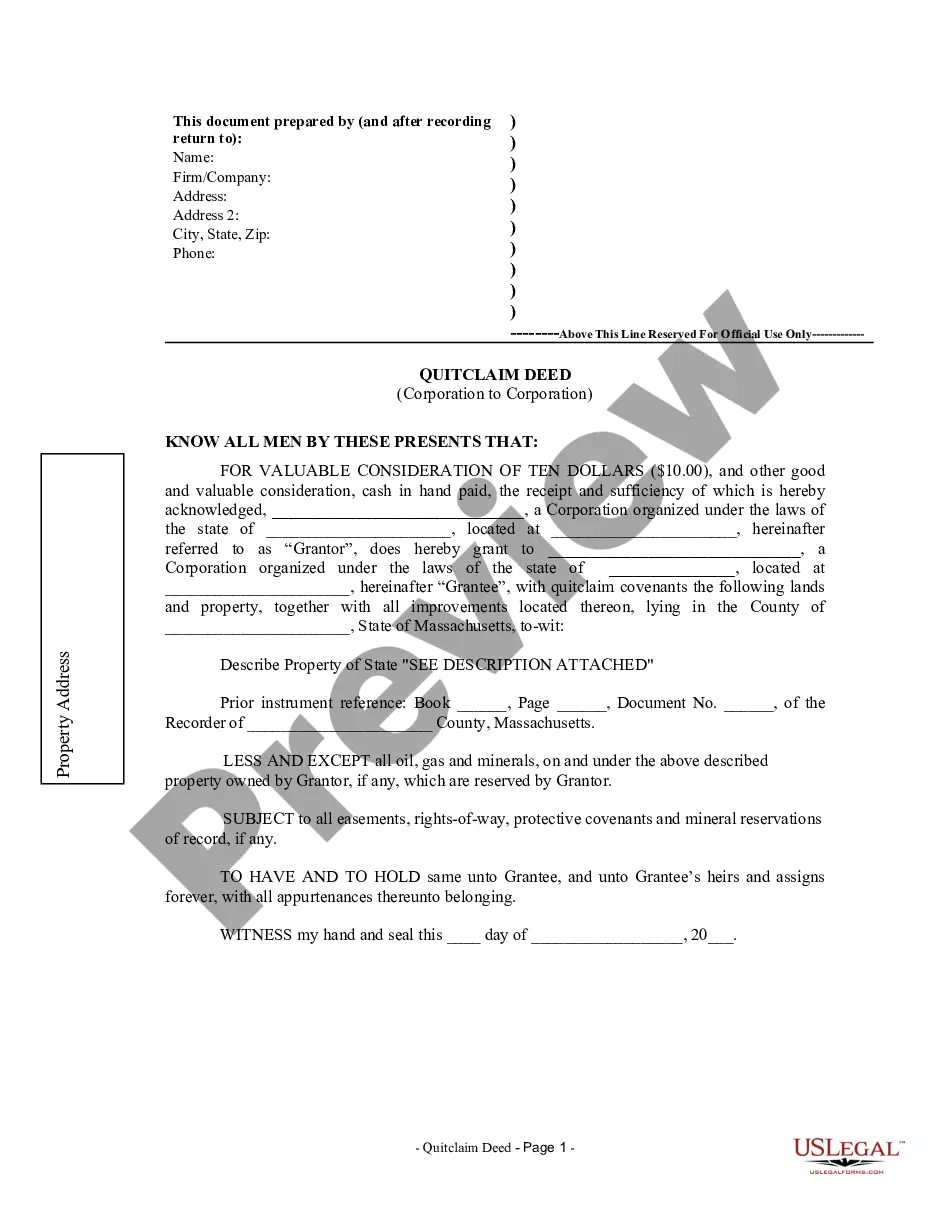

Massachusetts Quitclaim Deed from Corporation to Corporation

Description

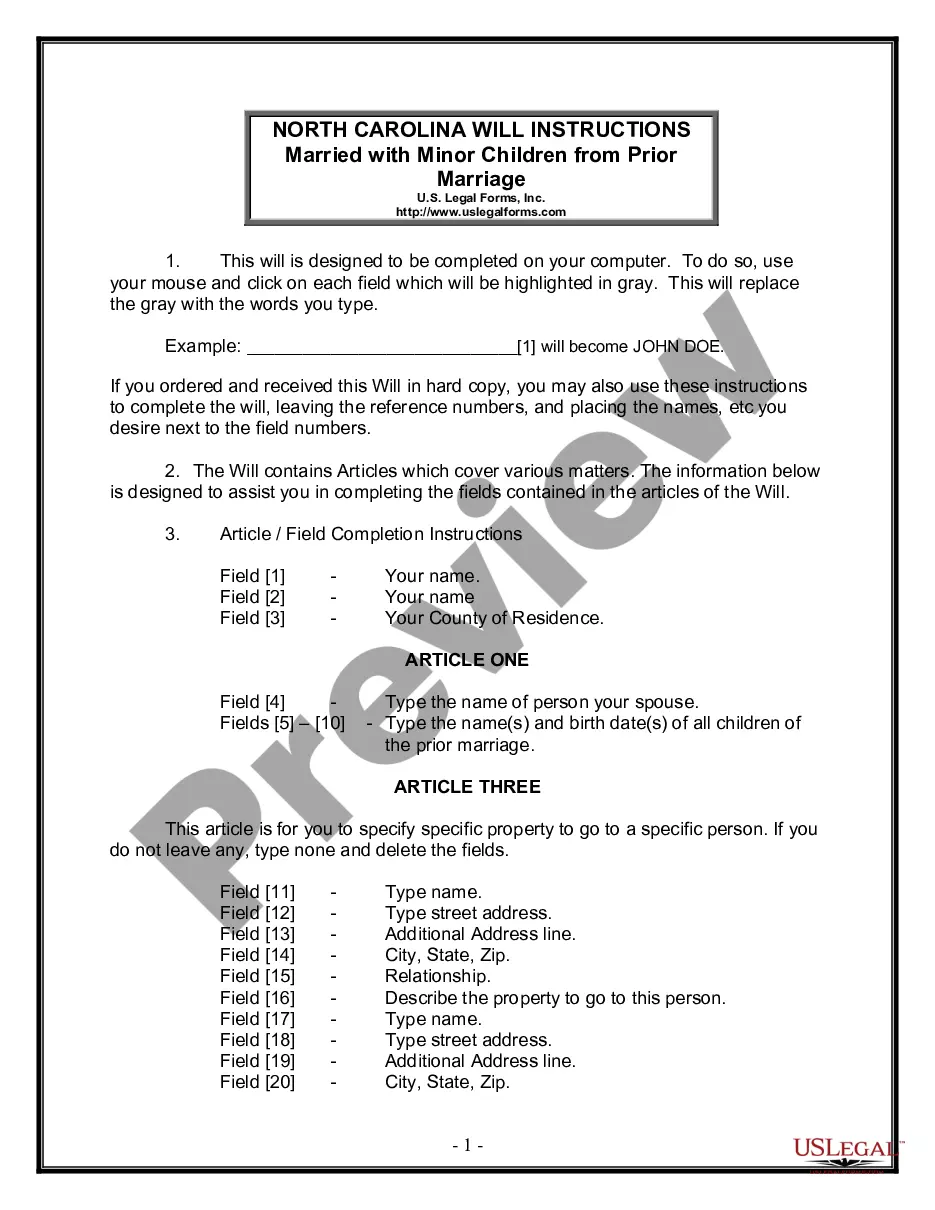

How to fill out Massachusetts Quitclaim Deed From Corporation To Corporation?

Welcome to the biggest legal files library, US Legal Forms. Here you can find any sample including Massachusetts Quitclaim Deed from Corporation to Corporation forms and save them (as many of them as you wish/need). Get ready official files in just a few hours, rather than days or even weeks, without having to spend an arm and a leg with an lawyer or attorney. Get your state-specific sample in a few clicks and be assured with the knowledge that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and click Download near the Massachusetts Quitclaim Deed from Corporation to Corporation you want. Because US Legal Forms is web-based, you’ll generally have access to your saved templates, regardless of the device you’re utilizing. Locate them within the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check our instructions listed below to get started:

- If this is a state-specific form, check its applicability in the state where you live.

- Look at the description (if offered) to learn if it’s the right template.

- See far more content with the Preview feature.

- If the example matches all of your requirements, click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to register.

- Save the file in the format you want (Word or PDF).

- Print the file and fill it with your/your business’s info.

