulations, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to obtain the ready-to-use Pennsylvania REV-1737-4 -- Schedule E:

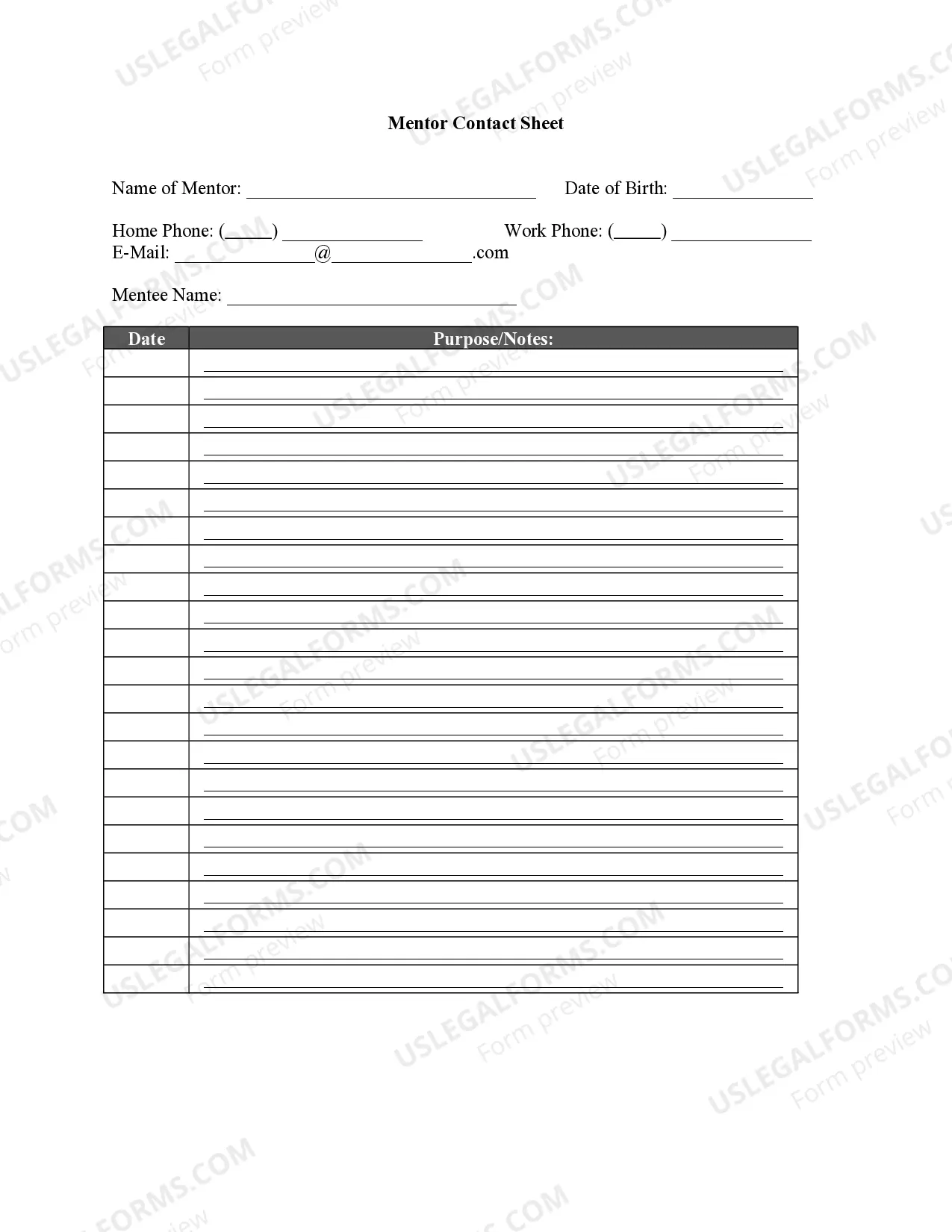

