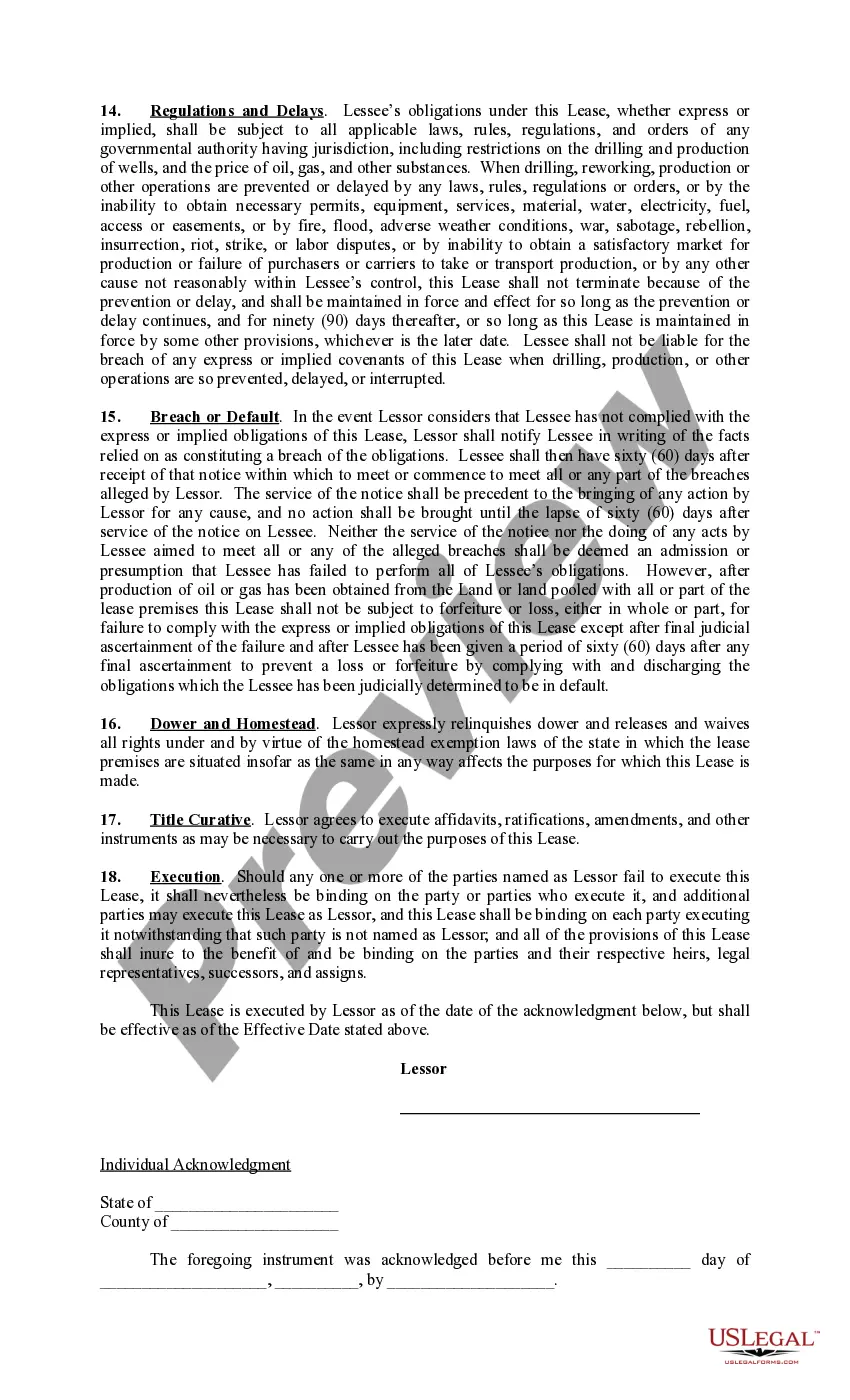

This form is a Pennsylvania Lease agreement wherein Lessor grants, leases, and lets exclusively to Lessee the lands described within for the purposes of conducting seismic and geophysical operations, exploring, drilling, mining, and operating for, producing and owning oil, gas, sulfur, and all other minerals whether or not similar to those mentioned (collectively the oil or gas ), and the right to make surveys, lay pipelines, establish and utilize facilities for surface or subsurface disposal of salt water, construct roads and bridges, dig canals, build tanks, power stations, power lines, telephone lines, and other structures on the Lands, necessary or useful in Lessee's operations on the Lands or any other land adjacent to the Lands. This lease is a paid up lease and provides for pooling.

Pennsylvania Paid Up Lease Pooling Provision

Description

How to fill out Pennsylvania Paid Up Lease Pooling Provision?

The work with documents isn't the most easy process, especially for people who almost never deal with legal paperwork. That's why we advise utilizing correct Pennsylvania Paid Up Lease Pooling Provision samples made by skilled lawyers. It allows you to prevent difficulties when in court or working with formal institutions. Find the files you require on our site for high-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will immediately appear on the template web page. After accessing the sample, it’ll be stored in the My Forms menu.

Users with no a subscription can easily get an account. Make use of this brief step-by-step help guide to get the Pennsylvania Paid Up Lease Pooling Provision:

- Be sure that the sample you found is eligible for use in the state it’s required in.

- Verify the document. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this template is what you need or use the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after completing these easy actions, you can complete the form in an appropriate editor. Recheck filled in details and consider asking a lawyer to examine your Pennsylvania Paid Up Lease Pooling Provision for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Form popularity

FAQ

In the United States, the "standard workweek" is generally considered to be 40 hours, with employees working five days a week, for eight hours per day. Some employers consider 37.5 hours to be full time, giving 30-minute unpaid lunch breaks each day, while others give an hour and consider 35 hours to be full-time.

In a nutshell, the new law provides that eligible employees will earn one hour of paid sick time per 35 hours worked within Allegheny County, up to 40 hours per year (exempt employees are presumed to work 40 hours per week). Employers are covered if they have more than 25 employees.

Pennsylvania employers must comply with the FMLA if they have at least 50 employees for at least 20 weeks in the current or previous year. Employees may take FMLA leave if: they have worked for the company for at least a year. they worked at least 1,250 hours during the previous year, and.

An employee who is required to work more than 12 consecutive hours per workday where mandatory overtime is allowed under section 3(c) of Act 102 or who volunteers to work more than 12 consecutive hours shall be entitled to at least 10 consecutive hours of off-duty time immediately after the worked overtime.

Official employer designations regarding full-time employment generally range from 35 to 45 hours, with 40 hours being by far the most common standard. Some companies consider 50 hours a week full-time for exempt employees.

A full time employee is a person who is generally employed to work at least thirty-eight (38) hours each week. If an employee works more than thirty eight hours in a week, then usually the employee is entitled to be paid at overtime rates, or to receive paid time off in lieu of overtime payment.

Pennsylvanians are caught between their work and family responsibilities. A national paid leave plan the FAMILY Act is the solution. Paid leave means not having to choose between job and family. Pennsylvania families will face increased family and medical care needs.

A full-time employee is, for a calendar month, an employee employed on average at least 30 hours of service per week, or 130 hours of service per month.

Pennsylvania's minimum wage, currently set at the federal minimum of $7.25 an hour since 2009, would rise in four steps to $9.50 over the next two years. On July 1, 2020, the wage would rise to $8 an hour; to $8.50 on Jan. 1, 2021; to $9 on July 1, 2021; and to $9.50 on Jan. 1, 2022.