Pennsylvania Dissolution Package to Dissolve Corporation

About this form

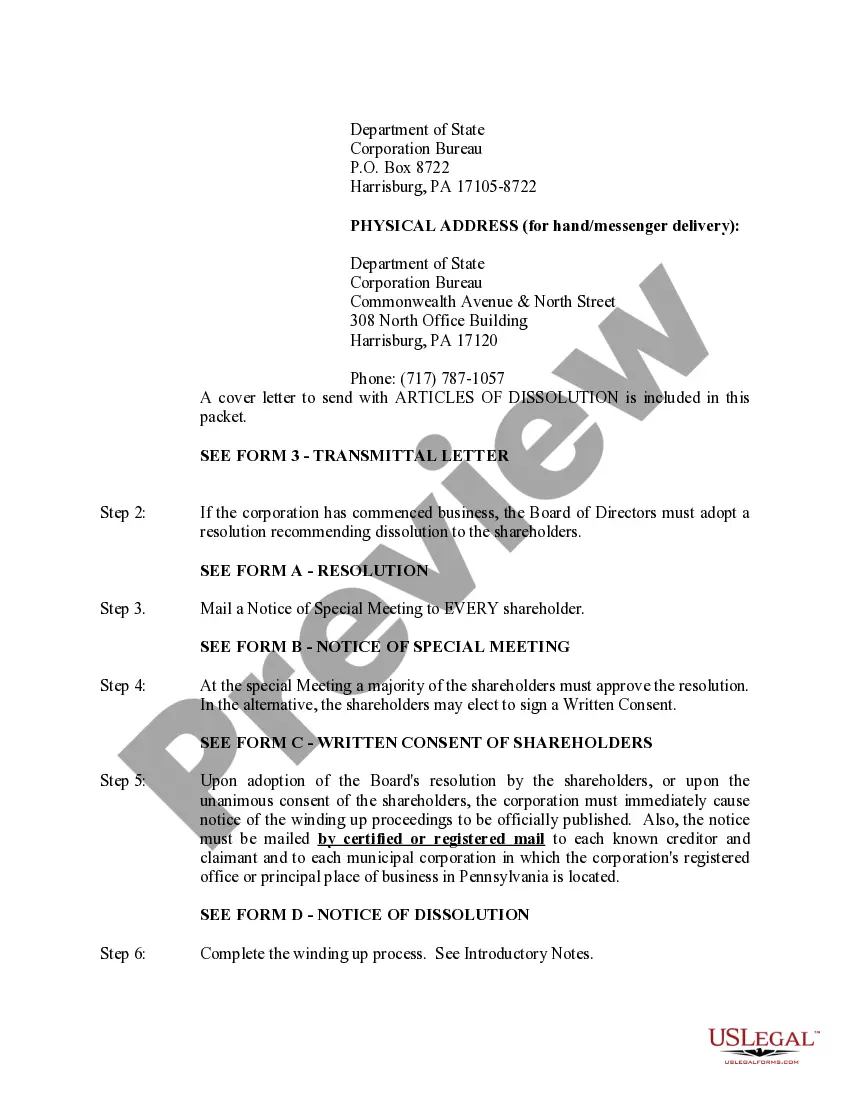

The Pennsylvania Dissolution Package to Dissolve Corporation is a comprehensive set of documents required for legally dissolving a corporation in Pennsylvania. This package is specifically designed for voluntary dissolution, distinguishing it from forms applicable to involuntary dissolution. It ensures that the process adheres to Pennsylvania's legal standards, providing a structured approach to winding up corporate affairs and discharging liabilities before the corporation ceases to exist.