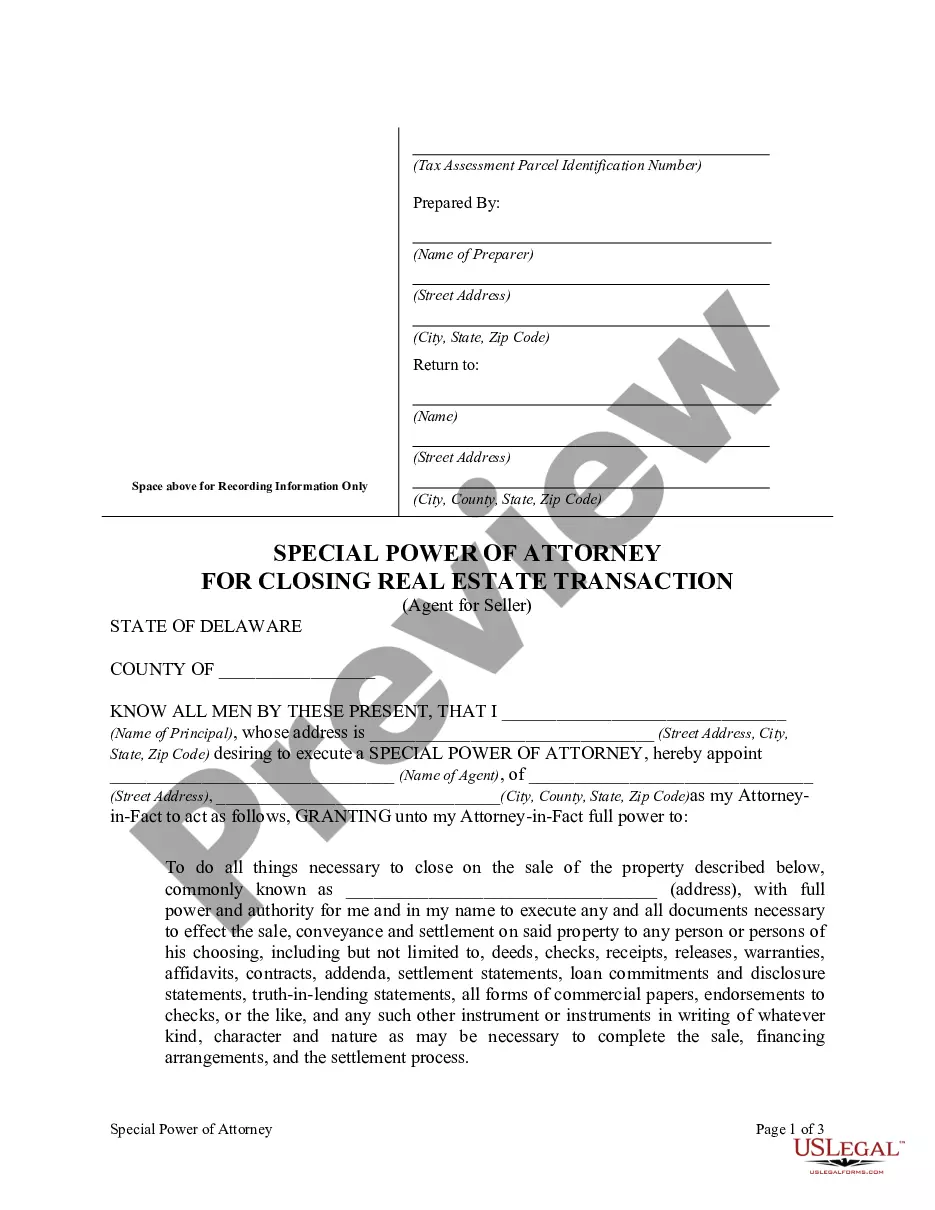

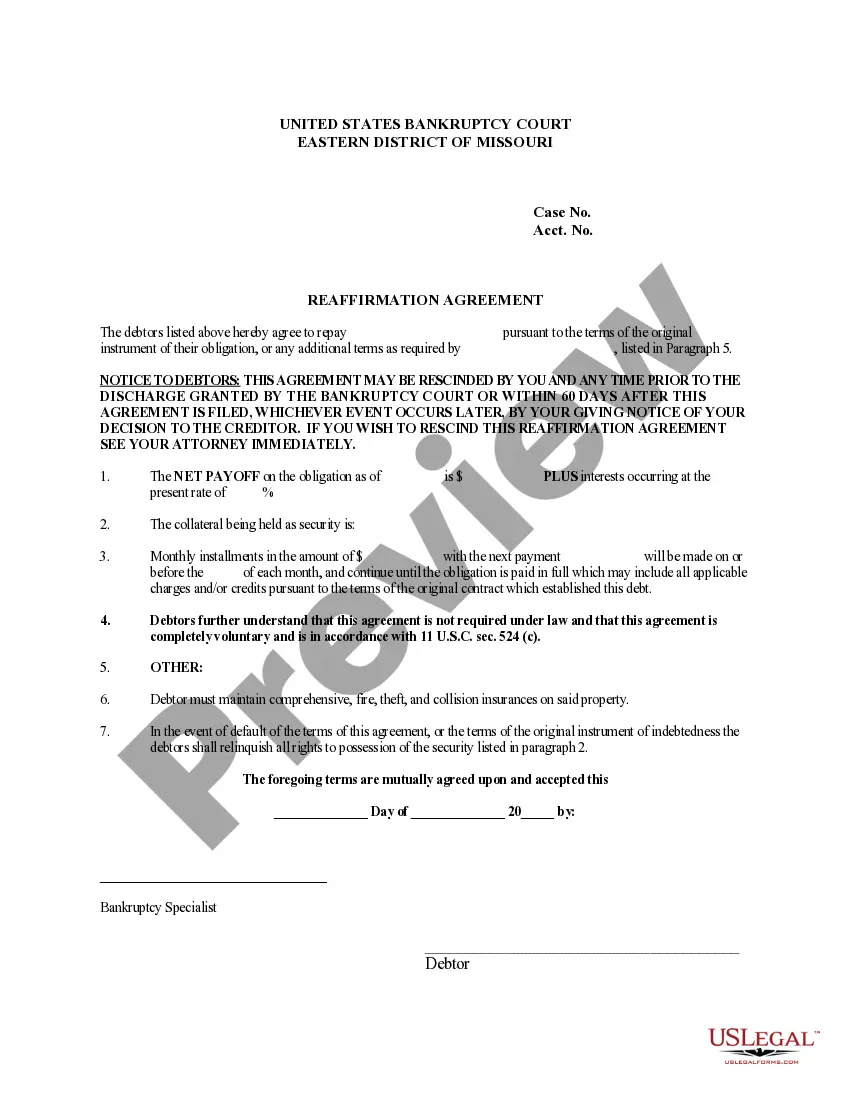

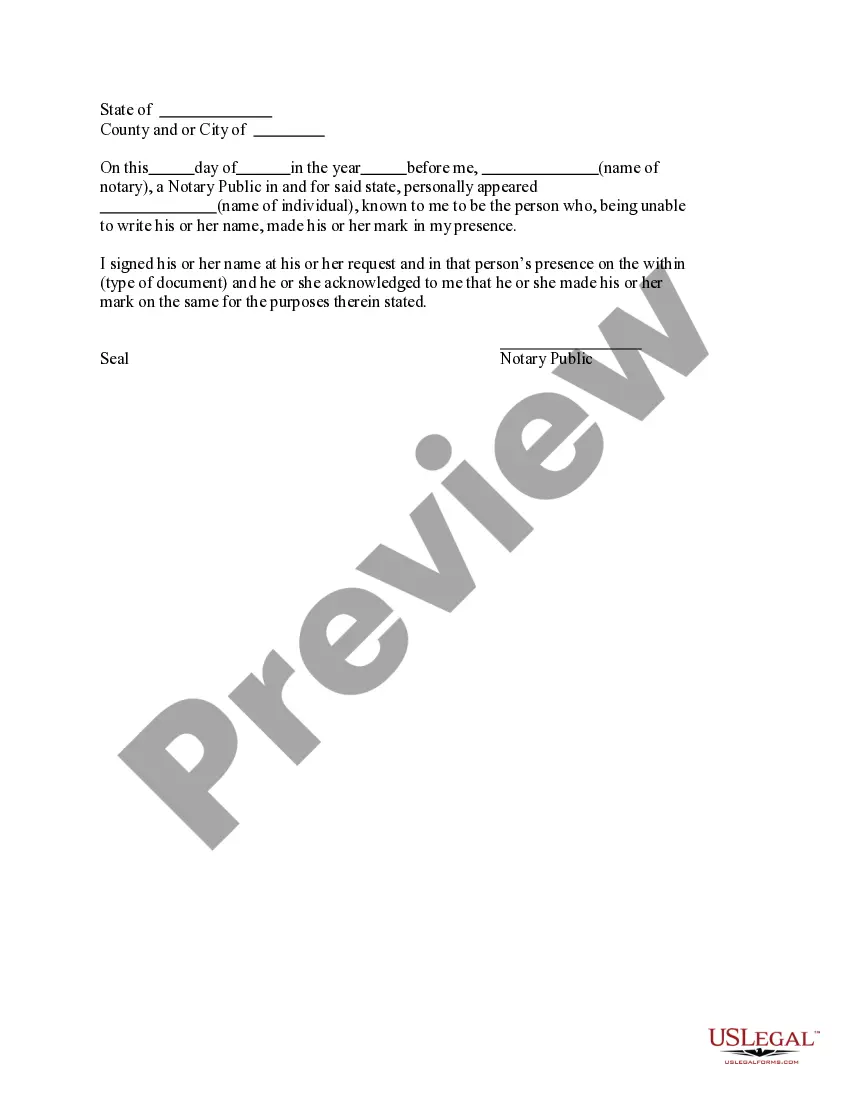

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the dropdown to find another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Pennsylvania REV-1737-4 -- Schedule E and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

