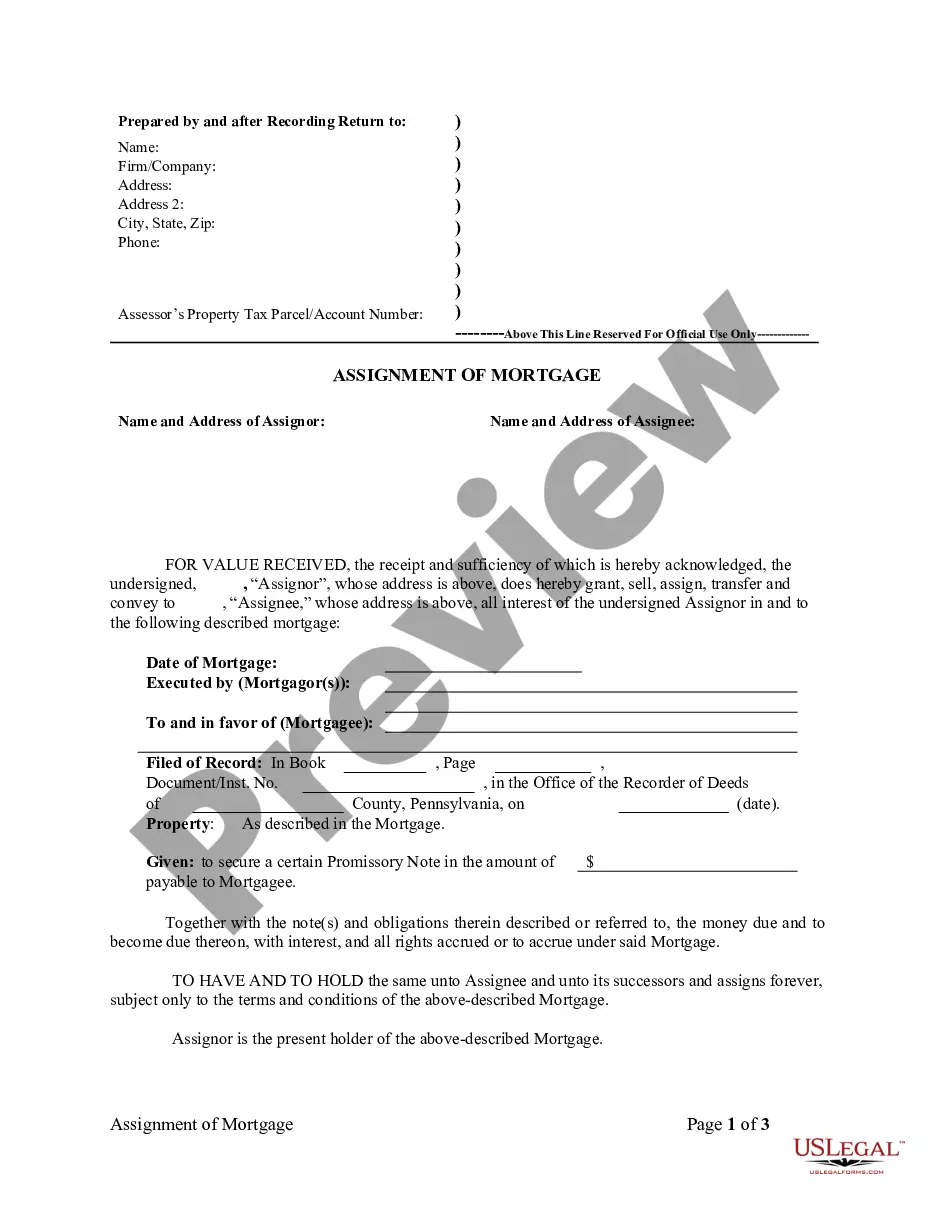

Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder

Description

