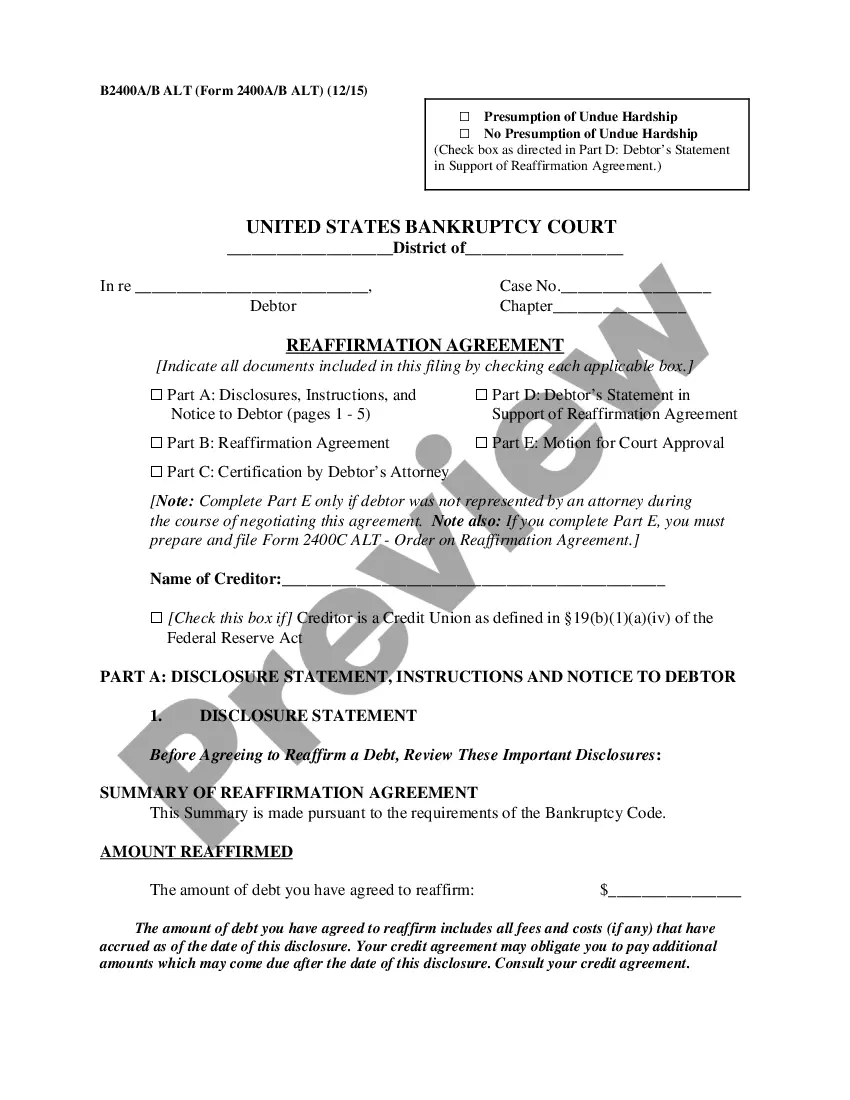

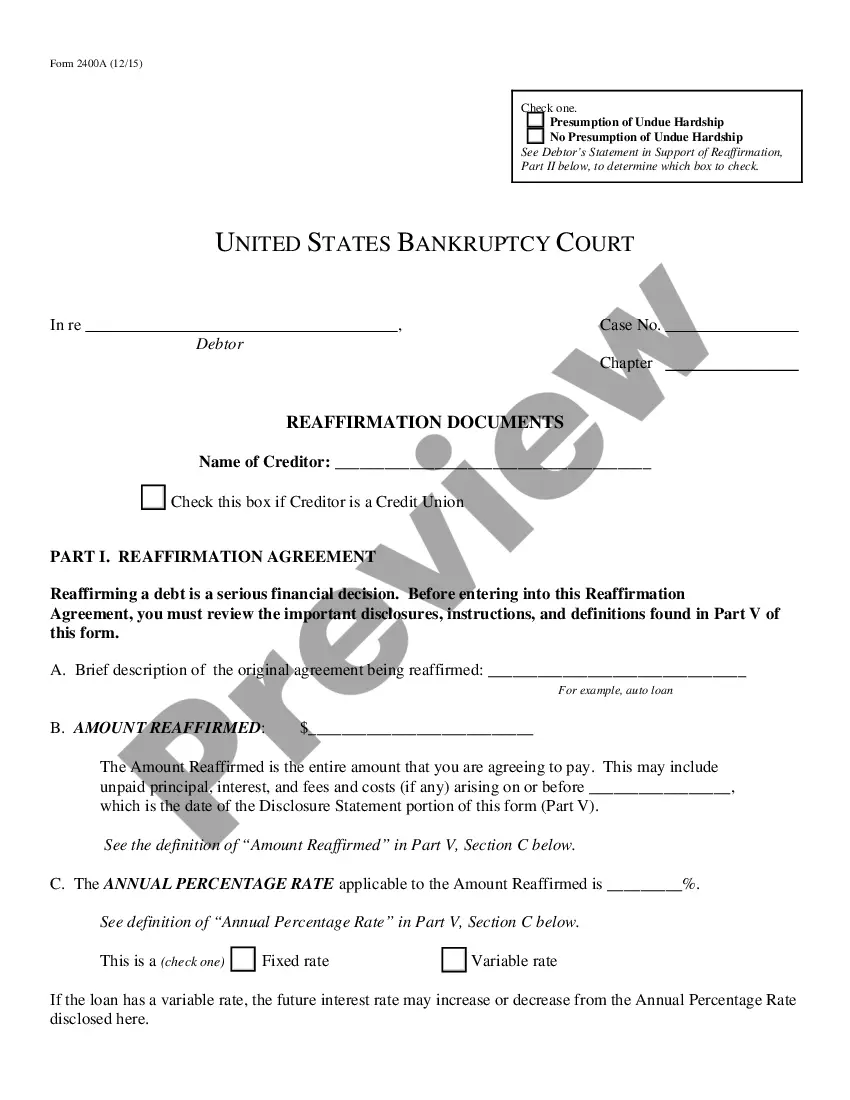

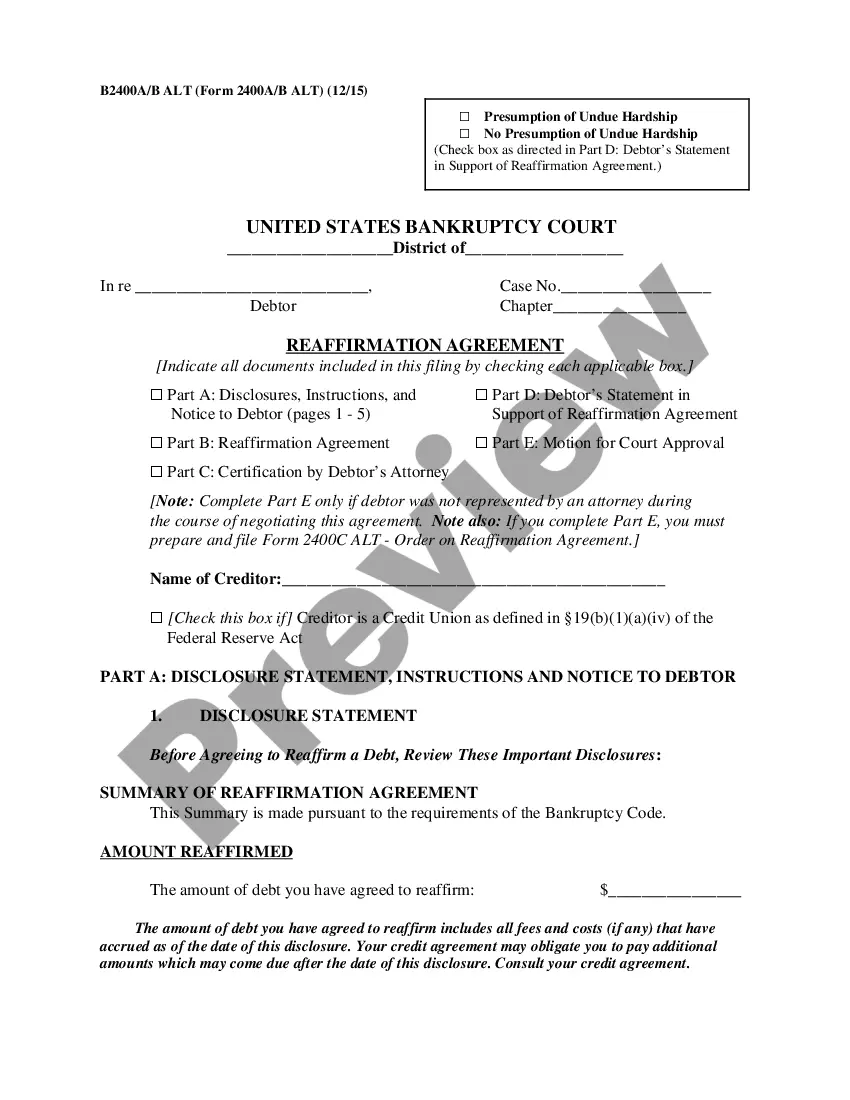

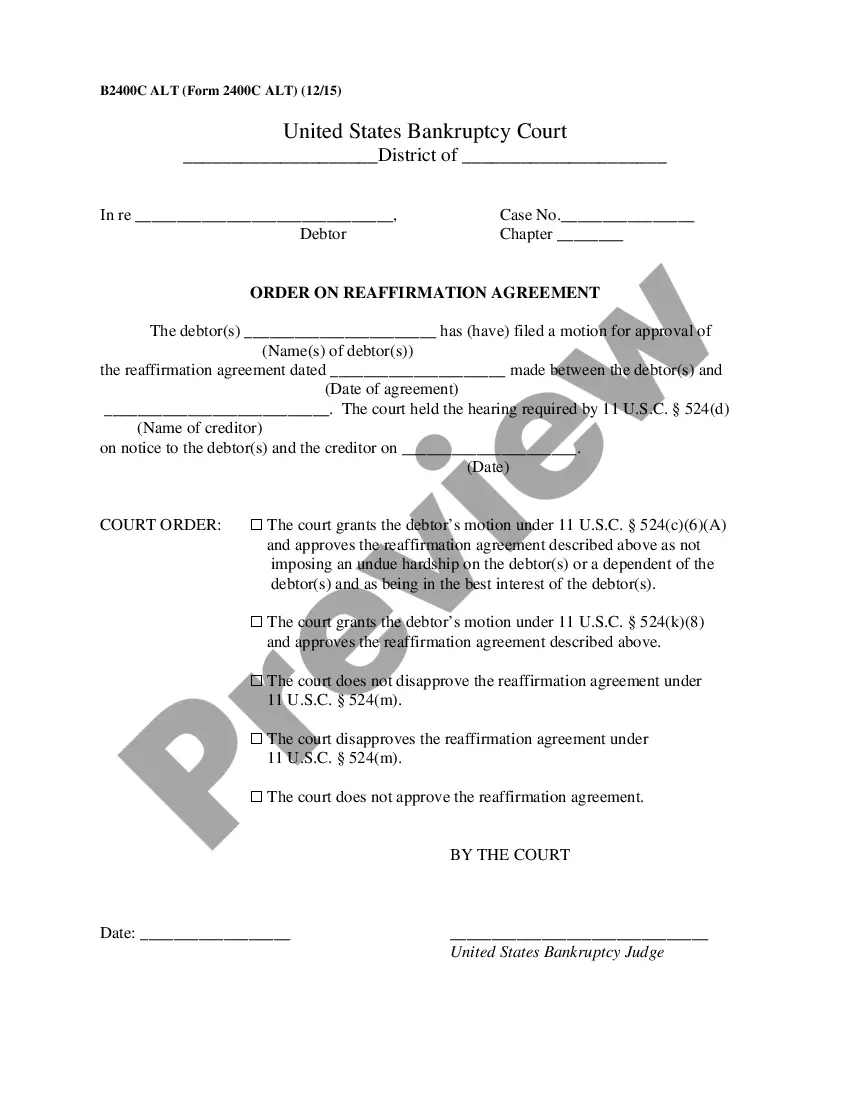

Pennsylvania Reaffirmation Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Pennsylvania Reaffirmation Agreement?

The work with papers isn't the most uncomplicated job, especially for people who almost never deal with legal papers. That's why we advise making use of accurate Pennsylvania Reaffirmation Agreement templates made by skilled lawyers. It gives you the ability to avoid problems when in court or handling formal institutions. Find the documents you require on our site for top-quality forms and correct descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the file page. After getting the sample, it’ll be saved in the My Forms menu.

Users without a subscription can quickly get an account. Utilize this short step-by-step help guide to get the Pennsylvania Reaffirmation Agreement:

- Make sure that file you found is eligible for use in the state it is required in.

