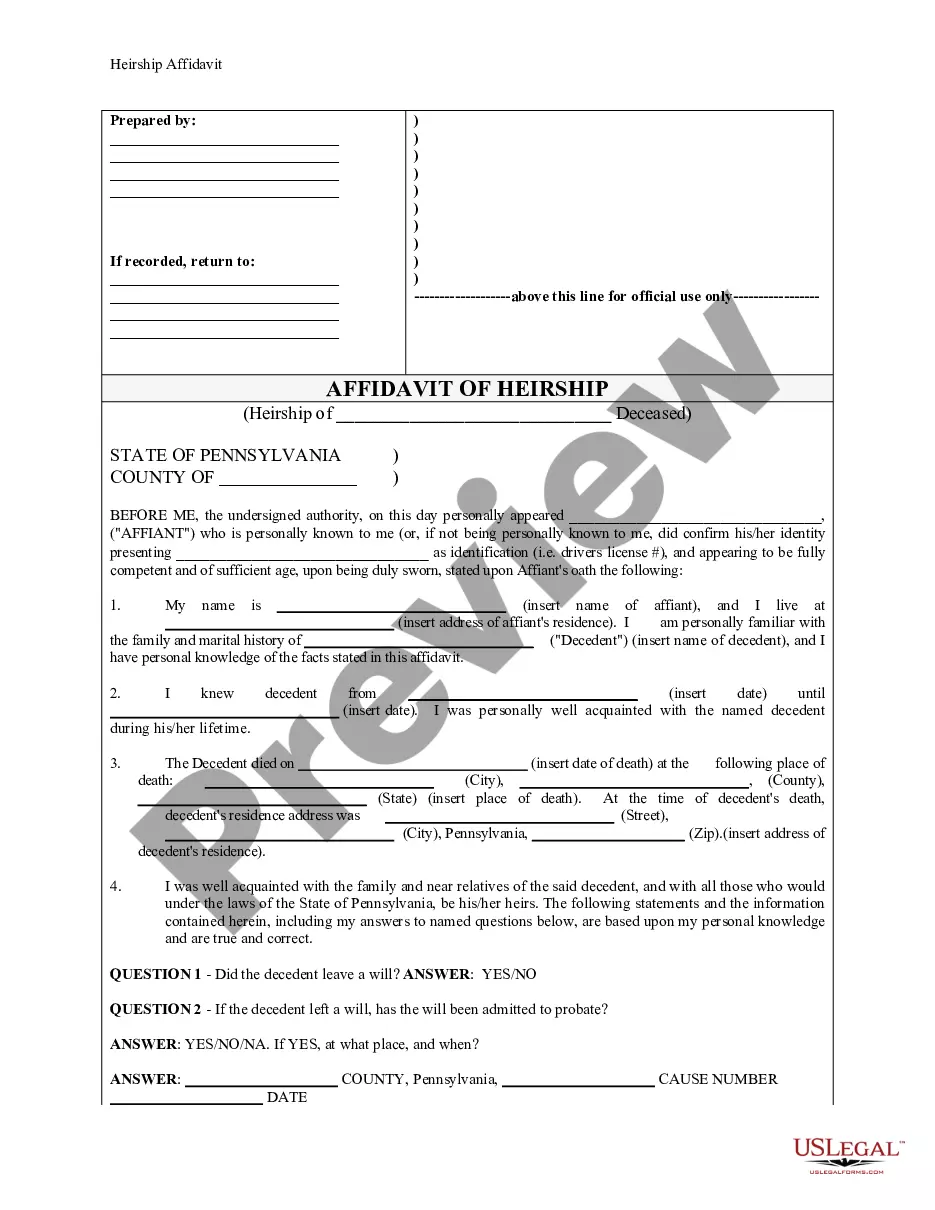

Pennsylvania Heirship Affidavit - Descent

What is this form?

The Heirship Affidavit - Descent is a legal document used to declare the heirs of a deceased individual. This affidavit is typically utilized in situations where a person passes away without leaving a will, thereby helping to establish rightful ownership of their personal and real property. Unlike a will, which outlines the deceased's wishes, this form serves to affirm heirs' identities and relationships to the deceased, facilitating property transactions such as sales or transfers in the absence of a probate process.

What’s included in this form

- Affiant's personal details, including name and address

- Decedent's details such as name, date, and place of death

- Questions regarding the existence of a will and its probate status

- Information on surviving family members and heirs

- Details of any debts left by the decedent

- Affiant's relationship to the deceased

When this form is needed

This Heirship Affidavit is used by individuals who need to identify heirs after someone has died without a will. Real-world scenarios include when an heir wishes to sell or transfer property that belonged to the deceased or when there's a need to establish inheritance rights. If no estate has been opened, this affidavit may help streamline the legal process involved in accessing or claiming property.

Who this form is for

- Individuals who are heirs or potential heirs to a deceased person's estate

- Family members or friends familiar with the deceased's family and relational history

- Real estate professionals assisting heirs in property transactions

Completing this form step by step

- Identify yourself as the affiant and provide your name and address.

- Document the decedentâs details, including their name, date of death, and last residence.

- Answer the questions about the existence of a will and other necessary information regarding the decedent's family and heirs.

- Provide the names and addresses of all surviving heirs, including children and spouses.

- Sign the affidavit in the presence of a notary public for validation.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete and accurate information about the decedent and heirs.

- Not responding to all required questions on the form.

- Submitting the affidavit without notarization when required by local law.

Advantages of online completion

- Convenient access to the form from anywhere at any time.

- Editable fields allow users to customize responses easily.

- Reliability of forms drafted by licensed attorneys ensures legal compliance.

Looking for another form?

Form popularity

FAQ

The family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in accordance with Section 3121 of the Probate, Estate and Fiduciaries Code. For decedents dying after Jan. 29, 1995, the family exemption is $3,500.

Use Life Insurance: Life insurance is generally exempt from PA Inheritance Tax. Your heirs will inherit a tax-free (income tax free, inheritance tax free, estate tax free) liquid asset. Lifetime Gifting: Making a gift during your lifetime reduces the inheritance tax on your estate.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

What property is subject to inheritance tax? All real property and all tangible personal property of a resident decedent, including but not limited to cash, automobiles, furniture, antiques, jewelry, etc., located in Pennsylvania at the time of the decedent's death is taxable.

While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds (for example, in 2021 the federal estate tax exemption amount is $11.7 million for an individual), receipt of an inheritance does not result in taxable income for federal or state income tax

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.