Oregon While You Were Out

Description

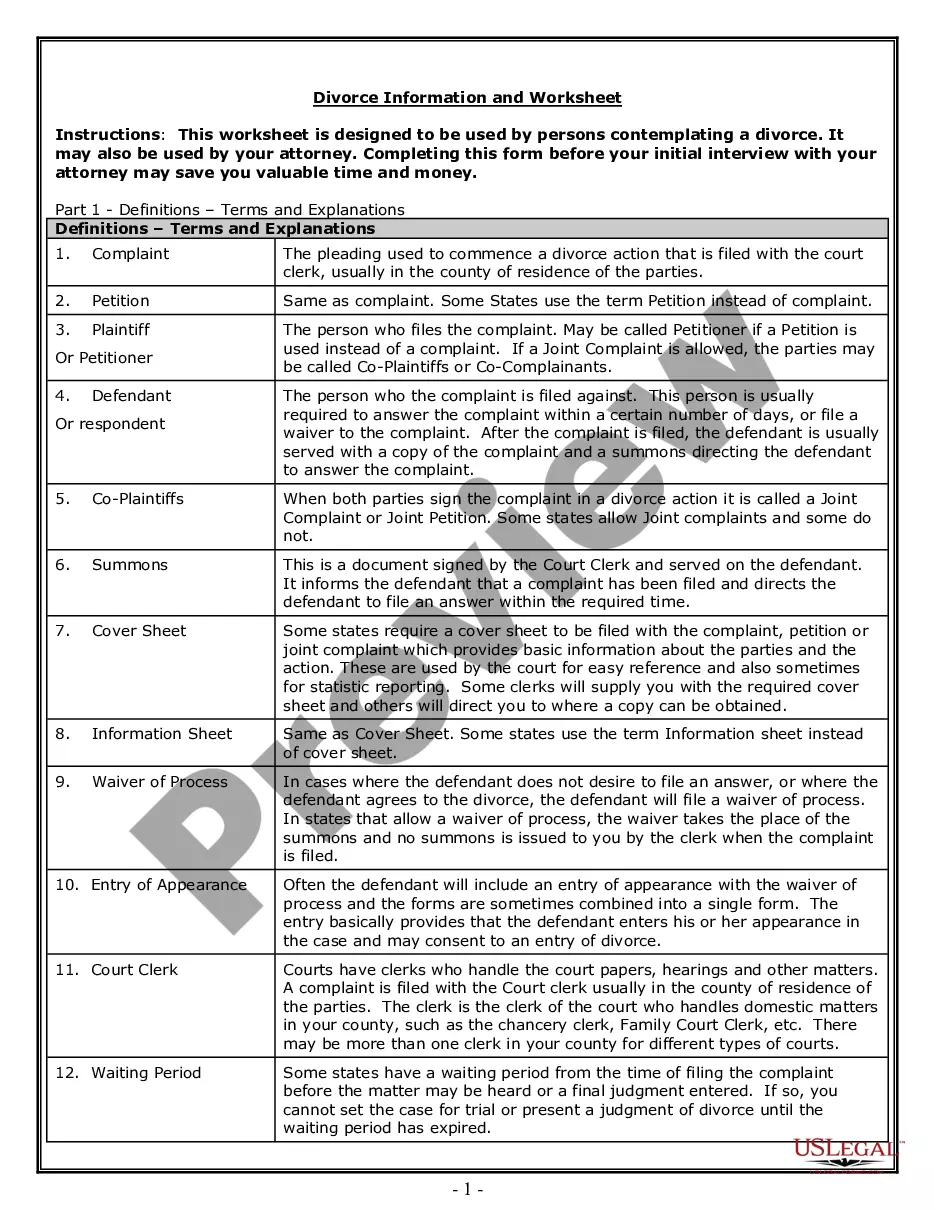

How to fill out While You Were Out?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad selection of legal document templates available for download or printing.

By using the site, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords.

You can obtain the latest versions of forms like the Oregon While You Were Out in a matter of minutes.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you want and provide your information to register for an account.

- If you have a monthly subscription, Log In to download Oregon While You Were Out from the US Legal Forms library.

- The Download button appears on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple guidelines to get you started.

- Ensure you’ve selected the correct form for your city/state.

- Click the Review button to examine the form’s content.

Form popularity

FAQ

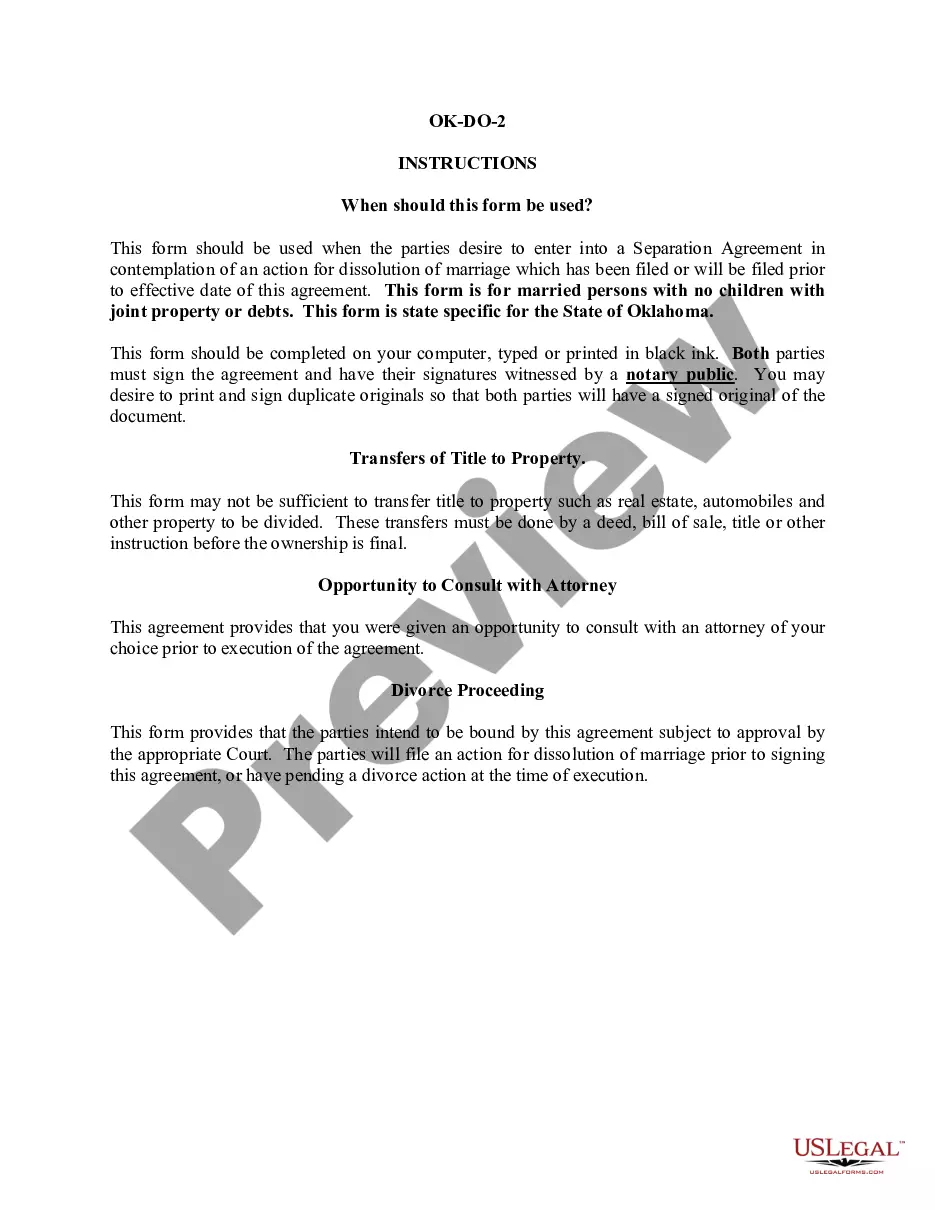

'While You Were Out' is a fictional narrative, although it captures sentiments that could mirror real-life events in Oregon. The characters’ experiences resonate with readers, making them reflect on their own lives. While it is not based on actual events, the story's authenticity lies in its portrayal of human emotions and relationships. Many readers appreciate how fiction can evoke truths about their reality.

'While You Were Out' follows the journey of its main characters as they confront challenges and face the consequences of their actions. The story unfolds with revelations and connections in various settings, including iconic locations in Oregon. As the plot develops, readers witness transformations that resonate deeply. This summary encourages potential readers to engage with the narrative tightly woven with relatable human experiences.

The book 'While You Were Out' explores themes of life changes and unexpected events. Set against a backdrop that includes Oregon, it navigates the complexities of relationships and personal growth. Readers find the narrative relatable, as it dives into how life can alter in a moment. This makes it a compelling read for those interested in stories that reflect real-life experiences.

The amount you should withhold for Oregon state tax depends on your income level and filing status. Generally, you can use the W-4 form to determine the correct withholding amount. Make sure to refer to the latest Oregon tax tables to find your specific requirement. When calculating, remember to consider Oregon While You Were Out for any changes that might impact your tax situation.

The 200-day rule in Oregon refers to how long a non-resident can stay in the state before needing to establish residency. This rule impacts various legal and tax considerations, so it is vital to understand your status if planning a long-term stay. Oregon While You Were Out can help you navigate these legal intricacies and ensure compliance.

You must use Oregon's Form OR-W-4 instead. How often does Form OR-W-4 have to be submitted? Complete and submit a new Form OR-W-4 when you start a new job and whenever your tax situation changes. This includes changes in your income, marital status, and number of dependents.

Every employee is asked to fill out a W-4 form, usually on the first day of the job. Failure to do so could result in you paying too much or too little tax.

Nonresidents. Oregon taxes the income you earned while working in Oregon. Oregon doesn't tax any amount you earned while you were working outside Oregon. Nonresident telecommuters who work for an Oregon employer are taxed only on the income earned from work performed in Oregon, including sick pay or other benefits.

The general rule is: your report all your income on your home state tax return, even the income earned out of state. You file a non-resident state return for the state you worked in and pay tax to that state. Your home state will give you a credit, or partial credit, for what you paid the non-resident state.

If you don't complete Form OR-W-4, your employer will withhold for Oregon based upon the following order: 2022 An Oregon-only version of the federal Form W-4 for a year prior to 2020. Federal Form W-4 for a year prior to 2020. Eight percent of your wages or other income requiring withholding.