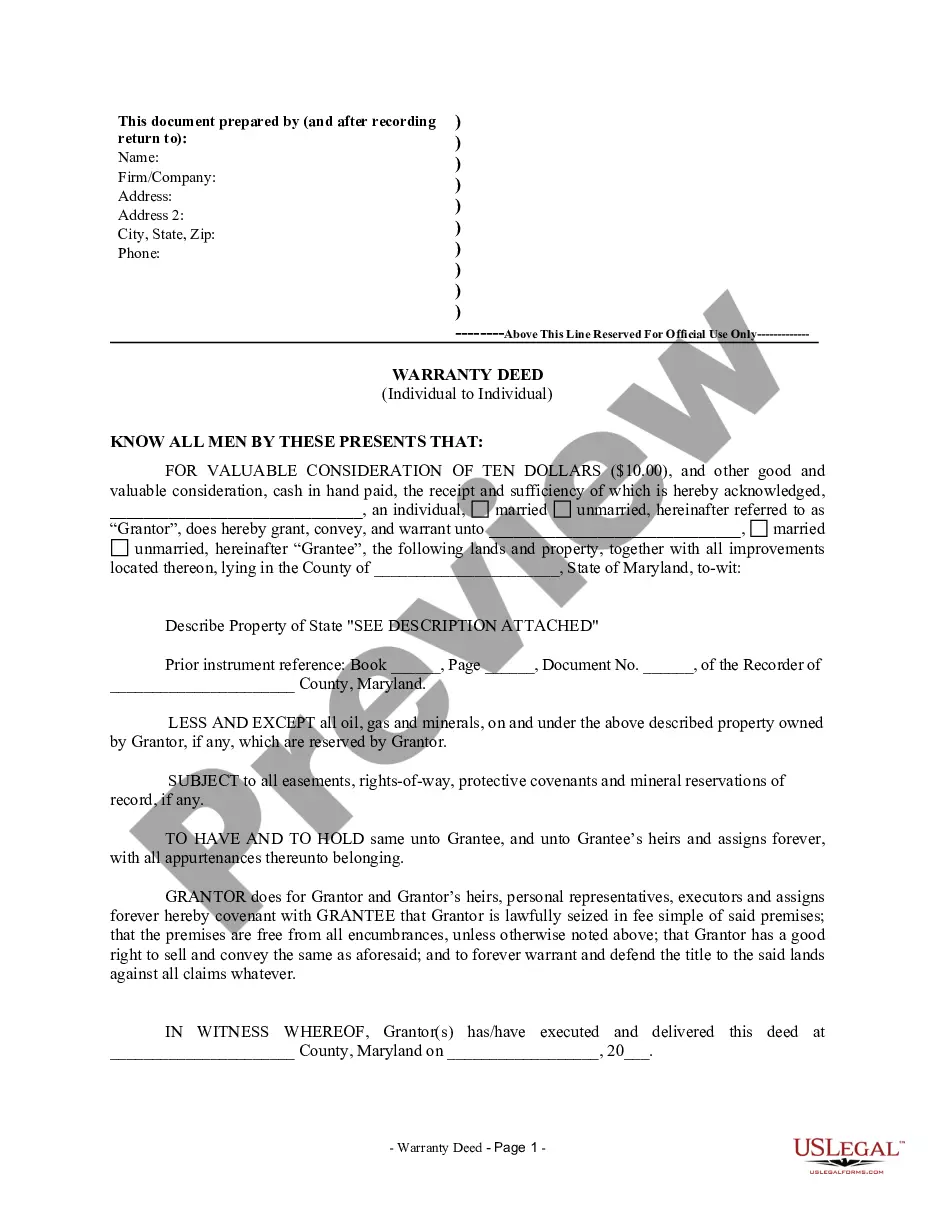

- Confirm the file. Utilize the Preview option or read its description (if offered).

- Click Buy Now if this sample is what you need or use the Search field to get another one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after doing these simple actions, it is possible to complete the sample in a preferred editor. Double-check filled in details and consider requesting a legal representative to examine your Pennsylvania Reaffirmation Agreement for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral). You and the lender enter into a new contractusually on the same termsand submit it to the bankruptcy court.

If you don't sign a reaffirmation agreement, the lender can repossess your car after your case closes and the automatic stay lifts. Some car lenders are known to repossess the car immediately, even if you are current on payments.

If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case. There may be other ways to renegotiate payments with creditors without entering into a reaffirmation agreement.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

If you do not reaffirm the mortgage, your personal liability for paying the debt represented by the promissory note is discharged in your bankruptcy case.The company can foreclose the mortgage and force a foreclosure sale if you stop making payments.