Oregon Complaint for Impropriety Involving Loan Application

Description

How to fill out Complaint For Impropriety Involving Loan Application?

Are you in a situation where you need files for both company or personal reasons nearly every day time? There are a lot of lawful papers themes available on the Internet, but getting types you can depend on is not straightforward. US Legal Forms delivers a huge number of form themes, much like the Oregon Complaint for Impropriety Involving Loan Application, which can be written to meet state and federal specifications.

If you are already familiar with US Legal Forms site and have your account, merely log in. Next, it is possible to obtain the Oregon Complaint for Impropriety Involving Loan Application design.

Unless you have an profile and would like to begin to use US Legal Forms, abide by these steps:

- Find the form you want and make sure it is for the proper town/county.

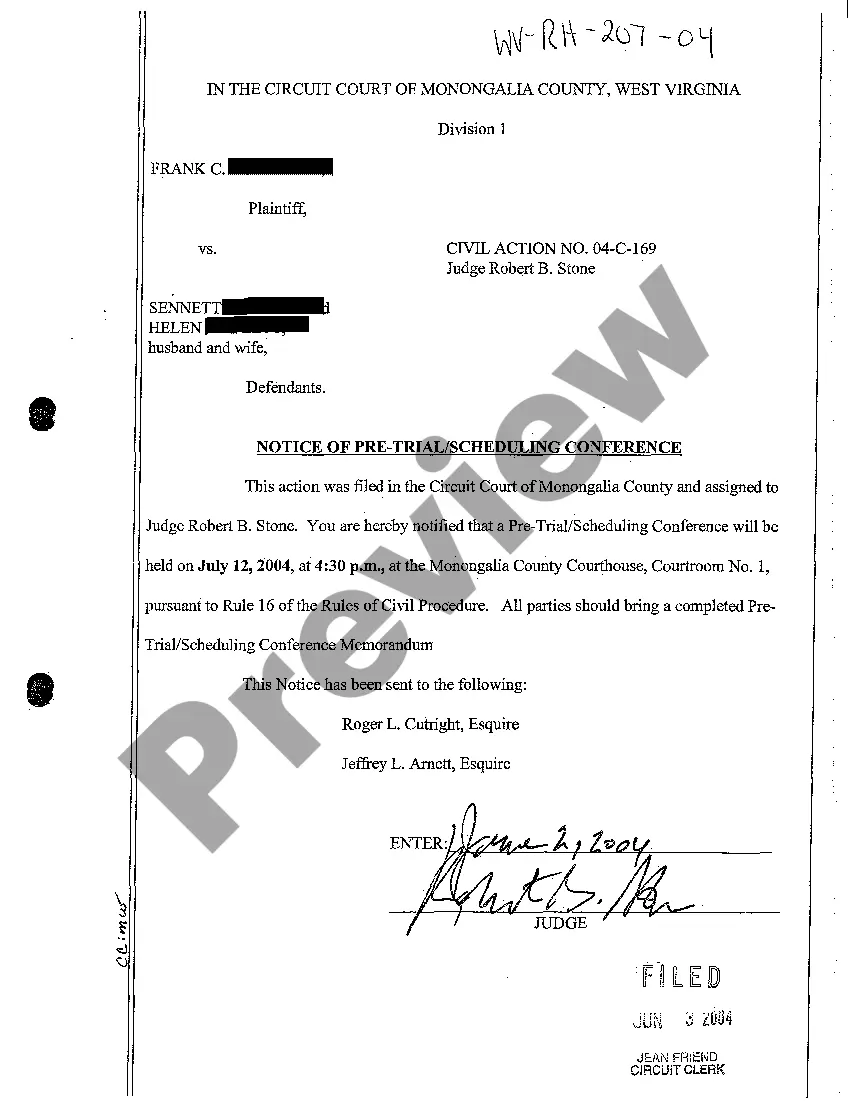

- Take advantage of the Preview switch to review the form.

- Read the information to actually have selected the correct form.

- In case the form is not what you are seeking, use the Look for industry to discover the form that fits your needs and specifications.

- If you obtain the proper form, click Purchase now.

- Opt for the rates program you would like, submit the desired information and facts to generate your money, and pay for an order using your PayPal or charge card.

- Decide on a practical file format and obtain your duplicate.

Get each of the papers themes you may have purchased in the My Forms food selection. You can aquire a more duplicate of Oregon Complaint for Impropriety Involving Loan Application at any time, if needed. Just click on the required form to obtain or print out the papers design.

Use US Legal Forms, the most substantial selection of lawful forms, to save lots of time as well as prevent mistakes. The assistance delivers skillfully made lawful papers themes which you can use for a selection of reasons. Create your account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Enforcing Oregon consumer protection laws. The Unlawful Trade Practices Act prohibits many practices, most of them involving some form of deception or misrepresentation by the seller, and Attorney General is the primary enforcer of this law.

The complaint must be received within 14 months from the date the contractor substantially completed the work.

Financial regulation and government guarantees, such as deposit insurance, are intended to protect consumers and investors and to ensure that the financial system remains stable and continues to make funding available for investments that support the economy.

The Division of Financial Regulation regulates producers, insurance institutions, and nearly a dozen other specialized programs or businesses, ranging from discount medical plans to life settlement providers.

If you are unsure where to report a complaint, call the division at 503-378-3278. File complaints with the Building Codes Division as soon as possible.

Refunds must be issued to the same credit card used to process the original transaction. Cash refunds are prohibited. Refunds will be made up to 30 days from the purchase date.

Contact Us Toll-Free: 1-877-877-9392, ? , Monday-Friday. Email: help@oregonconsumer.gov. Fill out the online Consumer Complaint Form »

If you have any questions, call our Consumer Hotline at 1-877-877-9392. The Attorney General's Consumer Hotline is open from a.m. to p.m., and is staffed by dedicated volunteers who field more than 50,000 calls each year.

Always confirm a contractor's license status before hiring. You can also call (503) 378-4621 to check their complaint history.