When you’ve completed the Massachusetts Quitclaim Deed from Corporation to Corporation, send it to your attorney for verification. It’s an extra step but an essential one for being certain you’re totally covered. Become a member of US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

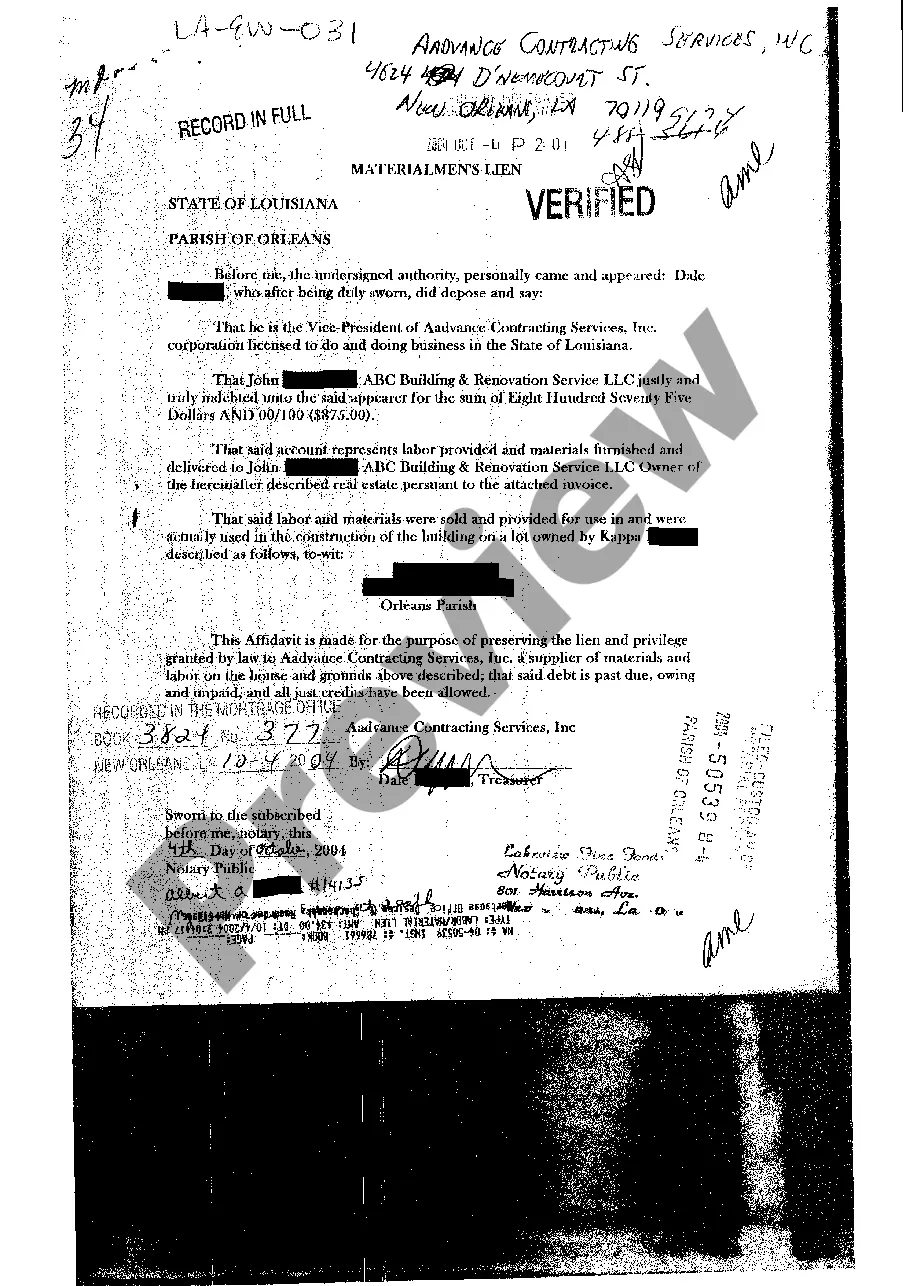

Filing a Massachusetts Quitclaim Deed from Corporation to Corporation involves several straightforward steps. First, complete your deed using a reliable source like USLegalForms to ensure it meets state requirements. Next, you must sign the deed in front of a notary public and file it with the appropriate registry of deeds in your county. Finally, paying the necessary fees will finalize the process and ensure the deed is officially recorded.

To obtain a Massachusetts Quitclaim Deed from Corporation to Corporation, consider using a reputable online service like USLegalForms. This platform simplifies the process by providing ready-to-use templates tailored for Massachusetts. You can complete the deed online and ensure all necessary details are included, which streamlines filing and reduces errors. Additionally, check if your corporation has unique requirements that might affect the deed.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

They are commonly used to add/remove someone to/from real estate title or deed (divorce, name changes, family and trust transfers). The quitclaim deed is a legal document (deed) used to transfer interest in real estate from one person or entity (grantor) to another (grantee).

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Recording: Massachusetts quitclaim deeds must be filed with the Registry of Deeds Office. Choose the office in the county where the property is. Filing Fee: Each Registry of Deeds Office charges a filing fee, which must be filed along with the deed.