This is a complaint to be filed by a former law partner who has been expelled from his law firm. It calls for an accounting of the firm, where the firm's partnership agreement did not provide for an accounting. The former partner alleges that the partnership has failed to pay him what was rightfully due, and asks for an accounting to calculate damages owing.

Oregon Complaint for an Accounting Claim

Description

How to fill out Complaint For An Accounting Claim?

You are able to devote time on the Internet searching for the legal document design that meets the state and federal needs you need. US Legal Forms provides a huge number of legal types that are reviewed by specialists. It is simple to obtain or print the Oregon Complaint for an Accounting Claim from the services.

If you have a US Legal Forms accounts, it is possible to log in and click the Obtain switch. After that, it is possible to comprehensive, change, print, or signal the Oregon Complaint for an Accounting Claim. Every legal document design you get is your own property for a long time. To obtain another version associated with a acquired form, proceed to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms site for the first time, follow the simple guidelines listed below:

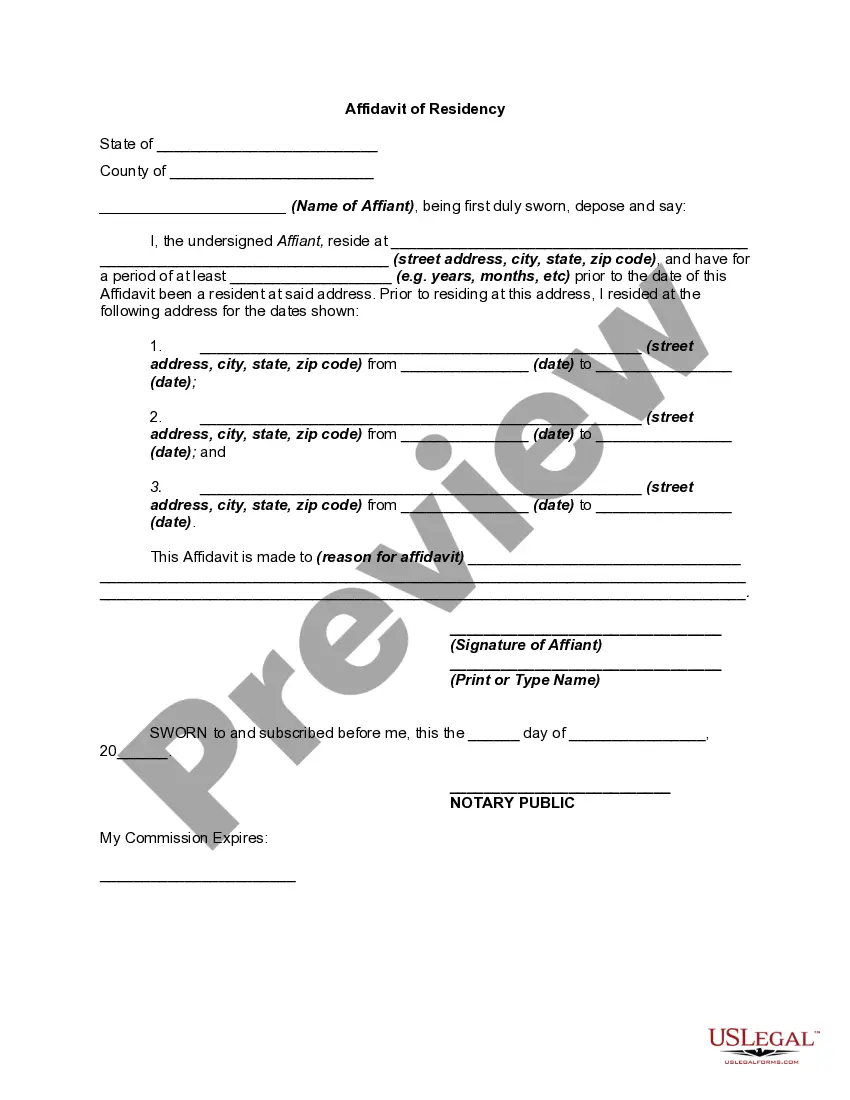

- Initially, ensure that you have selected the proper document design for your area/metropolis of your choosing. Look at the form information to ensure you have picked out the correct form. If readily available, take advantage of the Review switch to look from the document design at the same time.

- If you want to get another version in the form, take advantage of the Search discipline to find the design that meets your needs and needs.

- When you have identified the design you would like, just click Buy now to continue.

- Choose the costs prepare you would like, enter your references, and register for a merchant account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal accounts to fund the legal form.

- Choose the file format in the document and obtain it to the system.

- Make adjustments to the document if possible. You are able to comprehensive, change and signal and print Oregon Complaint for an Accounting Claim.

Obtain and print a huge number of document themes making use of the US Legal Forms Internet site, that offers the most important variety of legal types. Use specialist and condition-specific themes to tackle your business or individual demands.

Form popularity

FAQ

Contact Us Toll-Free: 1-877-877-9392, ? , Monday-Friday. Email: help@oregonconsumer.gov. Fill out the online Consumer Complaint Form »

Hear this out loud PauseGeneral Information: From the Salem area: 503-373-7300. Toll-free in Oregon: 800-850-0228. From outside Oregon: 503-378-5667.

Hear this out loud PauseThe Unlawful Trade Practices Act (UTPA) is Oregon's version of these consumer protection laws. ? Enacted in 1971 the UTPA is one of the few tool consumers can use to recover damages that occur as a result of deceptive sales or business practices.

If you are having problems with a Licensed Tax Consultant or Tax Preparer, you should contact the Board of Tax Practitioners at (503) 378-4034. Most CPAs and PAs sincerely try to do all they can on behalf of their clients.

Hear this out loud PauseRefunds must be issued to the same credit card used to process the original transaction. Cash refunds are prohibited. Refunds will be made up to 30 days from the purchase date.

What should I do if I have a complaint about an accountant or actuary? You should complain to the accountant (or their firm) or actuary first. If you are unhappy with their response you should complain to their professional body, if they have one.

You may email Joni? Gilles or call her at (503) 947-5638. The complaint and appeals team serves as the principal investigators for Division 22, retaliation, and religious entanglement complaints. If you have questions about those types of complaints, please ?contact Mark Mayer.

Featured Consumer Hotline:1-877-877-9392. Search Complaints Database » Report a Do Not Call Violation. File a Complaint Online » Free Fraud Prevention Training. Oregon's Lemon Law.