Oregon Resolution of Meeting of Corporation to Make Specific Loan

Description

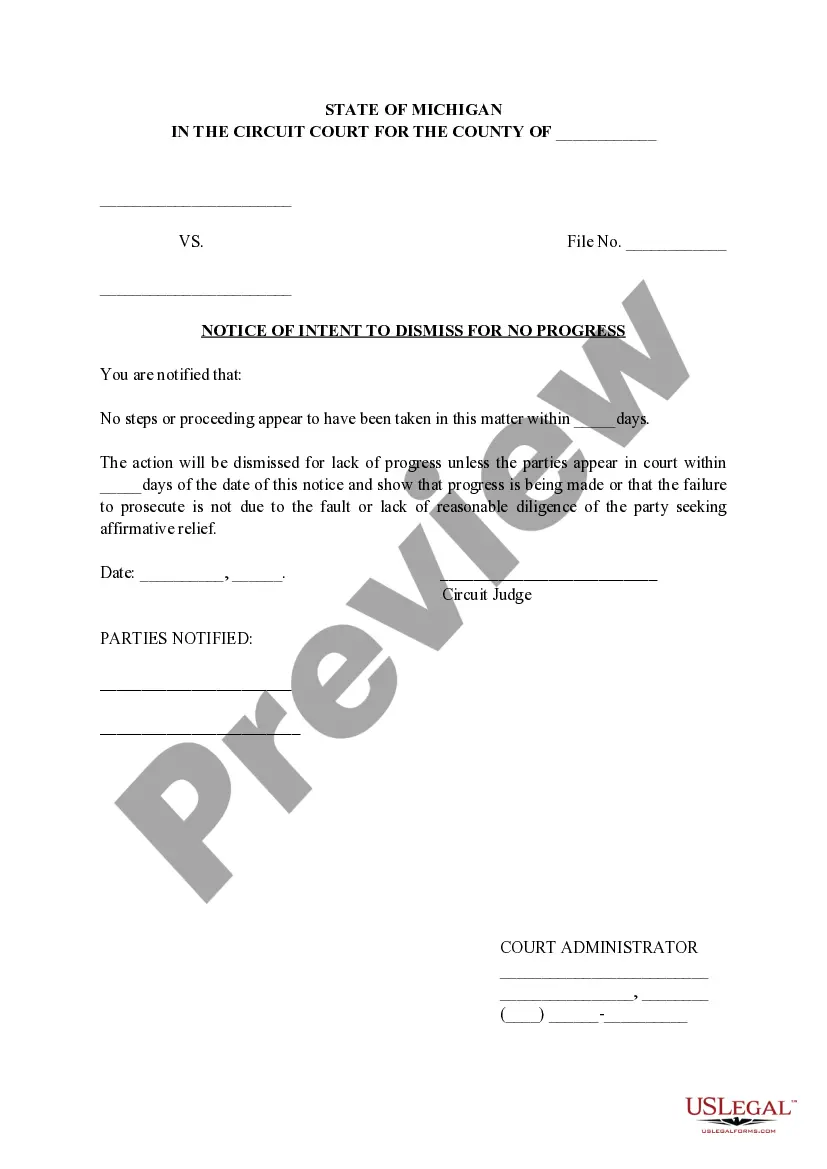

How to fill out Resolution Of Meeting Of Corporation To Make Specific Loan?

If you need to finalize, acquire, or print out sanctioned document templates, utilize US Legal Forms, the primary collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search function to locate the documents you require. Various templates for both business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to obtain the Oregon Resolution of Meeting of Corporation to Make Specific Loan with just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every form you obtained in your account. Navigate to the My documents section and select a form to print or download again.

Compete and acquire, and print the Oregon Resolution of Meeting of Corporation to Make Specific Loan with US Legal Forms. There are countless professional and state-specific forms available for both your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to find the Oregon Resolution of Meeting of Corporation to Make Specific Loan.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Confirm you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative templates in the legal document format.

- Step 4. Once you find the form you want, choose the Get now button. Select your preferred payment plan and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill, modify, and print or sign the Oregon Resolution of Meeting of Corporation to Make Specific Loan.

Form popularity

FAQ

An example of a company resolution could state, 'Resolved, that the corporation will enter into a loan agreement to fund expansion projects.' This resolution should specify the details regarding the agreement. Utilizing an Oregon Resolution of Meeting of Corporation to Make Specific Loan ensures that your resolution aligns with legal requirements and company policies.

To write a director resolution, start by identifying the directors present and the specific action being proposed. Clearly articulate the motion, such as 'Resolved, that the board of directors approves the terms of the loan as detailed in the Oregon Resolution of Meeting of Corporation to Make Specific Loan.' It is important to include dates and signatures to validate the resolution.

Writing a corporate resolution involves several key elements: the title, the date, the preamble, the resolved clause, and the signatories. For instance, you might write, 'Resolved, that the board approves the corporation's application for a loan as outlined in the Oregon Resolution of Meeting of Corporation to Make Specific Loan.' This format provides structure to your resolution.

An example of a written resolution could be one that states, 'Resolved, that the corporation authorizes a loan of $100,000.' This type of resolution is often followed by details regarding the terms of the loan and the parties involved. Such clarity is essential when creating an Oregon Resolution of Meeting of Corporation to Make Specific Loan.

To start writing a resolution, you should clearly define the purpose and the issues it addresses. Begin by stating the title and the specific action that the resolution seeks to accomplish, such as approving an Oregon Resolution of Meeting of Corporation to Make Specific Loan. This helps set the context, ensuring that all parties understand the resolution's intent.

Corporate bylaws in Oregon are the internal rules that govern how a corporation operates. They typically outline the roles and responsibilities of directors, the process for holding meetings, and how decisions are made. Understanding these bylaws is vital for creating an Oregon Resolution of Meeting of Corporation to Make Specific Loan, as they provide the framework within which corporate governance decisions are made.

To write a letter of resolution, begin with the company's header and the date. Clearly articulate the resolution’s intent, such as the 'Oregon Resolution of Meeting of Corporation to Make Specific Loan,' and outline the specific decisions made during the meeting. Conclude with signatures from directors and officers to validate the letter's authority.

A corporate resolution is typically created by the board of directors or shareholders of a corporation. In many cases, the corporate secretary prepares the document, ensuring it reflects decisions like the 'Oregon Resolution of Meeting of Corporation to Make Specific Loan.' This ensures all actions are documented and in compliance with corporate laws.

An example of a company resolution letter typically includes the company's name, a date, and a statement of the resolution. For instance, it may reference the 'Oregon Resolution of Meeting of Corporation to Make Specific Loan,' detailing the decision to approve a specific loan. This format solidifies the legitimacy of the decisions made during the meeting.

Writing a corporate resolution involves specifying the organization details, the context of the meeting, and the decisions reached. Include the title, 'Oregon Resolution of Meeting of Corporation to Make Specific Loan,' and outline the authorization for the specified actions. End with the necessary signatures from the authorized individuals to validate the resolution.