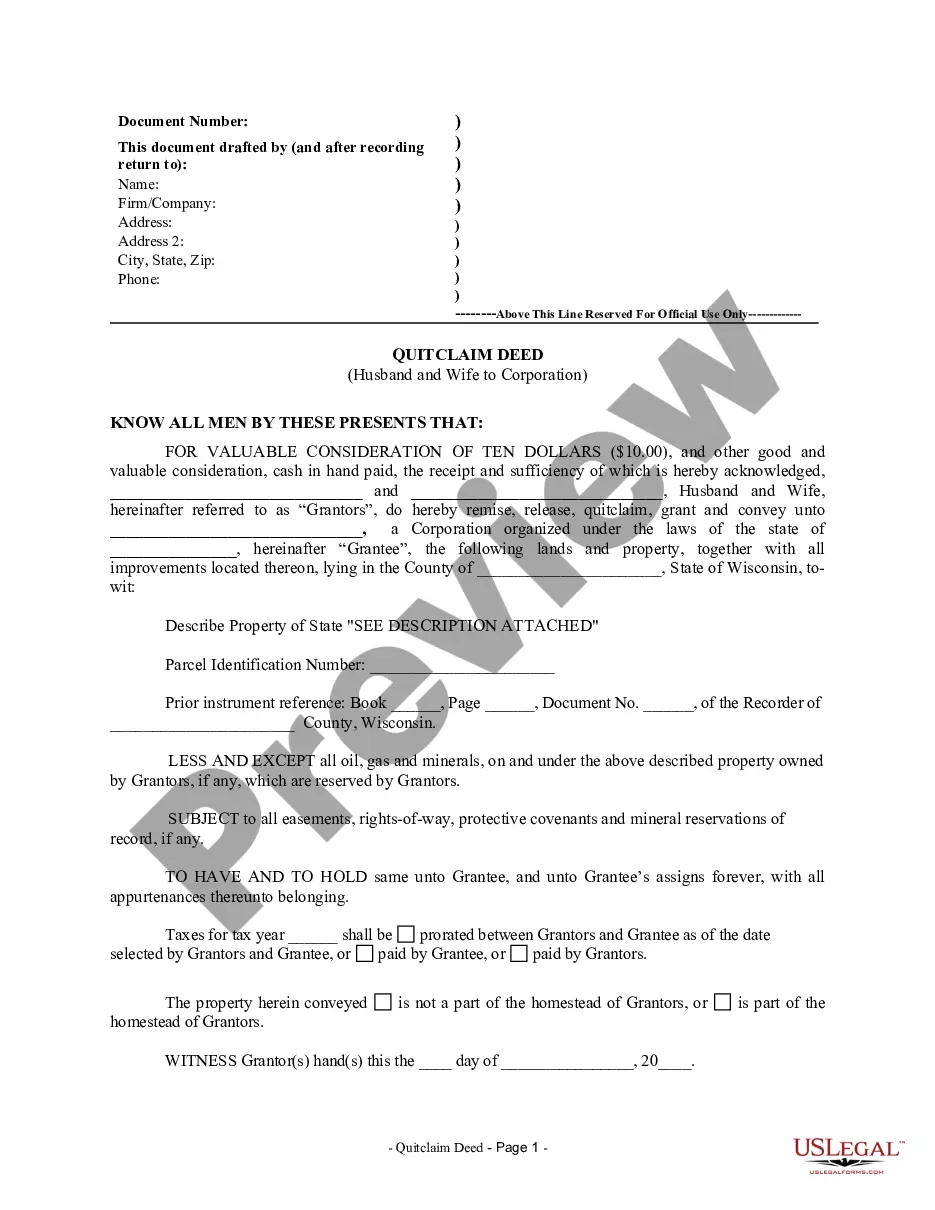

How to fill out Pennsylvania Assignment Of Mortgage By Corporate Mortgage Holder?

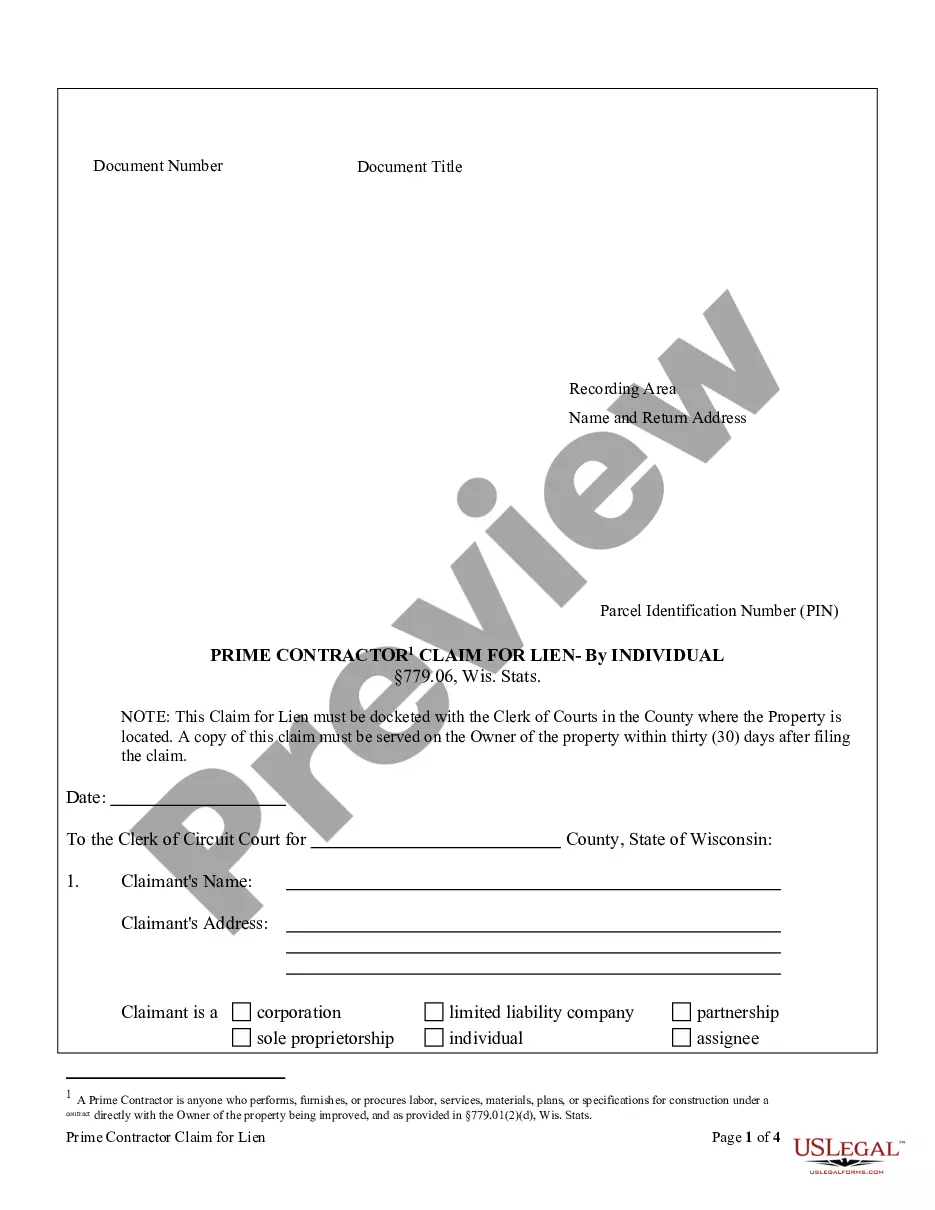

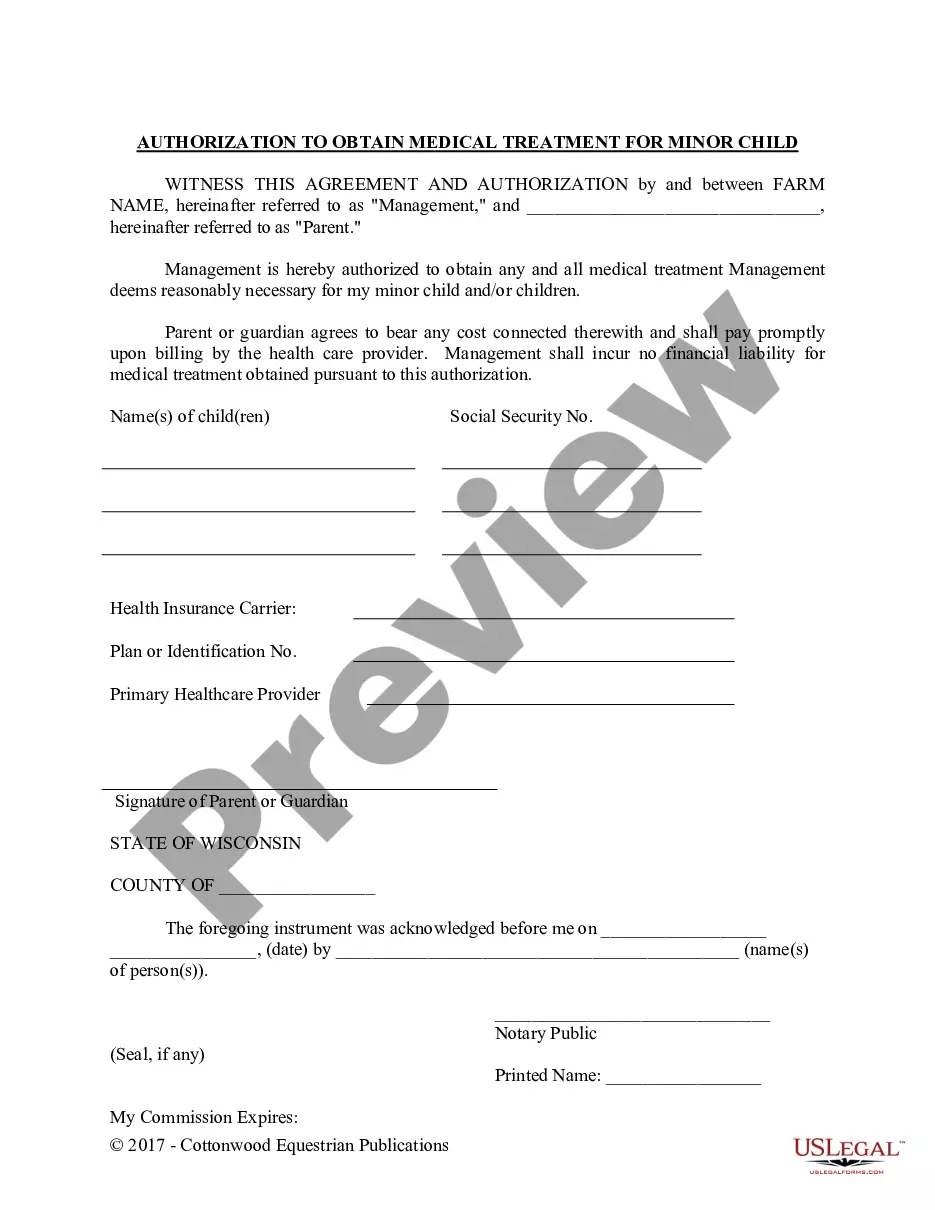

Creating papers isn't the most straightforward task, especially for people who almost never work with legal paperwork. That's why we advise making use of correct Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder templates made by professional attorneys. It allows you to avoid troubles when in court or dealing with formal institutions. Find the files you want on our site for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file webpage. After downloading the sample, it’ll be stored in the My Forms menu.

Customers with no a subscription can quickly get an account. Make use of this short step-by-step help guide to get the Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder:

- Make sure that the sample you found is eligible for use in the state it is necessary in.