Main sections of this form

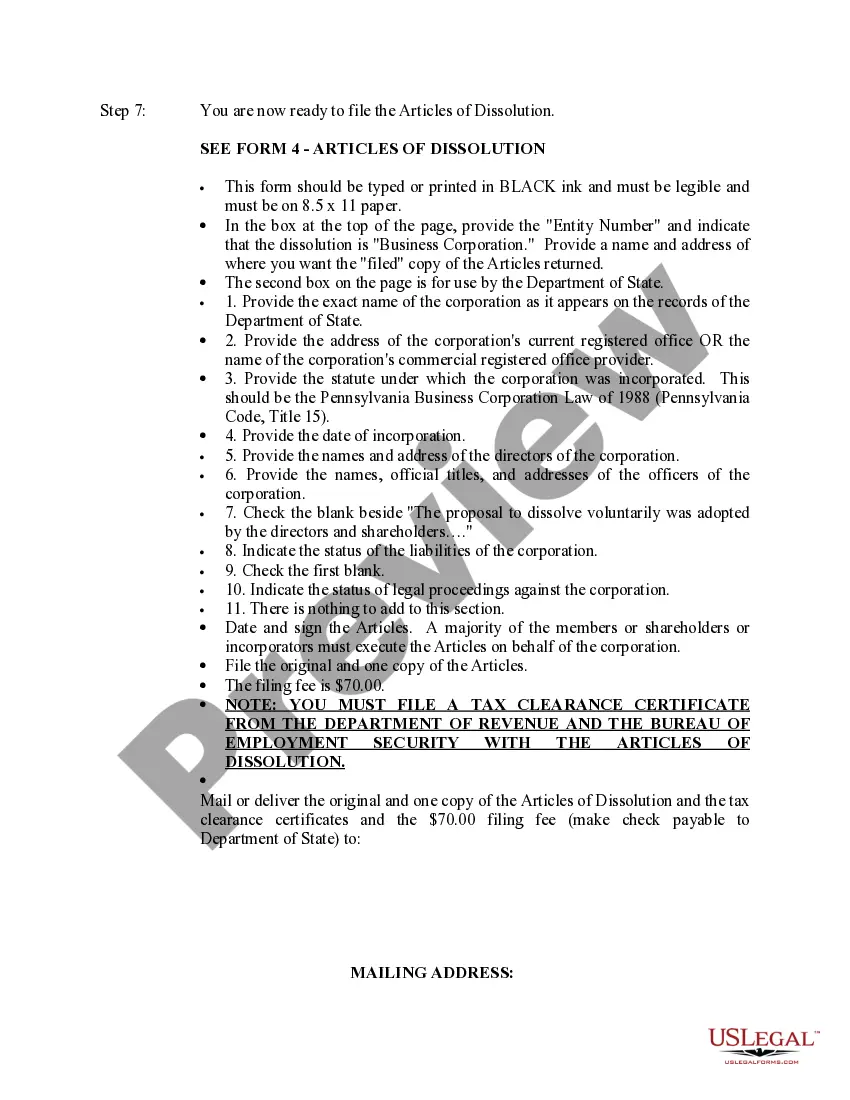

- Articles of Dissolution: The primary document initiating the dissolution process.

- Docketing Statement: Required alongside the Articles of Dissolution for official filing.

- Resolution of the Board: A formal recommendation by directors to shareholders for dissolution.

- Notice of Special Meeting: Notification to shareholders regarding the meeting to approve dissolution.

- Notice of Dissolution: Requires mailing to creditors and other relevant parties during the winding up process.

When to use this form

This form should be used when a corporation in Pennsylvania has decided to voluntarily dissolve. This situation may arise for various reasons, including the completion of the corporation's purpose, financial difficulties, or strategic business decisions. If the corporation has not commenced operations or has completed its business affairs, utilizing this package ensures compliance with Pennsylvania law during the dissolution process.

Who can use this document

- Business owners or shareholders seeking to dissolve a Pennsylvania corporation.

- Corporation directors wishing to formally recommend dissolution to shareholders.

- Counsel or legal representatives assisting clients in the dissolution process.

Instructions for completing this form

- Gather the necessary information about the corporation, including its name, address, and incorporation details.

- Complete the Articles of Dissolution, ensuring all required fields are filled accurately.

- Obtain board approval for dissolution and prepare the formal resolution to present to shareholders.

- Distribute the Notice of Special Meeting to all shareholders regarding the proposed dissolution.

- File the Articles of Dissolution along with the Docketing Statement and pay the required filing fee to the Pennsylvania Department of State.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to obtain board approval before sending notices to shareholders.

- Not including the necessary tax clearance certificates during filing.

- Inaccurate completion of the Articles of Dissolution leading to delays.

- Neglecting to notify all known creditors and claimants as required.

Why complete this form online

- Convenient access to all required forms in one package.

- Edit and customize documents easily before printing.

- Reliable and up-to-date templates drafted by licensed attorneys.

Key takeaways

- The Pennsylvania Dissolution Package is essential for the voluntary dissolution of a corporation in Pennsylvania.

- Complete each required form accurately to avoid delays in processing.

- Notify all stakeholders, including shareholders and creditors, as part of the winding up process.

Looking for another form?

Form popularity

FAQ

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.Even if the business has no income, it may still be considered active for tax purposes. There are many reasons a business may become inactive.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

In most states, to keep a corporation active, the owners must file annual reports and income tax returns. They may have to pay annual fees as well. Failure to do these things can render the corporation inactive. A corporation may also voluntarily become inactive by ceasing to do business.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.