Sample Letter regarding Finance Agreement

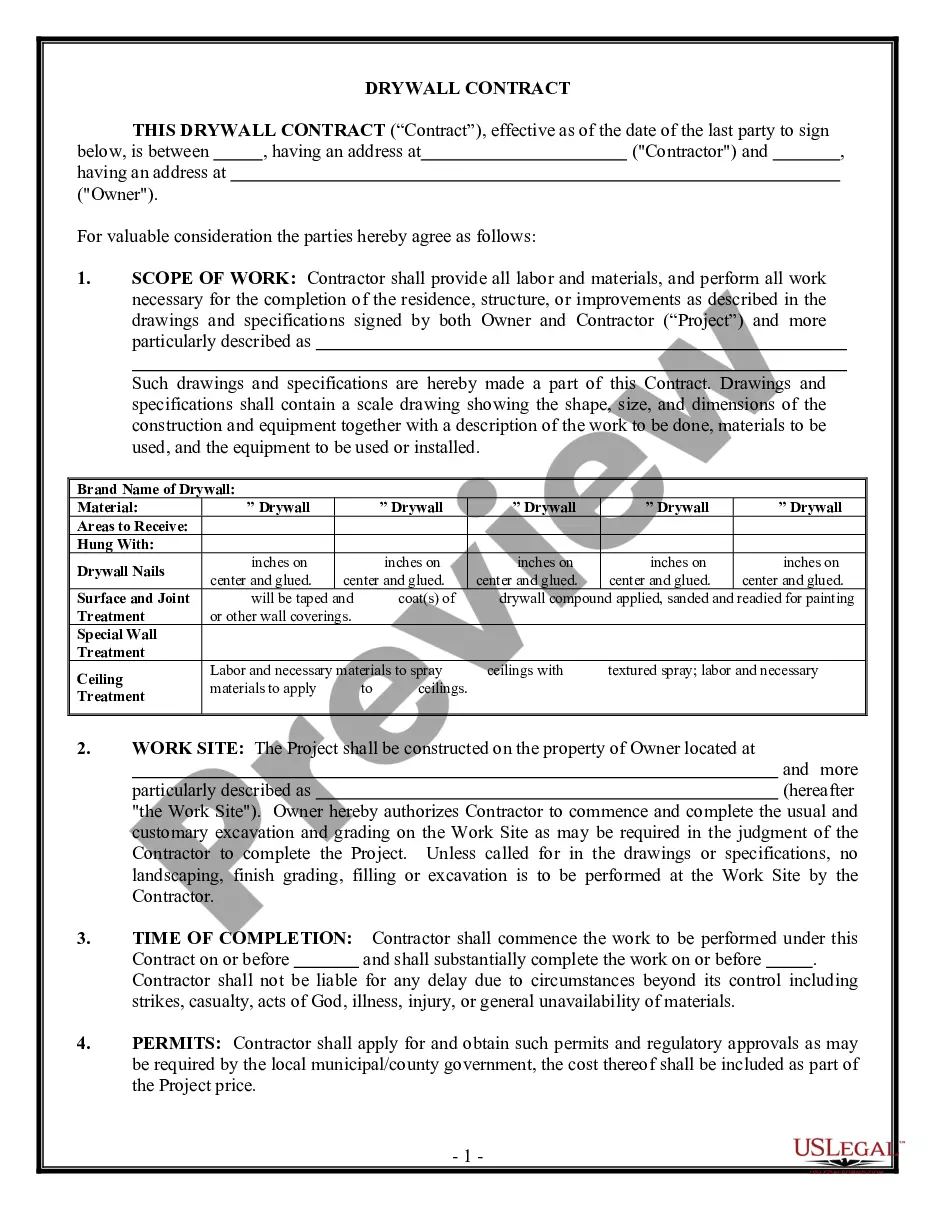

Overview of this form

The Sample Letter regarding Finance Agreement is a legal document used to outline the terms and conditions of a financial agreement between parties. This form serves as a formal notification regarding the agreement's specifics and can differ from informal communications by providing a structured format that ensures clarity and legal validity.

Key parts of this document

- Date: The date when the letter is being written.

- Recipient's Name: The person or entity the letter is addressed to.

- Company: The name of the company related to the finance agreement.

- Address: The mailing address for the recipient.

- City, State, Zip Code: Complete address to ensure proper delivery.

When to use this form

This form is used in scenarios where a party needs to officially communicate the details of a finance agreement. It can be used when entering into a new finance agreement, modifying an existing one, or clarifying terms that have previously been discussed. The letter serves to formalize the understanding of the agreement and provides a written record that can be referred to later.

Who needs this form

This letter is suitable for:

- Individuals or businesses entering into finance agreements.

- Parties involved in modifying existing financial arrangements.

- Anyone seeking to document terms for future reference.

Instructions for completing this form

- Identify the date you are drafting the letter.

- Enter the name of the recipient to whom the letter is addressed.

- Provide the name of the company relevant to the finance agreement.

- Fill in the complete address, including city, state, and zip code.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not including the date, which is crucial for tracking agreements.

- Failing to provide a complete address, which may lead to delivery issues.

- Using vague language that can cause misunderstandings about the agreement terms.

Why use this form online

- Convenient access to downloadable templates created by licensed attorneys.

- Editable format allows you to customize the letter to your specific needs.

- Reliable source of legal forms, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Look for a sample template online which you can use as a guide for when you are drafting your document. Open a word processing software and start formatting your document. Identify the parties who are involved in the loan. Write your consideration to make your loan valid.

Look for a sample template online which you can use as a guide for when you are drafting your document. Open a word processing software and start formatting your document. Identify the parties who are involved in the loan. Write your consideration to make your loan valid.

Complete necessary heading. Write introduction. Define services to be rendered. Identify benchmarks and timeline. Agree on revisions. Include payment information. Clarify the period of enforcement. State the governing law.

Begin your letter by clearly indicating the parties involved in the agreement. Remember to include the date the agreement takes effect and title of the venture. Clearly state the reason for your agreement in your first paragraph giving description of all details such as stake holder ratio, payment period etc.

Contact information for both parties. Location/state whose laws apply to the agreement. Terms and conditions of the business relationship. Terms of payment. Start date of the agreement. End date of the agreement.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

Creditor's Name and Address; Debtor's Name and Address; Acknowledgment of the Balance Owed; Amount Owed; Interest Rate (if any); Repayment Period; Payment Instructions; Late Payment (if any); and.