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Buy Now if this file is the thing you need or return to the Search field to find another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

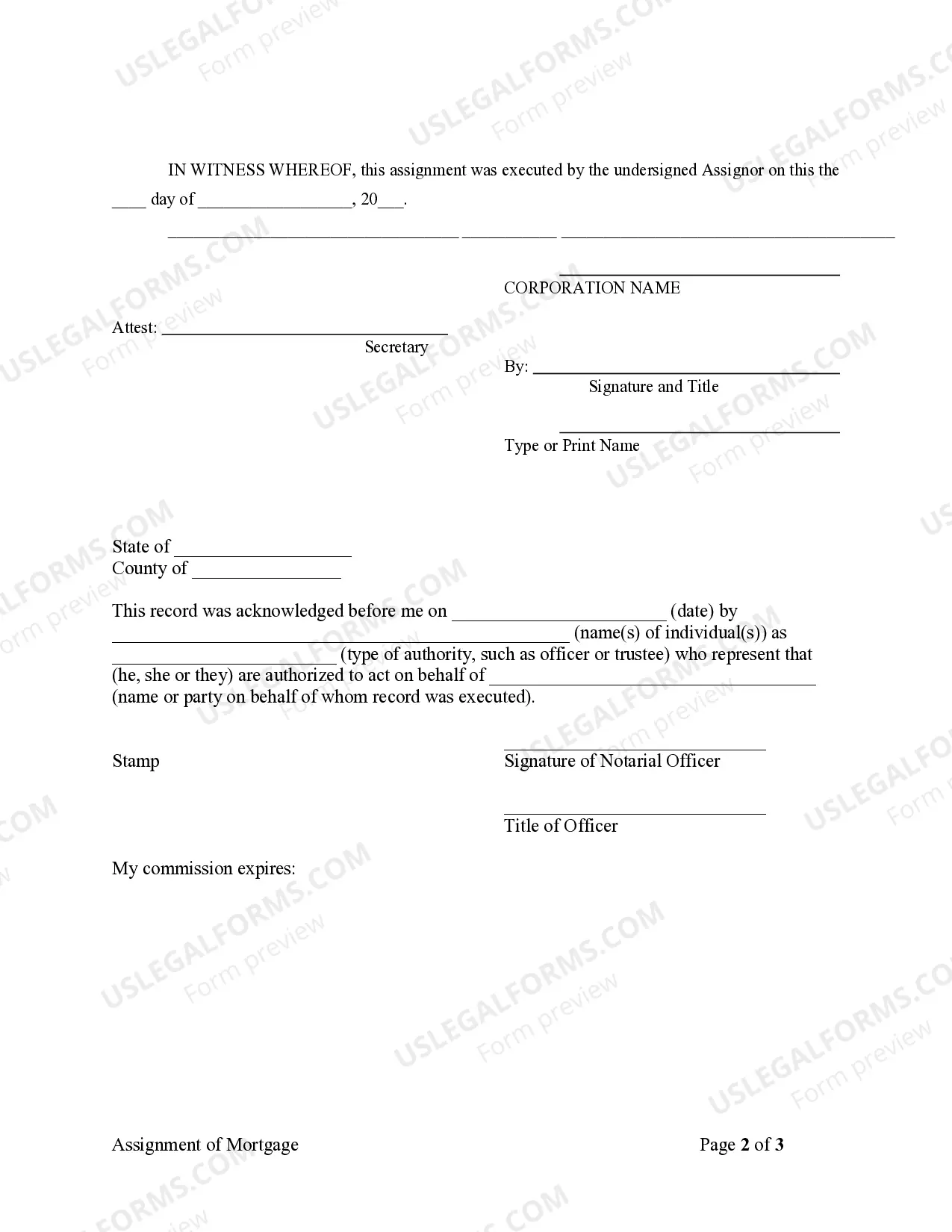

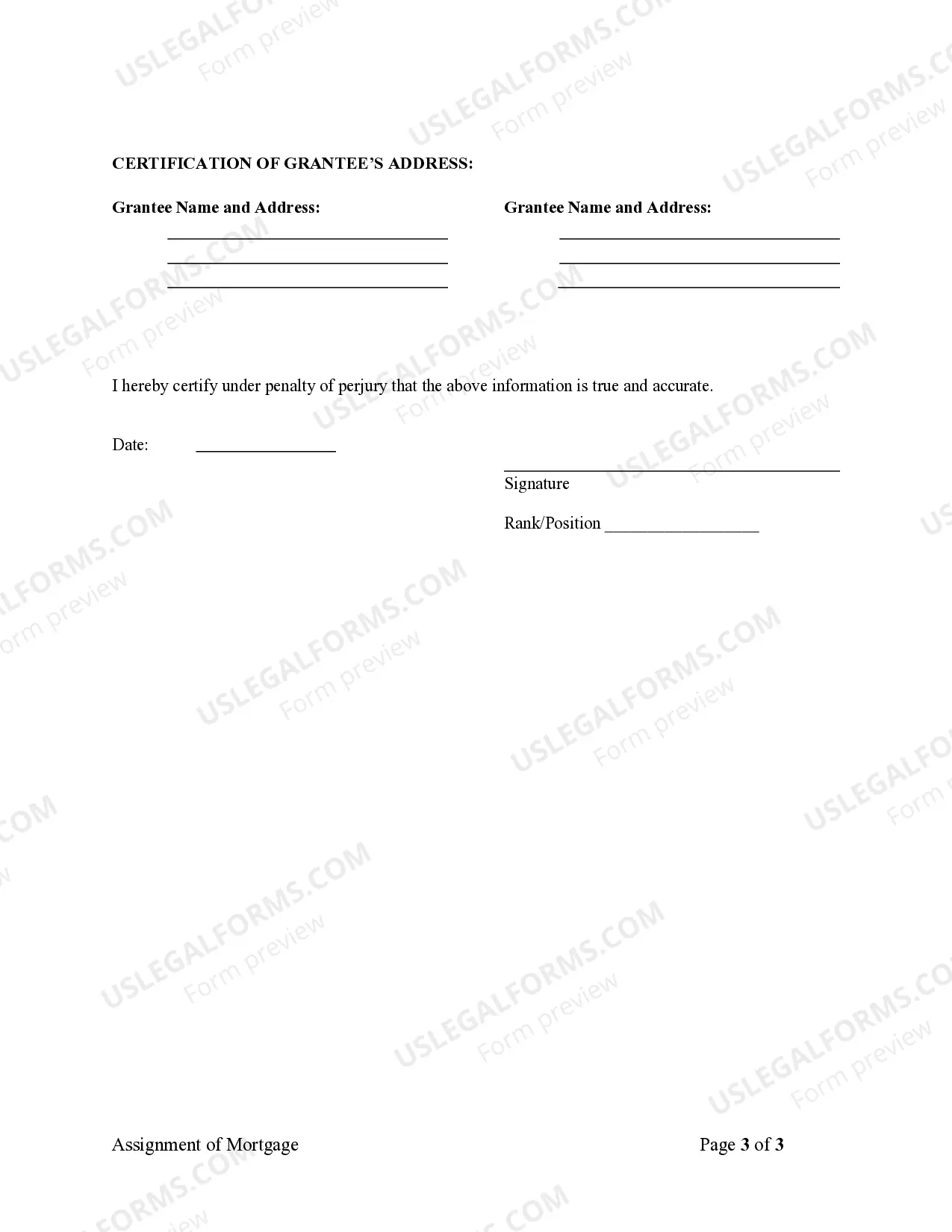

After completing these easy actions, you are able to fill out the form in an appropriate editor. Double-check filled in information and consider asking a legal professional to examine your Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

Purpose A gap mortgages allows funding for a property to continue while it is going through the process of selling.Documents required for a mortgage assignment are: Instead of having you pay off your old loan with money from your new lender, your original lender assigns your loan balance to the new one.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.