This complaint is for a plaintiff attorney who has been removed from the partnership of his former firm. The complaint requests an accounting of the former firm, stating that the plaintiff has been deprived of economic benefits rightfully due to him under the former partnership agreement, and also alleges egregious acts by his former partners.

Oregon Alternative Complaint for an Accounting which includes Egregious Acts

Description

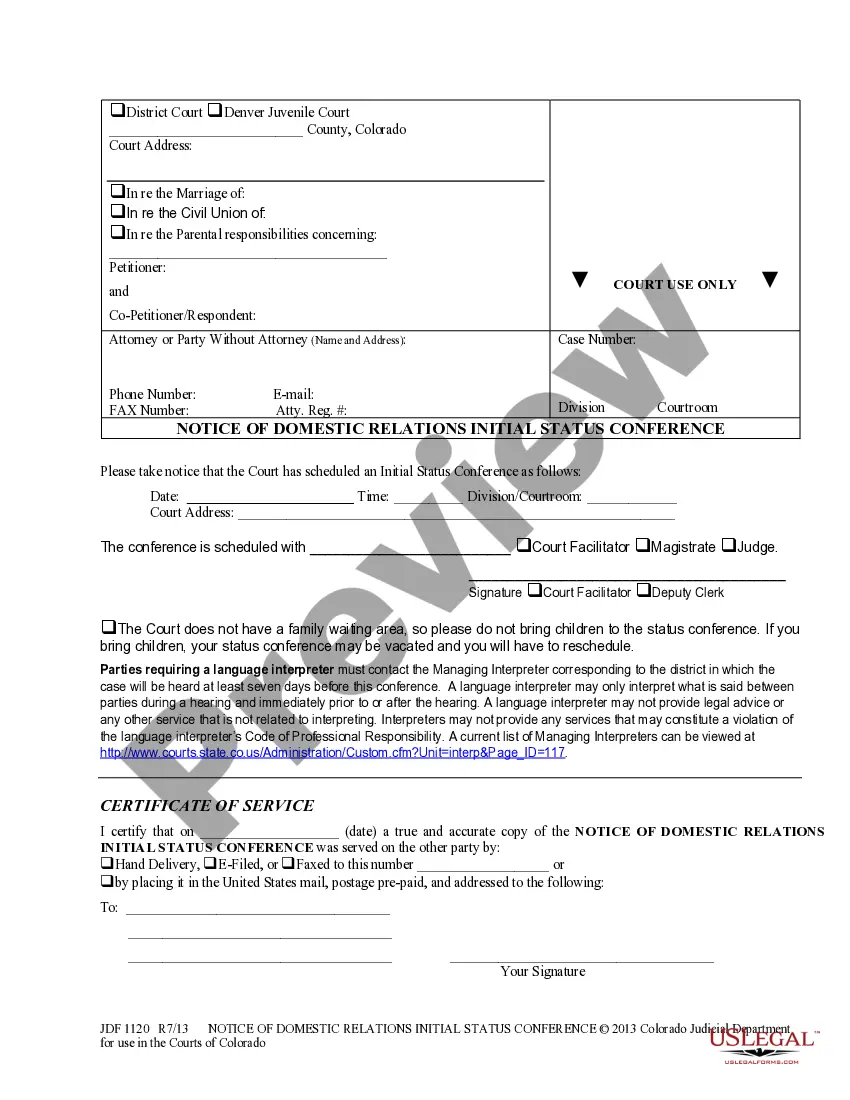

How to fill out Alternative Complaint For An Accounting Which Includes Egregious Acts?

US Legal Forms - one of the biggest libraries of authorized types in the USA - gives a wide array of authorized document web templates you may obtain or print. Using the site, you may get a huge number of types for organization and specific purposes, sorted by classes, states, or keywords and phrases.You will discover the most up-to-date models of types much like the Oregon Alternative Complaint for an Accounting which includes Egregious Acts within minutes.

If you already have a registration, log in and obtain Oregon Alternative Complaint for an Accounting which includes Egregious Acts through the US Legal Forms local library. The Down load key can look on each and every develop you view. You have access to all previously acquired types in the My Forms tab of your bank account.

If you want to use US Legal Forms for the first time, listed here are easy recommendations to help you started off:

- Be sure to have picked out the proper develop for the city/region. Select the Review key to review the form`s content material. Browse the develop outline to ensure that you have selected the appropriate develop.

- In the event the develop does not satisfy your specifications, utilize the Search area on top of the screen to obtain the one who does.

- When you are satisfied with the form, validate your decision by simply clicking the Get now key. Then, select the prices program you favor and offer your accreditations to register to have an bank account.

- Approach the transaction. Make use of your credit card or PayPal bank account to finish the transaction.

- Choose the formatting and obtain the form on the product.

- Make modifications. Load, edit and print and signal the acquired Oregon Alternative Complaint for an Accounting which includes Egregious Acts.

Each and every format you included with your money lacks an expiration day and is also your own permanently. So, if you would like obtain or print one more version, just check out the My Forms section and then click about the develop you will need.

Get access to the Oregon Alternative Complaint for an Accounting which includes Egregious Acts with US Legal Forms, one of the most comprehensive local library of authorized document web templates. Use a huge number of expert and status-specific web templates that meet up with your business or specific requires and specifications.

Form popularity

FAQ

Judgments entered under ORS 153.102 are termed ?default? judgments and impose a fine that a Defendant must pay. Failure to pay a judgment will result in the case being sent to a collections agency and additional fees. Oregon law allows you to request that the default judgment be set aside.

ORCP 69 requires the court or clerk to enter an order of default on a showing by affidavit or declaration that a party against whom a judgment is sought has been served with Summons or is otherwise subject to the jurisdiction of the Court and has failed to plead or otherwise defend within the time set by law. Motion and Order for Default Re: Modifications of Judgments ... oregon.gov ? forms ? Documents ? J... oregon.gov ? forms ? Documents ? J...

The ?motion,? ?reply,? or ?answer? must be given to the court clerk or administrator within 30 days along with the required filing fee. It must be in proper form and have proof of service on the defendant's attorney or, if the defendant does not have an attorney, proof of service on the defendant. ORCP 7 - Summons - Oregon Rules of Civil Procedure - Public.Law public.law ? rules-of-civil-procedure ? orc... public.law ? rules-of-civil-procedure ? orc...

In any action against parties jointly indebted upon a joint obligation, contract, or liability, judgment may be taken against less than all of those parties and a default, dismissal, or judgment in favor of or against less than all of those parties in an action does not preclude a judgment in the same action in favor ...

Summons shall be served, either within or without this state, in any manner reasonably calculated, under all the circumstances, to apprise the defendant of the existence and pendency of the action and to afford a reasonable opportunity to appear and defend. Rule 7 - Summons, Or. R. Civ. P. 7 | Casetext Search + Citator casetext.com ? oregon-rules-of-civil-procedure ? r... casetext.com ? oregon-rules-of-civil-procedure ? r...

Content. Edit.

Oregon Rules of Civil Procedure (ORCP) Rule 7D(6) allows a court to order alternative methods of service if service cannot be made by any other method specified by rule or statute. Service may be made by any method or combination of methods most reasonably calculated to advise the recipient of the action. Request for Alternative Service Method Oregon Judicial Department (.gov) ? Documents Oregon Judicial Department (.gov) ? Documents PDF

For all forms of discovery, parties may inquire regarding any matter, not privileged, that is relevant to the claim or defense of the party seeking discovery or to the claim or defense of any other party, including the existence, description, nature, custody, condition, and location of any books, documents, or other ...