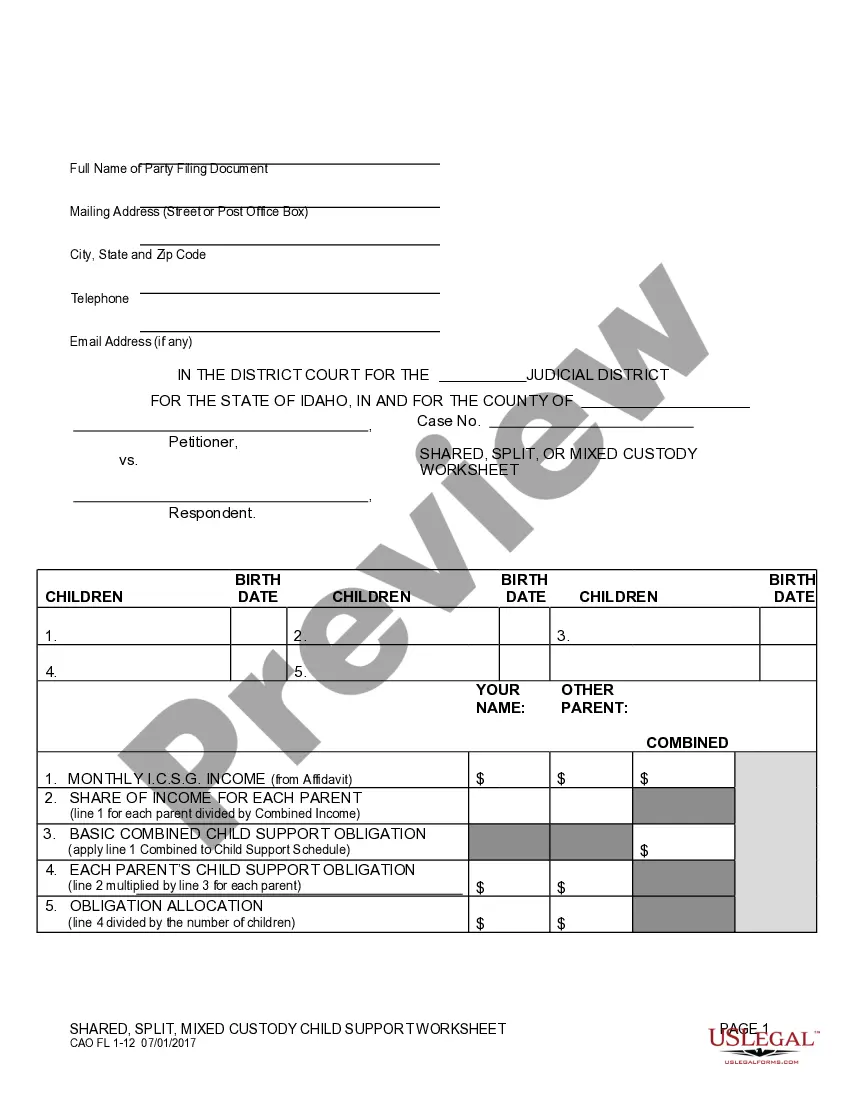

This is a Child Support Worksheet to be used by those parents where one has sole custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Worksheet for Sole Custody

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Child Support Worksheet For Sole Custody?

Among countless free and paid samples available on the web, you cannot guarantee their trustworthiness.

For instance, who produced them or whether they possess the expertise necessary for the task you require.

Stay calm and utilize US Legal Forms!

Review the document by exploring the description using the Preview feature. Click Buy Now to initiate the purchasing process or search for another sample using the Search field in the header. Select a pricing plan to register for an account. Make the payment for the subscription using your credit/debit card or Paypal. Download the form in your preferred file format. Once you have registered and purchased your subscription, you can utilize your Idaho Child Support Worksheet for Sole Custody as many times as needed or for as long as it stays valid in your area. Edit it with your chosen editor, fill it out, sign it, and print it. Accomplish more for less with US Legal Forms!

- Find Idaho Child Support Worksheet for Sole Custody templates created by proficient attorneys.

- Avoid the expensive and time-consuming task of searching for a lawyer and then having to compensate them to draft a document you can easily obtain yourself.

- If you already have a subscription, Log In to your account and look for the Download button beside the form you're looking for.

- You'll also have access to all your previously downloaded samples in the My documents section.

- If you're using our platform for the first time, follow the steps outlined below to acquire your Idaho Child Support Worksheet for Sole Custody swiftly.

- Ensure that the document you find is applicable in the state where you reside.

Form popularity

FAQ

Yes, children can benefit from 50/50 custody arrangements as they maintain close relationships with both parents. This balanced approach allows kids to enjoy the love and support of both parents, which can enhance their emotional and psychological well-being. However, the Idaho Child Support Worksheet for Sole Custody can highlight differences in support obligations when custody arrangements are not equal. Understanding these implications can help parents make informed decisions.

Child support is still paid when parents have joint custody in Texas in most situations.Generally, in most joint managing conservatorship cases one parent is named the primary conservator who has the right to determine the primary residence of the child, and the other parent has visitation.

In the case of a 50/50 split, the higher earner usually pays child support to the lower earner to ensure the children's standard of living is the same in both locations.

Idaho shared physical custody: Each parent has significant periods of physical custody, which allows them frequent and continuing contact with their children. Idaho law outlines shared custody as any arrangement in which the child has regular and continuing contact with both parents.

Each parent's wishes for custody. the child's relationship with siblings and each parent. the child's preference. each parent's physical and mental health, including parental fitness. each parent's ability to meet the physical, emotional and basic daily needs of the child.

Idaho, like some other states, follows the Income Shares Model for child support. Under the Income Shares Model, a judge estimates the amount parents would spend on their children if the family was still intact. This amount is divided between each parent according to their income to create a child support award.

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

For example, if parent A earns $7,000 a month and parent B earns $3,000 a month, parent A would be responsible for 70% of the support amount (7,000 divided by 10,000) and parent B for 30% of the support amount (3,000 divided by 10,000).

CHILD SUPPORT BASED ON GROSS INCOME CSA advises parties that this is what the children would be entitled to if the two parents were still together. But they would only be entitled to a net amount if the two parents were still together.