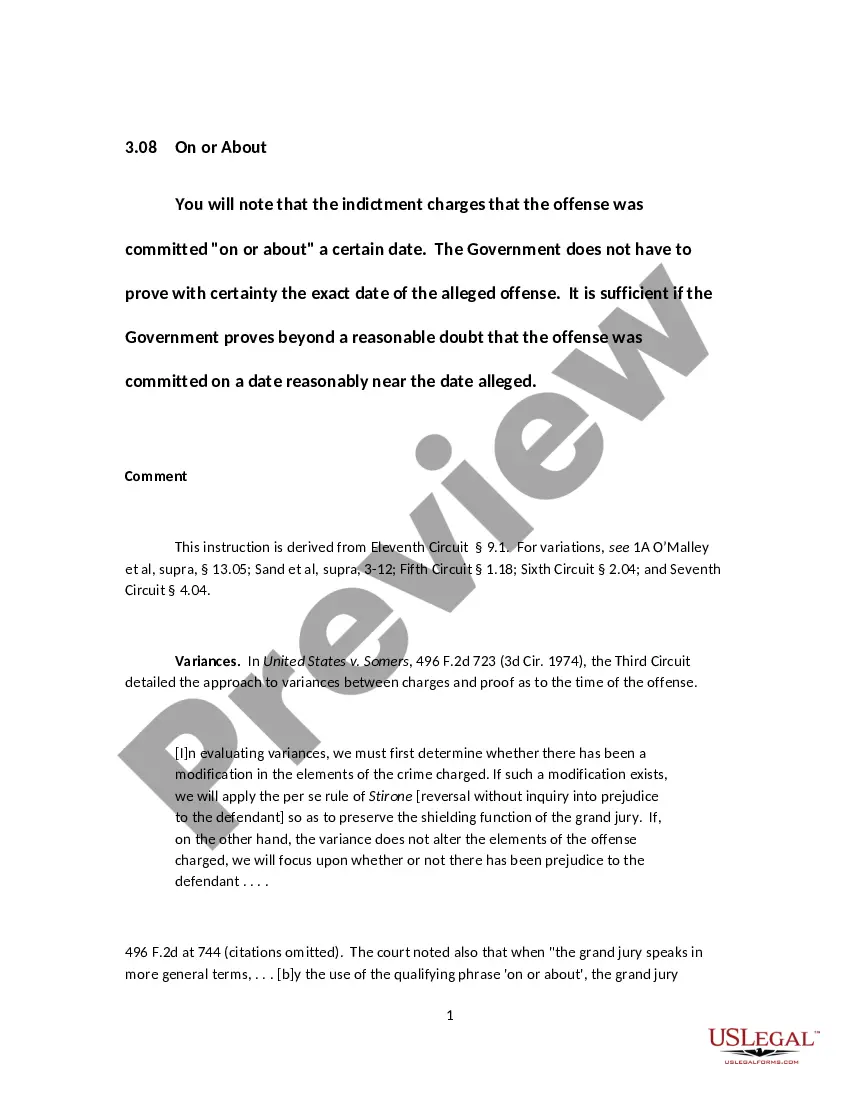

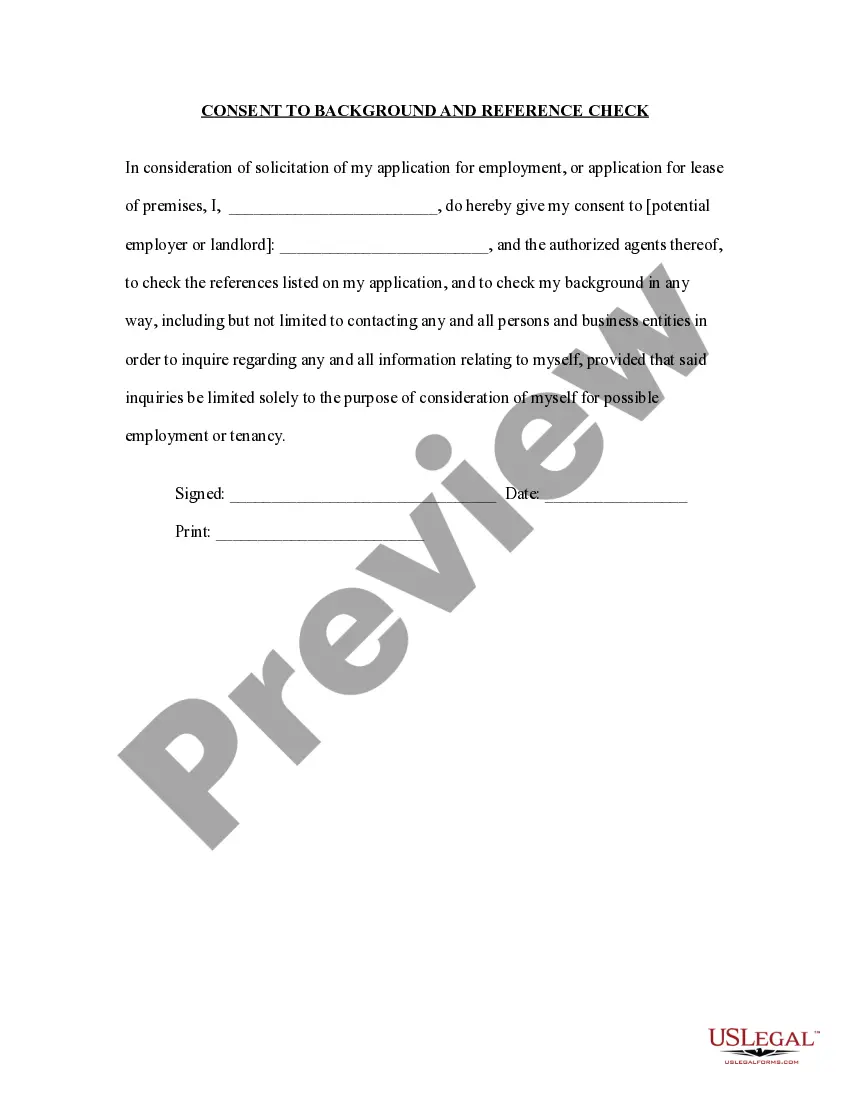

Out-Of-State Real Estate Is Not Taxed for Pa. Inheritance Tax purposes. Ironically, if the decedent owned a property in Stone Harbor, New Jersey or anywhere outside Pennsylvania, it is not taxed for Pa. Inheritance Tax purposes.

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

Cash, investments or property held in a trust sit outside of your estate for inheritance tax purposes, and can therefore help you avoid an inheritance tax bill. You may want to set up a trust for your children, grandchildren, or other family members.

One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

Give your assets away If you give assets away and you survive for at least 7 years then all gifts are free and avoid inheritance tax. If you die within 7 years then inheritance tax will be paid on a reducing scale.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.