Oregon Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

Selecting the appropriate legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Oregon Wage Withholding Authorization, which can be utilized for both business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Oregon Wage Withholding Authorization. Use your account to navigate through the legal forms you have purchased previously. Visit the My documents tab in your account and download another copy of the document you need.

US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize the service to obtain professionally crafted documents that meet state specifications.

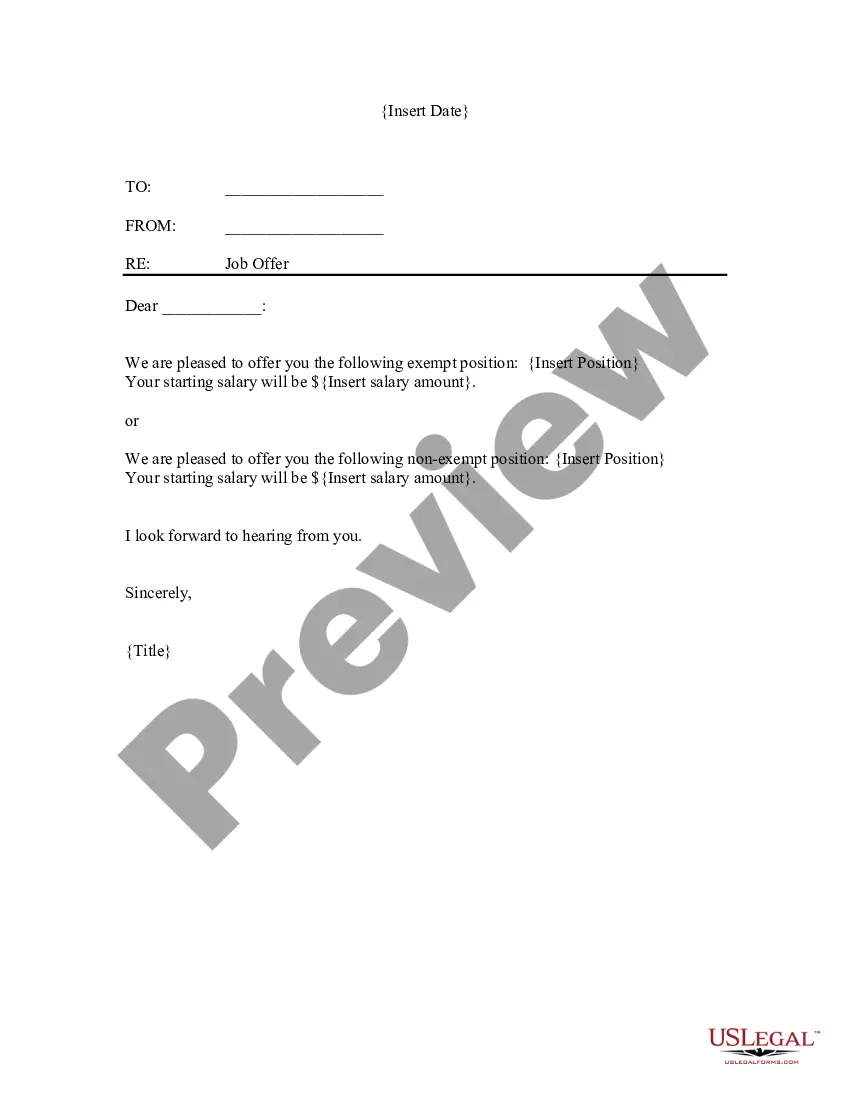

- Firstly, ensure you have selected the correct form for your city/county. You can preview the form using the Preview button and read the form description to confirm this is the correct one for you.

- If the form does not meet your requirements, utilize the Search box to find the correct form.

- Once you are confident that the form is accurate, click the Buy now button to acquire the form.

- Choose the payment plan you need and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the obtained Oregon Wage Withholding Authorization.

Form popularity

FAQ

Determining how much to withhold for Oregon state tax requires considering your income, tax deductions, and credits. A common guideline is to compare your expected tax liability with the amount withheld from your paycheck. To simplify this process, consider using the Oregon Wage Withholding Authorization to ensure that your withholdings align with your broader financial picture.

If an employee quits or is fired, their final paycheck must be paid on or before the next regularly scheduled payday. Employers cannot withhold a final paycheck if the employee does not turn in keys, uniforms, tools, equipment, etc.

What Is a Wage Deduction Authorization Agreement? A wage deduction authorization agreement is a legal document that permits youthe employerto deduct the agreed-upon amount from an employee's salary. The reasons for the salary reduction vary.

The final paycheck should contain the employee's regular wages from the most recent pay period, plus other types of compensation such as commissions, bonuses, and accrued sick and vacation pay. Employers can withhold money from the employee's last paycheck if the employee owes your organization.

The maximum interval between paydays is 1 month. If an employer pays wages based on a pay period that is less than 1 month, the regular payday shall be no later than 10 calendar days after the end of the pay period.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

Taking money from wages without consent or contractual provision can result in a claim for unlawful deduction of wages, even if the individual has been employed for less than two years.

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support

Final And Unclaimed Paychecks Laws In WashingtonWashington state law requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated.